Prospects, Challenges and Impacts of the Cloud

advertisement

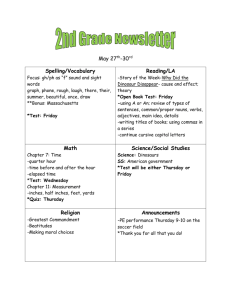

Prospects, Challenges and Impacts of the Cloud: Perspectives from (South) Africa Presentation to UNCTAD workshop on Cloud Economy, Geneva, February, 2013 Alison Gillwald, Research ICT Africa University of Cape Town, GSB, Management of Infrastructure Reform & Regulation With Mpho Moyo, Research ICT Africa, Cape Town, South Africa. 1 Thursday, 7 March 13 ICT ecosystem 1 SA ICT Landscape 12 SA cloud economy - benefits & risks Risks Bottlenecks 3 34 Bottlenecks Use this area to provide an optional section subtitle or explanation 2 Thursday, 7 March 13 ICT Ecosystem Integrated perspective of markets, networks, services, services, applications and content and determining governance, legal and regulatory frameworks Global/regional Governance ITU, ICANN, WTO n at io ov en m In n oy Services Institutional Arrangements (NRA, CC, USF) Apps Content H en t t en tm es Policy & Legal Framework m op el ev s) D ki l l an (e-s um Networks In v Market Structure (competitiveness) t CLOUD Affordability Users Consumers Citizens Access Multilateral Agencies (WB, AfDB, International Donors pl Em Global players and associations Google, Facebook, GSMA National/industry formations (unions, industry associations, NGOs) State Constitution Adapted from Gillwald (2012) 3 Thursday, 7 March 13 decisions need to be made regarding hardware, operating system, payment facilities and distribu these describe an m-app ecosystem where developers and customers meet. The general es prices for mobile voice, text (SMS) and data, as well as handset prices and availability (Figure emUp is a to substructure developers, generally hardware manufactures, andthe payment syste a two linking line subtitle, used to distribution describe uretakeaway 6). for the slide Mobile/wireless app ecosystem Figure 5: Mobile Application Ecosystem 4 layed in Figure 6 that allows the classification and analysis of m-app ecosystems. The analysis beg Thursday, 7 March 13 M-apps ecosystem Mobile Operating Systems such as iOS include an application programming interface (API), which is a software specification used as an interface between different software components. For example, the latest version of the Android OS, Jellybean, provides several public APIs that allows developers to integrate their applications with the OS. Platforms allow other software to be built on top. Examples of platforms include Facebook and emerging market social networking platforms such as Mxit in South Africa. A platform provides uniform standards and payment mechanisms - these standards are used by developers to develop and sell applications. A platform sits on top of an operating system. Mobile Applications run on mobile phones, either on the operating system or on a platform such as Mxit or Facebook, that themselves run on an operating system like iOS, Android or Symbian OS. iOS 5 Thursday, 7 March 13 Figure 6: Conceptual framework for business modeling ICT ecosystem 1 SA ICT landscape 2 3 SA cloud economy Bottlenecks Bottlenecks Use this area to provide an optional section subtitle or explanation 4 5 6 Thursday, 7 March 13 Department of Communications, which is responsible for locating its licence in the liberalised competitive market into which it is being inserted, it could not keep the interest of its target clients. The delays to the much awaited low cost access network resulted in MTN, Neotel and Vodacom co-building an alternative national infrastructure network, undermining the viability of their business model. They also face competition from Dark Fibre Africa who has installed a carrier neutral, open access ducting infrastructure in South Africa. Through this underground infrastructure any operator with a communications license can run a fibre optics network. South Africa ICT market • • • • Some provincial governments such as Gauteng and the Western Cape have instituted broadband plans and government e-services, as have their major cities, Johannesburg and Cape Town. Ethekwini municipality in KwaZulu Natal has also proceeded with metropolitan networks and services. The result has been significant duplication in areasnetwork where multiple cables (including non-licensed Twometropolitan fixed fixed operators + state cable company Dark Fibre Africa) have been laid, some Vodacom MTN Cell C 8ta owned broadband company duplication on the main intercity routes, and very little extension of the network off the main routes to smaller towns and villages. Three mobile operators building competing The mobile market has four mobile operators and one MNVO but backbones is dominated by the two incumbents,MTN and Vodacom, who jointly command a market share of more than 80%. Cell C has successfully established itself in providers a niche market segment by 5 first tier Internet access with targeting lower-income subscribers and more recently adopted a hundreds of ISPpricing (ICT) and and electronics more aggressive strategy tried to erodesector the share of the incumbents’ contract In 2006, Cell C entered comprises more thanmarket. 300 companies and ininto a partnership with Virgin as a virtual mobile operator. Virgin has 2001 was ranked 22nd in total worldwide IT focused its efforts on the high-end youth market, hoping to spend. capitalise on its brand positioning internationally. Even after several years of operation, Cell C and the virtual mobile operator have(SABC) only managed to secure than 15% ofand the market. OneVirgin PBS with threeless channels (Gillwald et al. 2012) 12 language radio stations (12 million+ In 2009, Telkom sold its share of Vodacom. Before the Vodafone listeners) transaction, the South African government owned 37.7% of • Telkom, which in turn owned 50% of Vodacom. The government has a 14% direct shareholding in Vodacom (Vodacom Annual Onenow Free-to-Air (e-TV) Report, 2009). Having sold its share in the dominant operator, in • One Africa wide DTH subscription (DSTV 32,9% 14,0% 1,8% 51,3% Figure 1: South African mobile operators market share based on reported number of subscribers (SIMS sold) Sources: Vodacom, Integrated report for the year ended 31 March 2012. MTN, Integrated Business Report for the year ended 31 December 2011. Cell C, ITWeb July 2012. 8ta, author’s calculations. 3 As part of this agreement Infraco, which will remain wholly owned by the state in terms of the broadband Infraco Act, was to provide wholesale bandwidth exclusively to Neotel, selling it on a cost-plus basis for its first three years. . Thursday, 7 March 13 7 Concentration of State ownership Up to a two line subtitle, generally used to describe the takeaway for the slide 8 Thursday, 7 March 13 Title - Top IDI: Three stages in the evolution towards an information-society: 1. ICT Readiness (infrastructure, access) 2. ICT Use (intensity) 3. ICT Capability (Skills) SOUTH AFRICA 2002 rank 77th 2005: rank 91st 2007: rank 91st 2008: rank 92nd 2010: rank 90th 9 Thursday, 7 March 13 (WEF) Network e-Readiness Index South Africa stable at 61st place (138 participating countries) Fallen from 34th in 2004, 37th in 2005, 47th in 2006, 51st in 2007, 52nd in 2008. Gained only a position from 2009, when it ranked 62nd It is only ranked 95 in terms of usage component Major barriers to market growth: Lack of competitive or affordable backbone infrastructure/ bandwidth High costs of access to communications Effective regulation Thursday, 7 March 13 Share of those with a mobile that own one that is capable of browsing the Internet 15+ Owning a mobile South Africa 84% Botswana 80% Kenya 74% Nigeria 66% Ghana 60% Namibia 56% Uganda 47% Cameroon 45% Tanzania Rwanda Ethiopia Thursday, 7 March 13 36% 24% 18% South Africa 51% Kenya 32% Namibia 31% Botswana 30% Ghana 29% Nigeria 23% Tanzania 19% Rwanda 19% Uganda 15% Cameroon 15% Ethiopia 7% 2007/8 Ethiopia 1% Tanzania 2% Rwanda 2% Uganda 2% Ghana 3% 6% 8% 6% 13% 13% 9% 18% Kenya South Africa Thursday, 7 March 13 14% 16% Nigeria Botswana Internet use (15+) more than doubled within 4 years 4% Cameroon Namibia 2011/12 15% 6% 26% 29% 15% 34% Using mobile to browse the Internet South Africa Kenya Namibia Botswana Nigeria Rwanda Ghana Cameroon Uganda Tanzania Ethiopia 28% 25% 24% 23% 16% 15% 13% 8% 8% 5% 5% Output Using mobile for Facebook etc. South Africa Kenya Botswana Namibia Nigeria Rwanda Ghana Cameroon Uganda Tanzania Ethiopia Thursday, 7 March 13 Internet use among mobile phone owners: Social networking more popular than email in some countries 25% 25% 18% 17% 16% 14% 11% 8% 7% 5% 2% Using mobile for emailing South Africa Kenya Botswana Namibia Nigeria Rwanda Ghana Cameroon Uganda Tanzania Ethiopia 17% 20% 17% 12% 15% 13% 10% 4% 6% 5% 10% Households with Internet connection South Africa Kenya Namibia Botswana Nigeria Ghana Cameroon Uganda Tanzania Rwanda Ethiopia Individuals 15+ using the Internet 19.7% 12.7% 11.5% 8.6% 3.4% 2.7% 1.3% 0.9% 0.8% 0.7% 0.5% Where was the Internet used first? Cameroon Rwanda Botswana Ghana Kenya South Africa Namibia Tanzania Nigeria Ethiopia Uganda Thursday, 7 March 13 South Africa Botswana Kenya Nigeria Namibia Cameroon Ghana Uganda Rwanda Tanzania Ethiopia Computer 34% 29% 26% 18% 16% 14% 13% 8% 6% 4% 3% Mobile phone 82% 18% 71% 29% 71% 29% 71% 30% 69% 31% 65% 35% 50% 50% 46% 54% 45% 55% 33% 67% 28% 72% Where did you use the Internet in the last 12 months Mobile phone Work Place of education Internet cafe 74% 20% 29% 31% 17% 75% 75% 78% 81% 81% 87% Uganda Namibia 48% Ethiopia 55% Kenya 61% 21% Nigeria 71% 39% 42% 36% Tanzania 64% 71% Rwanda 20% 10% 24% 45% 36% 23% 51% 45% 52% 51% 35% 31% 21% Ghana 80% 32% 33% 72% 63% South Africa 51% 50% 58% Botswana 85% Cameroon 30% Thursday, 7 March 13 Internet Access Models Thursday, 7 March 13 Old Internet New Internet Hardware Computer / Laptop Mobile Billing Postpaid (monthly Internet subscription) Prepaid Skill requirement High (Windows + Internet explorer + Viruses) Low Electricity electricity mostly required at location of Internet use no required at home Location Work, school, Internet cafe Anywhere Internet going mobile The mobile is closing the voice and the data gap in Africa First wave of Internet access through PCs and fixed-line /modem dial-up. Mostly through work, school or public access (Internet cafes) Second wave is through mobile phones Easier to use Cheaper equipment compared to computers Prepaid (modem dial-up was postpaid) No electricity at home needed Internet enabled mobile phones, low bandwidth applications, and social networking are the key drivers Mobile Internet reduces the cost of communication: Facebook Zero, whatsapp, Mixit Thursday, 7 March 13 ICT ecosystem 1 SA ICT landscape 2 3 SA cloud economy Bottlenecks 4 Bottlenecks 5 Use this area to provide an optional section subtitle or explanation 18 Thursday, 7 March 13 Cloud considerations in developing countries Large corporate enterprises earlier adopters of cloud computing greatest beneficiaries arguably exist for SME and the public sector who historically not invested as intensively in IT infrastructure and services and by moving onto the cloud can enjoy the cost benefits associated with the economies of scale offered by the cloud at a fraction of the cost of having invested in the physical network and services Benefits ‣ Cloud services eliminate the operational complexity and cost of installing maintaining and upgrading complex IT systems in the users own environment ‣ SME/public sector particular benefits of turnkey IT solution and fraction of the price ‣ Security - greater reliability/redundancy Risks ‣ Security/trust ‣ SME lock-into proprietorial systems ‣ Loss of control of strategic/critical ‣ SME lock-into proprietorial systems ‣ Squeeze out local developers/ entrepreneurs investors 19 Thursday, 7 March 13 Cloud services offerings in SA First three established, fourth challenged conceptually IaaS ‣ AWS’s virtual servers global leaders in the IaaS field. ‣ South Africa AWS competes against local providers such as Telkom, Internet Solutions and MTN Solutions. ‣ Hosting and data centre providers believe that hosting and co-location services as part of infrastructure as service offerings. Thursday, 7 March 13 PaaS ‣ Microsoft’s Windows Azure platform largest share of SA market but Google’s App Engine ‣ Competitiveness dependent on richness of the ecosystem of applications that leverage a common frameworks and interfaces. ‣ Monetize the services by charging developers to use the underlying processing power, storage and network capacity, billing, SLA but differentiate on unique attributes, efficiency of application SaaS ‣ Software as service providers such as Salesforce.com create third party application markets to enhance their server offering. ‣ Provides CRM and related cloud computing application solutions development tools for the business web. ‣ Applications and content services, include Google Apps and Microsoft Office, offer productivity services, e-mail, customer relationship management CRM and Enterprise Resource Planning via the Cloud. CaaS ‣ Content shift to cloud provides major services for individual users ‣ while shift from buying digital content (primarily music and video) to subscribing to services is quite comfortable for users the business models is not so clear ‣ content providers able to command less for the actual content and need to look for other revenue streams. ‣ mobile wireless devices offer an array of services and considerably more potentially, without cable entertainment is more 20 Integration as a service This is a delivery model in which functionality of system integration is put it into the cloud, providing data transport between enterprise wide systems and third parties (suppliers and other trading partners) on-demand. South African based cloud aggregator, Pamoja seeks to provide integration services between different cloud providers based on open application programme interfaces (APIs). This model is expected to allow greater flexibility than closed proprietor cloud computing services as companies have the liberty to select different cloud service from multiple cloud providers and that best meet their specifications and at the best price. 21 Thursday, 7 March 13 ‣ Enterprises ‣ Some companies have migrated onto the cloud mostly onto the private cloud as companies still have security concerns about moving on the public cloud. ‣ Out of 100 large JSE-listed corporations interviewed by World Wide Worx M 46% are already using cloud computing. Cloud providers believe that the significant benefits, and security and privacy improvements from the public cloud will help migrate customers there in time. ‣ However, even with these obvious advantages some large enterprises are constrained by Cloud providers believe that the significant benefits, and security and privacy improvements from the public cloud will help migrate customers there in time. ‣ Even with these obvious advantages some large enterprises are constrained by governance rules that prevent them from moving some of their applications into the public cloud as the location of the servers is unknown as required by law or company policy (Microsoft South Africa, Interviewed 29 June 2012). 22 Thursday, 7 March 13 SME ‣ Most to gain from the associated economies of scale at a fraction of the price of investing in such infrastructure and services ‣ High cost of bandwidth and absence of long standing trust relationships have inhibited SME take up ‣ Estimated that by 2011, only 9% of SMEs made use of the cloud, according to World Wide Works. ‣ Microsoft offering start-ups free cloud services on their platform as part of innovation entrepreneurialism support programme -USD 60,000 of free cloud computing over a two-year period. 23 Thursday, 7 March 13 ICT ecosystem SA ICT landscape SA cloud economy Bottlenecks Bottlenecks Use this area to provide an optional section subtitle or explanation 1 2 3 4 5 24 Thursday, 7 March 13 International bandwidth no longer a problem... electricity and backhaul national networks are.... HH connected to main electricity grid South Africa 89% Ghana South Africa 18.0% Botswana 15.0% Cameroon 65% Namibia Botswana 60% Ethiopia Kenya 60% Cameroon 2.2% Nigeria 58% Ghana 1.8% Uganda 1.5% Namibia 42% 11.5% 4.0% Tanzania 19% Kenya 0.6% Ethiopia 18% Tanzania 0.4% Rwanda 16% Nigeria 0.3% Uganda 13% Rwanda 0.2% Country ISP Technology Product name India MTNL ADSL TriB 49 2 Mbps 200 MB 0.88 Sri Lanka SLT ADSL Entrée 2 Mbps 2.5 GB 3.78 Mexico Cablevision Cable Intense 3.0 Mbps 3 Mbps South Africa MWEB ADSL Capped ADSL 384 Kbps Kenya TelkomKenya ADSL Surf and Talk Cameroon Ringo Fibre Fibre Ringo Uganda Uganda Telecom ADSL Thursday, 7 March 13 73% HH with landline Downstream Usage Monthly bandwidth cap cost (US$) Notes Speed reduces to 512Kbps after exceeding the usage cap + Additional charge INR1.00 per MB after exceeding usage cap 10.56 Installation charge for the internet only package is taken as the connection charge 17.55 Modem cost from ZAR 369 onwards, excludes voice line rentals. 256 Kbps 34.99 The cost of Livebox+Panasonic Handset is taken as the modem cost 1 Mbps 47.29 XAF95000 is the charge for equipment and installation cost. 64 Kbps 90 1 GB Fixed line prices Africa Monthly#Fixed#line#rental#(in#USD)# Gabon#(Gabon#Telecom)# Gabon#(Gabon#Telecom)# Lesotho#(Econet#Telecom#Lesotho)# Lesotho#(Econet#Telecom#Lesotho)# South#Africa#(Telkom#SA)# Ascension#Island#(Cable#&#Wireless)# Lesotho#(Econet#Telecom#Lesotho)# Gabon#(Gabon#Telecom)# South#Africa#(Telkom#SA)# Oman#(Omantel)# Morocco#(Maroc#Telecom)# South#Africa#(Telkom#SA)# Lesotho#(Econet#Telecom#Lesotho)# Oman#(Omantel)# Saudi#Arabia#(STC)# Lesotho#(Econet#Telecom#Lesotho)# Botswana#(BTC)# Lebanon#(Ministry#of#TelecommunicaHon)# Jordan#(Orange)# Mozambique#(TDM)# Saint##Helena#(Cable#&##Wireless)# Seychelles#(Cable#&#Wireless#Seychelles##Limited)# Niger#(Sonitel)# Sao#Tome#and#Principe#(CST)# Burkina#Faso#(Onatel)# Cape#Verde#(CV##Telecom)# Nigeria#(Nitel)# UAE#(Emirates#TelecommunicaHons#CorporaHon)# Swaziland#(Swazi#Telecom)# Swaziland#(Swazi#Telecom)# Tanzania#(TTCL)# Bahrain##(Bahrain#Telecom#(BATELCO))# Tunisia#(Tunisie#Telecom)# Sudan#(Sudatel)# Ethiopia#(ETC)# Egypt#(Telecom#Egypt)# 0,00# Thursday, 7 March 13 Gabon#(Gabon#Telecom)# Gabon#(Gabon#Telecom)# Lesotho#(Econet#Telecom#Lesotho)# Lesotho#(Econet#Telecom#Lesotho)# South#Africa#(Telkom#SA)# Ascension#Island#(Cable#&#Wireless)# Lesotho#(Econet#Telecom#Lesotho)# Gabon#(Gabon#Telecom)# South#Africa#(Telkom#SA)# Oman#(Omantel)# Morocco#(Maroc#Telecom)# South#Africa#(Telkom#SA)# Lesotho#(Econet#Telecom#Lesotho)# Oman#(Omantel)# Saudi#Arabia#(STC)# Lesotho#(Econet#Telecom#Lesotho)# Botswana#(BTC)# Lebanon#(Ministry#of#TelecommunicaEon)# Jordan#(Orange)# Mozambique#(TDM)# Saint##Helena#(Cable#&##Wireless)# Seychelles#(Cable#&#Wireless#Seychelles##Limited)# Niger#(Sonitel)# Sao#Tome#and#Principe#(CST)# Burkina#Faso#(Onatel)# Cape#Verde#(CV##Telecom)# Nigeria#(Nitel)# UAE#(Emirates#TelecommunicaEons#CorporaEon)# Swaziland#(Swazi#Telecom)# Swaziland#(Swazi#Telecom)# Tanzania#(TTCL)# Bahrain##(Bahrain#Telecom#(BATELCO))# Tunisia#(Tunisie#Telecom)# Sudan#(Sudatel)# Ethiopia#(ETC)# Egypt#(Telecom#Egypt)# 0,00# 10,00# 20,00# 30,00# 40,00# 50,00# 60,00# Unlimited#local#and#long# distance#calls#at#no#charge# 0,05# 0,10# 0,15# 0,20# 0,25# Leased lines Na#onal'leased'lines'basket,'34'mbps' Mexico! Korea! South!Africa!! Ireland! Canada! United!Kingdom! Portugal! France! Japan! Italy! Turkey! Greece! United!States! Austria! Belgium! Germany! Australia! Denmark! Luxembourg! Norway! Iceland! Leased&Lines&Pricing&Trends& 34"mbit/s"(Rands)" 140"000" 120"000" 100"000" 80"000" 60"000" 40"000" 20"000" !"!!!! !5!000!! !10!000!! !15!000!! !20!000!! !25!000!! 0" 2005" Thursday, 7 March 13 2"mbit/s"(Rands)" 2007" 2008" 2009" 2010" 2012" Broadband Pricing Comparison OECD/SA Broadband subscription price ranges, Sept. 2010 (SA July 2011), all platforms, logarithmic scale, including line charge (or 3G modem), USD PPP Thursday, 7 March 13 Title - Top (no bullets) HOME About IN-­DEPTH Advertise JERM Newsletter NEWS OPINION PEOPLE PODCASTS REVIEWS START-­UPS Contact WEEKEND ADVERTISE Thursday, February 21, 2013 ISPs call for Telkom price cuts Up to a two line subtitle, generally used to describe the Industry association wants wholesale access charges reduced again to takeaway for the slide ensure fixed-­line broadband remains competitive next to mobile alternatives. Added by Editor on 20 February 2013. Saved under News, Top Tags: Ispa, Marc Furman, Telkom 5 Tweet 5 4 Like Bottleneck: Broadband interconnect The Internet Service Providers’ Association (Ispa) has called for further reductions in the fees Telkom charges ISPs for access to its fixed-­line broadband network. The fees, known as Internet Protocol Connect (IPC) charges, were reduced by 30% in 2012, prompting a wave of price cuts to consumers. “Further reductions in IPC prices are required urgently to keep fixed-­line connectivity Thursday, 7 March 13 Connect with TechCentral Follow TechCentral o n Twitter Connect with TechCentral o n Facebook Connect with TechCentral o n Google+ 29 Bottleneck: Quality of Service Thursday, 7 March 13 Bottleneck: Computer ownership • 31 Thursday, 7 March 13 Legal protections/constraints ‣ Protection of Private Information Bill • Prohibits the transfer of personal information to a foreign entity unless the recipient of the information is subject to a law or agreement which upholds similar information protection principles or the data subject consents to the transfer. • Makes it difficult for local cloud service developers to compete/achieving economies of scale of global or trans-border players. 32 Thursday, 7 March 13 Bottleneck summary ‣ Regulatory uncertainty & lack of effective competition ‣ Institutional capacity/competencies ‣ Demand stimulation: e-literacy ‣ (International bandwidth) National backbone backhaul network capacity ‣ Open systems/interoperability ‣ Consumer protection ‣ Security & trust ‣ Taxation Thursday, 7 March 13 33