Informe 1

advertisement

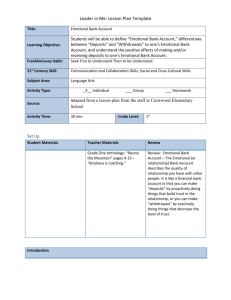

3/4/2016 DAILY MONETARY REPORT Monetary Analysis Department Figures in million, expressed in their original currency. BCRA Stocks Explanatory factors of Monetary Base and International Reserves 2-Mar-16 Monetary base Currency in circulation Held by public Held by financial entities ** 12 months before before 587,033 455,680 457,414 342,730 402,007 407,567 310,399 53,673 49,847 32,331 0 0 0 134,048 129,619 114,826 6,815 8,916 872 877 Current account in BCRA in foreign currency (1) Change Daily 589,728 Settlement check Current account in BCRA 30 days 457,557 Monetary base Monthly y.o.y. Nominal Nominal 10,553 30,590 -5.5% 29% 120 169 -4.8% 33% 2,285 1,909 -5.4% 30% -2,165 -1,740 -0.5% 66% 0 0 -44.2% 0% 10,433 30,422 -7.6% 17% Currency in circulation Held by public Held by financial entities ** Settlement check Current account in BCRA 2016 ytd 8,957 Variation factors % over MB change Cash held by financial entities in foreign currency (1)** Settlement check in foreign currency (1) Certificates of Deposits for Investment (CEDIN) (1) 0 0 342 377 829 Monetary base variation 10,553 30,590 -34,161 0 Foreign exchange purchases 81 -3,620 -7,427 22% -5 356 -7,457 22% 0 0 -4,300 13% Government´s account in pesos -5 455 2,551 -7% Government´s account in dollars 0 -99 -5,708 17% (3) -46% 380 Public sector operations Temporary Advances and Utility Transfers -811 17,404 15,610 Repo operations -815 17,384 15,350 -45% 4,151 463 BCRA Securities (4) 12,745 12,746 -66,741 195% 5,093 4,068 656 Other -1,457 3,704 31,853 -93% 0 0 0 Memo: -5 356 -7,457 22% 13,827 27,952 12,361 market -71 -275 2,561 2,637 2,772 4,187 International Financial Institutions 0 -4 -283 327,550 331,850 251,450 Other public sector operations 0 -2 -111 Foreign exchange purchases 6 -226 -407 -212 -180 -3,912 135 137 7,274 LEBAC (2) Repo operations and rediscounts In Pesos 424,735 396,648 4,113 (1) NOBAC (2) Benchmark exchange rate-adjusted LEBAC In dollars 322,112 Public sector adjusted by foreing currency purchases to Repos International reserves Rediscounts * Temporary advancements to National Government International reserves Dollar liquidity requirements In pesos In dollars (1) (1) Gold, Foreign Currencies, Time deposits and Others 441,131 422,437 274,742 28,124 29,985 31,467 23,124 24,985 31,467 5,000 5,000 0 Foreign Currencies - Reverse Repo in USD with Non-residents**** Other (incl. change in USD market value of non-dollar assets) billion $ Monetary Base and Explanatory Factors (last 30 days) billion $ (5) Broad Monetary Base 670 30 Monetary Base Currency held by public *** 620 570 20 520 10 470 420 0 370 -10 320 270 -20 FX Purchases Public Sector Sterilization Operations Instruments Other Monetary Base Mar-15 Monetary Base % May-15 Jul-15 Sep-15 Nov-15 Jan-16 Mar-16 Reserves and Exchange Rate billion US$ (y-o-y change) 45 220 $/US$ 40 18 35 16 40 14 30 12 35 25 10 20 30 , 8 15 6 25 10 20 4 BCRA Reserves 5 2 Exchange Rate published by BCRA (right axis) 0 0 15 Feb-15 Apr-15 Jun-15 Aug-15 Oct-15 Dec-15 Feb-16 Mar-15 May-15 Jul-15 Sep-15 Nov-15 Jan-16 Mar-16 * Provisory data subjected to change in valuation (1) Figures expressed in dollars. Provisory data subjected to change in valuation (2) Figures expressed in Nominal Value. Lebac and Nobac issued to be repo's collaterals or guarantee of operations are not considered (those concepts, among others, explain the differences with the figures in the financial statements of the B (3) Includes the monetary effect of current account remunerations. (4) Includes the monetary effect of LEBAC and NOBAC. (5) Main movements of financial entities' current accounts in the Central Bank. It does not include flows of International Financial Institutions due to "Rotatory Funds". (6) Includes Settlement checks. * Includes the monetary effect of the Bicentenary Overdrafts. Since October 3 ** Provisory figures. *** Includes settlement check. rd 2005, rediscount stock includes interests and CER capitalized less regularized accounts. ****According to the provisions of paragraph 7 of the Board Resolution N° 44 of 01/28/2016, it is reported that the amount of the line " Foreign Currencies - Reverse Repo in USD with non-residents", shall not be considered Excess Reserves as stated in Article 6 of Law N° 23.928 and its amendments. 3/4/2016 DAILY MONETARY REPORT Monetary Analysis Department Provisory figures, expressed in million. Stocks 2-Mar-16 Variations (in %) 30 days before Current Month Last 30 days 2016 YTD y.o.y In pesos Loans to Private sector Overdrafts Promissory notes Mortgages Pledge-backed loans 769,637 772,206 0.4 -0.3 -0.6 33.5 96,045 98,961 -0.2 -2.9 10.9 26.7 177,800 182,261 -0.8 -2.4 -7.8 33.4 54,937 55,131 0.0 -0.4 -0.7 14.8 21.9 39,987 40,259 0.0 -0.7 -0.6 Personal loans 166,562 163,706 0.2 1.7 3.3 35.7 Credit Cards 188,370 185,764 2.2 1.4 -0.4 52.6 Other loans 45,936 46,124 0.0 -0.4 -5.6 12.6 Deposits (1) 1,170,337 1,186,092 -0.5 -1.3 -0.5 29.2 Current account (2) 336,038 352,814 -1.6 -4.8 -9.9 26.0 Savings accounts 243,482 255,040 0.1 -4.5 -3.9 27.6 Time deposits not adjustable by CER 550,345 536,017 0.5 2.7 7.5 32.2 16 40,456 15 42,206 0.0 -7.9 6.7 -4.1 23.1 8.1 77.8 24.9 Time deposits adjustable by CER (3) Other deposits Private Sector Deposits 922,774 913,375 0.3 1.0 1.4 37.3 (6) 438,459 429,386 0.3 2.1 -0.6 29.3 Time deposits (6) 456,466 455,728 0.8 0.2 3.1 46.8 247,563 272,717 -3.3 -9.2 -6.7 5.9 141,061 178,468 -4.7 -21.0 -23.8 19.3 93,895 80,304 -0.9 16.9 35.2 -10.9 Sight deposits Public Sector Deposits Sight deposits (2) (6) Time deposits (6) In dollars (4) Loans to Private Sector Deposits Foreign lines of credit Financial Comercial Liquidity ratio (5) (C.A. in BCRA + Cash in vaults + Repo / Total deposits) 3,800 3,289 1.8 15.5 28.3 6.9 13,142 12,887 0.4 2.0 9.3 35.6 1,452 882 570 1,574 903 671 0.2 0.1 0.4 -7.8 -2.3 -15.1 -11.5 -7.6 -16.9 23.7 0.1 94.5 22.5 24.2 0.8 -1.7 -5.3 -1.1 Monetary aggregates M1 (currency held by public +settlement check in peso+Current accounts in pesos) M2 (M1 + Savings account in pesos) M3 (M2 + Time deposits in pesos + CEDRO adjusted by CER) M3* (M3 + deposits in dollars + settlement check in foreign 738,045 760,381 -0.5 -2.9 -7.5 27.9 981,527 1,572,344 1,783,838 1,015,421 1,593,659 1,780,527 -0.4 -0.3 -0.1 -3.3 -1.3 0.2 -6.6 -1.8 1.2 27.8 29.3 36.8 currency + CEDIN) (BCRA Current Account + Cash in vaults + Repo) / Total Deposits Total and Private Sector Deposits in pesos billion $ (includes CEDRO with CER) % 1,300 Private deposits 32 Total deposits 1,200 30 1,100 28 1,000 26 900 24 800 22 700 20 600 500 Mar-15 18 May-15 Jul-15 Sep-15 Nov-15 Jan-16 Mar-16 Monetary Aggregates billion $ Mar-15 200 1,600 Private M3 180 Jul-15 Sep-15 Nov-15 Jan-16 Mar-16 Loans to Private Sector in pesos billion $ 1,700 M3 May-15 billion $ Mortgages Pledge-backed loans 360 Personal loans Credit Cards 340 Commercial loans (right axis) 320 160 1,500 300 140 1,400 280 120 1,300 260 1,200 100 1,100 80 1,000 60 900 40 180 800 20 160 700 0 Mar-15 240 May-15 Jul-15 Sep-15 Nov-15 Jan-16 Mar-16 Mar-15 220 200 140 May-15 Jul-15 Sep-15 Nov-15 Jan-16 Mar-16 (1) Corresponds to deposits of public and private sectors (excludes financial sector and resident abroad deposits) (2) Net of the account known as "Use of unified funds". (3) Not include accrued CER. (4) In dollars. (5) Includes pesos and dollars operations, the latter valued in pesos. Deposits are net of BODEN. (6) Since December 9, 2008, it is shown the titular type change stated by the replacement of the Pension and Retirement Fund Administrators (Administradoras de Fondos de Jubilaciones y Pensiones) rights and obligations to the Social Security National Administration (Administración Nacional de la Seguridad Social), envisaged by Law 26.425 (in the framework of the creation of the Argentine Retirement Integrated System -Sistema Integrado Previsional Argentino-, which has effect since December 9 2008, the corresponding balances of the former Retirement System (Sistema Integrado de Jubilaciones y Pensiones) -Law 24.241 and complementary regulations- are considered as belonging to the Non Financial Public Sector). 3/4/2016 DAILY MONETARY REPORT Monetary Analysis Department Nominal annual interest rates (in percentage) 3-Mar-16 Other Markets Average(1) Average(1) 7 days before 30 days Interbank loans rate in pesos 3-Mar-16 Last week Last year level level Dollar spot Interest rate 32.50 25.66 21.39 Wholesale 15.20 15.39 8.74 Traded volume 3,592 3,963 2,980 Retail (7) 15.29 15.38 8.74 Pesos 27.83 24.10 24.51 NDF 1 month 15.44 15.61 8.90 Dollars 1.09 1.11 1.60 ROFEX (3) -Maturity 30-Abr-16- 15.28 15.55 8.89 Traded volume (all maturities) 11,904 11,142 1,746 Pesos 28.87 26.40 26.53 Dollars 1.88 1.63 2.50 Peso/real 4.01 3.90 2.94 Total 29.06 24.59 24.69 Peso/euro 16.72 17.00 9.68 Private Banks 30.50 26.34 26.40 13,328 12,936 9,668 415 317 177 1,600 1,594 1,183 542 551 331 Time deposits 30 days Future dollar 60 days and more BADLAR (2) MERVAL Overdrafts (1 to 7 days) Index More than $10 million Stock Repos 30-day gross interest rate Traded volume (all maturities) 34.59 28.53 25.60 32.00 571 27.70 587 27.76 542 Traded volume Government bonds BONAR X (4) Discount $ 1-month LIBOR 0.44 0.44 0.43 6-month LIBOR 0.89 0.88 0.86 2-year US Treasury bond 0.85 0.76 0.74 EMBI+ Argentina 484 461 586 FED Funds Rate 0.50 0.50 0.50 EMBI+ Latin America (without Argentina) 591 629 505 14.25 14.25 14.25 SELIC Loans interest rates in pesos Sovereign risk (5) Overdrafts Promissory notes Mortgages Pledge-baked loans Personal loans Credit cards 34.53 33.51 22.64 29.05 43.14 42.33 December 2015 (6) 34.51 30.63 22.85 26.03 39.01 39.97 January 2015 30.83 26.63 23.77 28.08 38.42 40.55 Month January 2016 (6) Peso time deposits interest rate % Call market in pesos % 40 33 Traded volume (right axis) Up to $100 thousand (30-44 days) - Total banks million $ Interest rate 5,000 35 Badlar- Private banks 5,500 4,500 30 30 27 4,000 3,500 25 3,000 20 24 2,500 15 2,000 21 1,500 10 1,000 18 5 500 0 15 Mar-15 May-15 Jul-15 Sep-15 Nov-15 Jan-16 MERVAL 15,000 million $ 700 Traded volume (right axis) 14,000 Mar-16 Index 600 13,000 500 12,000 0 May-15 Jul-15 Sep-15 Nov-15 Jan-16 Exchange rates $/USD $/EUR 18 Peso/Dollar 17 $/REAL 4.5 Peso/Euro Peso/Real (right axis) 16 Mar-16 4.0 15 14 11,000 400 10,000 3.5 13 12 300 9,000 8,000 200 7,000 100 6,000 11 3.0 10 9 2.5 8 7 5,000 Mar-15 Mar-15 0 May-15 Jul-15 Sep-15 Nov-15 Jan-16 Mar-16 6 Mar-15 2.0 May-15 Jul-15 (1) Moving averages of 5 working days, centered 7 days before. In case of holiday, the weekly change focuses on the last working day of the previous week (2) Corresponds to 30-35-day more than 1 million time deposits total operations. (3) "Mercado a Término de Rosario S.A." peso/dollar future exchange rate index . Traded volume in millions of pesos. (4) Market prices expressed in argentine pesos. (5) Monthly weighted average rate. (6) Provisory figures. (7) Bid-Ask avearage. Source: BCRA, IAMC, ROFEX and Bloomberg. Sep-15 Nov-15 Jan-16 Mar-16