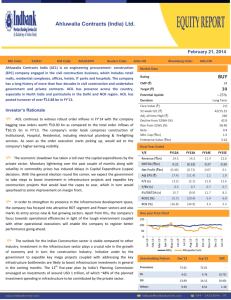

Ahluwalia Contracts India Ltd

advertisement

PRESS RELEASE 15th December, 2011 CARE Equity Research maintains Fundamental Grade of 4 to the equity shares of Ahluwalia Contracts (India) Limited AHLUWALIA CONTRACTS (INDIA) LIMITED About the Company Incorporated in 1979 and subsequently converted into a public limited company in 1990, Ahluwalia Contracts India Limited (ACIL) is engaged in the construction business for over four decades. ACIL has executed diverse projects across sectors like residential spaces, office spaces, retail malls, hotels, hospitals, IT parks, SEZ, industrial buildings, etc CARE Equity Research assigns Fundamental across geographies in India. Mainly involved in construction business, Grade on a scale of Grade 5 to Grade 1, with ACIL also offers total integrated engineering and design turnkey Grade 5 indicating ‘Strong Fundamentals’ and solutions to its clients in the public and private sector. ACIL through its Grade 1 indicating ‘Weak Fundamentals’. 100 per cent subsidiary Ahlcon Ready Mix Concrete Private Limited CARE assigns Valuation Grade on a scale of (ARMC) operates into the business of Ready Mix Concrete (RMC) – a Grade 5 to Grade 1, with Grade 5 indicating step towards backward integration. The company has successfully ‘Considerable Upside Potential’ and Grade 1 completed various projects in the residential, commercial, educational indicating ‘Considerable Downside Potential’. institutes, retail, hotels, industrial plants and hospitality sectors. Fundamental Grade 4 [Four] – ‘Very Good Fundamentals’ CARE Equity Research maintains a Fundamental Grade of 4 [Four] to the equity shares of ACIL, indicating ‘Very Good Fundamentals’. ACIL is largely present in civil construction with more than four decades of execution track record and healthy diversification across sectors, clients and geographies across India. The order book as of September 30th 2011 stood at Rs.3,620 crore, providing revenue visibility of around two years. ACIL reported revenues of Rs.303.9 crore in Q2FY12 (July 1 to September 30) as against Rs.341.2 crore in Q2FY11, down 11 per cent yo-y. Revenues were impacted due to slower execution of commercial and residential projects. The company reported an EBITDA of Rs. 4.5 crore in Q2FY12 as against Rs. 40.2 crore in Q2FY11, a drop of around 89% y-o-y, on account of 1) execution of low-margin orders, 2) cost overrun in certain projects and 3) higher material costs wherein passthrough arrangements are not available. Consequently, EBITDA margin too were lower at 1.5 per cent against 11.8 per cent in the previous quarter last year, a decline of 1030 bps. ACIL reported net loss for the quarter at Rs. 6.7 crore as against profit of Rs. 20.8 crore in Q2FY11. Depreciation expenses increased by 34 per cent to Rs. 10.5 crore due to increase in fixed cost (machinery) while interest expenses increased by 41 per cent to Rs. 5.2 crore for the quarter. ACIL being primarily into civil construction is exposed to the risk of slowdown in the economy, as the order-book is primarily inclined towards private sector. Any further slowdown in the real estate sector and the corporate capital expenditure would result in sluggish order flows. High working capital cycle will also continue to be a challenge for the company. Analytical Contact Business Development Contact Amod Khanorkar General Manager Anil Varghese AVP – Business Development Hand phone: +91-9322123311 Direct Line: +91-22-6754 3673 anil.varghese@careratings.com Direct Line: +91-22-6754 3520 amod.khanorkar@careratings.com Fundamental Grade CARE Equity Research’s Fundamental Grade is an opinion on the fundamental soundness of the company vis-à-vis other listed companies in India. The grade is assigned on a five-point scale as under: CARE Fundamental Grade 5/5 4/5 3/5 2/5 1/5 Evaluation Strong Fundamentals Very Good Fundamentals Good Fundamentals Modest Fundamentals Weak Fundamentals Valuation Grade This grade represents the potential value in the company’s equity share for the investor over a 1-year period. The grade is assigned on a five-point scale as under: CARE Valuation Grade 5/5 4/5 3/5 2/5 1/5 Evaluation Considerable Upside Potential (>25% upside from CMP) Moderate Upside Potential (10-25% upside from CMP) Fairly Priced (+/- 10% from CMP) Moderate Downside Potential (10-25% downside from CMP) Considerable Downside Potential (>25% downside from CMP) Grading determination is a matter of experienced and holistic judgment, based on relevant quantitative and qualitative factors of the company in relation to other listed companies. DISCLOSURES Each member of the team involved in the preparation of this grading report, hereby affirms that there exists no conflict of interest that can bias the grading recommendation of the company. The CARE EQUIGRADE report has been sponsored by the company. DISLCLAIMER This report is prepared by CARE Research, a division of Credit Analysis & REsearch Limited [CARE]. CARE Research has taken utmost care to ensure accuracy and objectivity while developing this report based on information available in the public domain or from sources considered reliable. However, neither the accuracy nor completeness of the information contained in this report is guaranteed. CARE Research operates independently of the ratings division and this report does not contain any confidential information obtained by the ratings division, which it may have obtained in the regular course of operations. Opinions expressed herein are our current opinions as on the date of this report. CARE’s valuation of the security is mainly based on company-specific fundamental factors. Equity prices are affected by both fundamental factors as well as market factors such as – liquidity, sentiment, broad market direction etc. The impact of market factors can distort the price of the security thereby deviating from the intrinsic value for extended period of time. This report should not be construed as recommendation to buy, sell or hold a security or any advice or any solicitation, whatsoever. It is also not a comment on the suitability of the investment to the reader. The subscriber / user assumes the entire risk of any use made of this report or data herein. CARE specifically states that it or any of its divisions or employees have no financial liabilities whatsoever to the subscribers / users of this report. This report is for personal information only of the authorised recipient in India only. This report or part of it should not be reproduced or redistributed or communicated directly or indirectly in any form to any other person, especially outside India or published or copied for any purpose. ABOUT US Credit Analysis & REsearch Ltd. (CARE) is a full-service rating company that offers a wide range of rating and grading services across sectors. CARE has an unparallel depth of expertise. CARE Ratings methodologies are in line with the best international practices. CARE Research CARE Research is an independent research division of CARE Ratings, a full-service rating company. CARE Research is involved in preparing detailed industry research reports with 5-year demand and 2-year profitability outlook on the industry besides providing comprehensive trend analysis and the current state of the industry. CARE Research currently offers reports on more than 26 industries which are updated on a monthly/quarterly basis. Subscribers can access CARE Research reports online. CARE Research also offers research that is customized to client requirements. Customized Research involves business analysis and position in the market, financial analysis, market sizing etc.