Textile report _1st semester 2011

advertisement

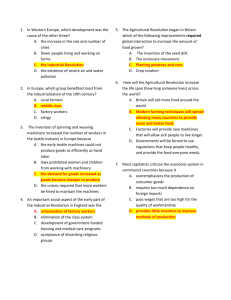

Italian Trade Commission - Jakarta Trade Promotion Section of the Italian Embassy Indonesian Textile Industry and Machinery Market Report and Statistics 2010 and 1st Semester of 2011 Country: Indonesia Reference period: January – December 2010 & January – June 2011 1. The General Economic Situation in the Country for 2010 Indonesia’s economic growth accelerated to a 10-year high and has proven to be robust during the wake of the 2008-2009 global economic crisis. In 2010, Indonesia’s GDP reached Rp 6,423.83 trillion or US$ 714.47 billion (Rp 2,310.69 trillion based on constant 2000 prices), registering an economic year-on-year growth rate of 6.10%. All economic sectors experienced growth, the highest being the transport and communication sector, registering a year-on-year growth rate of 12.76%. The average exchange rate in 2010 was Rp 8,991.0 per US Dollar). Total exports reached US$ 157.732 billion, representing an increase of 35.54% over 2009 which reached US$ 116.490 billion. Non-oil and gas exports rose from US$ 97.472 billion to US$ 129.739 billion, registering a growth rate of 33.08%. Total imports rose by 40.00% to US$ 135.606 billion from US$ 96.86 billion, with non-oil and gas imports increasing by 39.0% from US$ 77.87 billion to US$ 108.243 billion, resulting in a trade surplus of US$ 22.12 billion. The inflation rate in 2010 was 6.96%, as compared to 2.78% in the previous year. Investments are expected to grow 9-11% in 2011 on the back of higher public capital spending on infrastructure that drives better private investment and lower risk premium. On the fiscal side, Indonesia has been able, through prudent fiscal policy, to bring its public debt to GDP ratio lower. Projections indicate that this trend is likely to continue. Well maintained macroeconomic fundamentals, strengthening external liquidity position, gradually declining government debt ratio, supported by prudent fiscal policy and smooth implementation of structural reforms, is expected to sustain higher economic growth in the coming years to keep the positive momentum for further rating improvement. Indonesia’s economic growth is projected to rise to 6.0-6.5% in 2011 and expected to gradually return to the trend growth rates approaching 7.0% thereafter, which is supported export growth development and investment acceleration. Inflation will continue to be moderate and is likely to be at the lower end of its target range of 5%±1% in 2011 as the output gap is still wide enough to response to the acceleration in demand side and supported by stable rupiah exchange rate. In the medium term, inflation is expected to converge to its regional average of 3.5-4.0%. 2. Summary of the Economic Trend in the Textile Sector for 2010 According to data from the Ministry of Trade, exports of textile and textile articles (including garments) rose from US$ 9.245 billion in 2009 to US$ 11.206 billion in 2 2010, representing an increase of 21.2%. Out of the total exports, garments made up for 57.9%. Imports rose by 30.83% from US$ 5.19 billion to US$ 6.186, resulting in a surplus of US$ 5.015 billion. The domestic sales of textile and textile products grew by 10.5% in 2010 to US$ 5.83 billion. 3. Imports of Textile Machines 2010, January-December 2010 as against 2009 (in 1000 of US$) Machines Jan-Dec 2009 Jan-Dec 2010 Growth (%) Spinning 53,186.9 58,783.53 Weaving 39,530.9 86,576.59 Knitting 23,223.2 31,488.51 Finishing & Others 13,722.1 14,207.18 Accessories 9,934.6 29,447.30 Total 139,597.6 220,503.11 Source: Central Bureau of Statistics, processed Jan- June 2011 10.52 119.00 35.59 35.35 196.41 57.96 40,912.94 63,428.84 17,146.76 9,327.41 13,399.66 144,215.61 4. Origin of Imported Machines, January-December 2010 (in 1000 of US$) Country Spinning Weaving Knitting Japan 15,463.34 22,171.62 1,748.55 China 9,773.93 21,795.36 6,425.13 Germany 8,016.07 2,333.51 11,998.25 India 7,302.72 891.35 198.75 Switzerland 4,053.70 671.83 219.71 Taiwan 3,366.28 15,735.62 4,401.14 Korea Rep. of 2,458.87 809.82 4,116.45 Italy 1,456.82 1,825.69 876.65 Others 6,891.81 20,341.80 1,503.89 TOTAL 58,783.53 86,576.59 31,488.51 Source: Central Bureau of Statistics, processed Finishing & Others 1,683.85 4,504.94 688.57 63.80 150.00 2,529.91 1,676.40 501.57 2,408.14 14,207.18 Accessories 14,787.60 2,854.56 530.83 374.75 2,467.55 1,519.52 639.29 327.76 5,945.44 29,447.30 Total 55,854.96 45,353.92 23,567.24 8,831.36 7,562.79 27,552.46 9,700.83 4,988.48 37,091.07 220,503.11 Origin of Imported Machines, January- June 2011 (in 1000 of US$) Country Spinning Weaving Knitting Japan 6,832.24 25,677.02 1,048.52 China 5,519.76 11,456.94 3,733.86 Germany 11,063.82 4,682.46 5,811.35 India 5,868.02 444.37 88.55 Switzerland 3,565.83 2,726.04 353.58 Taiwan 1,917.25 5,153.94 3,870.63 Korea Rep. of 1,598.11 301.40 869.13 Italy 903.37 748.27 970.25 Others 3,644.55 12,238.41 400.91 TOTAL 40,912.94 63,428.84 17,146.76 Source: Central Bureau of Statistics, processed Finishing & Others 1,775.41 3,010.78 80.29 323.25 281.15 611.67 1,115.54 699.71 1,429.61 9,327.41 Accessories 1,866.11 3,442.87 1,721.10 904.97 90.20 1,537.70 178.12 2,710.91 947.68 13,399.66 Total 37,199.29 27,164.20 23,359.02 7,629.16 7,016.80 13,091.18 4,062.29 6,032.51 18,661.16 144,215.61 3 5. Positive Quality Image of Italian Textile Machinery Production and Trade Italian textile machinery has a high-quality image in Indonesia and is recognized for their technological innovation, creativity, sophistication, flexibility, durability and reliability, and is acknowledged to be among the best in the market. 6. Shortcomings of Italian Textile Machinery Production and Trade Interviews with numerous end-users of Italian textile machinery indicated that the main weakness does not lie in the machines themselves but rather in the weak distribution network and lack of promotion on the part of the local agents and distributors. One of the most important key criteria is the credit/ payment terms. In general, Japanese textile machinery suppliers are known to offer the best payment terms, better than European competitors. Chinese equipment on the other hand offer machines at the lowest prices and are known to have improved their quality. 7. Investments in the Textile Industry Planned for the Near Future (5 years) Year 2006 Foreign Investment (PMA) Number & Total Value 61 investments (US$ 424.0 million) Domestic Investment (PMDN) Number & Total Value 7 investments (Rp 81.7 billion) 2007 63 investments (US$ 131.7 million) 8 investments (Rp 226.2 billion) 2008 67 investments (US$ 210.2 million) 20 investments (Rp 719.6 billion) 2009 66 investments (US$ 251.4 million) 23 investments (Rp 2,645.7 billion) 2010 8 investments (US$ 154.8 million) 8 investments (Rp 431.7 billion) Source: Investment Coordinating Board, processed The above data is based on investment approvals by the Investment Coordinating Board (BKPM) and hence does not necessarily represent the actual investments to take place in the forthcoming five years. 4 8. Production of Various Textile Products: January - December 2008 (code PRODCOM) Description Code Volume (in kg) Value (in US$) Man-made fibres yarn (17.10.51 to 17.10.55) 9,508,317,171 2,365,165,866 Man-made fibres fabrics (17.20.31 to 17.20.33) 3,432,482,718 5,678,078,272 Cotton yarns (17.10.43) 400,429,206 812,683,616 Cotton fabrics (17.20.20) 443,929,383 1,402,045,896 Wool yarns (17.10.42) 1,080,000 7,708,537 Wool fabrics (17.20.10.22) - - Silk yarns (17.10.41) Silk fabrics (17.20.10.10) Knitwear Socks and Stockings 743,513 101,633,923 237,145,816 (17.72) 19,621,974 (145,987,478 m) 93,536,657 pcs (17.71) 77,274,614 pcs 11,273,284 271,541,272 Source: Central Bureau of Statistics, Large and Medium Industrial Production Statistics, processed. Year 2008 constitutes the latest production data available. 9. Exports of Various Textile Products: January - December 2010 (code NACE/CLIO) Description Man-made fibres yarn HS - Code Volume (in kg) Value (in US$) Cotton yarns (54.01 to 54.06 – 55.09 to 55.11) (54.07 to 54.08 – 55.12 to 55.16) (52.04 to 52.07) Cotton fabrics (52.08 to 52.12) 51,851,628 297,051,064 Wool yarns (51.07 to 51.10) 499,153 2,071,690 Wool fabrics (51.11 – 51.12 – 51.13) 5,887 16,866 Silk yarns (50.04 to 50.06) 18 6 Silk fabrics (50.07) 35,177 151,309 Knitwear (61.09 to 61.10) 95,732,052 1,314,411,106 Socks and stockings (61.15) 9,176,578 97,834,064 Man-made fibres fabrics Source: Central Bureau of Statistics, processed 658,205,063 1,758,327,820 176,487,694 1,020,336,510 126,979,508 407,781,330 5 Exports of Various Textile Products: January – June 2011 (code NACE/CLIO) Description Man-made fibres yarn HS - Code Volume (in kg) Value (in US$) Cotton yarns (54.01 to 54.06 – 55.09 to 55.11) (54.07 to 54.08 – 55.12 to 55.16) (52.04 to 52.07) Cotton fabrics (52.08 to 52.12) 25,457,003 191,380,132 Wool yarns (51.07 to 51.10) 264,808 892,321 Wool fabrics (51.11 – 51.12 – 51.13) 3,214 45,486 Silk yarns (50.04 to 50.06) 200 42 Silk fabrics (50.07) 8,273 35,840 Knitwear (61.09 to 61.10) 44,038,082 712,497,090 Socks and stockings (61.15) 4,562,888 54,970,551 Man-made fibres fabrics 304,761,846 1,055,813,235 95,567,273 667,133,326 49,405,682 240,384,313 Source: Central Bureau of Statistics, processed 10. Imports of Various Textile Products: January - December 2010 (code NACE/CLIO) Description Man-made fibres yarn HS - Code Volume (in Kg) Value (in US$) Man-made fibres fabrics Cotton yarns (54.01 to 54.06 – 55.09 to 55.11) (54.07 to 54.08 – 55.12 to 55.16) (52.04 to 52.07) Cotton fabrics (52.08 to 52.12) 121,000,462 1,006,174,603 Wool yarns (51.07 to 51.10) 50,642 701,580 Wool fabrics 2,426,636 50,133,047 Silk yarns (51.11 - 51.12 51.13) (50.04 to 50.06) 417,953 1,381,199 Silks fabrics (50.07) 370,657 5,245,300 Knitwear (61.09 to 61.10) 2,617,348 32,621,756 536,247 2,905,641 Socks and stockings (61.15) Source: Central Bureau of Statistics, processed 78,002,540 295,726,844 112,992,284 801,747,663 21,443,091 74,564,147 6 Imports of Various Textile Products: January - June 2011 (code NACE/CLIO) Description HS - Code Man-made fibres yarn Man-made fibres fabrics Cotton yarns (54.01 to 54.06 – 55.09 to 55.11) (54.07 to 54.08 – 55.12 to 55.16) (52.04 to 52.07) Cotton fabrics Volume (in Kg) Value (in US$) 57,111,090 220,647,360 72,984,575 611,566,251 12,738,926 63,343,359 (52.08 to 52.12) 65,041,212 692,558,712 Wool yarns (51.07 to 51.10) 21,033 183,186 Wool fabrics 1,544,295 35,974,792 Silk yarns (51.11 - 51.12 51.13) (50.04 to 50.06) 153,979 968,205 Silks fabrics (50.07) 147,339 2,384,196 Knitwear (61.09 to 61.10) 1,057,146 18,339,302 196,931 1,929,807 Socks and (61.15) stockings Source: Central Bureau of Statistics, processed 11. Value of Production: January – December 2010 Value (in 1000 US$) 2009 2010 Growth (%) Textile sector* 3,123,913 3,428,388** 4.76 Clothing sector 8,344,247 8,662,997** 3.82 Note: * Excl. Fiber and Spinning/ yarn ** Preliminary Figure based on production index of the Central Bureau of Statistics 12. How did the Production Structure Change in 2010 (Number of Mills and Annual Production Capacity) The data is no longer available from the Investment Coordinating Board (BKPM). As of 2008, the BKPM no longer publishes the details of approved investments permits, but merely presents aggregate data for the entire textile sector (as presented in 7.). The total number of companies in operation is as follows: Sub-Sector Number of Companies as of December 2010 Fiber 10 Yarn 225 Fabrics 1,067 Garments 996 Other Textiles 535 Souce: Ministry of Industry, Directorate of Textile Industry 7 13. Other Events Indonesia’s Textile and Textile Products Machinery Restructuring Program In 2010, the Indonesian government once again launched the textile and textile products machinery restructuring program at a total budget allocation of Rp 154.15 billion for the 2010 budget year. The allocation dropped by Rp 85 billion compared to the previous year, and was the lowest in the past four years. The program consists of two schemes, the first scheme being a price discount granted for the purchase of machinery, while the second scheme mostly serves the interest of medium size businesses, in the form of loans for funding machinery at low interest rates by way of equity participation. The textile machinery restructuring program has been implemented since April 2007. Of the 2010 budget allocation, Rp 154.15 billion was used by 151 textile industries with a total absorption of Rp 144.37 billion (93.7%). The machinery revitalization program in 2010 is expected to increase Indonesia’s production by 15 – 18%, create additional employment for 46,902 people, increase the productivity by 7 – 17 %, and in the process increase the energy efficiency by 6 – 18%. Banks have started indicating confidence in the textile industries which were previously regarded as highly risky. This increase in the interest of textile industries in the textile machinery restructuring program had encouraged the government in maintaining this program. Allocation for Textile Machinery Restructuring and Absorption, 2007 – 2010 Year Specification Fund Allocation Absorption 2007 Rp 255.0 billion Rp 153.31 billion 2008 Rp 330.0 billion Rp 181.7 billion 2009 Rp 240.0 billion Rp 170.75 billion 2010 Rp 154.15 billion Rp 144.37 billion Source: Ministry of Industry, processed % 60.1% 55.1% 71.1% 93.7% Number of participating companies 92 175 193 151 Performance of Indonesia’s Textile Sector in 2010 In 2010, Indonesia's textile and clothing exports increased sharply by 21.2% to US$ 11.206 billion. This growth was particularly driven by man-made fibers and manmade fiber exports (with a growth of 46.7%), yarn and fabric exports (with an increase of 29.3%) and apparel (with a growth rate of 15.3% to US$ 6.7 billion. Imports to the United States, as the world's largest textile market, grew by 15% to US$ 94.2 billion in 2010. Indonesia took up fourth place, with a 21.7% growth rate, followed by Vietnam with 16.7% and India with 16.7%. In 2010, Indonesia's imports of textiles rose by 30.83% from US$ 5.19 billion to US$ 6.186, which was dominated by yarn and fabrics (which climbed by 70.1%), apparel (growing by 45.8%) and fibers, particularly cotton (which increased by 35.0%). The rise in fabric imports was primarily caused by high growth rates of export-oriented garment industries and the lack of competitiveness of the local weaving industry. The 8 growth of fiber imports is attributable to the high prices of imported cotton, which reached US$ 2.8/ kg. With regard to the local market, Indonesia’s improving economy has strengthened the country's domestic textile consumption. Although the total textile consumption makes up for only about 2% of the total public expenditure, nevertheless in 2010 the consumption of textile products grew by 28.6%, increasing from US$ 1.05 billion in 2009 to US$ 1.35 billion in 2010. The Government’s Allocation of Funds for the Modernization of Small and Medium Sized Textile & Leather Enterprises In the 2010 budget, the government of Indonesia allocated Rp 9 billion for the modernization of old textile and leather machineries of Small and Medium Enterprises (SMEs). The textile and leather products manufactured in SMEs have also been struggling to compete in the market due to their aging machinery, which constitutes the main obstacle in the development of these SMEs. Moreover, small and medium scale textile and leather industries find it difficult to access financial institutions and source funds to purchase new machinery. The program is supposed to modernise machinery of about 80 - 100 textile and leather SMEs per year, under a six-year restructuring program that was implemented since 2009. This program was designed to help modernize at least 50% of the plants by 2014. The government, under this six-year program, will offer 25% of the funds to the industries to import new machinery and 30% of the funds will be offered for acquiring new machines from local machine manufacturers, in the price range of Rp 40 million - Rp 2 billion each. Effect of FTA to Indonesia’s Exports of Textile and Textile Products to China According to the Indonesian Textile Association (API), the Free Trade Agreement (FTA) that Indonesia has signed with China boosted the former’s textile items’ export to China by over 30% during 2010, and has thus earned Indonesia recognition as an exporter of textile items to China. While Indonesia’s textile exports to China witnessed a 70% rise during 2010, fibre and yarn exports too individually grew by 65%. Indonesia serves to be a consistent source for China for importing raw material for textile industry. It is not possible for China, the world’s most populated country housing around 1.3 billion inhabitants, to domestically meet its overall demand for textile and textile items. Also because China’s per head textile consumption is growing at a higher pace and has soared from 12 kg - 18 kg per head per annum. Indonesia’s textile and textile products export to China during 2010 comprised of 60% garments and 3% fibre yarn. The rising cost of human resources has rendered China’s textile sector less competitive, while trade conflicts with the US and the EU too have also adversely affected the competitiveness of the China’s textile industry. On the contrary to China, Indonesia has attained the targets set for development of the textile sector during the last three years, but the Indonesian industry still needs to imporove its quality and marketing. Import Duties imposed on 2,165 Raw Materials, Capital Goods and Finished Goods The 2010 Finance Ministerial Regulation on Import Duties which was issued during December last year, subjected 2,165 raw materials, capital goods, and finished 9 goods to import duty imposition. Several industrial groups have requested the government to defer the execution of new rule on import duties until next year, as the same was believed to have impaired the country’s local industry. The new regulation caused the domestic manufacturers to incur higher cost of production due to import duty imposition on raw inputs and capital assets. The regulation shoots up their cost of production as they need to incur higher cost for raw materials and capital goods, and it grants duty exemption to several imported finished goods. Such high cost of production would cause the locally produced finished goods to get more costly, and would render them less competitive in comparison with those of other countries. The ASEAN free trade agreement that the country inked with China and which became effective in 2010, facilitates trading of goods in partner countries without any impediment like import duties. Turkey Applied Anti-Dumping Sanctions on Indonesian Textile Products In 2010, Turkey imposed antidumping and safeguard duties ranging from 5% – 33% on 58 Indonesian products, including woven fabrics and apparel. For Indonesia, Turkey is the gateway to both Eastern and Western European markets. Indonesia’s exports to Turkey amounted to US$1.07 billion in 2010, mainly consisting of textiles, chemicals, plastics and steel products, while imports reached US$ 304.76 million. As a result, the additional duties had pushed up the prices of Indonesian goods making them uncompetitive. In the case of unprocessed polyester synthetic staple fibers which had been slapped with an anti-dumping duty from 6.2 – 12%. In case of woven fabrics and apparels, safeguard duties of 18 – 27% were applied. Loans are Still Costly for the Textile Industry Access to financing generally remains difficult and expensive for the textile industry. Bank Indonesia, in one of its recent surveys revealed that, banks still somewhat refrain from providing loans. Owing to higher lending rates, which almost reach 16% in a number of local banks, most of the Indonesia textile manufacturers had to bear currency risk, as they were pushed to borrow from international banks. The expensive funds in the country are due to government’s heavy dependency on the rupiah bond market, to finance arrears in budget and also the central bank’s failure to push banks to augment their lending. Moreover, government’s financial policy, although traditional in nature, had led to congestion in the bond market, which has restricted private firms from issuing their own bonds to garner funds. Due to this, private firms are facing difficulties, to obtain bank loans and garner funds from their bond offerings. Textile and Textile Products Machinery Restructuring Program In 2011, the government has sanctioned a sum of Rp 177 billion or US$ 20.36 million towards a program machinery restructuring program. The sum allocated would be doled out to 150 textile companies and 20 footwear manufacturers and leather tanners, to aid them to procure new equipment in place of old obsolete ones. 10 14. Expected Changes Well maintained macroeconomic fundamentals supported by the conducive political situation are expected to sustain further national industry development. To achieve a strong national industry and to improve the competitiveness of national industries, within the next five years the Ministry of Industry will focus on industrial competitiveness enhancement program according to groups of industry, namely: (1) Labor Intensive Industries (textille and textille product, footwear and furniture industry); (2) Small and Medium Industries (fashion, handicrafts, precious stones, ceramics and essential oils industry); (3) Capital Goods Industries (machinery and shipping industry); (4) Natural Resource-Based Industry (palm oil, cocoa, rubber, seaweed, steel and aluminum upstream industry); (5) High Growth Industry (automotive, electronics, and telematics industry); (6) Special Priority Industries (sugar, fertilizer and petrochemical industry). The development of priority industries are expected to increase the contribution of industrial sector on the national economy. For 2011, Indonesia has fixed a target of US$ 15 billion in exports of textile and textile goods, over last year’s US$ 11.2 billion. With the improved efficiency and higher production, Indonesia's textile exports are expected to increase by 4% - 5%. The contribution of the Indonesian textile exports in the world trade is likely to increase from current 1.8 percent to 2.5 percent through 2014. The per capita consumption of textile items rose from 3.9 kg per year in 1999 to 4.5 kg per year in 2005 and again to 5.3 kg in 2008, while it is estimated to grow to 6.5 kg in 2011. Textile Industry Capacity Utilization is Expected to Reach 90% The Ministry Industry estimates that the installed capacity utilization of the national textile industry will reach 85 - 90 % in 2011 following the increase in demand in the export and domestic markets. This year’s textile industry utilization was higher than in 2010, which reached 65 - 70 %. The Ministry of Industry projects that textile investments in 2011 will reach at least Rp 3.5 trillion, consisting of both new investments and expansions. Data from the Ministry show that 130 companies that have submitted proposals to participate in the machinery restructuring program which requires a total of Rp 227 billion. The government has also prepared 200 hectares of land for industry expansion in Kawarang, West Java, which can accommodate around 60 - 70 textile factories. According to the Indonesian Textile Association, up to the first quarter of 2011, investments in the textile sector has reached US$ 400 million. Currently, there are 12 Chinese companies conducting studies to invest in the textile industry in Indonesia and many Korean investors also plan to relocate their textile factories to Karawang, West Java. 15. New Laws and Regulations for the Textile Industry Enacted in the Period Taken into Consideration In 2010 and 2011, three new regulations for the textile industry were enacted as follows: • Decree of the Ministry of Industry of the Republic of Indonesia No 30/MIND/PER/3/2010 dated March 2010 on the second Amendment of the Decree No 15/M-IND/PER/3/2008 on Restructuring Program of Textile and Textile Products Machinery. 11 • • Decree of the Ministry of Trade of the Republic of Indonesia No 02/MDAG/PER/1/2010 on the Amendment of the Decree No. 23/M-DAG/PER/6/2009 on the Import Regulations of Textile and and Textile Products. Decree of the Minister of Industry of the Republic of Indonesia No. 123/MPER/11/2010 dated 30 November 2010, regarding the Revitalization and Industrial Growth Program through the Restructuring of Machines / Equipment of the Textile Industry, Textile Products Industry and Footwear Industry 16. Tenders in the Period Considered, Indicating Details of the Tender and a Brief Illustration of the Object) In the general announcement of tenders conducted in the period of 2010 and first half of 2011, none covered in the textile industry. 17. New Joint Ventures between Textile Producers or Textile Machinery Manufacturer, if any (specify Partners and Object) Based on data from the Data Center of the Ministry of Industry, in 2010 and 2011 three new textile machinery component manufacturers were established. (i) PT Intex Mesin Indonesia Products Manufactured: Textile Machines for Dyeing & Finishing Industrial Code: 29263 - Textile Machinery Address: Kawasan Dwipapuri Kav M-11 Factory Location: Cimanggung, Sumedang – West Java - Phone: 022-7792158, Fax: 022-7792525 Headcount: 25 Contact Person: Erlinawati (GM) (ii) PT Simpletex Machinery Products Manufactured: Textile Machines Industrial Code: Other General Purpose Machines Address: Jl. Cibaligo No 169 Factory Location: Cimahi - Cimahi Selatan, Jawa Barat - Phone: 0226033735, Fax: 0226042584 Headcount: 22 Contact Person: Djoni Mulia Santosa (Admin) (iii) CV Sumber Indo Machinery Products Manufactured: Spare Parts for Textile Machines Address: Jl. Poksay No. 77 Factory Location: Sukoharjo, Mojolaban – Central Jawa - Phone: 0271-826277, Fax: 0271-826506 Headcount: 54 Contact Person: Suwanto Enggal Rejo (Director) According to the Indonesian Textiles Association, some 20 Japanese textile machinery manufacturers have shown interest in investing in Indonesia and are planning to set up machinery production plants. However, these investors are looking to receive incentives from the government as well as good infrastructure facilities before setting up the plants. 12 Up to now, Indonesia only has one integrated producer of textile machinery, i.e. PT Texmaco Perkasa Engineering of the Texmaco Group. The company produces air-jet and water-jet weaving machines, rapier shuttle-less looms, seizing machines, printing machines, stenter machines, dobby machines, steamers and spare parts, mainly for the group’s own operations and partly for exports. The machines are produced with the technology of MS Machinery from Italy, ICBT from France and Draper Inc. of the US. PT Texmaco Perkasa Engineering Head Office: Jl. H.R. Rasuna Said Kav. X.6 Phone: 002-12520656, Fax: 002-15225738 Factory Address 1: Kiara Payung Klari, Klari 41300 – West Java Phone: 0267-431645, Fax: 0267-432312 Factory Address 2: Jl. Raya Kaliwungu Km 19, Kaliwungu – Central Java Phone: 0294-81253, Fax: 0294-81861 Industry Code: 29263 Headcount: 2247 Contact Person: Anang Sukantono (HRD Manager) Email: mustofa@perkasa.co.id Perkasa Heavyndo Engineering, PT (Subsidiary) Product: Weaving Machines Office Address: Jl. H.R. Rasuna Said – Jakarta Factory Address: Jl. Raya Kaliwungu Km.19 – Kaliwungu 51372 – Central Java Phone: 024-660055, Fax: 024-6600271 Headcount: 337 Contact Person: Nurcholis Habib (HRD Manager) The latest list of textile machine components manufacturers are provided in the appendix of the report. 18. New Textile Machines Agencies Records at the Ministry of Trade indicate that no new textile machine agencies were established in 2010 and the first half of 2011. Information was obtained that in many cases existing textile machinery agencies have broadened their variety to include more brands. 19. New Trading Companies The data is no longer available from the Investment Coordinating Board. As of 2008, the BKPM no longer publishes the details of approved investments permits, but merely presents aggregate data for the entire textile sector. The Ministry of Trade publishes directories of trading companies in operation, but do not provide lists of new textile trading companies. 20. New Engineering Companies Data from the Department of Industry and Department of Trade and Investment Coordinating Board indicate that no new engineering companies in the field of textiles were established in 2010. 13 Appendix Hereunder is the latest list of textile component manufacturers published by the Department of Industry in 2011. Source: Data and Information Center, Departement of Industry 1. Altindo, PT Product: Weaving Comb Factory Address: Jl. Margacinta No. 72 – Margacinta 40287 – West Java Phone: 021-7563008, Fax: 021-7563272 Head Count: 32 Contact Person: Sulaeman (Ass. Accounting) 2. Around Star, PT Product: Hand Knitting Office Address: Factory Address: Jl. Cilampeni No. 12A RT 03/02, Ketapang – West Java Phone: 021-7563008, Fax: 021-7563272 Head Count : 62 Contact Person : Weng Chih Feng (Director) 3. Bengkel Mesin Garuda Product: Spare-parts Office Address: Factory Address: Jl. Komodor Udara Supardio – Cicendo 40174 – West Java Phone: 022-6031303 Fax: 022-6015304 Head Count: 42 Contact Person: Yetty SE (Admin. Staff) 4. Bengkel Tisna Product: Pen Press Office Address: Factory Address: Jl. A. Yani No.580, Kiorocondong 40282 – West Java Phone: 022-708018 Fax: 022-772711 Head Count: 24 Contact Person: Siti Halimah (Admin. Staff) 5. Bintang Permata, CV Product: Spare-parts Office Address: Factory Address: Jl. Burangrang No. 22 Lengkkong 40262 – West Java Phone: 022-7306591 Fax: 022-7310419 Head Count: 67 Contact Person: Allin Rumiyati (Accounting) 6. Falmac Jaya, PT Product: Textile Machines Office Address: Factory Address: Jl. Raya Batujajar Km 3.2, Batu Jajar 40561 – West Java Phone: 022-6866104 Head Count: 32 Contact Person: Teddy Hanafi (Director) 14 7. Hangga Bengkel Product: Spare-parts Factory Address: Jl. Cijerah No. 33, Bandung Kulon 40212 – West Java Phone/Fax: 022-635148 Head Count: 32 Contact Person: Handi Mulyana (Director) 8. Ekaprima, PT Product: Weaving Comb Factory Address: Jl. Panghegar Permai No. 62 – Cibiru 40613 – West Java Phone/Fax: 022-7800617 Head Count: 54 Contact Person: Yahya Hamdani (Admin. Staff) 9. Sinar Honda Jaya, PT Product: Garment Manufacturing Equipment Factory Address: Kawasan Industri Indotaisai, Cikampek 41373 – West Java Phone: 022-35156466 Fax: 022-351563 Head Count: 54 10. Sintotex Lestari, PT Product: Textile Machinery Factory Address: Jl. Cibaligo Mancong No. 268, Cimahi Selatan – West Java Phone: 022-638400 Head Count: 54 Contact Person: Henny (Admin. Staff) 11. Fermatik Product: Weaving Equipment Factory Address: Jl. Waru – Tambak Sawah 6A – East Java Phone/Fax: Head Count: 39 12. Asia Protendo Graha Product: Cutting & Sealing Machines Factory Address: Jl. Raya Solo – Boyolali Km 14, Banyudono 57273 – Central Java Phone: 0271-780150 Fax: 780149 Head Count: 94 Contact Person: Pono Budi Sutrisno, Dipl. (Director) 13. Logam Indonesia Product: Weaving Machines Factory Address: Batur, Tegalrejo, Ceper 57465 – Central Java Phone: 0272-551381 Head Count: 22 Contact Person: Ny. Haryono (Owner) 14. Sahabat Kerja Product: Textile Machinery Spare-parts Factory Address: Jl. Ds. Tegalrejo, Ceper 57465 – Central Java Phone: 0272-51233 Head Count: 25 Contact Person: Sukiran (Owner) 15 15. Setia Abadi Logam, PD Product: Textile Machinery Spare-parts Factory Address: Jl. Ds. Kradenan III No. 1A, Pekalongan Selatan 51132 Central Java Phone: 0285-25058 Head Count: 48 Contact Person: Sapto (Staff) 16. Singer Product: Textile Machines Factory Address: Sentono Ngawonggo, Ceper 57465 – Central Java Phone: 0272-51249 Head Count: 34 Contact Person: H. Hardi (owner) 17. Sugiarto Product: Packing Bowl Factory Address: Pagongan RT 3 / 4 Dukuh Turi 52192 – Central Java Phone: 0272-55960 Head Count: 20 Contact Person: Sugiarto (Manager) 18. PT Intex Mesin Indonesia Products: Textile Machines for Dyeing & Finishing Address: Kawasan Dwipapuri Kav M-11 Factory Location: Cimanggung, Sumedang – West Java Phone: 022-7792158 Fax: 022-7792525 Headcount: 25 Contact Person: Erlinawati (GM) 19. PT Simpletex Machinery Products: Textile Machines Address: Jl. Cibaligo No 169 Factory Location: Cimahi - Cimahi Selatan, Jawa Barat Phone: 0226033735 Fax: 0226042584 Headcount: 22 Contact Person: Djoni Mulia Santosa (Admin) 20. CV Sumber Indo Machinery Products: Spare Parts for Textile Machines Address: Jl. Poksay No. 77 Factory Location: Sukoharjo, Mojolaban – Central Jawa Phone: 0271-826277 Fax: 0271-826506 Headcount: 54 Contact Person: Suwanto Enggal Rejo (Director)