Toys & Giftware M&A Report - Intrepid Investment Bankers LLC

January 2015

Toys & Giftware M&A Report

Sector M&A Posts Productive 2014

11755 Wilshire Blvd., Suite 2200, Los Angeles, CA 90025 ● T 310.478.9000 ● F 310.478.9004 ● IntrepidIB.com

Toys & Giftware M&A Posts Productive 2014 January 2015

Bolstered by a strong first quarter, M&A in the Toys & Giftware sector made significant strides in 2014. The year featured increased activity from strategic and financial acquirers alike, across multiple industry subsectors, including construction, education, games/puzzles and juvenile products. Intrepid is confident that this momentum will continue in 2015 based on the continued strength of the overall M&A market and our on-going industry conversations. Sector highlights include:

• According to NPD Group, U.S. retail sales of toys grew to nearly $18.1 billion in 2014, an increase of 4% over 2013;

• Deal volume in 2014 increased 20% from 2013 (see page 2 for details );

• Public company valuation multiples remained strong in 2014, exceeding the industry average over the prior five-year period;

• Private equity continued to roll up smaller brands to form larger platforms; and

• Strategic acquirers addressed weak categories through acquisition—with an emphasis on construction toys and juvenile products.

Mike Rosenberg , Senior Managing Director, Head of Toys & Giftware, MRosenberg@IntrepidIB.com

Recently Announced Transactions

Blue Box Expanded International Products Business with Acquisition of Infantino (Oct. 2014) – Blue

Box Holdings, a vertically-integrated international juvenile products company, acquired Infantino, a San

Diego-based infant products brand, from Step2. Infantino’s products, including developmental toys, activity gyms, play mats, infant carriers, travel accessories and feeding products, sell through many leading retailers, such as Babies

‘R’ Us, Target, Walmart, Amazon.com and BuyBuy Baby, among others. Blue Box plans to continue to grow its juvenile products division into new product categories and geographies. Intrepid’s M&A

International partner firm, Quam Capital, served as financial advisor to Blue Box.

Topspin Partners Acquired Toy Platform, Patch, and Quickly Sought Growth (Sept. 2014) – Topspin

Partners acquired Wisc.-based toy company Path Products. Patch has grown from a small puzzle and game manufacturer to a family entertainment company which designs, manufactures, distributes and markets games, children’s puzzles, preschool toys, creative activities and educational materials under several recognizable brands. Just 41 days after close, Topspin completed its first add-on for Patch, acquiring the

Onaroo line of night lights and alarm clocks from American Innovative. The company will continue to seek to add complementary product categories serving both the specialty and mass channels.

Propel Equity Partners Continued to Add to Alex Brands Platform (May 2014) – Propel Equity Partners acquired substantially all of the assets of Summit Products through a Chapter 7 liquidation sale, paying approximately $3 million for the company.

Summit’s primary product lines are focused on teaching children to better understand the value of money through play and the natural sciences through outdoor games.

Additionally, Propel Equity Partners also acquired CitiBlocs ® , a line of high quality, precision cut wood construction blocks. The CitiBlocs ® acquisition enhances Alex Brands’ presence in the growing construction toy category, which already includes IDEAL ® Frontier Logs ™ , Amaze N’ Marbles ® , ZOOB ® , Kinderblocks and

Fiddlestix ® . To date, Propel has completed eight acquisitions in addition to its Alex Brands platform investment.

Mattel Filled Void in Construction Category with MEGA Deal (Feb. 2014)

–

Mattel completed the acquisition of Montreal-based MEGA Brands for approximately US$460 million. Prior to the acquisition, Mattel held ~1% market share in the $4 billion construction building sets category in the U.S. and Europe. In buying

MEGA, Mattel fills its largest toy category void and instantly becomes the No. 2 player in the category, second to only LEGO. This move comes approximately six months after Canadian competitor Spin Master acquired French Meccano, a model construction toy company and owner of the Erector brand. MEGA will benefit from Mattel’s international scale, supply chain infrastructure and sizable advertising budget.

11755 Wilshire Blvd., Suite 2200, Los Angeles, CA 90025 ● T 310.478.9000 ● F 310.478.9004 ● IntrepidIB.com 1

Publicly-Traded Companies

(USD Millions)

Company

Hasbro Inc.

Enterprise

Value

Market

Capitalization

$7,751 $6,546

Revenue

Last Twelve Months

Gross Profit

% Margin

EBITDA

% Margin

$4,260 51.3% 19.1%

JAKKS Pacific, Inc.

$303 $138 $694 28.1% 5.3%

Mattel, Inc.

$11,294

TOMY Company, Ltd.

$830

$277

$9,404

$4,404

$528

$6,143

$4,547

$532 $1,261

Average

Adjusted Mean*

38.6%

51.2%

37.8%

34.7%

40.3%

40.6%

6.4%

19.0%

13.7%

7.1%

11.8%

11.6%

Five-Year Historical Trading Multiples

EV / Revenue Multiples

(10.9%)

(7.3%)

9.2%

(14.9%)

(1.6%)

(1.2%)

Revenue Growth

1-year 3-year

4.3% 0.2%

10.4% (1.9%)

7.1%

(0.5%)

9.1%

(4.5%)

1.6%

1.2%

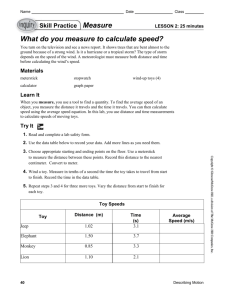

EV / EBITDA Multiples

0.3x

1.8x

0.7x

0.7x

1.0x

0.9x

Enterprise Value / LTM

Revenue EBITDA

1.8x

9.5x

0.4x

8.2x

4.9x

9.7x

5.4x

9.2x

7.8x

8.1x

5-Year Average = 1.2x

Global Toy Equity Price Performance

Past Six-Month Equity Price Performance

5-Year Average = 8.0x

Global Toy M&A Transactions

No. of Announced Toy Transactions by Quarter

Note: Indices calculated using a median equally-weighted basis; All data sourced from S&P Capital IQ as of 01/20/2015.

11755 Wilshire Blvd., Suite 2200, Los Angeles, CA 90025 ● T 310.478.9000 ● F 310.478.9004 ● IntrepidIB.com 2

Upcoming Events

Meet Us at Toy Fair 2015, NYC – Feb. 14-17

11755 Wilshire Blvd., Suite 2200, Los Angeles, CA 90025 ● T 310.478.9000 ● F 310.478.9004 ● IntrepidIB.com 3

Select Transactions *

* Certain transactions herein may have been executed by principals of Intrepid while at previous firms. a portfolio company of has been acquired by has sold substantially all of its operating assets, including to has been acquired by

Pacific Direct Marketing LLC an affiliate of has completed a recapitalization with

JAYTS, LLC

has sold selected broadcast assets to

* has been acquired by

* has been acquired by

Equity Marketing, Inc.

*

Figi Graphics, Inc. has been acquired by

*

Applause, LLC a company organized by

Robert G. Solomon has acquired the assets and business of

Applause, Inc.

* has been acquired by

*

Toys & Giftware Team

Mike Rosenberg

Senior Managing Director

MRosenberg@IntrepidIB.com

Brian Levin

Vice President

BLevin@IntrepidIB.com

Ryan Makis

Associate

RMakis@IntrepidIB.com

About Intrepid

Intrepid Investment Bankers is a specialty investment bank that provides M&A , capital raising and strategic advisory services to middle-market companies across various industry sectors . We have a unique culture rooted in our founders’ successful 30-year history of advising entrepreneur and family-owned businesses, financial sponsors and major corporations. We believe that every company has an entrepreneurial passion that drives it and a story that defines it. We deliver unconventional results through our unique ability to tell each client’s story, and drive relentless execution through senior banker immersion in each process. We augment our international capabilities through our membership and active participation in

M&A International Inc.

, an exclusive global alliance of select independent middle-market M&A advisory firms.

Follow Intrepid

11755 Wilshire Blvd., Suite 2200, Los Angeles, CA 90025 ● T 310.478.9000 ● F 310.478.9004 ● IntrepidIB.com 4