course outline

advertisement

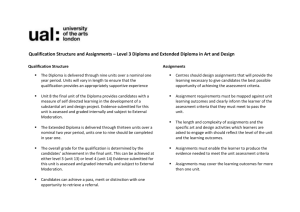

SCHOOL OF BUSINESS 1 of 6 BUSINESS AND CREATIVE ARTS Post Diploma Marketing Management COURSE OUTLINE: MARK 1031 Principles of MARKETING FINANCIAL SERVICES COURSE NAME: PROFESSOR: PHONE: EMAIL: EFFECTIVE DATE: COURSE CODE: CREDIT HOURS: PREREQUISITES: COREQUISITES: September 2005 MARK 1031 42 MARK 1027 None PLAR ELIGIBLE: YES x NO NOTE TO STUDENTS Academic Departments at George Brown College will NOT retain historical copies of Course Outlines. We urge you to retain this Course Outline for your future reference. FOR OFFICE USE ONLY ORIGINATOR: _____________________________________________________________________________________________________________ SIGNATURE DATE September 2005 CHAIR: ___________________________________________________________________________________________________________________ SIGNATURE DATE DATE OF REVISION: _______________________________________________________________________________________________________ EQUITY STATEMENT George Brown College values the talents and contributions of its students, staff and community partners and seeks to create a welcoming environment where equity, diversity and safety of all groups are fundamental. Language or activities which are inconsistent with this philosophy violate the College policy on the Prevention of Discrimination and Harassment and will not be tolerated. The commitment and cooperation of all students and staff are required to maintain this environment. Information and assistance are available through your Chair, Student Affairs, the Student Association or the Human Rights Advisor. STUDENT RESPONSIBILITIES Students should obtain a copy of the Student Handbook and refer to it for additional information regarding the grading system, withdrawals, exemptions, class assignments, missed tests and exams, supplemental privileges, and academic dishonesty. Students are required to apply themselves diligently to the course of study, and to prepare class and homework assignments as given. Regular attendance, though not a requirement, is strongly advised. Past student performance shows a strong relationship between regular attendance and success. Principles of marketing Financial Services | MARK 1031 SCHOOL OF BUSINESS 2 of 6 BUSINESS AND CREATIVE ARTS Post Diploma Marketing Management COURSE DESCRIPTION This course takes the key principles of marketing and places them in the context of this important sector. As traditional distinctions among types of financial institutions continue to blur, competing in this marketplace will require strategic, not just tactical marketing. The focus is on learning how to solve marketing problems and applying marketing theory to” real life” situations. Key topics include: the Canadian financial services market, trends in the financial services sector; the global factors that impact marketing management in this industry, product development; pricing; distribution channels and the impact of technology; customer loyalty and retention; and customer relationship marketing. Students will focus on developing marketing strategies and communications solutions using case analysis. COURSE OUTCOMES & OBJECTIVES 1. Describe the Canadian Financial services industry and the role of marketing within each sector Explain the banking industry and marketing issues Explain the insurance industry and marketing issues Explain the mutual fund industry and marketing issues Discuss the key players in the financial services market and their roles 2. Discuss the global financial services marketplace and the impact of globalization on marketing Identify the key players in the global financial services marketplace Describe some of the issues involved in global marketing 3. Develop integrated marketing communication strategies for various market segments in the financial services industry Compare the role of experiential branding versus product branding Understand what makes product launches different in the financial services industry Explain the critical issues of advertising, sales promotion, sponsorship & events and PR in the financial services industry 4. Develop a customer relationship management strategy Explain the components of services marketing and strategies to address them Discuss the elements of providing added value in a service industry Develop long term customer retention and development strategies for B to B customers Principles of marketing Financial Services | MARK 1031 SCHOOL OF BUSINESS 3 of 6 BUSINESS AND CREATIVE ARTS Post Diploma Marketing Management 5. Discuss the factors affecting pricing decisions for financial products and service Discuss the impact of various distribution channels used by financial institutions and the impact of technology ( internet) on the delivery of financial services Explain how prices are developed for financial services and products 6. Use segmentation tools and strategies to develop effective marketing strategies Apply database marketing theory to the financial services industry Discuss the impact of lifestages and consumer behavior in marketing to FI customers Apply segmentation, targeting and positioning strategies in FI case studies. ESSENTIAL EMPLOYABILITY SKILLS: As mandated by the Ministry of Training, Colleges and Universities essential employability skills (EES) will be addressed throughout all programs of study. Students will have the opportunity to learn (L) specific skills, to practice (P) these skills, and/or be evaluated (E) on the EES outcomes in a variety of courses. The EES include communication, numeracy, critical thinking & problem solving, information management, interpersonal and personal skills. The faculty for this course has indicated which of the EES is Learned (L), Practiced (P) or Evaluated (E) in this course: L P E Skill to communicate clearly, concisely and correctly in the written, spoken and visual form that fulfills the purpose and meets the needs of the audience to respond to written, spoken or visual messages in a manner that ensures effective communication to execute mathematical operations accurately to apply a systematic approach to solve problems to use a variety of thinking skills to anticipate and solve problems. to analyze, evaluate, and apply relevant information from a variety of sources L P E Skill x x x x x x x x x x x x to locate, select, organize and document information using appropriate technology and information sources to show respect for the diverse opinions, values, belief systems, and contributions of others to interact with others in groups or teams in ways that contribute to effective working relationships and the achievement of goals to manage the use of time and other resources to complete projects to take responsibility for my actions, decisions and consequences x x x x x x x x x Principles of marketing Financial Services | MARK 1031 SCHOOL OF BUSINESS 4 of 6 BUSINESS AND CREATIVE ARTS Post Diploma Marketing Management DELIVERY METHODS Case studies, in-class discussions and lectures, guest speakers, assignments, analysis of industry articles and student presentations TEXTBOOKS AND OTHER TEACHING AIDS Handouts/supplemental materials as provided by the professor. Other recommended supplemental resources: Globe & Mail, National Post, Canadian Business and Marketing Magazine “Financial Markets and Institutions”, Frederic S. Mishkin et al, Canadian edition, 2004, Pearson . TESTING & ASSIGNMENT POLICY Assignment due dates and test or exam dates are announced in class and published on the course outline. Students are responsible for keeping track of these dates. If a student misses a key date they must call or e-mail the professor in advance and set up an alternative plan, then they must provide appropriate support documentation immediately upon return to school. Acceptable documentation would be in the form of a doctor’s note, a court summons or funeral documentation. Success in this course is based heavily on in class participation and assignments. Late assignments will be penalized accordingly with a grade reduction as detailed in class. Failure to attend these classes will therefore result in zero on that particular assignment. NOTE: Students must pass the final test/exam to pass the course. GROUP WORK: This course has a large group work component. In some cases your groups will be assigned and in others you can select your own groups. It is the individual student’s responsibility to ensure they are an active, contributing member of the group. EVALUATION SYSTEM Assignments Participation Final test Group Case project Total 35% 10% 25% 30% 100% Principles of marketing Financial Services | MARK 1031 SCHOOL OF BUSINESS 5 of 6 BUSINESS AND CREATIVE ARTS Post Diploma Marketing Management GRADING SYSTEM A+ A A- 90-100 86-89 80-85 4.0 4.0 3.7 B+ B B- 77-79 73-76 70-72 3.3 3.0 2.7 C+ C C- 67-69 63-66 60-62 2.3 2.0 1.7 D+ D 57-59 50-56 1.3 1.0 Below 50 F 0.0 Excerpt from the College Policy on Academic Dishonesty The minimal consequence for submitting a plagiarized, purchased, contracted, or in any manner inappropriately negotiated or falsified assignment, test, essay, project, or any evaluated material will be a grade of zero on that material To view George Brown College policies please go to www.gbrownc.on.ca/policies Principles of marketing Financial Services | MARK 1031 SCHOOL OF BUSINESS 6 of 6 BUSINESS AND CREATIVE ARTS Post Diploma Marketing Management COURSE SCHEDULE Week Topic Assignment/Test Week 1 Introductions and Course overview Introduction to Financial Services industry in Canada and role of institutions ( e. g. Bank of Canada) Assignment #1 – 10% Week 2 Impact of globalization on the Financial Services Industry Week 3 Customer segmentation for Financial industries‐ impact of lifestages and consumer behavior Week 4 Building long term customer relationship through customer loyalty and customer service Week 5 Marketing strategy and the banking industry Retail banking and role of physical elements Week 6 Marketing strategy and the mutual fund industry Week 7 Marketing strategy and the insurance industry Week 9 Branding the FI – experiential versus product branding and Launching new products in FI’s Week 10 Integrated marketing communications strategy – the role of advertising in brand building Assignment # 3 – 5% Week 11 More IMC – the role of sales promotion, sponsorship and PR Assignment #4 – 10% Week 12 Final Test Week 13 Customer Relationship Management – B to B Week 14 Marketing Technology and FI’s, Marketing Channels, Pricing and Profitability and its Evolution in FI’s Week 15 Group Presentations/It’s a Wrap! Assignment # 2 – 10% Group Case Assigned Group project due Note: Schedule is approximate and may vary as circumstances dictate. Principles of marketing Financial Services | MARK 1031