Insolvency Risk Appendix - Pension Protection Fund

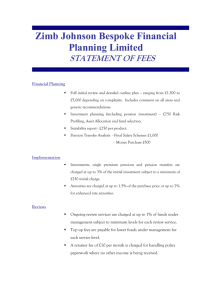

advertisement

Insolvency Risk Appendix This is the Insolvency Risk Appendix to the Board’s determination under Section 175(5) of the Act in respect of the 2015/16 Levy Year. Unless defined in this Appendix, expressions defined in the rules set out in the determination (the "Rules") shall have the same meanings as set out therein. Part 1: Categorisation Principles This Part sets out the categorisation principles referred to at Rule E3.2, which will be applied for the purposes of assigning Employers to categories pursuant to Rule E3. 1 Subject to paragraphs 6 and 7 of this Part 1 and Rule E7, all provisions of Rule E2 will apply in relation to data collection and use to determine which category an Employer is assigned to. 2 If an Employer is categorised as Not-For-Profit, Scorecard 8 (Not-For-Profit) will be used regardless of the type of accounts, if any, Filed by that Employer and regardless of any financial data contained in them. 3 To be assigned to a Group category pursuant to Rule E3.1(2), (3), (4) or (5), the following conditions must be satisfied: 4 5 3.1 the Employer must be or must have a Parent; and 3.2 either: (a) Experian must have collected, or there must have been Filed, in accordance with Rule E2, Consolidated Accounts for the Employer's Ultimate Parent; or (b) there must be at least one other member of the Group other than the Employer which has filed its Latest Accounts with Companies House in the UK. Where Rule E2.4(2)(c) has applied for the purposes of the 2015/16 Levy Year, but has not applied in any subsequent Levy Year, the Employer concerned will, nonetheless, be categorised for the purposes of any subsequent Levy Year as follows: (a) Group <£10m in the case of an Employer which is part of a Group; or (b) Independent Full in the case of an Employer which is not part of a Group.1 For the purposes of assigning Employers in any case where Accounts are expressed in a currency other than sterling, the currency conversion rate which would be used by Experian in its ordinary course of business at the 1st April 1 Note, paragraph 4 is not intended to be part of the determination for the 2015/16 Levy Year but signals the Board's intention in relation to future determinations. Pension Protection Fund 1 December 2014 immediately preceding the Score Measurement Date in question is used to convert the currency of the Accounts to sterling. 6 7 For the purposes of determining whether Rule E3.1(8) applies to an Employer: 6.1 Experian will take into account (in addition to data collected or Filed in accordance with Rule E2) any other data which the Board supplies to it for this purpose (or which the Board directs it to collect), and the Board may direct Experian that Rule E3.1(8) does or does not apply to a particular Employer; and 6.2 subject to any evidential requirements set out in Rule E3.1(8) being met, assignment will be based on whether the factual tests in Rule E3.1(8) are met as at the relevant Score Measurement Date. For the purposes of determining whether Rule E3.1(1)(b)(iii) applies, Experian will accept data provided pursuant to Rule E2.3 up to and including the Measurement Time. Pension Protection Fund 2 December 2014 Part 2: Scorecards Set out below are the Scorecards to which Employers will be assigned pursuant to Rule E3 and on the basis of which their Monthly Scores and Adjusted Monthly Scores will be calculated pursuant to Rule E4. Scorecard 1 – Large/Complex Variable Unit Band Gradient Intercept Constant -10.29774872993580000000 Capital Employed £Millions Unknown Capital Employed £Millions <0 Capital Employed £Millions 0 to 3.75 Capital Employed £Millions 3.75 to 18.75 Capital Employed £Millions 18.75 to 90 Capital Employed £Millions 90 to 150 Capital Employed £Millions >150 Turnover £Millions Turnover 0.00000000000000000000 3.10540699916430000000 0.00000000000000000000 3.10540699916430000000 -0.19513860442514400000 3.10540699916430000000 -0.06189097166656380000 2.60572837631962000000 -0.01244731476535150000 1.67865980942189000000 -0.00930669134233767000 1.39600370135065000000 0.00000000000000000000 0.00000000000000000000 Unknown 0.00000000000000000000 1.65181760596388000000 £Millions <1.25 0.00000000000000000000 1.65181760596388000000 Turnover £Millions 1.25 to 11.25 -0.054289922479561000000 1.719680009063330000000 Turnover £Millions 11.25 to 35 -0.00514048400086315000 1.16674882617798000000 Turnover £Millions 35 to 150 -0.00025985865990575100 0.99592693924447500000 Turnover £Millions 150 to 500 -0.00266139058453724000 1.35615672793920000000 Turnover £Millions 500 to 750 -0.00010184574268231600 0.07638430701173680000 Turnover £Millions >750 0.00000000000000000000 0.00000000000000000000 Turnover by Stock Ratio Unknown 0.00000000000000000000 0.73918598667321900000 Pension Protection Fund 3 December 2014 Turnover by Stock Ratio <7.5 Turnover by Stock Ratio 7.5 to 25 Turnover by Stock Ratio 25 to 60 Turnover by Stock Ratio 60 to 80 Turnover by Stock Ratio >80 Return on Assets % Unknown Return on Assets % <0 Return on Assets % 0 to 1.5 Return on Assets % 1.5 to 5.25 Return on Assets % 5.25 to 7.5 Return on Assets % >7.5 Sales by Employee £Thousands Unknown Sales by Employee £Thousands 0 to 87.5 Sales by Employee £Thousands 87.5 to 250 Sales by Employee £Thousands 250 to 400 Sales by Employee £Thousands > 400 Change in Net Worth % Unknown Change in % <-50 Pension Protection Fund 0.00000000000000000000 1.27593909277427000000 -0.01144968488021280000 1.36181172937587000000 -0.00192700237127101000 1.12374466665232000000 -0.05040622621880300000 4.03249809750424000000 0.00000000000000000000 0.00000000000000000000 0.00000000000000000000 1.57356524248057000000 0.00000000000000000000 1.57356524248057000000 -0.41120077092757000000 1.57356524248057000000 -0.21044210575493300000 1.27242724472161000000 -0.07449163978142750000 0.55868729836070600000 0.00000000000000000000 0.00000000000000000000 0.00000000000000000000 0.75087707468776200000 0.00000000000000000000 0.75087707468776200000 -0.00332834844748428000 1.04210756384264000000 -0.00140013634647711000 0.56005453859084500000 0.00000000000000000000 0.00000000000000000000 0.00000000000000000000 0.04502490504354130000 0.00000000000000000000 1.04315761635834000000 4 December 2014 Net Worth Change in Net Worth % -50 to -35 Change in Net Worth % -35 to -10 Change in Net Worth % -10 to 0 Change in Net Worth % >0 Mortgage Age Years Unknown Mortgage Age Years None Mortgage Age Years <0.5 Mortgage Age Years 0.5 to 5.5 Mortgage Age Years 5.5 to 10 Mortgage Age Years >10 -0.03153062745763520000 -0.53337375652341600000 -0.01742390923273210000 -0.03963861865180800000 -0.01346004736755130000 0.00000000000000000000 0.00000000000000000000 0.00000000000000000000 0.00000000000000000000 1.04325319684589000000 0.00000000000000000000 0.00000000000000000000 0.00000000000000000000 1.54396157548580000000 -0.12971719653883700000 1.60882017375522000000 -0.19897235395369200000 1.98972353953692000000 0.00000000000000000000 0.00000000000000000000 Scorecard 2 - Group £50m+ Variable Unit Band Gradient Constant -7.10460674910167000000 Intercept Pre Tax Margin % Unknown Pre Tax Margin % <2 Pre Tax Margin % 2 to 6 Pre Tax Margin % 6 to 10 Pension Protection Fund 0.00000000000000000000 1.32960640343370000000 0.00000000000000000000 1.32960640343370000000 -0.10021122021618400000 1.53002884386607000000 2.32190380642242000000 -0.23219038064224200000 5 December 2014 Pre Tax Margin % >10 Average Remuneration per Employee £Thousands Unknown Average Remuneration per Employee £Thousands Average Remuneration per Employee £Thousands Average Remuneration per Employee £Thousands Average Remuneration per Employee £Thousands Average Remuneration per Employee £Thousands Mortgage Age Years Mortgage Age 0.00000000000000000000 0.00000000000000000000 0.00000000000000000000 1.53020793691005000000 0.00000000000000000000 1.53020793691005000000 -0.00329720691773492000 1.55493698879306000000 -0.07380646967737340000 2.78884908708673000000 -0.01370817655857750000 0.68540882792887700000 0.00000000000000000000 0.00000000000000000000 Unknown 0.00000000000000000000 1.25860760820654000000 Years None 0.00000000000000000000 0.00000000000000000000 Mortgage Age Years 0 to 1.5 0.00000000000000000000 1.80635551381964000000 Mortgage Age Years 1.5 to 5 -0.02684691718207970000 1.84662588959276000000 Mortgage Age Years 5 to 7 -0.85619565184117900000 5.99336956288826000000 Mortgage Age Years 7+ 0.00000000000000000000 0.00000000000000000000 Change in Turnover Ratio Unknown 0.00000000000000000000 0.57794182692327700000 Change in Turnover Ratio <-0.625 0.00000000000000000000 1.47610914888338000000 Change in Turnover Ratio -0.625 to -0.83066692375223800000 0.95694232153822900000 Change in Turnover Ratio -1.87919490492926000000 0.77344992483225000000 <7.5 7.5 to 17.5 17.5 to 35 35 to 50 >50 -0.175 Pension Protection Fund -0.175 to 0.05 6 December 2014 Change in Turnover Ratio 0.05 to 0.2 Change in Turnover Ratio >0.2 Parent Strength Score -4.52993453057191000000 0.90598690611438200000 0.00000000000000000000 0.00000000000000000000 -0.01852533324005720000 Scorecard 3 - Group £10m to £50m Variable Unit Band Gradient Constant -4.80943033510774000000 Intercept Mortgage Years Unknown Mortgage Years None Mortgage Years <0.5 Mortgage Years 0.5 to 2.5 Mortgage Years 2.5 to 7 Mortgage Years 7 to 10 Mortgage Years >10 Pre Tax £Thousands Unknown Pre Tax Profit £Thousands <0 Pre Tax Profit £Thousands 0 to 250 Pre Tax Profit £Thousands 250 to 750 Pre Tax £Thousands 750 to 1000 Age Age Age Age Age Age Age Profit Pension Protection Fund 0.00000000000000000000 -0.49723056159746300000 0.00000000000000000000 -1.47142928033267000000 0.00000000000000000000 0.00000000000000000000 -0.35264578836699500000 0.17632289418349700000 -0.15462782457365200000 -0.31872201529985900000 -0.02343749767241590000 -1.23705430360851000000 0.00000000000000000000 -1.47142928033267000000 0.00000000000000000000 1.19543713038494000000 0.00000000000000000000 1.19543713038494000000 -0.00006320000339169150 1.19543713038494000000 -0.00048622418427667800 1.30119317560618000000 -0.00374610014959470000 3.74610014959470000000 7 December 2014 Profit Pre Tax Profit £Thousands >1000 Change in Fixed Assets % Unknown Change in Fixed Assets % Change in Fixed Assets % Change in Fixed Assets % Change in Fixed Assets % Change in Fixed Assets % Capital Employed Per Employee £Thousands Capital Employed Per Employee £Thousands Capital Employed Per Employee £Thousands Capital Employed Per Employee £Thousands Capital Employed Per £Thousands Pension Protection Fund 0.00000000000000000000 0.00000000000000000000 0.00000000000000000000 0.00000000000000000000 0.00000000000000000000 0.84800358089174600000 -0.00529351429274873000 0.45099000893559200000 0.00011413868057498400 0.58618133326868400000 -0.01183776534594870000 1.18377653459487000000 0.00000000000000000000 0.00000000000000000000 0.00000000000000000000 1.10489944079703000000 0.00000000000000000000 1.10489944079703000000 -0.01719216052331670000 1.27682104603020000000 -0.00037301453846788900 0.77224666648473200000 -0.04290276174416160000 3.21770713081212000000 <-75 -75 to -25 -25 to 50 50 to 100 >100 Unknown 0 to 10 10 to 30 30 to 57.5 57.5 to 75 8 December 2014 Employee Capital Employed Per Employee £Thousands Parent Strength Score >75 0.00000000000000000000 0.00000000000000000000 -0.03277697266547760000 Scorecard 4 – Group < £10m Variable Unit Band Gradient Constant -3.38077850913273000000 Intercept Shareholders Funds £Millions Unknown Shareholders Funds £Millions <0 Shareholders Funds £Millions 0 to 0.5 Shareholders Funds £Millions 0.5 to 3 Shareholders Funds £Millions 3 to 27.5 Shareholders Funds £Millions 27.5 to 50 Shareholders Funds £Millions >50 Return on Capital % Unknown Return on Capital % <0 Return on Capital % 0 to 2.5 Return on Capital % 2.5 to 10 Return on Capital % 10 to 15 Pension Protection Fund 0.00000000000000000000 0.00000000000000000000 0.00000000000000000000 0.00000000000000000000 -0.91206029956916500000 0.00000000000000000000 -0.10349585501941800000 -0.40428222227487300000 -0.00848947323523620000 -0.68930136762741900000 -0.02902450579496550000 -0.12458797223486400000 0.00000000000000000000 -1.57581326198314000000 0.00000000000000000000 0.41340558608153200000 0.00000000000000000000 0.41340558608153200000 -0.01860038381795590000 0.41340558608153200000 -0.02461476240704040000 0.42844153255424300000 -0.03645878169676780000 0.54688172545151600000 9 December 2014 Return on Capital % >15 Creditor Days (Sales Based) Days Unknown Creditor Days (Sales Based) Days 0 to 2.5 Creditor Days (Sales Based) Days 2.5 to 12.5 Creditor Days (Sales Based) Days 12.5 to 30 Creditor Days (Sales Based) Days 30 to 40 Creditor Days (Sales Based) Days >40 Change in Employee Remuneration % Unknown Change in Employee Remuneration % Change in Employee Remuneration % Change in Employee Remuneration % Change in Employee Remuneration % Change in Employee Remuneration % Mortgage Age Years Mortgage Age 0.00000000000000000000 0.00000000000000000000 0.00000000000000000000 0.00000000000000000000 0.00000000000000000000 -1.27904322731378000000 0.10270413882800100000 -1.53580357438378000000 0.02073595775533760000 -0.51120131097549100000 0.00949512138266521000 -0.17397621979531900000 0.00000000000000000000 0.20582863551128900000 0.00000000000000000000 0.00000000000000000000 0.00000000000000000000 0.25990254479020700000 -0.00908300227157929000 -0.28507759150455100000 -0.01475304500820340000 -0.34177801887079100000 -0.00947282410672507000 -0.44738243690035700000 0.00000000000000000000 -0.82629540116936000000 Unknown 0.00000000000000000000 0.49506133695288800000 Years None 0.00000000000000000000 0.00000000000000000000 Mortgage Age Years <1 0.00000000000000000000 0.82662297743542800000 Mortgage Age Years 1 to 6 -0.02548354216567390000 0.85210651960110200000 Pension Protection Fund <-60 -60 to -10 -10 to 20 20 to 40 >40 10 December 2014 Mortgage Age Years 6 to 10 -0.13256099328193000000 1.49457122629864000000 Mortgage Age Years >10 0.00000000000000000000 0.16896129347933900000 Parent Strength Score -0.01744964317425120000 Scorecard 5 - Group Small Variable Unit Band Gradient Constant -3.41773314024334000000 Intercept Cash £Thousands Unknown 0.00000000000000000000 1.55720431578069000000 Cash £Thousands 0 to 10 0.00000000000000000000 1.55720431578069000000 Cash £Thousands 10 to 110 -0.00229037802861790000 1.58010809606687000000 Cash £Thousands 110 to 350 -0.00292863584726865000 1.65031645611845000000 Cash £Thousands 350 to 500 -0.00416862606382951000 2.08431303191475000000 Cash £Thousands >500 0.00000000000000000000 0.00000000000000000000 Retained Earnings £Thousands Unknown 0.00000000000000000000 0.93080181141807400000 Retained Earnings £Thousands < -1000 0.00000000000000000000 1.90439398546942000000 Retained Earnings £Thousands -1000 to 500 -0.00107216847005242000 0.83222551541699700000 Retained Earnings £Thousands -500 to 50 -0.00087501587805027000 0.93080181141807400000 Retained Earnings £Thousands 50 to 100 -0.01774102035031120000 1.77410203503112000000 Retained Earnings £Thousands >100 0.00000000000000000000 0.00000000000000000000 Shareholder Funds £Thousands Unknown 0.00000000000000000000 0.11524982519832300000 Shareholder Funds £Thousands <550 0.00000000000000000000 0.11524982519832300000 Pension Protection Fund 11 December 2014 Shareholder Funds £Thousands 550 to 1750 0.00045136490144059200 -0.13300087059400300000 Shareholder Funds £Thousands 1750 to 2500 -0.00087585027590271200 2.18962568975678000000 Shareholder Funds £Thousands >2500 0.00000000000000000000 0.00000000000000000000 Change in Stock or Work in Progress % Unknown 0.00000000000000000000 -0.93102951143215700000 Change in Stock or Work in Progress % 0.00000000000000000000 -0.26251265273709900000 Change in Stock or Work in Progress % -0.01979469421901740000 -1.54916777697323000000 Change in Stock or Work in Progress % -0.04944706247085060000 -1.99395330075073000000 Change in Stock or Work in Progress % 0.02023208266451460000 -2.69074475210438000000 Change in Stock or Work in Progress % 0.01493873424031750000 -2.24081013604763000000 Change in Stock or Work in Progress % 0.00000000000000000000 0.00000000000000000000 Company Age Years Unknown 0.00000000000000000000 1.14616546488905000000 Company Age Years 0 to 2.5 0.00000000000000000000 1.14616546488905000000 Company Age Years 2.5 to 7.5 -0.41774065976980100000 2.19051711431355000000 Company Age Years 7.5 to 15 -0.06934574133669080000 -0.42244477393478000000 Company Age Years 15 to 30 0.07188618247482660000 -2.54092363110754000000 Company Age Years 30 to 40 0.03843381568627420000 -1.53735262745097000000 Company Age Years >40 0.00000000000000000000 0.00000000000000000000 Parent Strength Score Unknown 0.00000000000000000000 0.00000000000000000000 -100 to -65 -65 to -15 Pension Protection Fund -15 to 10 10 to 85 85 to 150 >150 12 December 2014 Parent Strength Score 0 to 6 Parent Strength Score 7 to 23 Parent Strength Score 24 to 60 Parent Strength Score 61 to 84 Parent Strength Score 85 to 96 Parent Strength Score >=97 0.00000000000000000000 0.00000000000000000000 -0.03850420084408910000 0.23102520506453500000 -0.00989703332825611000 -0.44124323155754100000 -0.04502979380153140000 1.68428877707562000000 -0.05054210008969370000 2.14732250528125000000 0.00000000000000000000 -2.70471910332935000000 Scorecard 6 – Independent Full Variable Unit Band Gradient Constant -2.70959543964669000000 Intercept Capital Employed £Millions Unknown Capital Employed £Millions <2.5 Capital Employed £Millions 2.5 to 6.25 Capital Employed £Millions 6.25 to 30 Capital Employed £Millions 30 to 50 Capital Employed £Millions >50 Return on Shareholder Funds % Unknown Return on Shareholder % 0.00000000000000000000 1.56287872266163000000 0.00000000000000000000 1.56287872266163000000 -0.05870293583248920000 1.70963606224285000000 -0.02095048027970940000 Pension Protection Fund <0 1.47368321503798000000 -0.04225844033233480000 2.11292201661674000000 0.00000000000000000000 0.00000000000000000000 0.00000000000000000000 0.00000000000000000000 0.00000000000000000000 0.00000000000000000000 13 December 2014 Funds Return on Shareholder Funds % Return on Shareholder Funds % Return on Shareholder Funds % Return on Shareholder Funds % Turnover £Millions Turnover 0 to 2.5 -0.18937499668665500000 0.00000000000000000000 -0.07785004801744110000 -0.27881237167303500000 -0.01218389523599440000 -1.42797004534835000000 0.00000000000000000000 -1.79348690242819000000 Unknown 0.00000000000000000000 0.00000000000000000000 £Millions < 0.5 0.00000000000000000000 0.00000000000000000000 Turnover £Millions 0.5 to 3 -0.06766837610214240000 0.03383418805107120000 Turnover £Millions 3 to 12.5 -0.03224889642302690000 -0.07242425098627540000 Turnover £Millions 12.5 to 60 -0.00260054785419973000 -0.44302860809661500000 Turnover £Millions 60 to 100 -0.03020806571985800000 1.21342246384288000000 Turnover £Millions > 100 0.00000000000000000000 -1.80738410814292000000 Creditor Days Sales Based Days Unknown 0.00000000000000000000 0.00000000000000000000 Creditor Days Sales Based Days 0 to 5 0.00000000000000000000 -1.12474497934805000000 Creditor Days Sales Based Days 5 to 20 0.03543866832682370000 -1.30193832098217000000 Creditor Days Sales Based Days 20 to 45 0.02859530301750610000 -1.16507101479582000000 Creditor Days Sales Based Days 45 to 60 0.00624449206016738000 -0.15928452171557700000 Creditor Days Sales Based Days > 60 0.00000000000000000000 0.21538500189446500000 Mortgage Age Years Unknown 0.00000000000000000000 -0.43938159575365800000 Mortgage Age Years None 0.00000000000000000000 -1.24074019271856000000 Pension Protection Fund 2.5 to 17.5 17.5 to 30 > 30 14 December 2014 Mortgage Age Years <3 0.00000000000000000000 0.00000000000000000000 Mortgage Age Years 3 to 13 -0.04310318880839860000 0.12930956642519600000 Mortgage Age Years 13 to 20 -0.04911592746865970000 0.20747516900859000000 Mortgage Age Years >20 0.00000000000000000000 -0.77484338036460300000 Change in Total Assets % Unknown 0.00000000000000000000 -1.14987512802437000000 Change in Total Assets % <-70 0.00000000000000000000 0.00000000000000000000 Change in Total Assets % -70 to -25 -0.01427968444112810000 -0.99957791087896600000 Change in Total Assets % -25 to -5 -0.01916976249122930000 -1.12182986213150000000 Change in Total Assets % -5 to 10 -0.02477881566980450000 -1.14987512802437000000 Change in Total Assets % 10 to 30 0.01867313970821350000 -1.58439468180455000000 Change in Total Assets % 30 to 40 0.00714037348349167000 -1.23841169506290000000 Change in Total Assets % >40 0.00000000000000000000 -0.95279675572323000000 Scorecard 7 – Independent Small Variable Unit Band Gradient Constant -7.42847191411750000000 Intercept Fixed Assets £Thousands Unknown 0.00000000000000000000 1.70425268931740000000 Fixed Assets £Thousands <15 0.00000000000000000000 1.70425268931740000000 Fixed Assets £Thousands 15 to 115 0.00068520397208649400 1.69397462973610000000 Fixed Assets £Thousands 115 to 600 -0.00091750503752257000 1.87828616584115000000 Fixed Assets £Thousands 600 to 1000 -0.00331945785831901000 3.31945785831901000000 Fixed Assets £Thousands >1000 0.00000000000000000000 0.00000000000000000000 Pension Protection Fund 15 December 2014 Total Stock & Work in Progress £Thousands Total Stock & Work in Progress £Thousands Total Stock & Work in Progress £Thousands Total Stock & Work in Progress £Thousands Total Stock & Work in Progress £Thousands Total Stock & Work in Progress £Thousands Total Stock & Work in Progress £Thousands Acid Test Ratio Acid Test Unknown 0.00000000000000000000 -0.28861244946851900000 0.00000000000000000000 -0.28861244946851900000 0.00404470301604913000 -0.29872420700864200000 0.01089023964680860000 -0.41852109804693300000 -0.00073610078814206600 0.33719103022486200000 -0.00058180396891120900 0.29090198445560500000 0.00000000000000000000 0.00000000000000000000 Unknown 0.00000000000000000000 1.56505745365779000000 Ratio <0.75 0.00000000000000000000 1.56505745365779000000 Acid Test Ratio 0.75 to 1.25 -1.05946555271998000000 2.35965661819777000000 Acid Test Ratio 1.25 to 1.5 -4.14129870919120000000 6.21194806378680000000 Acid Test Ratio >1.5 0.00000000000000000000 0.00000000000000000000 Days Beyond Terms: Last Months Days No Late Payments Seen 0.00000000000000000000 0.00000000000000000000 Days Beyond Terms: Last Months Days 0.00000000000000000000 0.22743951329736400000 Days Beyond Terms: Last Months Days 0.06865482097191900000 -0.01285236010435240000 Pension Protection Fund <2.5 2.5 to 17.5 17.5 to 65 65 to 300 300 to 500 >500 < 3.5 3.5 to 14.5 16 December 2014 Days Beyond Terms: Last Months Days 14.5 to 21 Days Beyond Terms: Last Months Days Retained Earnings £Thousands Unknown Retained Earnings £Thousands <0 Retained Earnings £Thousands 0 to 250 Retained Earnings £Thousands 250 to 500 Retained Earnings £Thousands >500 0.08652453538489940000 -0.27196321909256900000 0.00000000000000000000 1.54505202399032000000 0.00000000000000000000 1.46540618484971000000 0.00000000000000000000 1.46540618484971000000 -0.00173751027401629000 1.46540618484971000000 -0.00412411446538253000 2.06205723269127000000 0.00000000000000000000 0.00000000000000000000 > 21 Scorecard 8 – Not-For-Profit Variable Unit Band Gradient Constant -5.54886900580876000000 Intercept Capital Employed £Thousands Unknown Capital Employed £Thousands <0 Capital Employed £Thousands 0 to 50 Capital Employed £Thousands 50 to 175 Capital Employed £Thousands 175 to 250 Capital Employed £Thousands >250 Current Ratio Ratio Unknown Pension Protection Fund 0.00000000000000000000 0.00000000000000000000 0.00000000000000000000 0.00000000000000000000 -0.03193840698152200000 0.00000000000000000000 -0.00211937484349816000 -1.49095160690119000000 -0.00284390708555960000 -1.36415846454044000000 0.00000000000000000000 -2.07513523593034000000 0.00000000000000000000 0.00000000000000000000 17 December 2014 Current Ratio Ratio 0 to 1 0.00000000000000000000 0.00000000000000000000 Current Ratio Ratio 1 to 3.5 -0.05757706522657200000 0.05757706522657200000 Current Ratio Ratio 3.5 to 7.5 -0.01153844504264750000 -0.10355810541716400000 Current Ratio Ratio 7.5 to 10 -0.05460211487618760000 0.21941941833438700000 Current Ratio Ratio > 10 0.00000000000000000000 -0.32660173042748900000 Total Assets £Millions Unknown 0.00000000000000000000 1.18542929107433000000 Total Assets £Millions 0 to 1.25 0.00000000000000000000 1.18542929107433000000 Total Assets £Millions 1.25 to 3.75 -0.10656391377156800000 1.31863418328879000000 Total Assets £Millions 3.75 to 7.5 -0.05941645114710960000 1.14183119844707000000 Total Assets £Millions 7.5 to 15 -0.06748397555965640000 1.20233763154117000000 Total Assets £Millions 15 to 20 -0.03801559962926500000 0.76031199258530000000 Total Assets £Millions >20 0.00000000000000000000 0.00000000000000000000 Equity Gearing % Unknown 0.00000000000000000000 0.98250773923699000000 Equity Gearing % <40 0.00000000000000000000 0.98250773923699000000 Equity Gearing % 40 to 50 -0.02940539077020480000 2.15872337004518000000 Equity Gearing % 50 to 70 -0.01127238851930820000 1.25207325750035000000 Equity Gearing % 70 to 90 -0.02315030305743880000 2.08352727516950000000 Equity Gearing % >90 0.00000000000000000000 0.00000000000000000000 Change in Total Net Assets % Unknown 0.00000000000000000000 -0.49916587299576600000 Change in Total Net Assets % 0.00000000000000000000 0.00000000000000000000 Pension Protection Fund <-40 18 December 2014 Change in Total Net Assets % Change in Total Net Assets % Change in Total Net Assets % Change in Total Net Assets % Change in Total Net Assets % Mortgage Age Years Mortgage Age -40 to-20 -0.02495829364978830000 -0.99833174599153200000 -0.01387599108753050000 -0.77668569474637600000 0.00335225863381021000 -1.03510944056649000000 0.00421427376688617000 -1.13424118087022000000 0.00000000000000000000 -0.29138642749298900000 Unknown 0.00000000000000000000 0.45357461071521900000 Years None 0.00000000000000000000 0.00000000000000000000 Mortgage Age Years <1 0.00000000000000000000 0.76644150183040900000 Mortgage Age Years 1 to 6 -0.03661315934609000000 0.80305466117649900000 Mortgage Age Years 6 to 10 -0.14584392627499000000 1.45843926274990000000 Mortgage Age Years >10 0.00000000000000000000 0.00000000000000000000 Pension Protection Fund -20 to 15 15 to 115 115 to 200 >200 19 December 2014 Part 3: Variables – Calculation Principles 1. Table 1 below and paragraphs 2 - 9 of this Part 3 set out how the Variable Values (as defined in Part 4 of this Appendix) set out in each Scorecard will be calculated by using data collected or received in accordance with Rule E2. To the extent that the method of calculation of any Variable Value (or the inputs to that calculation) are not expressly set out (or, as the case may be, defined) in this Part 3, the method of calculation (or definition, as the case may be) shall be in accordance with Experian's ordinary course of business from time to time. Table 1 Variable Source Calculation Notes Acid Test Accounts [Current Assets – Stock and Work in Progress] divided by Current Liabilities If primary financial statements do not identify current assets/liabilities, this is derived from the notes. Current Liabilities are liabilities due within 12 months of the Year End Date and Current Assets are assets which are cash, or which could be turned into cash within 12 months of the Year End Date. Average Remuneration per Employee Accounts Total Employee Remuneration divided by Total Number of Employees Total Employee Remuneration includes wages, social security and pensions payments and the figure is annualised if accounting period is not 52 weeks. See paragraph 7 of this Part 3 in relation to Total Number of Employees. Capital Employed Accounts Taken directly from Accounts If not stated in Accounts, calculated as Total Assets minus Current Liabilities. If primary financial statements do not Pension Protection Fund 20 December 2014 identify current liabilities, this is derived from the notes. Current Liabilities are those due within 12 months of the Year End Date. If the above does not create a Variable Value for this Variable, Shareholder Funds / Total Net Assets will be used in substitution for it. Capital Employed Per Employee Accounts Capital Employed divided by Total Number of Employees If not stated on Accounts, Capital Employed is calculated as Total Assets minus Current Liabilities If primary financial statements do not identify current liabilities, this is derived from the notes. If the above does not create a figure for Capital Employed, Shareholder Funds / Total Net Assets will be used in substitution for it. See paragraph 7 of this Part 3 in relation to Total Number of Employees. Cash Accounts Taken directly from Accounts Change in Employee Remuneration Accounts [Total Employee Remuneration in Year N minus Total Employee Remuneration in Year Pension Protection Fund 21 Year N figure taken from Latest Accounts. Year N-3 figure taken from the N-3 Accounts. December 2014 N-3] divided by Employee Remuneration in Year N-3 and expressed as a percentage Total Employee Remuneration includes wages, social security and pensions payments. Figure is annualised if accounting period is not 52 weeks. See further paragraphs 7 and 8 below. See also Part 4 of this Appendix re missing/disregarded data. Change in Fixed Assets Accounts [Fixed Assets in Year N minus Fixed Assets in Year N-3] divided by Fixed Assets in Year N-3 and expressed as a percentage Year N figure taken from Latest Accounts. Year N-3 figure taken from the N-3 Accounts. See further paragraph 8 below. See also Part 4 of this Appendix re Missing/disregarded data Change in Net Worth Accounts [Net Worth in Year N minus Net Worth in Year N-3] divided by Net Worth in Year N3 and expressed as a percentage Net Worth is calculated as Shareholders' Funds less Intangible Assets. Year N figure taken from Latest Accounts. Year N-3 figure taken from the N-3 Accounts. See further paragraph 8 below. See also Part 4 of this Appendix re Missing/disregarded data Pension Protection Fund 22 December 2014 Change in Stock & Work in Progress Change in Total Assets Change in Total Net Assets Change in Turnover Accounts Accounts Accounts Accounts [Stock + Work in Progress in Year N minus Stock + Work in Progress in Year N3] divided by Stock + Work in Progress in Year N-3 and expressed as a percentage Year N figure taken from Latest Accounts. Year N-3 figure taken from the N-3 Accounts. [Total Assets in Year N minus Total Assets in Year N-3] divided by Total Assets in Year N-3 and expressed as a percentage Year N figure taken from Latest Accounts. Year N-3 figure taken from the N-3 Accounts [Total Net Assets in Year N minus Total Net Assets in Year N3] divided by Total Net Assets in Year N3 and expressed as a percentage Year N figure taken from Latest Accounts. Year N-3 figure taken from the N-3 Accounts [Turnover in Year N minus Turnover in Year N-3] divided by Turnover in Year N-3 and expressed as a percentage Year N figure taken from Latest Accounts. Year N-3 figure taken from the N-3 Accounts See further paragraph 8 below. See also Part 4 of this Appendix re Missing/disregarded data See further paragraph 8 below. See also Part 4 of this Appendix re Missing/disregarded data See further paragraph 8 below. See also Part 4 of this Appendix re Missing/disregarded data Figure is annualised if accounting period is not 52 weeks. See further paragraph 8 below. See also Part 4 of this Appendix re Missing/disregarded Pension Protection Fund 23 December 2014 data If reported turnover figure is 0, or null but Other Income figure is positive, the Other Income figure is used in place of Turnover Company Age Companies House registration date Time elapsed between date of incorporation of the business and Score Measurement Date Creditor Days (Sales Based) Accounts [Trade Creditors divided by Turnover] x 365 Trade Creditors can include Accounts Payable. Turnover figure annualised if accounting period is not 52 weeks. If reported turnover figure is 0, or null but Other Income figure is positive, the Other Income figure is used in place of Turnover. Current Ratio Accounts Current Assets divided by Current Liabilities If primary financial statements do not identify current assets/liabilities, this is derived from the notes. Current liabilities are liabilities due within 12 months of the Year End Date and Current Assets are assets which are cash, or which could be turned into cash within 12 months of the Year End Date. Days Beyond Terms: Last Month Pension Protection Fund Experian Payment Performance Programme See paragraph 2 below for details 24 December 2014 Equity Gearing Accounts Total Net Assets Divided by Total Assets and expressed as a percentage Fixed Assets Accounts Taken directly from Accounts Mortgage Age UK Companies House (and other overseas electronic public registries in the following countries: Australia, Gibraltar, Hong Kong, India, Ireland, Isle of Man, Malaysia, New Zealand and Singapore) mortgages and charges data Time elapsed between most recently registered mortgage or charge at UK Companies House (or other overseas electronic public registries in the following countries: Australia, Gibraltar, Hong Kong, India, Ireland, Isle of Man, Malaysia, New Zealand and Singapore) and Score Measurement Date. Only charges where the chargor is the Employer are taken into account, even where Consolidated Accounts are used. Parent Strength Various See paragraph 3 below for details Pre Tax Margin Accounts Pre-Tax Profit divided by Turnover and expressed as a percentage Pension Protection Fund 25 Turnover and Pre-Tax Profit figures annualised if accounting period is not 52 weeks. If reported turnover figure is 0, or null but Other Income figure is positive, the Other Income figure is used in place of Turnover December 2014 Pre Tax Profit Accounts Taken directly from Accounts Pre-Tax Profit figure annualised if accounting period is not 52 weeks Retained Earnings Accounts Taken directly from Accounts Return on Assets Accounts Pre-Tax Profit divided by Total Assets and expressed as a percentage Pre-Tax Profit figure annualised if accounting period is not 52 weeks Return on Capital Accounts Pre-Tax Profit divided by Capital Employed and expressed as a percentage Pre-Tax Profit figure annualised if accounting period is not 52 weeks. If not stated on Accounts, Capital Employed calculated as Total Assets minus Current Liabilities If primary financial statements do not identify current liabilities, this is derived from the notes. Current Liabilities are liabilities due within 12 months of the Year End Date. See further, paragraph 9 below. Return on Shareholder Funds Accounts Pre-Tax Profit divided by Shareholders Funds and expressed as a percentage Pre-Tax Profit figure annualised if accounting period is not 52 weeks See further, paragraph 9 below Sales by Employee Pension Protection Fund Accounts Turnover divided by Total Number of 26 Turnover figure annualised if December 2014 Employees accounting period is not 52 weeks. If reported turnover figure is 0, or null but Other Income figure is positive, the Other Income figure is used in place of Turnover. See paragraph 7 of this Part 3 in relation to Total Number of Employees. Shareholders Funds Accounts Taken directly from Accounts Total Net Assets Accounts Taken directly from Accounts Total Assets Accounts Taken directly from Accounts Total Stock & Work in Progress Accounts Taken directly from Accounts Turnover Accounts Taken directly from Accounts Includes tangibles and intangibles Turnover includes Revenue and Sales. Turnover figure annualised if accounting period is not 52 weeks. If reported turnover figure is 0, or null but Other Income figure is positive, the Other Income figure is used in place of Turnover Pension Protection Fund 27 December 2014 Turnover by Stock 2. Accounts Turnover divided by Stock + Work in Progress Turnover figure annualised if accounting period is not 52 weeks. If reported turnover figure is 0, or null but Other Income figure is positive, the Other Income figure is used in place of Turnover Days Beyond Terms For the avoidance of doubt, this Variable will be calculated in accordance with Experian's ordinary course of business from time to time using its Payment Performance Programme2. 3. Parent Strength 3.1 The Parent Strength Variable is calculated by generating an Adjusted Monthly Score for the Ultimate Parent (as defined in these Rules) of the Employer, using the same procedures as set out in these Rules as if that Ultimate Parent were an Employer provided that, for these purposes: (a) Scorecard 1 is always used (notwithstanding the provisions of Rule E3 and Part 1 of this Appendix). (b) For the purposes of calculating the Mortgage Age Variable, any charge where the Ultimate Parent or any Group Subsidiary is chargor is taken into account notwithstanding the definition of Mortgage Age in Table 1 above. (c) In circumstances where no Consolidated Accounts have been Filed by the Ultimate Parent and Experian has not otherwise collected those Consolidated Accounts pursuant to Rule E2.2(1): (i) where Consolidated Accounts have been Filed by the entity which would be the Ultimate Parent if any Non-UK Group members were disregarded, the Latest Consolidated Accounts of that entity will be used and treated as if they were the Latest Consolidated Accounts of the Ultimate Parent; and (ii) where (i) does not apply, Variable Values calculated by reference to the Latest Accounts filed at Companies House in the UK of each member of the Group will be summed (excluding any Consolidated Accounts Filed by any member of the Group other than the Ultimate Parent, where Experian is satisfied that to include them would cause double counting). 2 For the purposes of information only, a summary of the current methodology is available on request from Experian. Pension Protection Fund 28 December 2014 3.2 That Ultimate Parent's Adjusted Monthly Score is then converted into a 1-100 Score as set out in Table 2 below and that 1-100 Score is the Variable Value for the Parent Strength Variable of the Employer. Pension Protection Fund 29 December 2014 Table 2: 1-100 Score Minimum Score Maximum Score 1 3.946% 100.000% 2 2.919% 3.946% 3 2.384% 2.919% 4 2.014% 2.384% 5 1.768% 2.014% 6 1.577% 1.768% 7 1.428% 1.577% 8 1.300% 1.428% 9 1.200% 1.300% 10 1.098% 1.200% 11 1.001% 1.098% 12 0.922% 1.001% 13 0.847% 0.922% 14 0.786% 0.847% 15 0.727% 0.786% 16 0.674% 0.727% 17 0.624% 0.674% 18 0.581% 0.624% 19 0.546% 0.581% 20 0.514% 0.546% 21 0.484% 0.514% 22 0.456% 0.484% 23 0.430% 0.456% 24 0.408% 0.430% 25 0.387% 0.408% 26 0.369% 0.387% 27 0.351% 0.369% 28 0.333% 0.351% 29 0.317% 0.333% Pension Protection Fund 30 December 2014 30 0.304% 0.317% 31 0.291% 0.304% 32 0.277% 0.291% 33 0.265% 0.277% 34 0.252% 0.265% 35 0.240% 0.252% 36 0.229% 0.240% 37 0.218% 0.229% 38 0.208% 0.218% 39 0.199% 0.208% 40 0.191% 0.199% 41 0.184% 0.191% 42 0.176% 0.184% 43 0.169% 0.176% 44 0.162% 0.169% 45 0.155% 0.162% 46 0.149% 0.155% 47 0.143% 0.149% 48 0.137% 0.143% 49 0.131% 0.137% 50 0.126% 0.131% 51 0.120% 0.126% 52 0.115% 0.120% 53 0.110% 0.115% 54 0.106% 0.110% 55 0.102% 0.106% 56 0.098% 0.102% 57 0.094% 0.098% 58 0.089% 0.094% 59 0.085% 0.089% 60 0.082% 0.085% Pension Protection Fund 31 December 2014 61 0.078% 0.082% 62 0.074% 0.078% 63 0.071% 0.074% 64 0.068% 0.071% 65 0.065% 0.068% 66 0.062% 0.065% 67 0.059% 0.062% 68 0.056% 0.059% 69 0.054% 0.056% 70 0.051% 0.054% 71 0.049% 0.051% 72 0.047% 0.049% 73 0.045% 0.047% 74 0.043% 0.045% 75 0.040% 0.043% 76 0.038% 0.040% 77 0.035% 0.038% 78 0.033% 0.035% 79 0.031% 0.033% 80 0.029% 0.031% 81 0.028% 0.029% 82 0.026% 0.028% 83 0.025% 0.026% 84 0.023% 0.025% 85 0.021% 0.023% 86 0.020% 0.021% 87 0.019% 0.020% 88 0.018% 0.019% 89 0.017% 0.018% 90 0.016% 0.017% 91 0.015% 0.016% Pension Protection Fund 32 December 2014 92 0.014% 0.015% 93 0.014% 0.014% 94 0.013% 0.014% 95 0.011% 0.013% 96 0.009% 0.011% 97 0.007% 0.009% 98 0.006% 0.007% 99 0.004% 0.006% 100 0.000% 0.004% 4. Consolidated Accounts For the avoidance of doubt, where Accounts are Consolidated Accounts, the Variable Value will be calculated on the basis of the consolidated position in relation to all entities in respect of which the Consolidated Accounts are prepared. 5. Currency Conversion In any case where Accounts are expressed in a currency other than sterling, the currency conversion rate which would be used by Experian in its ordinary course of business at the 1st April immediately preceding the Score Measurement Date in question is used to convert the currency of the Accounts to sterling for the purposes of assessing the Variable Value. 6. Data collection, provision and use For the avoidance of doubt, Rule E2 will apply for the purposes of assessing which set of Accounts are to be used to calculate each Variable Value. 7. Total Number of Employees 7.1 Save where paragraph 7.3 or 7.4 applies, the Total Number of Employees will be assessed without reference to the number of hours ordinarily worked by those employees. 7.2 Where Experian has, before the Measurement Time, received a written statement, signed by the Employer's (or, as the case may be, Group Subsidiary or Ultimate Parent's) auditor which complies with guidance issued by the Board from time to time and confirms: (a) that the Employer, Group Subsidiary or Ultimate Parent (as the case may be), has not stated (and is not required by law to state) in its Accounts the number of its employees; and (b) the number of its employees, as at the date of its Latest Accounts (calculated in accordance with paragraph 7.1 above unless paragraph 7.4 below applies), Pension Protection Fund 33 December 2014 Experian will use that data to calculate the Variable Value in respect of the Variables which depend on Total Number of Employees. 7.3 Where Experian has, before the Measurement Time, received a written request from an Employer, Group Subsidiary or Ultimate Parent (as the case may be), that it should use the number of employees which appears in the Latest Accounts and is calculated on a FTE Basis for the purposes of calculating all relevant Variable Values, Experian will use that data to calculate the Variable Values which depend on Total Number of Employees. 7.4 Where Experian has, before the Measurement Time, received a written statement, signed by the Employer's (or, as the case may be, Group Subsidiary or Ultimate Parent's) auditor which complies with guidance issued by the Board from time to time and confirms: (a) that the Employer, Group Subsidiary or Ultimate Parent (as the case may be), has not stated (and is not required by law to state) in its Accounts the number of its employees; and (b) the number of its employees, as at the date of its Latest Accounts calculated on a FTE Basis, Experian will use that data to calculate the Variable Values which depend on Total Number of Employees. 8. Change Variables 8.1 This paragraph 8 applies for the purposes of calculating the following Variable Values: (a) Change in Employee Remuneration; (b) Change in Fixed Assets; (c) Change in Net Worth; (d) Change in Stock & Work in Progress; (e) Change in Total Assets; (f) Change in Total Net Assets; and (g) Change in Turnover. 8.2 Where this paragraph applies, subject to paragraph 1.3 of Part 4 of this Appendix, in the event that the figure in the N-3 Accounts which is to be used as the denominator of the fraction to calculate the relevant Variable Value is negative, that figure shall be converted to its absolute (or modulus) value for the purposes of using it as the denominator. 9. Return on Shareholder Funds and Capital 9.1 This paragraph 9 applies for the purposes of calculating the following Variables: Pension Protection Fund 34 December 2014 9.2 (a) Return on Shareholder Funds; and (b) Return on Capital. Where this paragraph applies, in the event that the figures in the Accounts which are to be used as inputs to the calculation of the Variable Value (as set out in Table 1) are both negative, the figure used as the denominator of the fraction to calculate the relevant Variable Value shall be converted to its absolute (or modulus) value for the purposes of using it as the denominator. Pension Protection Fund 35 December 2014 Part 4: Monthly Score Methodology Once data has been applied to the relevant Scorecard, the Monthly Score is calculated by applying the following process: 1. Coefficients are created for each Variable within the Scorecard: 1.1 Subject to paragraphs 1.2 and 1.3 below, the Coefficient for any Variable is calculated by using the following formula: Coefficient = (Variable Value x Gradient) + Constant, where: “Variable Value” is the value of that Variable for the Employer in question, calculated in accordance with Part 3 of this Appendix and converted to the unit of measurement set out in the unit column of the relevant part of the relevant Scorecard;3 “Gradient” is the number which appears in the Gradient column of the relevant Scorecard which corresponds to the band within which the Variable Value falls; and “Constant” is the number which appears in the Constant column of the relevant Scorecard which corresponds to the band in which the Variable Value falls. 1.2 1.3 Where paragraph (a) or (b) applies (or they both apply), the Coefficient will be the number which appears in the Constant column corresponding to the band which relates to that Variable and is marked as "unknown": (a) This paragraph (a) applies where the data collected or received pursuant to Rule E2 are insufficient for Experian to calculate a given Variable Value; (b) This paragraph (b) applies where a figure which appears in the Latest Accounts and which would fall to be used in the calculation of the Variable Value as one of the inputs to the calculation (set out in the Calculation column of Table 1 in part 3 of this Appendix as read with the Notes column of that table) is zero. In the case of any Variable which measures a change in value over time, the Coefficient will be the number which appears in the Constant column corresponding to the band which relates to that Variable and is marked as "unknown" in any case where one or more of the following applies: (a) there are no Accounts meeting the definition of N-3 Accounts; (b) where the figure used to calculate the Variable Value and which would fall to be used in the calculation of the Variable Value as one of the inputs to the calculation (set out in the Calculation column of Table 1 in part 3 of this Appendix as read with the Notes column to that table) is zero in the Latest Accounts or the N-3 Accounts. 3 For example, if a band, expressed in units of £millions, is 0-3.75 (see fifth row of scorecard 1), a value of £2,500,000 would fall within this band and its Variable Value would be 2.5. Pension Protection Fund 36 December 2014 2. The Coefficients are summed together with the Intercept which appears in the relevant Scorecard. 3. An algorithm is applied to transform the sum of the Coefficients and the Intercept, as follows: eX/(1+eX), where: X is the sum of the Coefficients and the Intercept; and "e" is "Euler's number", a mathematical constant4 4. The value obtained at paragraph 3 is multiplied by the Adjustment Multiplier which applies to the relevant Scorecard as set out in Table 3 below: Table 3 Scorecard Adjustment Multiplier 0.320629365841239 1: Large/Complex 0.645891243861122 2: Group £50m+ 0.934907280339482 3: Group £10m-50m 0.596408095011219 4: Group <£10m 0.457177139005499 5: Group Small 0.513687981544692 6: Independent Full 0.770341556629668 7: Independent Small 0.372994220661699 8: Not-for-Profit 5. The result of the calculation at paragraph 4 generates the Monthly Score. 6. In calculating the Monthly Score pursuant to this Part 4, figures will not be rounded. 4 For the purposes of information only, "e", to 10 decimal places is: 2.71828182845. Pension Protection Fund 37 December 2014 Part 5: Adjustments The following adjustments will be applied to any Monthly Scores calculated by Experian to produce the Adjusted Monthly Score, PROVIDED THAT, where the data collected pursuant to Rule E2 are insufficient to allow Experian to independently verify that these adjustments should be made, no such adjustments will be made. 1. This paragraph applies in the case of any Employer or, as the case may be, Ultimate Parent, where, as at the Measurement Time: 1.1 it has already suffered an insolvency event for the purposes of section 121 of the Act; or 1.2 it is already the subject of another insolvency procedure or another procedure analogous to an insolvency event under section 121 of the Act in a non-UK jurisdiction including, without limitation, proceedings under Chapter 7 or 11 of the United States Bankruptcy Code. In a case to which this paragraph applies, each Monthly Score shall be adjusted so that it is 100%. 2. Each Monthly Score shall be adjusted to what it would have been if the existence of the following were disregarded: 2.1 Any Pension Scheme Mortgage(s); 2.2 Any Rent Deposit(s); and 2.3 Any Immaterial Mortgage(s), PROVIDED THAT such adjustments shall only be made to the extent that any relevant guidance issued by the Board has been complied with and PROVIDED FURTHER THAT, where an adjustment is made pursuant to paragraph 4 below, the Refinance Mortgage in respect of which that adjustment has been made cannot be treated as an Immaterial Mortgage pursuant to this paragraph 2. 3. Where the CRA Test is met, the Monthly Score of any Employer or, for the purposes of calculating the Parent Strength Variable, Ultimate Parent, will be adjusted to what it would have been if Experian were satisfied that all members of the Employers Group had no mortgages or other charges, PROVIDED THAT such adjustments shall only be made to the extent that any relevant guidance issued by the Board has been complied with. 4. Each Monthly Score shall be adjusted to what it would have been if the age of any Refinance Mortgage were deemed to be the age of the corresponding Original Mortgage, PROVIDED THAT such adjustments shall only be made to the extent that any relevant guidance issued by the Board has been complied with. Pension Protection Fund 38 December 2014 Part 6: Calculation Principles 1. Unless otherwise specified in the Rules or in this Appendix, the Board shall round all figures representing a measure of insolvency risk to six decimal places (that is, to four decimal places when expressed as a percentage) at each stage of the calculation. Without limitation, this shall apply to (i) all figures derived by taking the average of LRs and to (ii) the product of the weighted LRs and a scaling factor based on Scheme structure in accordance with Rule E6. 2. Where an Employer has become an Employer in respect of a Scheme part way through the Levy Year immediately preceding the 2015/16 Levy Year, Rule E5.1 applies notwithstanding that the Employer was not an Employer in respect of the Scheme in question for some or all of the Score Measurement Dates during the 6month period immediately preceding the start of the 2015/16 Levy Year. 3. Where an Employer in respect of a Scheme has come into existence as an entirely new entity part way through a Levy Year, the Mean Score which applies to the Employer shall be the value constituting the mean average of the Adjusted Monthly Scores that Experian informs the Board had been assigned to that Employer at each Score Measurement Date for which the Employer was in existence, provided that if a Monthly Score is not available as at each such Score Measurement Date, the Mean Score shall be the mean average of the Adjusted Monthly Scores derived from the Monthly Scores that are available. 4. For the purposes of Rule E5.3 and E5.4, Medians shall be based on the same set of Levy Rate data as supplied by Experian to the Board for the purposes of calculating the Levies in the 2015/16 Levy Year. 5. The Board may instruct Experian to exclude specified classes of Score which it regards as unrepresentative when calculating the relevant Medians. 6. For the avoidance of doubt, in determining such Medians Experian shall not include any Employer to which a Scheme average LR has been applied in accordance with Rule E5.2 7. For the purposes of Rule E5.2, where the mean average LR falls between two Levy Bands, the mean average is that point at which the average falls notwithstanding that this mean average would not correspond with a LR contained within Table 4 of Part 7 of this Appendix. 8. For the purposes of Rule E5.3 and E5.4, where the Median LR falls between two Levy Bands, the Median is the mid point between those two Levy Bands notwithstanding that this Median would not correspond with a LR contained within Table 4 of Part 7 of this Appendix. Pension Protection Fund 39 December 2014 Part 7: Levy Rate Table Table 4: Levy Bands and Levy Rates calculated by reference to Minimum and Maximum Mean Scores. Minimum Mean Score Maximum Mean Score Levy Band 0.000% <0.030% 1 0.030% <0.049% 2 0.049% <0.086% 3 0.086% <0.143% 4 0.143% <0.243% 5 0.243% <0.488% 6 0.488% <1.049% 7 1.049% <1.595% 8 1.595% <2.986% 9 2.986% 100.000% 10 Pension Protection Fund 40 Levy Rate (LR) 0.17% 0.23% 0.30% 0.40% 0.53% 0.81% 1.26% 1.76% 2.39% 3.83% December 2014