Net operating income is defined as total revenue less property

advertisement

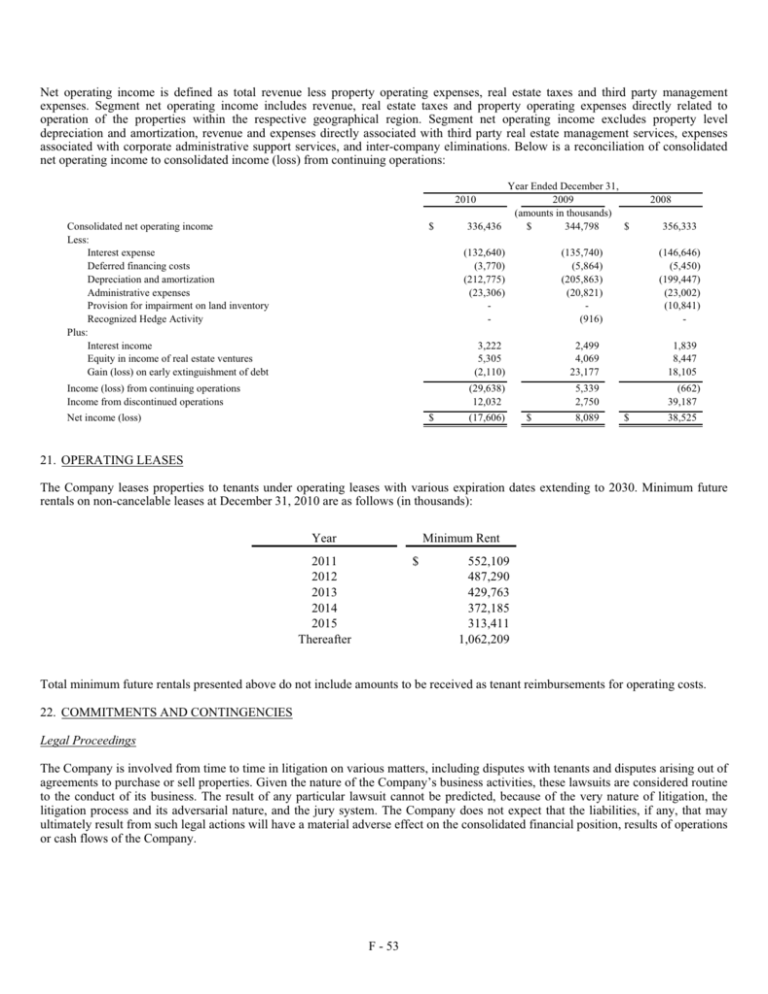

Net operating income is defined as total revenue less property operating expenses, real estate taxes and third party management expenses. Segment net operating income includes revenue, real estate taxes and property operating expenses directly related to operation of the properties within the respective geographical region. Segment net operating income excludes property level depreciation and amortization, revenue and expenses directly associated with third party real estate management services, expenses associated with corporate administrative support services, and inter-company eliminations. Below is a reconciliation of consolidated net operating income to consolidated income (loss) from continuing operations: Year Ended December 31, 2009 (amounts in thousands) 336,436 $ 344,798 $ 2010 Consolidated net operating income Less: Interest expense Deferred financing costs Depreciation and amortization Administrative expenses Provision for impairment on land inventory Recognized Hedge Activity Plus: Interest income Equity in income of real estate ventures Gain (loss) on early extinguishment of debt $ (132,640) (3,770) (212,775) (23,306) - Income (loss) from continuing operations Income from discontinued operations Net income (loss) $ 2008 356,333 (135,740) (5,864) (205,863) (20,821) (916) (146,646) (5,450) (199,447) (23,002) (10,841) - 3,222 5,305 (2,110) 2,499 4,069 23,177 1,839 8,447 18,105 (29,638) 12,032 5,339 2,750 (662) 39,187 (17,606) $ 8,089 $ 38,525 21. OPERATING LEASES The Company leases properties to tenants under operating leases with various expiration dates extending to 2030. Minimum future rentals on non-cancelable leases at December 31, 2010 are as follows (in thousands): Year Minimum Rent 2011 2012 2013 2014 2015 Thereafter $ 552,109 487,290 429,763 372,185 313,411 1,062,209 Total minimum future rentals presented above do not include amounts to be received as tenant reimbursements for operating costs. 22. COMMITMENTS AND CONTINGENCIES Legal Proceedings The Company is involved from time to time in litigation on various matters, including disputes with tenants and disputes arising out of agreements to purchase or sell properties. Given the nature of the Company’s business activities, these lawsuits are considered routine to the conduct of its business. The result of any particular lawsuit cannot be predicted, because of the very nature of litigation, the litigation process and its adversarial nature, and the jury system. The Company does not expect that the liabilities, if any, that may ultimately result from such legal actions will have a material adverse effect on the consolidated financial position, results of operations or cash flows of the Company. F - 53