e_week_7_directions

advertisement

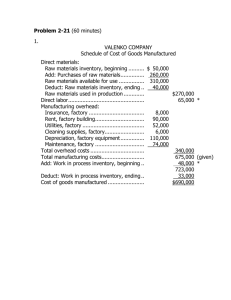

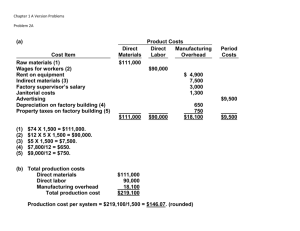

E-27-2A : Cost of gods manufactured $287,500 Schedule of cost of goods manufactured. Prepare a schedule of cost of goods manufactured for Tomas Company for the year ended June 30, 20-2. Information to prepare the schedule is as follows: Work in process, July 1, 20-1 $6,400 Materials inventory, July 1, 20-1 4,875 Materials purchases 68,950 Direct labor 140,300 Actual factory overhead 85,225 Work in process, June 30, 20-2 7,700 Materials inventory, June 30, 20-2 6,950 Indirect materials charged to production P 27-6A 3,600 Net income $104,845 Work sheet, adjusting entries, and financial statements Herrera Company had the following trial balance columns on its work sheet. Herrera Company Trail Balance December 31, 20— Account Title Debit Balance Credit Balance Cash-----------------------------------------------------------30,300.00--------------------------------------Government Notes------------------------------------------5,000.00-------------------------------------Interest Receivable-------------------------------------------------------------------------------------------Accounts Receivable--------------------------------------34,000.00---------------------------------------Allowance for Bad Debts-------------------------------------------------------------------530.00--------- Finished Goods Inventory--------------------------------24,000.00-------------------------------------Work in Process Inventory---------------------------------9,000.00-------------------------------------Materials Inventory------------------------------------------8,500.00-------------------------------------Office-Supplies------------------------------------------------3,100.00-------------------------------------Factory Supplies-----------------------------------------------3,800.00---------------------------------------Land-----------------------------------------------------------100,000.00--------------------------------------Factory Building---------------------------------------------120,000.00-------------------------------------Accumulated Depreciation—Factory Building----------------------------------- 10,000.00 Factory Equipment-------------------------------------------40,000.00-----------------------------------------Accumulated Depreciation—Factory Equipment-----------------------------------------5,000.00 Interest Payable----------------------------------------------------------------------------------------------------Accounts Payable---------------------------------------------------------------------------------13,800.00 Income Tax Payable----------------------------------------------------------------------------------------------Bonds Payable--------------------------------------------------------------------------------------80,000.00 Capital Stock----------------------------------------------------------------------------------------50,000.00 Paid-In Capital in Excess of Par-----------------------------------------------------------------30,000.00 Retained Earnings----------------------------------------------------------------------------------92,400.00 Cash Dividends----------------------------------------------30,000.00--------------------------------------Sales----------------------------------------------------------------------------------------------405,100.00--Interest Revenue-----------------------------------------------------------------------------------300.00— Factory Overhead-------------------------------------------78,630.00---------------------------------------- Cost of Goods Sold-----------------------------------------190,700.00------------------------------------------------Wages Expense-----------------------------------------------70,000.00--------------------------------------------------- Office Supplies Expense------------------------------------------------------------------------------------------------------Bad Debit Expense---------------------------------------------------------------------------------------------------------------Utilities Expense---Office------------------------------------4,400.00------------------------------------------------------Interest Expense-----------------------------------------------7,000.00-----------------------------------------------------Income Tax Expense---------------------------------------18,000.00---------------------------------------------------------------------------------------------------------------------------776,430.00---------------------776,430.00-----------------Data for adjusting the accounts are as follows: a. b. c. d. e. f. g. h. i. j. k. Factory overhead to be applied to work in process ending inventory Interest receivable Interest payable Estimate of uncollectible accounts based on an aging of accounts receivable Office supplies consumed 2,900 Factory supplies consumed 3,300 Factory building depreciation 5,000 Factory equipment depreciation 4,000 Over applied factory 1,470 Provision for corporate income taxes 6,100 Physical counts of the inventories agreed with the amounts in the books. Additional information needed to prepare the financial statements is as follows: Beginning inventories: Finished goods January 1 $18,000 Work in process, January 1 7,300 Materials inventory, January 1 9,500 Materials purchases for the year 51,500 Direct labor Actual factory overhead 60,000 90,930 Indirect materials charged to production 3,400 Required: 1. Prepare a work sheet 2. Prepare the following financial statements and schedule: $3,100 $75 600 2,930 a. b. c. d. Income statement Schedule of cost of goods manufactured Retained earnings statement Balance sheet