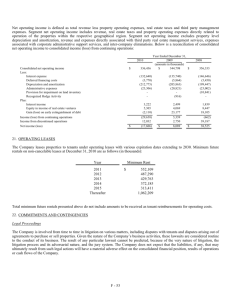

Consolidated Audited Financial Statements

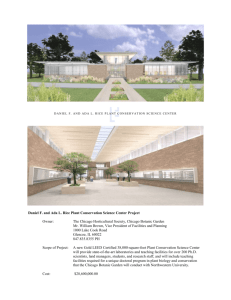

advertisement