Group Audited Financial Results

advertisement

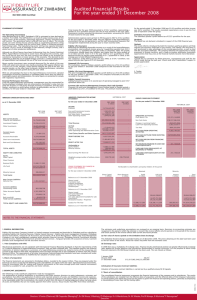

Group Audited Financial Results For the year ended 31December 2009 Chairman’s Statement Group statement of financial position as at 31 December 2009 OPERATING ENVIRONMENT The introduction of the multi currency system in February 2009 brought stability in the economy with notable positive results on inflation. The 2009 monetary and fiscal policies managed to reduce inflation to a negative 7.7% and created a conducive environment which resulted in companies increasing capacity utilization to average between 30% and 40%. We expect continual improvement in the Socio economic and political environment, leading to enhanced growth in Gross Domestic Product in 2010. The Pensions and Insurance sector will benefit from improved industrial activity and disposable incomes. Assets FINANCIAL PERFORMANCE REVIEW GROUP RESULTS The Group’s financial performance during the period under review was commendable, given the prevailing operating environment. Total revenue for the year was $3.9 million, while profit after tax was $2.2 million. During the same period, investment income's contribution to total income was 26% from the 95% in the previous year. This was largely a result of decline in values of mainly equity investments, in view of the liquidity challenges and low economic activity. The Group successfully undertook a capital raising exercise during the second half of 2009 to recapitalize the business. The company will use the stronger capital base to take advantage of the expected growth in the economy going forward. Fidelity Life Assurance Of Zimbabwe Total premium income for the year was $1.5 million, while claims during the same period were at $130 000. Investments income stood at $1.5 million. This was due to a deliberate non crystallization strategy on equities positions to take advantage of the upside potential to be triggered by economic recovery. We are hopeful that our strategy on investments will still deliver value going forward. Operating and administration costs were $1.3 million. Overally the company recorded a profit after tax for the year of $2.1 million. • Individual Life Division Premium income was $239 000 reflecting the harsh economic realities characterized by low household disposable incomes. Product innovation remains a priority area going into the future. • Employee Benefits Division Premium income for the period was $1.2 million. Most companies have reverted to remunerating employees via the payroll albeit on low salaries and this has helped in terms of premium income inflows. Going forward, the company will be aggressive on acquiring new business while at the same time ensuring business presently on board is retained. Vanguard Life Assurance This subsidiary, based in Malawi, posted a profit before tax of $813 000 for the year ended 31 December 2009. Fidelity Life Assurance Zambia This subsidiary, based in Zambia, posted a loss before tax of $476 000 for the year ended 31 December 2009. There was a fraud involving senior management. The extent of the loss to date is about $100 000 broken down as follows: Company $36 043 and $63 957 from funds under management and the investigation is still on going to establish the full extent of the loss. The company's trading license was subsequently suspended in June 2009 hence the loss is due to fixed over heads without income being generated. The company's operation has been temporarily suspended pending the resolution of the license suspension. Fidelity Life Asset Management The asset management subsidiary posted a loss before tax of $42 000 for the year ended 31 December 2009. The company was largely affected by prevailing liquidity challenges and low economic activity which affected institutional, corporate entities and individual investors alike. Zimbabwe Actuarial Consultants Profit before tax for the year ended 31 December 2009 amounted to $5 000. The subsidiary continues to compete for business with other players in the industry, both locally and regionally. Fidelity Funeral Services The company recorded a marginal loss of $14 000 for the period under review. We expect the company to increase its presence in the market in 2010 and compete effectively with other players in the sector. Contribution to Group performance is expected to improve going forward. Dividend Due to the need to strengthen the group's balance sheet and underwriting capacity, the Directors recommend that no dividend be declared for the year. Outlook General economic improvement is expected across all sectors of the economy and this is likely to boost disposable incomes in the market. The group is positive about the future in view of the political dispensation ushered in by the signing of the Global Political Agreement and already improving operating environment. Appreciation I take this opportunity to express my deep appreciation to our clients and stakeholders for their continued support. I would also like to commend my fellow directors, management and staff for the efforts made during the past twelve months. Non-current assets Property, plant and equipment Investments Deferred acquisition costs 4 US$ 9,212,941 3,970,753 4,106,756 1,135,432 6,667,711 8,919 1,244,921 4,361,423 763,050 289,398 Current assets Inventory Trade and other receivables Held for trading investments Short term investments Cash and cash equivalents 15,880,652 Total assets Equity and liabilities 15,055,926 1,089,233 1,202,667 1,912,588 58,898 22,664 545,942 10,223,934 Equity and policyholders’ funds Share capital Share premium Non distributable reserve Currency translation reserve Revaluation surplus Retained earnings Life fund (15,047) Non-controlling interest 15,040,879 Total equity Non-current liabilities Deferred tax 10,663 10,663 Current liabilities Trade payables Related party payables Current tax payable 829,110 767,082 34,901 27,127 Total liabilities 839,773 15,880,652 Total Equity and liabilities Group statement of comprehensive income for the year ended 31 December 2009 Notes US$ Premium income 5 3,902,070 Net benefits and claims Operating and administrative expenses 6 (3,525,003) (535,985) (2,989,018) 377,067 Underwriting surplus 1,504,380 353,815 Investment income Other income Profit before tax Tax Profit for the period Other comprehensive income: Exchange differences on translation of foreign operations Gains on property, plant and equipment revaluations 7 2,235,262 (14,399) 2,220,863 58,898 22,664 Total comprehensive income for the period 2,302,426 Total comprehensive income attributable to: Transfer to policy holders Owners of the parent Non-controlling interests Total comprehensive income for the period 1,654,983 656,025 (8,582) 2,302,426 Weighted number of ordinary shares in issue 76,697,574 Basic Earnings Per Share (cents) 0.8553 Diluted Earnings Per Share (cents) 0.8553 Headline Earnings Per Share (cents) 0.8879 Group statement of cashflows for the year ended 31 December 2009 US$ Cashflows from operating activities Profit before tax 2,235,262 Non- cash items (539,681) Changes in working capital (616,914) Tax paid Net cash from operating activities Net cash outflow from investing activities Net cash inflow from financing activities S Tembo Chairman Notes (6,523) 1,072,144 (2,084,226) 1,700,000 Net increase in cash and cash equivalents 687,918 Cash and cash equivalents at 01 January 2009 364,530 Cash and cash equivalents at 31 December 2009 1,052,448 Directors: S Tembo (Chairman) SB Chapereka (Managing)*, Dr. EM Khosa, PS Madzonga, Dr. G Mandishona, P Razunguzwa*, G Mushoma*, Dr. GC Mataka, Prof. R Murapa, S Mabheju * Executive Group statement of changes in equity for the year ended 31 December 2009 Share capital Share premium US$ US$ Retained earnings Currency translation reserve Revaluation surplus Life Fund Non distributable reserves US$ US$ US$ US$ US$ - - (110,083) - - 8,852,380 Issue of shares 429,676 1,202,667 - - - Transfer from non distributable reserve 659,557 - - - - Balance at 1 January 2009 Equity attributable to owners of Nonparent andControlling policyholdersInterest US$ US$ Total equity US$ 2,572,145 11,314,442 (6,465) 11,307,977 - - 1,632,343 - 1,632,343 - (659,557) - - 2,302,426 Changes in equity for 2009 Total comprehensive income for the year - - 656,025 58,898 22,664 1,573,421 - 2,311,008 (8,582) Life fund withdrawal - - - - - (201,867) - (201,867) - (201,867) 1,089,233 1,202,667 545,942 58,898 22,664 10,223,934 1,912,588 15,055,926 (15,047) 15,040,879 Balance at 31 December 2009 Notes to the consolidated financial statements for the year ended 31 December 2009 1.GENERAL INFORMATION Fidelity Life Assurance of Zimbabwe is a limited company incorporated and domiciled in Zimbabwe and has the following subsidiaries, Fidelity Life Asset Management Company of (Private) Limited, Fidelity Financial Services (Private) Limited, Fidelity Funeral Services (Private) Limited, Zimbabwe Actuarial Consultants (Private) Limited, Vanguard Life Assurance Company (Private) Limited and Fidelity Life Zambia (2009) Limited. Fidelity Life asset Management Company (Private) Limited is an asset management company which provide financial services, Zimbabwe Actuarial Consultants (Private) Limited provides actuarial services, Fidelity Life Funeral Services (Private) Limited provides funeral services, Vanguard provides life assurance services, Fidelity Life Zambia (2009) Limited provides asset management and life assurance services. 2. STATEMENT OF COMPLIANCE The Group’s accounting policies used in preparing these financial results are in all material respects consistent with those applied in previous years except for the non compliance with International Financial Reporting Standards (IFRS) as regards the following: IAS 1 - Presentation of Financial Statements. IAS 21 - The effects of changes in Foreign Exchange Rates. IAS 29 - Financial Reporting in Hyperinflationary Economies IAS 1 requires an entity to disclose comparative information in respect of previous reporting periods, while in order to report in the new functional currency, IAS 21 and IAS 29 require that inflation adjusted financial statements be prepared and converted into new currency using the closing exchange rates at the date of change to the new functional currency. The effects of these departures have not been quantified. However in preparing these financial statements, the Group has complied with the Financial Reporting Guidance jointly recommended for use by the Public Accountants and Auditors Board, the Zimbabwe Accounting Practices Board and the Zimbabwe Stock Exchange. Although it’s not a legal requirement to apply the Financial Reporting Guidance, the directors, in line with their fiduciary responsibilities to prepare financial statements that fairly present the state of affairs and performance of the Group have adopted these recommendations as it is the best possible manner in which they can present financial statements that are as fair as practicable under the prevailing circumstances. 3. CURRENCY The financial statements are expressed in United States Dollars which is the group’s functional currency. The functional currency was changed from Zimbabwe dollars to United States Dollars on 1 February 2009. US$ 4. INVESTMENTS Investment properties Unlisted equities 3,606,756 500,000 4,106,756 5.PREMIUM INCOME Individual life business Group business Gross premium income Less: Reassurance Net premium income 6. NET CLAIMS Death Maturities Annuities Surrenders Group claims Gross Claims Less: Reassurance recoveries 1,614,934 2,384,507 3,999,441 (97,371) 3,902,070 182,823 48,187 21,136 93,010 262,516 607,672 (71,687) 535,985 7. PROFIT BEFORE TAX Profit before tax at is shown after crediting/(charging) the following: Fair value adjustments on held for trading investments Fair value adjustments on investment properties Audit fees Directors emoluments- for services as directors - for other services Depreciation of property, plant & equipment Unrealised exchange gain Amortisation of deferred acquisition costs Staff costs Life and Funeral Assurance Pensions and Employee Benefits Asset Management Financial Services 188,144 744,614 (29,556) (165,377) (75,348) (256,757) 58,898 (160,256) (1,377,116)