Principles of Cost Accounting 13E

advertisement

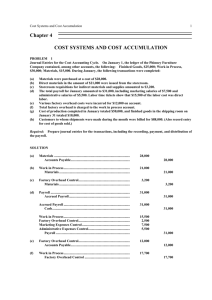

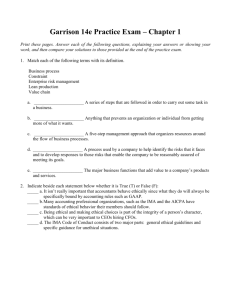

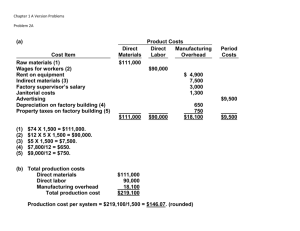

Principles of Cost Accounting 13E Edward J. VanDerbeck Chapter 1 Introduction to Cost Accounting Learning Objectives Explain the uses of cost accounting data. Describe the ethical responsibilities and certification requirements for management accountants. Describe the relationship of cost accounting to financial and managerial accounting. Learning Objectives Identify the three basic elements of manufacturing costs. Illustrate basic cost accounting procedures. Distinguish between the two basic types of cost accounting systems. Illustrate a job order cost system. The Need for Cost Accounting Cost accounting provides the detailed cost data that management needs to control current operations and plan for the future. Companies must control costs in order to keep prices competitive. In today’s global environment, cost information is more crucial than ever in remaining competitive. Types of Businesses That Use Cost Accounting Manufacturers (Ford, General Motors) Merchandisers (WalMart, Kmart) Wholesalers (Beverage Distributors) For-profit Service Businesses (CPAs, Attorneys) Not-for-profit Service Agencies (United Way, Red Cross) The Manufacturing Process This process involves the conversion of raw materials, direct labor, and factory overhead into finished goods. Product quality is an important competitive weapon in manufacturing. Many companies require their suppliers to be ISO 9000 certified. ISO 9000 Certification The International Organization for Standardization created a set of five international standards for quality management, ISO 9000-9004. These standards require that manufacturers have a well-defined quality control system and they consistently maintain a high level of quality. Determining Product Costs and Pricing Cost accounting is used to determine product costs and help with marketing decisions. Determining the selling price of a product. Meeting competition. Bidding on contracts. Analyzing profitability. Planning and Control Planning is the process of establishing objectives or goals for the firm and determining the means by which the firm will attain them. Effective if facilitated by the following: Clearly defined objectives of the manufacturing operation. A production plan that will assist and guide the company in reaching its objectives. Planning and Control (Cont.) Control is the process of monitoring the company’s operations and determining whether the objectives identified in the planning process are being accomplished. Effective control is achieved through the following: Assigning responsibility. Periodically measuring and comparing results. Taking necessary corrective action. Responsibility Accounting Responsibility accounting is the assignment of accountability for costs or production results to those individuals who have the most authority to influence them. A cost center is a unit of activity within the factory to which costs may be practically and equitably assigned. The manager of a cost center is responsible for those costs that the manager controls. Reporting Cost and production reports for a cost center reflect all cost and production data identified with that center. The performance report will include only those costs and production data that the center’s manager can control. A variance is the difference between actual costs and budgeted costs. Performance Report Example Renaldi’s Restaurant Performance Report September 30, 2005 Budgeted Expense September Actual Year-to-Date September Variance Year-to-Date September Year-to-Date Kitchen Wages $5,500 $47,000 $5,200 $46,100 $300 F $900 F Food 17,700 155,300 18,300 157,600 600 U 2,300 U Supplies 3,300 27,900 3,700 29,100 400 U 1,200 U Utilities 1,850 15,350 1,730 16,200 120 F 850 U $28,350 $245,550 $28,930 $249,000 $580 U $3,450 Total F = Favorable U = Unfavorable Management Accounting The Institute of Management Accountants (IMA) is the largest organization of accountants in the industry. The Certified Management Accountant (CMA) is comparable to the Certified Public Accountant (CPA) for public accountants. For more information, please visit the IMA’s website at www.imanet.org Cost Accounting vs. Financial and Managerial Accounting Cost Accounting System Characteristics Financial Accounting Managerial Accounting Users: •External Parties •Managers Managers Focus: Entire business Segments of the business Uses of Cost Information: Product costs for calculating cost of goods sold and finished goods, work in process, and raw materials inventory using historical costs and GAAP. •Budgeting •Special decisions such as make or buy a component, keep or replace a facility, and sell a product at a special price. •Nonfinancial information such as defect rates, % of return products, and ontime deliveries Cost Accounting vs. Financial and Managerial Accounting (cont.) Cost accounting includes those parts of both financial and management accounting that collect and analyze cost information. Cost of Goods Sold Merchandiser Manufacturer Beginning merchandise inventory Beginning finished goods inventory Plus purchases Plus cost of goods manufactured Merchandise available for sale Less ending merchandise inventory Cost of good sold Finished goods available for sale Less ending finished goods inventory Cost of good sold Inventories Most manufacturers maintain a perpetual inventory system that uses FIFO, LIFO, or moving average methods of costing. An inventory ledger is maintained to provide support for the control accounts. Some manufacturers may use a factory ledger, which contains all of the accounts relating to manufacturing. Inventories Merchandiser Current assets: Cash Accounts receivable Mdse. inventory Manufacturer Current assets: Cash Accounts receivable Inventories: Finished goods Work in process Materials Elements of Manufacturing Costs Direct materials Materials that become part of and can be readily identified. Direct labor Labor of employees who work directly on the product manufactured. Factory overhead Includes all costs related to production other than direct materials and direct labor. Prime Cost and Conversion Cost Direct Materials Elements of Cost Direct Labor Factory Overhead Prime Cost Conversion Cost Flow of Manufacturing Costs Direct Materials Direct Labor Factory Overhead Work in Process (Assets) Finished Goods (Assets) Cost of Goods Sold (Expenses) Cost Accounting Systems Job Order Cost System Output consists of special or custom-made products. Provides a separate record for the cost of each quantity of these special or custommade products. Process Cost System Accumulates costs for each department or process in the factory. Job Order Cost System Direct Materials Direct Labor Factory Overhead Job Cost Sheets Work in Process Account Finished Goods Process Cost System Work in Process Dept. 2 Work in Process Dept. 1 Direct Materials Direct Labor Factory Overhead Direct Materials Finished Goods Direct Labor Factory Overhead Standard Cost System May be used with either a job order or a process cost system. Uses predetermined standard costs to furnish a measurement that helps management make decisions regarding the efficiency of operation. Standard costs are costs that would be incurred under efficient operating conditions and are forecast before the manufacturing process begins. Appendix Standards of Ethical Conduct for Management Accountants Members of the IMA have an obligation to the public, their profession, the organizations they serve, and themselves to maintain the highest standards of ethical conduct. Competence Confidentiality Integrity Objectivity Appendix (cont.) Resolution of Ethical Conflict When applying the standards of ethical conduct, IMA members may encounter problems in identifying unethical behavior or in resolving an ethical conflict. Discuss problems with the immediate superior except when it appears that the superior is involved. Clarify relevant ethical issues by confidential discussion with an objective advisor. Consult your own attorney as to legal obligations and rights concerning the ethical conflict. If the conflict remains after exhausting the preceding actions, resign from the organization and submit an informative memorandum to an appropriate member of the organization.