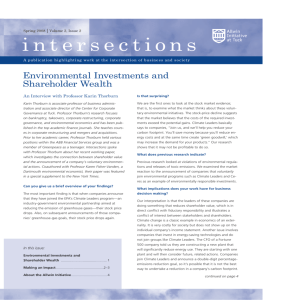

Midterm Exam - Tuck School of Business

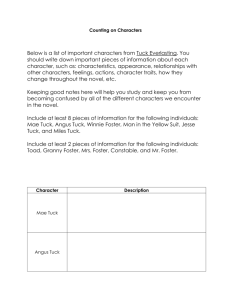

advertisement