'Willful defaulter' tag on UB Holdings to wait till

advertisement

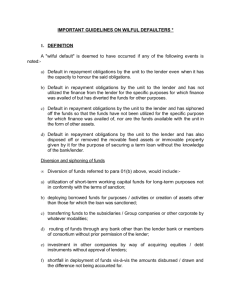

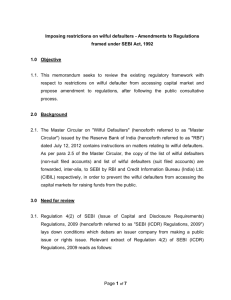

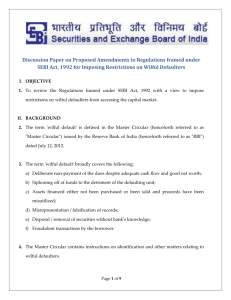

‘Willful defaulter’ tag on UB Holdings to wait till United Bank gets new CMD United Bank of India is likely to declare United Breweries Holdings (UBHL) — the parent company of Vijay Mallya’s UB Group — a ‘wilful defaulter’ after its new chairman and managing director (CMD) assumes office. The public sector bank is headless since February after the previous CMD, Archana Bhargava, quit on health grounds even as the lender was facing a probe by the RBI and the government over bad loan pile-up. “We identified UBHL as a wilful defaulter earlier this month. The grievance redressal committee on this will be held when the new CMD joins. We will have to go back to the board to take a call on UBHL,” United Bank of India executive director Deepak Narang told FE in an interview. Bank sources said the ministry of finance was expected to notify the name of the new CMD soon. UBHL was the guarantor for the now-grounded Kingfisher Airlines. The Reserve Bank of India, in its master circular on wilful defaulters issued in 2012, said in cases where the guarantees furnished by the companies within the group on behalf of the wilfully defaulting units are not honoured when invoked by the banks/FIs, such group companies should also be reckoned as wilful defaulters. Cracking down on Kingfisher Airlines for non-payment of over R300-crore outstanding dues, United Bank had declared its promoter Mallya a wilful defaulter in September. The Calcutta High Court, however, dismissed the bank’s decision last week. The bank said since it lost the appeal on technical grounds, it will declare Mallya a wilful defaulter within a month’s time. Narang told FE that the court had found no flaw in its evidence, but ruled in favour of Mallya on purely technical grounds. While RBI guidelines require a three-member grievance redressal committee, United Bank had formed a four-member committee. United Bank will now form a three-member committee and use the same evidence as earlier, he said. “We will also have to go back to the board to reduce the number of members of the committee,” he said, adding the new committee, once formed, was expected to declare Mallya a wilful defaulter within 15-20 days. “Simultaneously, we may also move a division bench of the high court against the last week’s judgment. Our legal department will take an appropriate decision,” Narang said. Apart from Mallya, the bank had earlier declared three former directors of Kingfisher Airlines — Subhash R Gupte, AK Ravi Nedungadi and AK Ganguly—as wilful defaulters in September. A borrower is a ‘wilful defaulter’ if he has not met repayment obligations even when he has the capacity to do so or has not utilised the money from the lender for the specific purposes for which finance was availed of, but has diverted the funds for other purposes. Significantly, once listed as wilful defaulters, no additional loans are given by any bank or financial institution to them. The airline has unpaid loans amounting to close to R6,500 crore, borrowed from a consortium of 17 banks. A few lenders, including the country’s largest State Bank of India (SBI), have identified the airline company a wilful defaulter, but are yet to declare it. Earlier too, bankers’ efforts to recover dues from errant borrowers have been stymied by the courts. In September, the Gujarat High Court had deemed RBI’s wilful default guidelines as ‘unconstitutional’ and said it was violative of the RBI Act. Following this, RBI governor Raghuram Rajan had said RBI would alter the definition of wilful defaulters to accommodate the concerns of the court. On JP Associates, Narang said United Bank had a total exposure of R250 crore to the company but later the bank recalled Rs 100 crore of that because of “some irregularities”. “The company now will have to pay us the remaining R150 crore in instalments within September 15 next year,” he said, informing that the account was still standard. JP Associates, the flagship company of the Jaypee Group, is currently selling some of its assets. Aditya Birla Group company UltraTech Cement recently announced the acquisition of JP Associates’ two cement units and associated power plants in Madhya Pradesh for R5,400 crore. The bank has no exposure to the Dabhol power project.