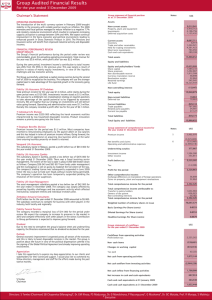

Audited Financial Results For the year ended 31 December 2008

advertisement

Audited Financial Results For the year ended 31 December 2008 ISO 9001:2000 Certified CHAIRMAN’S STATEMENT The Operating Environment After declining by 6% in 2007, Zimbabwe's GDP is estimated to have declined by a further 7% in 2008. The GDP decline is a result of output slump across all the major sectors of the economy, particularly agriculture, mining, manufacturing, and tourism. The agricultural sector suffered from lack of inputs. The mining sector saw some mining houses closing shop or suspending operations citing foreign currency shortages and the central bank's delay in releasing proceeds from mineral sales. The manufacturing sector still has low capacity utilization of below 15% as a result of shortages of raw materials, foreign currency, and a whole host of other production bottlenecks. Although no official figures have been forthcoming from the Central Statistical Office, hyperinflation continued to wreck havoc throughout the economy, with the result that by year end, the local currency had ceased to be accepted for commercial transactions in most sectors of the economy. The decision by the authorities to allow the use of multiple foreign currencies is a welcome development as hyperinflation had rendered the use of the local currency impractical. Money market investment rates remained depressed for the whole of the year 2008, with short-term interest rates hardly exceeding 200% against inflation rate in excess of 231m%. Despite a sharp decline towards the end of the year, the equities market, on the other hand, achieved a brilliant performance, recording a 30.3 sextillion percent growth during the year 2008. While we acknowledge that due to the hyperinflationary environment, detailed presentation of financial statements in Zimbabwe dollar terms does not allow for meaningful analysis and interpretation, the same figures are presented to comply with regulatory requirements. Financial Performance Overview Given the hyperinflationary environment, management must be commended for having employed strategies that not only preserve shareholder’s value, but also grew the business in real terms through investing in properties and the stock market, resulting in a profit before transfer to policyholders and tax of $143.3 sextillion, for the year ended 31 December 2008. Total income for the year 2008 amounted to $155.2 sextillion, representing a growth of 39.5 quintillion percent over the $6 430 achieved in the year 2007. Investments income remained the dominant contributor, accounting for 99.6% of total income for the year 2008. Administration expenses went up from $1.99 thousand in 2007 to $10.2 sextillion for the year ended 31 December 2008. This was reflective of the hyperinflationary environment that we are operating in, and the staff remuneration measures that management implemented during the year to retain essential skills. Fidelity Life Assurance Reflecting the dwindling disposable incomes as a result of the hyperinflationary environment, total premium income grew by 5 quadrillion percent from $22.3 in 2007 to $11.2 quintillion for the year ended 31 December 2008. The growth in premiums, though lower than inflation, was higher than the claims growth of 14.3 trillion percent, from $1.9 in the year 2007 to $2.7 quadrillion in 2008. Realised income on equities grew marginally to $1.2 quadrillion in 2008, as the strategy was to hold inflation hedging assets. The company's profit before tax for the year 2008, at $134.7 sextillion, was above the prior year figure of $5.95 thousand. Vanguard Life Assurance This subsidiary, based in Malawi, posted a profit before tax of $2.55 sextillion for the year ended 31 December 2008 compared to $86 recorded for the year 2007. Fidelity Life Asset Management The asset management subsidiary posted a profit before tax of $4.09 sextillion for the year ended 31 December 2008. This compares favourably to the $810 recorded in the year 2007. as at 31 December 2008 for the year ended 31 December 2008 INCOME Premium ASSETS Dividend The Board has not declared a dividend in respect of the 2008 financial year. Outlook The recent reforms introduced by both the monetary and fiscal policies will help improve the business landscape in the country, and Fidelity Life Assurance is well positioned to take advantage of the arising opportunities, as well as deal with the associated challenges. The company welcomes the opportunity to charge premiums in foreign currency, and is ready to explore alternative investment opportunities that may arise as the financial markets become more liberalised. Appreciation I would like to commend my fellow directors, management and staff for the efforts made during the past year. Clients and other stakeholders' support is greatly appreciated. S. Tembo Chairman Cavmont Life and Asset Management Company (Pvt) (Ltd) (Zambia) Cavmont Life and Asset Management Private Limited based in Zambia posted a profit before tax of $1.24 sextillion for the year. The premium income generated ABRIDGED CONSOLIDATED INCOME STATEMENT DEC 2007 $ trillion Zimbabwe Actuarial Consultancy The subsidiary posted a profit before tax of $325 quintillion for the year. Fidelity Funeral Assurance Fidelity Funeral Assurance in its second year of operating managed to post $167 quintillion before tax. ABRIDGED CONSOLIDATED BALANCE SHEET DEC 2008 $ trillion for the period ended 31 December 2008 was $3.63 sextillion and other income was $0.52 sextillion. The results exceeded expectations since it was the first year of operation under the group. Fees and Commission Income Investment Income Fair Value Gains - Investments Other Operating income HISTORICAL COST GROUP CASHFLOW STATEMENT DEC 2008 $ trillion DEC 2007 $ trillion 13,734,445,097 - 1,365,203,310 738,731,761 137,456,912,736 1,944,670,384 - 141,505,518,191 for the year ended 31 December 2008 HISTORICAL COST DEC 2008 AUDITED $ trillion DEC 2007 AUDITED $ trillion OPERATING ACTIVITIES Profit Before Tax 143,315,144,600 - - Non Cash Items (136,517,546,224) - (945,073,959) 5,852,524,417 Non Current Assets Property and Equipment 54,758,853,906 - Investment Property 59,236,423,353 - Total Revenue 155,239,963,288 - Other Investments 18,605,694,690 132,600,971,949 - OUTGO Claims Transfer to Policy Holders Other Operating and Administration Costs Changes in working Capital Cash From Operating Activities 1,716,445,677 128,388,115,209 10,208,373,011 - Tax Paid (869,339,834) - 4,983,184,583 - 140,312,933,897 - NET CASH FROM OPERATING ACTIVITIES (4,732,035,053) - - - 251,149,529 - - - 251,149,529 - Current Assets Inventory 61,801,532 - Total Claims, Benefits and Other Expenses 6,078,569,869 - PROFIT BEFORE TAX 14,927,029,391 - Short term investments 104,742,880,265 - Tax (1,460,807,975) - Bank and Cash Balances 281,585,307 111,164,836,973 - PROFIT AFTER TAX 13,466,221,416 - 13,080,151,995 386,069,421 13,466,221,416 - 4,492,059,545 - 299,778,340 299,778,340 Accounts Receivable TOTAL ASSETS 243,765,808,922 - Basic Earnings Per Share ($) EQUITY AND LIABILITIES Equity Share Capital - - Share Premium - - Retained Profit 13,080,151,995 - Life Fund 222,743,706,478 235,823,858,473 - Minority Interest Total Equity Attrbutable to Equity Holders Minority Interest 386,069,421 - 263,209,927,894 - Weighted average number of ordinary shares in issue GROUP STATEMENT OF CHANGES IN EQUITY AND RESERVES Current Liabilities Outstanding claims Other Accounts Payable Tax Bank overdraft Total Current Liabilities TOTAL EQUITY AND LIABILITIES 1,951,347,651 - 893,298,708 - 4,301,998,734 - 378,800,158 - 30,435,778 5,604,533,377 - 243,765,808,922 - NET CASH INFLOW FROM FINANCING ACTIVITIES NET DECREASE/INCREASE IN CASH AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD CASH AND CASH EQUIVALENTS AT END OF PERIOD Attributable to shareholders and policy holders of the parent for the year ended 31 December 2008 Retained Minority Share Capital $ trillion - Share Premium $ trillion - Profit $ trillion - Life fund $ trillion - Interest $ trillion - Total $ trillion - Shares Issued Translation Gain Property revaluation Surplus For The Year Dividend paid - - - - - - Balance as at 31 December 2007 - - - - - - Shares Issued Life fund withdrawal Translation Gain Fair value adjustment-Available for sale Investments Revaluation Surplus - Properties - - - 26,644,388,657 - 26,644,388,657 - - - 14,975,751,995 54,530,753,997 - 14,975,751,995 54,530,753,997 Surplus For The Year - - 13,080,151,995 128,388,115,209 386,069,421 141,854,336,625 Balance as at 31 December 2008 - - 13,080,151,995 222,743,706,478 394,480,743 236,209,927,894 Balance as at 31 December 2006 Non Current Liabilities Deferred Tax NET CASH OUTFLOW FROM INVESTING ACTIVITIES NOTES TO THE FINANCIAL STATEMENTS 1 GENERAL INFORMATION Fidelity Life Assurance Company Limited is a limited company incorporated and domiciled in Zimbabwe and has subsidiaries including Fidelity Life Financial Services, Fidelity Funeral Services , Fidelity Life Asset management Company, Zimbabwe Acturial Consultants, Vanguard Life Assurance and Cavmont Life & Asset Management. Fidelity Life Asset Management Company is an asset management company which provides financial services, Zimbabwe Acturial Consultants provides acturial services, Fidelity Funeral Services provides funeral services , Vanguard provides life assurance services, Cavmont provides asset management and life assurance services. The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognised in the period in which the estimate is revised if the revision affects only the period or in the period of the revision and future periods if the revision affects both current and future periods. (a) Fair value of shares quoted on the Zimbabwe Stock Exchange. The Zimbabwe Stock Exchange suspended trading on 20 November 2008. The prices obtaining on this date have been used as the fair values of the shares. Actual fair values may differ from the estimates used. 1.1 Non Compliance with IFRS (b) Exchange rates The financial statements are not compliant with International Financial Reporting Standards in that the requirements of IAS 29 "Financial Reporting in Hyperinflationary Economies" have not been complied with. The standard requires that financial statements of entities reporting in currencies of a hyperinflationary economy be stated in terms of the measuring unit currrent at the balance sheet date. Restatements have not been possible due to non availability of indices from the Central Statistical Office. The requirements of all other lnternational Financial Reporting Standards have been complied with under the historical cost convention as modified by fair valuation of certain assets. In 2008 there was a multiplicity of exchange rates. Financial results and financial position are greatly influenced by exchange rates applied on foreign balances and transactions denominated in foreign currencies. For the purpose of these Group financial statements the Old Mutual Implied rate has been used. The rate moved as follows: 1.2 Basis of preparation The financial statements are presented in Zimbabwe dollars, rounded to the nearest trillion. They are prepared under the historical cost basis except that the following assets and liabilities are stated at their fair value: derivative financial instruments, financial instruments held for trading and financial instruments at fair value through profit and financial instruments classified as available for sale, properties and motor vehicles. 2 SIGNIFICANT JUDGEMENTS The following are the significant judgements made by management: The preparation of financial statements in accordance with IFRSs requires directors to make judgements, estimates and assumptions that affect the application of policies and reported amounts of assets and liabilities, income and expenses. The estimates and associated assumptions are based on historical experience and various other factors that are believed to be reasonable under the circumstances, the results of which form the basis of making judgements about carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates. 1 January 2008 30 June 2008 31 December 2008 $8.254 $12,617,983,349,233,500.000 (c)Valuation of Insurance Contract liabilities Valuation of insurance contract liabilities is carried out by a qualfied actuary Mr N Kapadia 2.7 Basis of consolidation The consolidated financial statements incorporate the financial statements of the company and its subsidiaries. The results of the subsidiaries are included from the effective dates of acquisition until the effective dates of their disposal. Subsisiaries are all the entities over which the Group has the power to govern the financial and operating policies, generally accompanying a shareholding of more than half the voting rights.