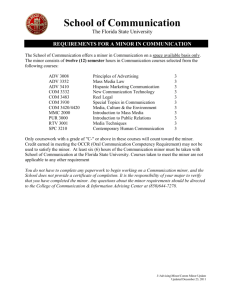

Advanced Financial Accounting - Accounting Technicians Ireland

advertisement