BSBFIA401A

advertisement

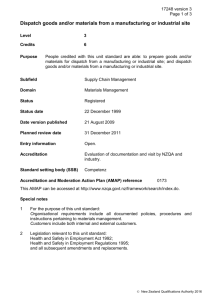

Recognition for Unit of Competency Unit Number: Teaching Section: BSBFIA401A Unit Name: Prepare financial reports Accounting Step 1: Read the unit competency requirements (If you have the skills/knowledge to meet these elements, go to step 2) Unit Descriptor: This unit describes the performance outcomes, skills and knowledge required to record general journal adjustment entries and to prepare end of period financial reports. No licensing, legislative, regulatory or certification requirements apply to this unit at the time of endorsement. ELEMENTS 1. Maintain asset register PERFORMANCE CRITERIA Prepare a register of property, plant and equipment from fixed asset transactions in accordance with organisational policy and procedures Determine method of calculating depreciation in accordance with organisational requirements Maintain asset register and associated depreciation schedule in accordance with organisational policy, procedures and accounting requirements 2. Record general journal entries for balance day adjustments Record depreciation of non-current assets and disposal of fixed assets in accordance with organisational policy, procedures and accounting requirements Adjust expense accounts and revenue accounts for prepayments and accruals Record bad and doubtful debts in accordance with organisational policy, procedures and accounting requirements Adjust ledger accounts for inventories, if required, and transfer to final accounts 3. Prepare final general ledger accounts Enter general journal entries for balance day adjustments in general ledger system in accordance with organisational policy, procedures and accounting requirements Post revenue and expense account balances to final general ledger accounts system Prepare final general ledger accounts to reflect gross and net profits for reporting period 4. Prepare end of period financial reports Prepare revenue statement in accordance with organisational requirements to reflect operating profit for reporting period Prepare balance sheet to reflect financial position of business at end of reporting period Identify and correct, or refer errors for resolution in accordance with organisational policy and procedures Unit Number: BSBFIA401A Unit Name: Prepare financial reports 2013 OTEN Step 1: Read the unit competency requirements to determine if you meet the skills/knowledge required. Step 2: Complete your personal and unit details on the yellow Enrolment Adjustment – Credit – Recognition of Prior Learning (RPL) form (PDF 204KB) Step 3: Sign the Student Declaration Step 4: Collect your evidence for recognition providing as much detail as possible. Use the Recognition e-kit for Students (PDF 1, 683KB) to help you. Note: Recognition can only be granted for a full unit of competency. If you can meet most of these elements but not all, contact the appropriate teaching section to discuss gap training. Evidence may include: Qualifications and/or formal statements o List your qualifications and/or formal statements relevant for this unit. o Copy of your testamur eg: Statement of Attainment, Certificate, Diploma and etc. Professional Development and Training o List any other training and development activities completed at work, eg: Staff Development Activities, Training Sessions, One to one training by a qualified senior staff member. Work Experience o List your membership of organisations, voluntary work, and community work or self-employment/home business. o Membership certificate/s o Reference letter/s from clients. Other Experience and Skills o List what you do, or have done at work that meets the unit description. eg: activities, duties, projects, and etc. o Letter of confirmation from your employer o Duty statement Return your application to: The Recognition Officer, 51 Wentworth Road, Strathfield 2135. Version 5.2 OTEN