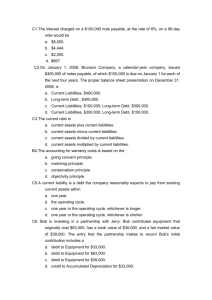

Ch 13 : Current Liabilities and Contingencies What is a Liability

advertisement

Ch 13 : Current Liabilities and Contingencies ► What is a Liability: Three Main Characteristics: 1. Present obligation. 2. Arises from past events. 3. Results in an outflow of resources (cash, goods, services). ► What is the Types of Liabilities: Three are two Types of Liabilities 1. Current Liabilities [ Chapter 13 ] 2. Non Current Liabilities [ Chapter 14 ] ► What is a Current Liability?: Current liability is reported if one of two conditions exists: 1. Liability is expected to be settled within its normal operating cycle; or 2. Liability is expected to be settled within 12 months after the reporting date. The operating cycle is the period of time elapsing between the acquisition of goods and services and the final cash realization resulting from sales and subsequent collections. ► Types of Current Liability?: Accounts payable. Notes payable. Unearned revenues. Sales taxes payable. Income taxes payable. Current maturities of long-term debt. Short-term obligations expected to be refinanced. Dividends payable. Employee-related liabilities. Accounts Payable (trade accounts payable) Balances owed to others for goods, supplies, or services purchased on open account. Illustration: On October 1, 2011, Landscape Co. Purchased inventory for $10,000 Terms 2/10, n30 from Mary Co. Date Accounts Dr. Cr. October 1 Inventory 10,000 Accounts Payable 10,000 On October 9, 2011, Landscape Co. Paid the amount due to Mary Co. Date Accounts Dr. October 9 Accounts Payable 10,000 Inventory ( $10,000 × 2% ) Cash Intermediate Accounting 2:IFRS Page 1 of 8 Cr. 200 9,800 Ehab Abdou 97672930 Ch 13 : Current Liabilities and Contingencies Notes Payable It is a Written promises to pay a certain sum of money on a specified future date. Arise from Purchases, financing, or other transactions (Converting A/P to N/P ). Notes classified as short-term or long-term. Notes may be interest-bearing or zero-interest-bearing. Interest Bearing Note Zero Interest Bearing Note فوائد صريحة فوائد ضمنية The Note Payable Doesn’t include interest The Note Payable Includes Interest The amount of Note Equal to the The amount of Note More Than the amount of Credit ( Cash Borrowed ) amount of Credit ( Cash Borrowed ) For Example : For Example : Amount of Credit = $10,000 Amount of Credit = $10,000 Amount of Note = $10,000 Amount of Note = $12,000 Interest-Bearing Note Illustration: On October 1, 2011, Landscape Co Borrowed $120,000 from Castle National Bank by signs a $120,000, 6 percent, four-month note. Date October 1, 2011 December 31, 2011 February 1, 2012 Accounts Cash Note Payable Interest expenses Interest Payable (120,000x6%x3/12) Interest Payable Interest expenses (120,000x6%x1/12) Note Payable Cash Dr. 120,000 Cr. 120,000 1,800 1,800 1,800 600 120,000 122,400 Zero-Bearing Note Issued Illustration: On October 1, Landscape issues a $122,400, four-month, zero-interest-bearing note to Castle National Bank. The present value of the note is $120,000. Date October 1, 2011 December 31, 2011 February 1, 2012 Accounts Cash Note Payable Interest expenses(120,000x6%x3/12) Note Payable Interest expenses (120,000x6%x1/12) Note Payable Note Payable Cash Intermediate Accounting 2:IFRS Page 2 of 8 Dr. 120,000 Cr. 120,000 1,800 1,800 600 600 122,400 122,400 Ehab Abdou 97672930 Ch 13 : Current Liabilities and Contingencies Unearned Revenue Amounts received before the company delivers goods or provides services. Accounting Treatment: 1- When Cash is received Date Accounts Cash Unearned ………………….. Dr. $$$$$ Cr. $$$$$ 2- When Services is performed Date Accounts Unearned ………………….. ………………….. Revenue Dr. $$$$$ Cr. $$$$$ BE13-6: Sports Pro Magazine sold 12,000 annual subscriptions on August 1, 2010, for $18 each. Prepare Sports Pro’s August 1, 2010, journal entry and the December 31, 2010, annual adjusting entry. Date August 1 December 31 Accounts Cash (12,000 × $18) Unearned subscriptions Unearned subscriptions Subscriptions Revenue (216,000 × 5/12) Dr. 216,000 Cr. 216,000 90,000 90,000 Sales Tax Payable. Sales taxes are expressed as a stated percentage of the sales price. نسبة مئوية من ثمن البيع Retailer collects tax from the customer. يقوم تاجر التجزئة بتحصيلها من العميل Retailer remits the collections to the state’s department of revenue. ثم يحولها إلى إدارة الضرائب المختصة في الدولة Either rung up separately or included in total receipts Exercise 3: In Providing accounting services to small business, you encounter the following situations pertaining to cash sales. 1. Kemer Company rings up sales and sales tax separately on its cash register. On April 10, the register totals are sales TL30,000 and sales tax TL1.500. 2. Bodrum company doesn’t segregate sales and sales taxes. Its register total for April 15 is TL23,540, which includes a 7% sales tax. Instructions Prepare the entry to record the sales transactions and related taxes for each client Intermediate Accounting 2:IFRS Page 3 of 8 Ehab Abdou 97672930 Ch 13 : Current Liabilities and Contingencies Solution: Apr. 10 15 KEMER COMPANY Cash ................................................................. 31,500 Sales ................................................................... Sales Taxes Payable .......................................... BODRUM COMPANY Cash ............................................................... 23,540 Sales (TL23,540 ÷ 1.07)...................................... Sales Taxes Payable .......................................... ($23,540 - $22,000) 30,000 1,500 22,000 1,540 Income tax Payable. Businesses must prepare an income tax return and compute the income tax payable. Taxes payable are a current liability. Corporations must make periodic tax payments. Differences between taxable income and accounting income sometimes occur (Chapter 19). Current Maturity of Long Term Debt. Portion of bonds, mortgage notes, and other long-term indebtedness that matures within the next fiscal year. Exclude long-term debts maturing currently if they are to be: 1. Retired by assets accumulated that have not been shown as current assets, 2. Refinanced, or retired from the proceeds of a new debt issue, or 3. Converted into ordinary shares. Short Term Obligations expected to be Refinanced . Exclude from current liabilities if both of the following conditions are met: 1. Must intend to refinance the obligation on a long-term basis. 2. Must have an unconditional right to defer settlement of the liability for at least 12 months after the reporting date. Customers Advances and Deposits . Returnable cash deposits received from customers and employees. May be classified as current or non-current liabilities. Employee Related Liability . Amounts owed to employees for salaries or wages are reported as a current liability, it may includes: Payroll deductions. Compensated absences. Bonuses. Intermediate Accounting 2:IFRS Page 4 of 8 Ehab Abdou 97672930 Ch 13 : Current Liabilities and Contingencies ► Provisions. Provision is a liability of uncertain timing or amount. Reported either as current or non-current liability. Common types are ► Obligations related to litigation. ► Warrantees or product guarantees. ► Premiums BE13-10: ( Litigation ) Scorcese Inc. is involved in a lawsuit during 2010. Instructions: (a) Prepare the December 31 entry assuming it is probable that Scorcese will be liable for $900,000 as a result of this suit. (b) Prepare the December 31 entry, if any, assuming it is not probable that Scorcese will be liable for any payment as a result of this suit. Date (a) Date (b) Accounts Lawsuit Loss Lawsuit Liability Dr. 900,000 Cr. 900,000 Accounts No entry is necessary because it is not Probable that a liability has been incurred at December 31, 2010. Dr. Cr. Illustration : (Warranty ) During December 2011, Cap City Inc. introduced a new line of televisions that carry a two-year warranty against manufacturer's defects. Based on past experience with similar products, warranty costs are expected to be approximately 1% of sales during the first year of the warranty and approximately an additional 3% of sales during the second year of the warranty. Sales were $6,000,000 for the first year of the product's life and actual warranty expenditures were $29,000. Assume that all sales are on credit. Required: 1. Prepare journal entries to summarize the sales and any aspects of the warranty for 2011 assuming that actual warranty costs incurred during 2011. 2. What amount should Cap City report as a liability at December 31, 2011? 3. Repeat the answer of (1) and (2) above, assuming the actual warranty costs incurred during 2012. Intermediate Accounting 2:IFRS Page 5 of 8 Ehab Abdou 97672930 Ch 13 : Current Liabilities and Contingencies Solution Requirement (1) Date During 2011 During 2011 Dec 31 2011 Accounts Accounts Receivables Sales Revenue TO RECORD 2011 SALES REVENUE Warranty Expenses Cash TO RECORD ACTUAL WARRANTY COSTS Warranty Expenses Warranty Liabilities [($6,000,000 × 4%) - $29,000 ] TO RECORD ESTIMATED WARRANTY Dr. 6,000,000 Cr. 6,000,000 29,000 29,000 331,000 331,000 Requirement (2) Dr. Warranty Liability Dec 31 Ending Bal. Cr. 331,000 331,000 Requirement (3) Date During 2011 Dec 31 2011 During 2012 Accounts Accounts Receivables Sales Revenue TO RECORD 2011 SALES REVENUE Warranty Expenses Warranty Liabilities [($6,000,000 × 4%) ] TO RECORD ESTIMATED WARRANTY Warranty Liability Cash TO RECORD ACTUAL WARRANTY COSTS Dr. Warranty Liability 29,000 Dec 31 Ending Bal. Intermediate Accounting 2:IFRS Page 6 of 8 Dr. 6,000,000 Cr. 6,000,000 360,000 360,000 29,000 29,000 Cr. 360,000 331,000 Ehab Abdou 97672930 Ch 13 : Current Liabilities and Contingencies Illustration 1 : (Premium ) Albertson Corporation began a special promotion in July 2011 in an attempt to increase sales. A coupon was placed in each box of product which sold at $10 each. Customers could send in 5 coupons for a free prize. Each prize cost Albertson Corporation $3.00. Albertson's management estimated that 80% of the coupons would be redeemed. For the six months ended December 31, 2011, the following information is available: Prizes Purchased Product Sold Coupons redeemed During 2011 35,000 Prize 200,000 Boxes 56,000 Coupons Required: Prepare all required Journal entries to account for Premium. Solution: Date During 2011 During 2011 During 2011 During 2011 Accounts Inventory – Prizes (35,000 × $3 ) Cash TO RECORD THE PURCHASE OF PRIZES Cash ( 200,000 × $10 ) Sales Revenue TO RECORD THE SALE OF PRODUCT Premium Expenses Inventory – Prizes ( 56,000 ÷ 5 ) = 11,200 × $3 TO RECORD THE ACTUAL REDEMTION Premium Expenses Premium Liability TO RECORD ESTIMATED PREMIUM Total Coupons × Percentage estimated to be redeemed = Total Estimated Coupons to be redeemed - Actual Coupons redeemed = Unredeemed Coupons ÷ Number of Coupons required for each prize = Estimated Number of Prizes × Cost Per Prize = Estimated Premium Expenses Dr. 105,000 Cr. 105,000 2,000,000 2,000,000 33,600 33,600 62,400 62,400 200,000 80% 160,000 56,000 104,000 5 20,800 $3 $ 62,400 Illustration 2 : (Premium ) Answer illustration 1, assuming that the actual redemption were incurred during 2012 instead of 2011. Intermediate Accounting 2:IFRS Page 7 of 8 Ehab Abdou 97672930 Ch 13 : Current Liabilities and Contingencies Solution: Date During 2011 During 2011 During 2011 During 2012 Accounts Inventory – Prizes (35,000 × $3 ) Cash TO RECORD THE PURCHASE OF PRIZES Cash ( 200,000 × $10 ) Sales Revenue TO RECORD THE SALE OF PRODUCT Premium Expenses (Computed Below) Premium Liability TO RECORD ESTIMATED PREMIUM Premium Liability Inventory – Prizes ( 56,000 ÷ 5 ) = 11,200 × $3 TO RECORD THE ACTUAL REDEMTION Total Coupons × Percentage estimated to be redeemed = Total Estimated Coupons to be redeemed - Actual Coupons redeemed = Unredeemed Coupons ÷ Number of Coupons required for each prize = Estimated Number of Prizes × Cost Per Prize = Estimated Premium Expenses Intermediate Accounting 2:IFRS Page 8 of 8 Dr. 105,000 Cr. 105,000 2,000,000 2,000,000 96,000 96,000 33,600 33,600 200,000 80% 160,000 0 160,000 5 32,000 $3 $ 96,000 Ehab Abdou 97672930