Trade Promotion of Consumer Durables

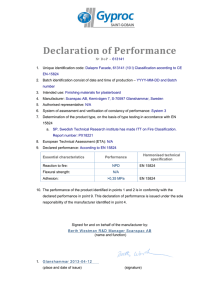

advertisement