The Trustees of Columbia University in the City of New York

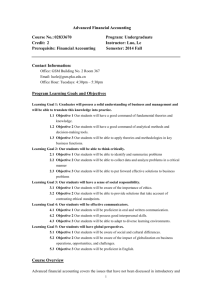

advertisement