(a) Product Costs Cost Item Direct Materials Direct Labor

advertisement

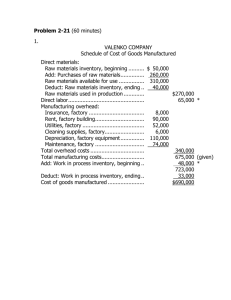

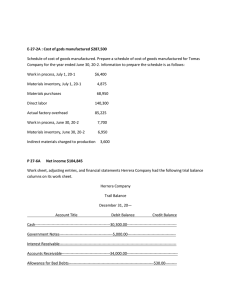

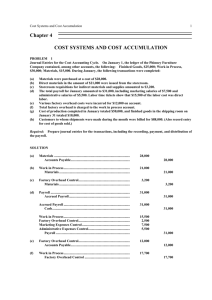

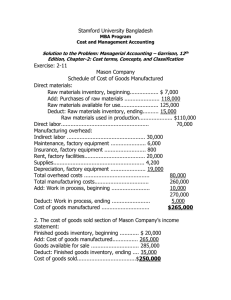

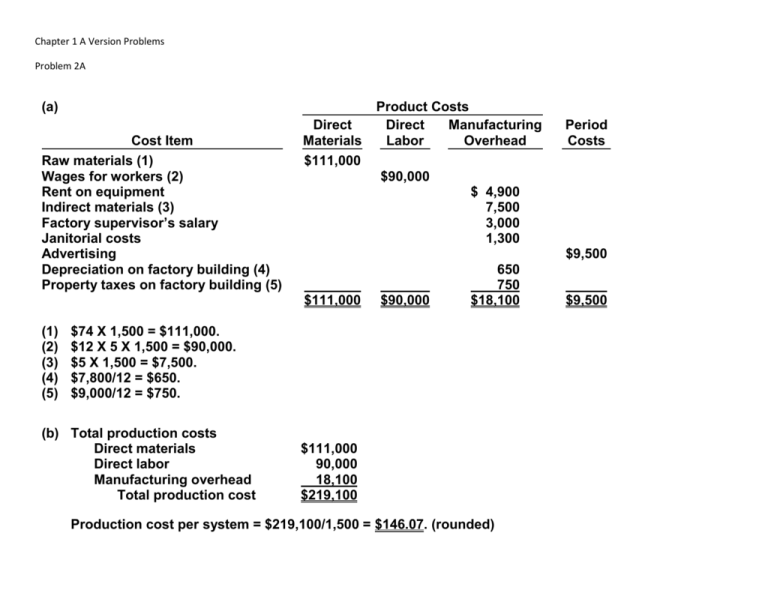

Chapter 1 A Version Problems Problem 2A (a) Cost Item Raw materials (1) Wages for workers (2) Rent on equipment Indirect materials (3) Factory supervisor’s salary Janitorial costs Advertising Depreciation on factory building (4) Property taxes on factory building (5) (1) (2) (3) (4) (5) Direct Materials $111,000 Product Costs Direct Manufacturing Labor Overhead $90,000 $ 4,900 7,500 3,000 1,300 $9,500 00_0,000 $111,000 000,000 $90,000 650 750 $18,100 $74 X 1,500 = $111,000. $12 X 5 X 1,500 = $90,000. $5 X 1,500 = $7,500. $7,800/12 = $650. $9,000/12 = $750. (b) Total production costs Direct materials Direct labor Manufacturing overhead Total production cost Period Costs $111,000 90,000 18,100 $219,100 Production cost per system = $219,100/1,500 = $146.07. (rounded) 00,000 $9,500 PROBLEM 1-4A (a) CLARKSON COMPANY Cost of Goods Manufactured Schedule For the Year Ended June 30, 2014 Work in process, July 1, 2013............. Direct materials Raw materials inventory, July 1, 2013 .............................. Raw materials purchases ............ Total raw materials available for use....................................... Less: Raw materials inventory, June 30, 2014 .................... Direct materials used................... Direct labor .......................................... Manufacturing overhead Plant manager’s salary ................ Factory utilities ............................ Indirect labor ................................ Factory machinery depreciation .... Factory property taxes ................ Factory insurance ........................ Factory repairs ............................. Total manufacturing overhead ........................... Total manufacturing costs .................. Total cost of work in process ............. Less: Work in process, June 30 ........ Cost of goods manufactured .............. $ 19,800 $ 48,000 96,400 144,400 39,600 $104,800 139,250 58,000 27,600 24,460 16,000 9,600 4,600 1,400 141,660 385,710 405,510 18,600 $386,910 PROBLEM 1-4A (Continued) (b) CLARKSON COMPANY (Partial) Income Statement For the Year Ended June 30, 2014 Sales revenues Sales revenue ............................................ Less: Sales discounts .............................. Net sales ..................................................... Cost of goods sold Finished goods inventory, July 1, 2013 ............................................ Cost of goods manufactured .................... Cost of goods available for sale ............... Less: Finished goods inventory, June 30, 2014 ................................. Cost of goods sold ............................. Gross profit ................................................ (c) $534,000 4,200 $529,800 96,000 386,910 482,910 75,900 407,010 $122,790 CLARKSON COMPANY (Partial) Balance Sheet June 30, 2014 Assets Current assets Cash............................................................ Accounts receivable .................................. Inventories Finished goods................................... Work in process ................................. Raw materials ..................................... $ 32,000 27,000 $75,900 18,600 39,600 134,100 Total current assets.................... $193,100 PROBLEM 1-5A (a) PHILLIPS COMPANY Cost of Goods Manufactured Schedule For the Month Ended October 31, 2014 Work in process, October 1 .............. Direct materials Raw materials inventory, October 1 ................................ Raw materials purchases ............................... Total raw materials available for use..................................... Less: Raw materials inventory, October 31....................... Direct materials used................. Direct labor ........................................ Manufacturing overhead Factory facility rent .................... Depreciation on factory equipment .............................. Indirect labor .............................. Factory utilities* ......................... Factory insurance** ................... Total manufacturing overhead ......................... Total manufacturing costs ................ Total cost of work in process ........... Less: Work in process, October 31 .... Cost of goods manufactured ............ $ 16,000 $ 18,000 264,000 282,000 29,000 $253,000 190,000 60,000 31,000 28,000 9,000 4,800 132,800 575,800 591,800 14,000 $577,800 **$12,000 X 75% = $9,000 **$ 8,000 X 60% = $4,800 PROBLEM 1-5A (Continued) (b) PHILLIPS COMPANY Income Statement For the Month Ended October 31, 2014 Sales revenue .................................................... Cost of goods sold Finished goods inventory, October 1 ....... Cost of goods manufactured .................... Cost of goods available for sale ............... Less: Finished goods inventory, October 31 ..................................... Cost of goods sold ............................. Gross profit........................................................ Operating expenses Advertising expense .................................. Selling and administrative salaries .......... Depreciation expense—sales equipment .............................................. Insurance expense** .................................. Utilities expense* ....................................... Total operating expenses .................. Net income ......................................................... **$12,000 X 25% **$ 8,000 X 40% $780,000 $ 30,000 577,800 607,800 45,000 562,800 217,200 90,000 75,000 45,000 3,200 3,000 216,200 $ 1,000