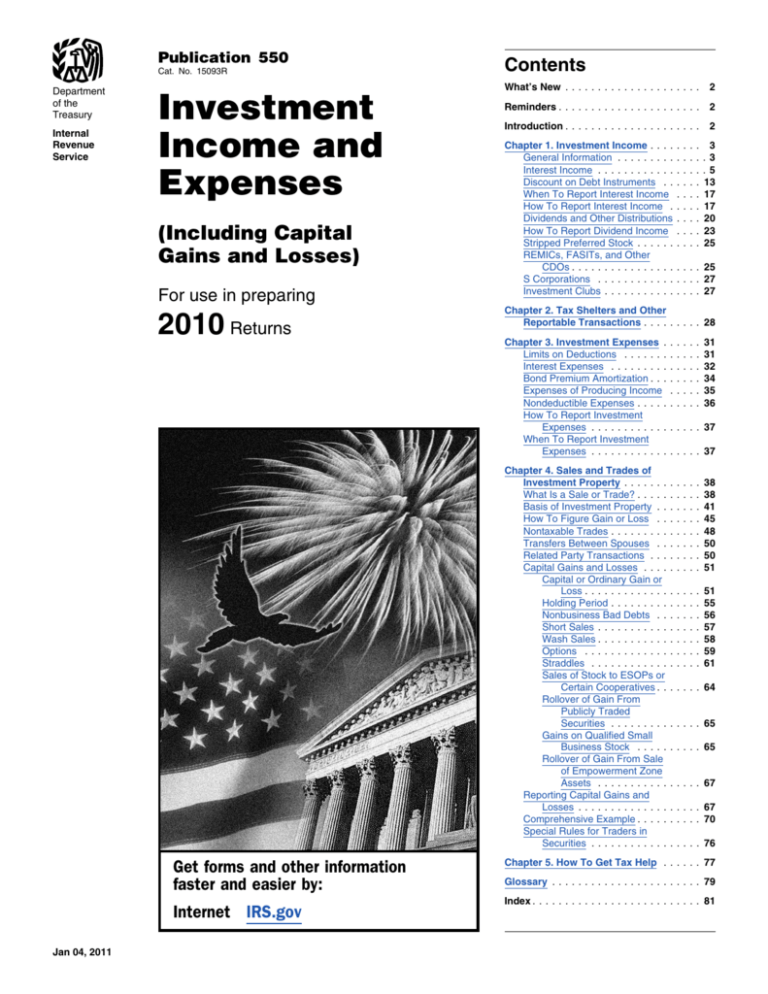

Publication 550 - Uncle Fed's Tax*Board

advertisement