Cost Accounting Problem Packet

advertisement

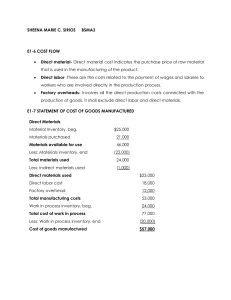

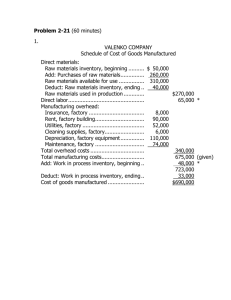

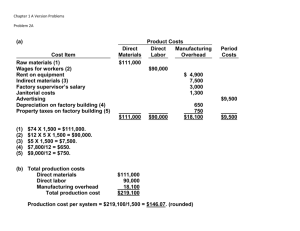

Chapter 1 Problem Packet 1. The proper sequence for the planning and controlling process is a. Set objectives, set goals, develop plans, implement plans, evaluate performance, and modify goals or plans as needed b. Develop plans, set objectives, set goals, implement plans, evaluate performance, and modify goals or plans as needed. c. Set goals, set objectives, develop plans, implement plans, evaluate performance, and modify goals or plans as needed. d. Set goals, develop plans, set objectives, implement plans, evaluate performance, and modify goals and plans as needed. 2. ___F__Product costs are the costs and resources consumed as part of administrative and selling activities during a fiscal period. 3. __F___The costs of the significant raw materials from which a product is manufactured are classified as direct labor costs. 4. ___T__If the cost of tracking an item exceeds the benefit or value of that information, the cost of the item should be assigned to an overhead category and later allocated to products in a logical manner. 5. Period expenses are most closely associated with a. Cost of direct materials for the product b. Cost of goods manufactured c. Product expenses d. Selling and administrative expenses 6. Which of the following is not a product cost? a. Fire insurance on factory equipment b. Hourly wages for shipping clerks c. Supplies for factory equipment operators d. Depreciation on factory building 7. Which of the following would be considered part of manufacturing overhead? a. Hourly wages for employees in the accounting department b. Monthly salary expense for factory maintenance personnel c. Monthly salary expense for finished good warehouse personnel d. Sales commissions paid to sales personnel directly related to product sales 8. During the month of October, Smythe Productions purchased $35,000 of raw materials. Total manufacturing costs were $130,000. Indirect labor was $20,000 and direct labor was $40,000. There was no beginning raw materials inventory, but ending raw materials inventory was $5,000. Total manufacturing overhead costs must have been a. $130,000 b. $ 60,000 c. $ 55,000 d. $ 40,000 9. Which costs are sometimes found on the income statement and sometimes found on the balance sheet? a. Period costs b. Product costs c. Both period and product costs d. Neither period nor product costs 10. Product vs Period costs Classify each of the following costs as period expenses (PE) or product costs (PC) _PC__ 1. Direct labor _PC__ 2. Indirect labor _PE__ 3. Interest expense _PE__ 4. Shipping expense _PC__ 5. Raw materials used _PE__ 6. Office salaries _PC__ 7. Factory equipment depreciation _PE__ 8. Sales commissions _PC__ 9. Factory equipment repairs _PC__ 10. Factory rent 11. Problem – COGM and COGS The following partial data is available for the month of February. Raw materials inventory, February 1 Work-in-process inventory, February 1 Work-in-process inventory, February 28 Finished goods inventory, February 1 Finished goods inventory, February 28 Raw materials purchased in February Direct materials used in February Indirect materials used in February Direct labor, February Indirect labor, February Equipment depreciation for February Sales commissions for February sales $ 15,000 10,000 12,000 48,000 37,000 93,000 63,000 12,000 72,000 30,000 5,000 45,000 Calculate the following missing information a. b. c. d. Ending raw materials inventory Total manufacturing overhead costs Total cost of good manufactured Total cost of goods sold. Problem 12 Cabinets Inc. Cost of Good Manufactured/Cost of Goods Sold Cabinets, Inc. provides the following data for year 2020: Work in process inventory, December 31, 2019 Work in process inventory, December 31, 2020 Insurance, factory Depreciation, factory Depreciation, general office Indirect labor cost Utilities, factory General office supplies Purchases of raw materials Raw materials inventory, December 31, 2019 Raw materials inventory, December 31, 2020 Direct labor cost $ 6,000 7,500 6,000 24,000 2,000 10,000 8,000 7,500 30,000 7,000 4,000 40,000 Manufacturing overhead is applied to production at the rate of $5 per machine hour. Production records reveal that a total of 10,000 machine hours were used for year 2020. Required: 1. Compute the amount of under or over applied overhead. 2. Prepare a schedule of cost of goods manufactured for year 2020. Problem 13 Helen company Use the following data for Helen Company to prepare a Cost of Goods Manufactured in good form: Raw materials inventory, January 1 Raw materials inventory, December 31 Work in process, January 1 Work in process, December 31 Finished goods, January 1 Finished goods, December 31 Raw materials purchases Direct labor Factory utilities Indirect labor Factory depreciation $ 10,000 10,000 8,000 5,000 20,000 16,000 200,000 120,000 50,000 25,000 100,000