ISM=R(Word) - BMO Nesbitt Burns

advertisement

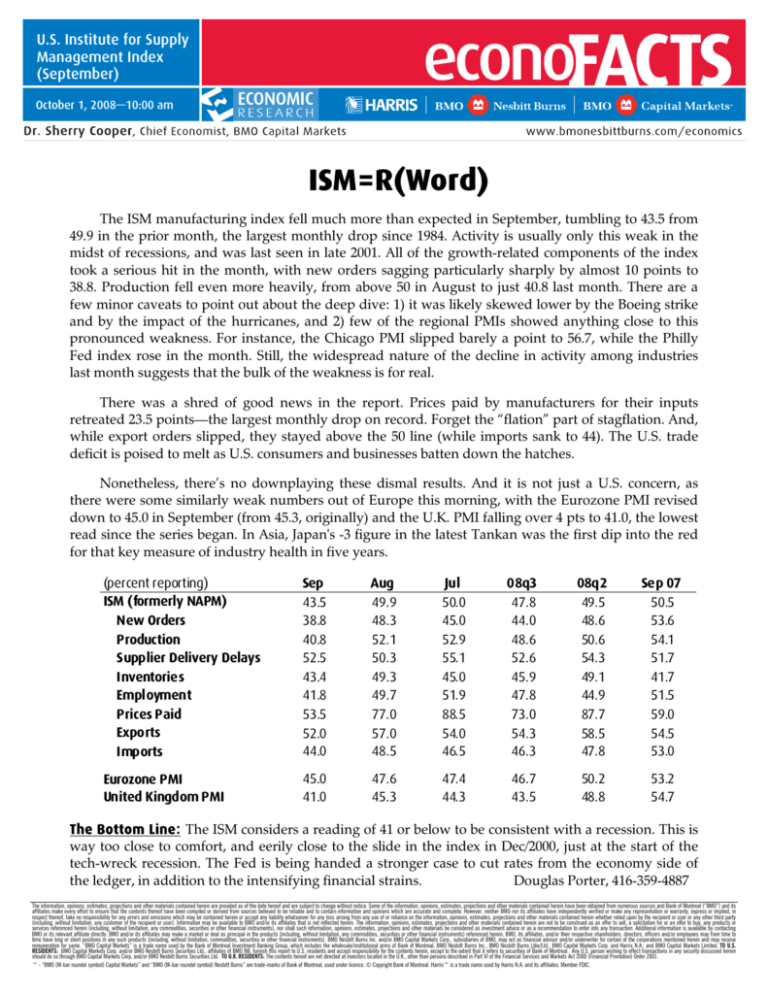

U.S. Institute for Supply Management Index (September) October 1, 2008—10:00 am ISM=R(Word) The ISM manufacturing index fell much more than expected in September, tumbling to 43.5 from 49.9 in the prior month, the largest monthly drop since 1984. Activity is usually only this weak in the midst of recessions, and was last seen in late 2001. All of the growth-related components of the index took a serious hit in the month, with new orders sagging particularly sharply by almost 10 points to 38.8. Production fell even more heavily, from above 50 in August to just 40.8 last month. There are a few minor caveats to point out about the deep dive: 1) it was likely skewed lower by the Boeing strike and by the impact of the hurricanes, and 2) few of the regional PMIs showed anything close to this pronounced weakness. For instance, the Chicago PMI slipped barely a point to 56.7, while the Philly Fed index rose in the month. Still, the widespread nature of the decline in activity among industries last month suggests that the bulk of the weakness is for real. There was a shred of good news in the report. Prices paid by manufacturers for their inputs retreated 23.5 points—the largest monthly drop on record. Forget the “flation” part of stagflation. And, while export orders slipped, they stayed above the 50 line (while imports sank to 44). The U.S. trade deficit is poised to melt as U.S. consumers and businesses batten down the hatches. Nonetheless, there’s no downplaying these dismal results. And it is not just a U.S. concern, as there were some similarly weak numbers out of Europe this morning, with the Eurozone PMI revised down to 45.0 in September (from 45.3, originally) and the U.K. PMI falling over 4 pts to 41.0, the lowest read since the series began. In Asia, Japan's -3 figure in the latest Tankan was the first dip into the red for that key measure of industry health in five years. (percent reporting) ISM (formerly NAPM) New Orders Production Supplier Delivery Delays Inventories Employment Prices Paid Exports Imports Sep 43.5 38.8 40.8 52.5 43.4 41.8 53.5 52.0 44.0 Aug 49.9 48.3 52.1 50.3 49.3 49.7 77.0 57.0 48.5 Jul 50.0 45.0 52.9 55.1 45.0 51.9 88.5 54.0 46.5 08q3 47.8 44.0 48.6 52.6 45.9 47.8 73.0 54.3 46.3 08q2 49.5 48.6 50.6 54.3 49.1 44.9 87.7 58.5 47.8 Sep 07 50.5 53.6 54.1 51.7 41.7 51.5 59.0 54.5 53.0 Eurozone PMI United Kingdom PMI 45.0 41.0 47.6 45.3 47.4 44.3 46.7 43.5 50.2 48.8 53.2 54.7 The Bottom Line: The ISM considers a reading of 41 or below to be consistent with a recession. This is way too close to comfort, and eerily close to the slide in the index in Dec/2000, just at the start of the tech-wreck recession. The Fed is being handed a stronger case to cut rates from the economy side of the ledger, in addition to the intensifying financial strains. Douglas Porter, 416-359-4887 The information, opinions, estimates, projections and other materials contained herein are provided as of the date hereof and are subject to change without notice. Some of the information, opinions, estimates, projections and other materials contained herein have been obtained from numerous sources and Bank of Montreal (“BMO”) and its affiliates make every effort to ensure that the contents thereof have been compiled or derived from sources believed to be reliable and to contain information and opinions which are accurate and complete. However, neither BMO nor its affiliates have independently verified or make any representation or warranty, express or implied, in respect thereof, take no responsibility for any errors and omissions which may be contained herein or accept any liability whatsoever for any loss arising from any use of or reliance on the information, opinions, estimates, projections and other materials contained herein whether relied upon by the recipient or user or any other third party (including, without limitation, any customer of the recipient or user). Information may be available to BMO and/or its affiliates that is not reflected herein. The information, opinions, estimates, projections and other materials contained herein are not to be construed as an offer to sell, a solicitation for or an offer to buy, any products or services referenced herein (including, without limitation, any commodities, securities or other financial instruments), nor shall such information, opinions, estimates, projections and other materials be considered as investment advice or as a recommendation to enter into any transaction. Additional information is available by contacting BMO or its relevant affiliate directly. BMO and/or its affiliates may make a market or deal as principal in the products (including, without limitation, any commodities, securities or other financial instruments) referenced herein. BMO, its affiliates, and/or their respective shareholders, directors, officers and/or employees may from time to time have long or short positions in any such products (including, without limitation, commodities, securities or other financial instruments). BMO Nesbitt Burns Inc. and/or BMO Capital Markets Corp., subsidiaries of BMO, may act as financial advisor and/or underwriter for certain of the corporations mentioned herein and may receive remuneration for same. “BMO Capital Markets” is a trade name used by the Bank of Montreal Investment Banking Group, which includes the wholesale/institutional arms of Bank of Montreal, BMO Nesbitt Burns Inc., BMO Nesbitt Burns Ltée/Ltd., BMO Capital Markets Corp. and Harris N.A., and BMO Capital Markets Limited. TO U.S. RESIDENTS: BMO Capital Markets Corp. and/or BMO Nesbitt Burns Securities Ltd., affiliates of BMO NB, furnish this report to U.S. residents and accept responsibility for the contents herein, except to the extent that it refers to securities of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Capital Markets Corp. and/or BMO Nesbitt Burns Securities Ltd. TO U.K. RESIDENTS: The contents hereof are not directed at investors located in the U.K., other than persons described in Part VI of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2001. ™ - “BMO (M-bar roundel symbol) Capital Markets” and “BMO (M-bar roundel symbol) Nesbitt Burns” are trade-marks of Bank of Montreal, used under licence. © Copyright Bank of Montreal. Harris™ is a trade name used by Harris N.A. and its affiliates. Member FDIC.