Document

advertisement

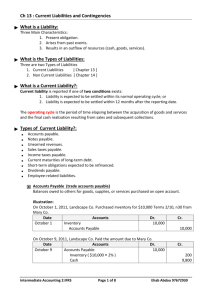

C1.The interest charged on a $100,000 note payable, at the rate of 8%, on a 90-day note would be a. $8,000. b. $4,444. c. $2,000. d. $667 C2.On January 1, 2008, Brunson Company, a calendar-year company, issued $400,000 of notes payable, of which $100,000 is due on January 1 for each of the next four years. The proper balance sheet presentation on December 31, 2008, is a. Current Liabilities, $400,000. b. Long-term Debt , $400,000. c. Current Liabilities, $100,000; Long-term Debt, $300,000. d. Current Liabilities, $300,000; Long-term Debt, $100,000. C3.The current ratio is a. current assets plus current liabilities. b. current assets minus current liabilities. c. current assets divided by current liabilities. d. current assets multiplied by current liabilities. B4.The accounting for warranty costs is based on the a. going concern principle. b. matching principle. c. conservatism principle. d. objectivity principle. C5.A current liability is a debt the company reasonably expects to pay from existing current assets within a. one year. b. the operating cycle. c. one year or the operating cycle, whichever is longer. d. one year or the operating cycle, whichever is shorter. C6. Bob is investing in a partnership with Jerry. Bob contributes equipment that originally cost $63,000, has a book value of $30,000, and a fair market value of $39,000. The entry that the partnership makes to record Bob's initial contribution includes a a. debit to Equipment for $33,000. b. debit to Equipment for $63,000. c. debit to Equipment for $39,000. d. credit to Accumulated Depreciation for $33,000. C7. In the liquidation of a partnership, any gain or loss on the realization of noncash assets should be allocated a. first to creditors and the remainder to partners. b. to the partners on the basis of their capital balances. c. to the partners on the basis of their income-sharing ratio. d. only after all creditors have been paid. C8.Partners A, B, and C have capital account balances of $120,000 each. The income and loss ratio is 5:2:3, respectively. In the process of liquidating the partnership, noncash assets with a book value of $100,000 are sold for $40,000. The balance of Partner B's Capital account after the sale is a. $90,000. b. $102,000. c. $108,000. d. $132,000. C9.In the final step of the liquidation process, remaining cash is distributed to partners a. on an equal basis. b. on the basis of the income ratios. c. on the basis of the remaining capital balances. d. regardless of capital deficiencies. C10.A, B and C are partners, sharing income 2:1:2. After selling all of the assets for cash, dividing gains and losses on realization, and paying liabilities, the balances in the capital accounts are as follows: A, $10,000 Cr; B, $10,000 Cr; and C, $30,000 Cr. How much cash should be distributed to A? a. $6,000 b. $20,000 c. $10,000 d. $16,667 11 Tom Byers sells televisions with a 2-year warranty. Past experience indicates that 2% of the units sold will be returned during the warranty period for repairs. The average cost of repairs under warranty is estimated to be $50 per unit. During 2008, 7,000 units were sold at an average price of $400. During the year, repairs were made on 55 units at a cost of $2,400. Instructions Prepare journal entries to record the repairs made under warranty and estimated warranty expense for the year. Solution 11 (5 min.) Estimated Warranty Liability ............................................................... 2,400 Repair Parts/Wages Payable ..................................................... 2,400 (To record cost of honoring 55 warranties) Warranty Expense .............................................................................. 7,000 Estimated Warranty Liability ....................................................... 12 Presley Company sells a product that includes a one-year warranty on parts and labor. During the year, 10,000 units are sold. Presley expects that 3% of the units will be defective and that the average warranty cost will be $50 per unit. Actual warranty costs incurred during the year were $14,000. Instructions Prepare the journal entries to record (a) the estimated warranty costs and (b) the actual costs incurred. Solution 12 (5 min.) (a) Warranty Expense (10,000 × 3% × $50) Estimated Warranty Liability (b) Estimated Warranty Liability 15,000 15,000 14,000 Repair Parts, Wages Payable, etc. 14,000 Ex. 13 The Smith and Wilson partnership reports net income of $45,000. Partner salary allowances are Smith $18,000 and Wilson $12,000. Any remaining income is shared 60:40. Instructions Determine the amount of net income allocated to each partner. 7,000 Solution 13 (5 min.) Salary allowance Smith Wilson Total $18,000 $12,000 $30,000 6,000 15,000 $18,000 $45,000 Remaining income, $15,000 Smith ($15,000 × 60%) 9,000 Wilson ($15,000 × 40%) Total division $27,000 Ex. 14 Prior to the distribution of cash to the partners, the accounts of ABC Company are: Cash $30,000, Alt Capital (Dr.) $10,000, Bell Capital (Cr.) $25,000, and Cole Capital (Cr.) $15,000. They share income on a 5:3:2 basis. Instructions Prepare entries to record (a) the absorption of Alt's capital deficiency by the other partners and (b) the distribution of cash to the partners with credit balances. Solution 14 (8 min.) (a) Bell, Capital ($10,000 × 3/5) ........................................................ 6,000 Cole, Capital ($10,000 × 2/5) ....................................................... 4,000 Alt, Capital .......................................................................... (b) 10,000 Bell, Capital ($25,000 – $6,000) .................................................. 19,000 Cole, Capital ($15,000 – $4,000) ................................................. 11,000 Cash ................................................................................... 30,000