Guarantors can also be named as 'Wilful Defaulters' : RBI

30.09.2014

Guarantors can now be treated as 'Wilful Defaulters' if they refuse to clear the amounts guaranteed

despite having the requisite means to do so.

The Reserve Bank of India ('RBI') recently issued clarifications regarding guarantors, lenders and units vide its notification number

(RBI/2014-15/221 DBOD.NO.CID. 41/20. 16.003/2014-15) dated 9th September 2014 (the 'Notification'). This notification is in

reference to the Master Circular on ‘Wilful Defaulters’ (RBI/2014-15/73 DBOD.NO.CID.BC.3/20.16.003/2014-15) issued by RBI on

1st July 2014.The Notification states that individuals who act as guarantors to loans can be treated as ‘Wilful Defaulters’ if they

refuse to clear the amounts due despite having the requisite means to do the same.

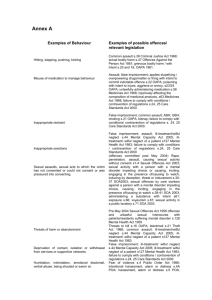

The Notification provides that if guarantees furnished by companies within the group on behalf of defaulting firm are not

honoured when invoked by the banks, such group companies should also be reckoned as ‘Wilful Defaulters’, also widening the

ambit to individuals, juristic person and all the other forms of business enterprise, whether incorporated or not. Alluding to

Section 128 of the Indian Contract Act, 1872, the Notification advises that the liability of the guarantor is co-extensive with that of

the principal debtor, unless otherwise provided by the contract. Consequently, the bankers will be able to proceed against the

guarantor even without exhausting the remedies against the principal debtor. Under such circumstances, upon a claim by the

bankers on the guarantor, the guarantor’s liability is immediate. If the guarantor fails to comply with the demands for repayment

of dues despite having the means to do so, such guarantor will be treated as a ‘Wilful Defaulter’. However, the Notification is silent

as to the meaning of the term 'sufficient means', which has been left to the subjective evaluation of the concerned authorities.

Furthermore, an individual or a company, who is the principal debtor, could also be termed as a ‘Wilful Defaulter’ if it is found that

the borrowed funds are being used for some purpose other than that for which the loan was sought. However, the Notification

provides that the rule would apply only prospectively and not to cases where guarantees were taken prior to the Notification.

Once an individual or a business entity is declared a ‘Wilful Defaulter’, they would be debarred from (i) seeking institutional

finance from scheduled commercial banks, development financial institutions, investment institutions etc.; and (ii) floating a new

venture for a period of 5 years from the date the name of ‘Wilful Defaulter’ is published in the list of ‘Wilful Defaulters’ by the RBI.

A copy of the list of ‘Wilful Defaulters’ will be forwarded to SEBI (Securities and Exchange board of India) and CIBIL (Credit

Information Bureau of India) to restrict such ‘Wilful Defaulters’ from accessing the capital and financial markets. Further,

depending upon the facts and circumstances of the case, the banks and the financial institutions can also invoke criminal action

under sections 403 (misappropriation of property) & 415 (cheating) of the Indian Penal Code, 1860. If declared a 'Wilful Defaulter'

individual guarantors risk being cut away from traditional financing markets, and consequently increasing their cost of borrowing

significantly. The Notification aims to curb down the quantum of Non-Performing Assets with the banks and the financial

institutions, and gives them the requisite powers to take stern steps to recover money from principal debtors and the guarantors.

***

Copyright © 2014 T&T Law. All rights reserved. For private circulation only. The contents of this Newsletter are solely meant to inform and is not a

substitute for legal advice. Please seek comprehensive legal advice for your particular requirements. You have received this Update because of

your association with T&T Law. If you wish not to receive any future Updates please let us know.

R – 89, Greater Kailash Part 1, New Delhi – 110 048 | Ph. +91-11-40860000 | Fax. +91-11-40860020 | tandtlaw@tandtlaw.co.in