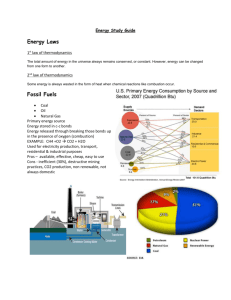

Renewable Energy Technology Cost Review

advertisement