Chapter 5 Activity-Based Costing Overcosting and Undercosting

advertisement

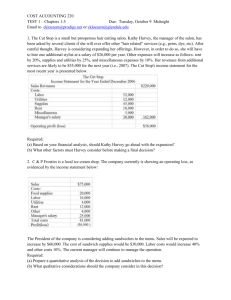

Chapter 5 Activity-Based Costing Overcosting and Undercosting Plant-wide rate versus departmental rate versus ABC Example 1 (text – pages 133 to 134) Distortions from inaccurate costing Activities/Resources/Cost Drivers Steps in ABC Identify resources and activities Assign costs to activities Assign costs to cost objects Types of cost-pools and drivers: Unit based (volume) Batch-level Product-sustaining level Facility-sustaining level Comparison of volume-based (POHR) allocation and ABC Example 2 (at the end of these notes) Activity analysis and value-added activities ABC for a service firm (example 3 – at the end of these notes) ABC for customer profitability analysis (example 4 – at the end of these notes) Strategic cost management Over and under-costing example Orange networks makes network hubs. They have two types: C (complex) and S (simple). They are the industry leader – and have been for years in making hubs like the S hub. But they find that they are not currently price competitive in making these anymore. Their strategy is to mark up their products 30% on full cost – which is about as much as the market for this type of product will allow. Here is a summary of their unit manufacturing costs: Direct materials Direct labor Overhead Total C $120.00 40.00 97.78 $257.78 S $90.00 $20.00 48.89 $158.89 Selling prices are, thus set at: $205 for S and $335 for C. The “market” price for C is $198 and for S is $375. Direct labor is $20 per hour and overhead is applied based upon the rate of $48.89 per DLH. After investigation, they noted that there were two cost pools. There was a volume-based cost pool that totaled $120,000 and a batch-based cost pool that totaled $100,000. There are 2 units of C or 10 units of S in a batch and DLH is still considered an appropriate driver for the volume based cost pool. Orange networks plans to produce 1,000 units of C and 2,500 units of S. What is the appropriate unit cost for each of these products and what is the appropriate selling price to obtain a 30% markup on full cost? Example 2 Demski Company has used a two-stage cost allocation system for many years. In the first stage, plant overhead costs are allocated to two production departments, P1 and P2 based on machine hours. In the second stage, Demski uses direct labor hours to assign overhead costs from the production departments to individual products A and B. Budgeted factory overhead costs for the year are $300,000. Both the budgeted and actual machine hours in P1 and P2 are 12,000 and 28,000 hours, respectively. After attending a seminar to learn the potential benefits of adopting an activity-based costing system (ABC), Ted Demski, the president of Demski Company, is considering implementing an ABC system. Upon his request, the controller at Demski Company has compiled the following information for analysis: Cost Pool Machine setup Inspection Power Supervision Total overhead cost Factory overhead costs $100,000 50,000 50,000 100,000 $300,000 Activity cost driver Setup hours Inspection hours Kilowatt hours Direct labor hours Expected activity level 1,000 2,500 25,000 10,000 Demski manufactures two types of product A and B, for which the following information is available: A B Units produced and sold 5,000 10,000 Direct materials $200,000 $250,000 Direct labor costs $80,000 150,000 Direct labor hours in P1 1,500 3,000 Direct labor hours in P2 1,500 4,000 Setup hours 700 300 Inspection hours 1,500 1,000 Power (kilowatt hours) 12,500 12,500 Required: (a) Determine the unit cost for each of the two products using the traditional two-stage allocation method. (b) Determine the unit cost for each of the two products using the proposed ABC system. (c) Compare the unit manufacturing costs for product A and product B computed in requirements a and b. (1) Why do two the cost systems differ in their total cost for each product? (2) Why might these differences be important to the Demski Company? Example 3 The Wolfson Group (WG) provides tax advice to multinational firms. WG charges clients for (a) direct professional time (at an hourly rate), and (b) support services (at 30%) of the direct professional costs billed). The three professionals in WG and their rates per professional hour are: Professional Myron Wolfson Ann Brown John Anderson Billing Rate per Hour $500 120 80 WG has just prepared the May 1999 bills for two clients. The hours of professional time spent on each client are as follows: Professional Wolfson Brown Anderson Total Hours per client Seattle Tokyo Dominion Enterprises 15 2 3 8 22 30 40 40 a. What amounts did WG bill to Seattle Dominion and Tokyo Enterprises for May 1999? b. Suppose support services were billed at $50 per professional labor-hour (instead of 30% of professional labor costs). How would this change the amounts WG billed to the two clients for May 1999? c. What rate per professional labor-hour must WG charge in order for the total overhead allocation to be the same under the two approaches? Example 4 Grabbler Company has gathered the following data pertaining to activities it performed for two of its major customers. Number of orders Units per order Sales returns: Number of returns Total units returned Number of sales calls Thomas Inc. Inc. 10 500 Balky Company. 4 40 10 10 200 4 30 200 Grabbler sells its products at $500 per unit, net 30. The firm's gross margin ratio is 20 percent. Both Thomas Inc. and Balky Company pay their accounts promptly and no accounts receivable is over 30-days. Vikki Smith, the controller of Grabbler has determined the following activity costs: Activity Sales calls Order processing Deliveries Sales returns Sales salary Cost Driver and Rate $1,000 per visit $ 300 per order $ 500 per order $100 per return and $5 per unit returned $100,000 per month Required 1. Classify activity costs into cost categories and compute the total cost for Grabbler Company to service Thomas and Balky. 2. Compare the profitability of these two customers (ignore cost of funds).