2015 Study Guide Subject ST6

ST6: Study Guide Page 1

2015 Study Guide

Subject ST6

Introduction

This Study Guide contains all the information that you will need before starting to study

Subject ST6 for the 2015 exams. Please read this Study Guide carefully before reading the Course Notes, even if you have studied for some actuarial exams before.

When studying for the UK actuarial exams, you will need:

a copy of the Formulae and Tables for Examinations of the Faculty of

Actuaries and the Institute of Actuaries, 2nd Edition (2002) – these are often referred to as simply the “Yellow Tables ”

a “permitted” scientific calculator – you will find the list of permitted calculators on the profession’s website. Please check the list carefully, since it is reviewed each year.

These are both available from the Institute and Faculty of Actuaries’ eShop. Please visit www.actuaries.org.uk

.

Contents

Section 1

Section 2

Section 3

Section 4

Section 5

The Subject ST6 course structure

ActEd study support

How to study to pass the exams

Frequently asked questions

Core Reading and the Syllabus

Page 2

Page 3

Page 11

Page 16

Page 18

The Actuarial Education Company © IFE: 2015 Examinations

Page 2 ST6: Study Guide

1 The Subject ST6 course structure

There are six parts to the Subject ST6 course. The parts cover related topics and have broadly equal lengths. The parts are broken down into chapters.

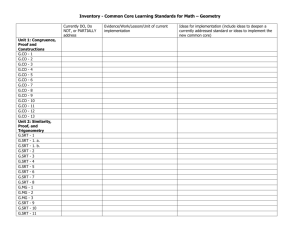

The following table shows how the parts, the chapters and the syllabus items relate to each other. The end columns show how the chapters relate to the days of the regular tutorials. This table should help you plan your progress across the study session.

Part Chapter Title

No of pages

Item

Syllabus objectives

Sub-items

Tutorials

3 full days

1

1 Background 17

2

3

Forwards and futures

Traded derivatives contracts

30

(a)

(b)

(c)

(iv)

(i)-(ii)

(i)-(ii)

18 (d) n/a

1

2

3

4

6

7

8

Probability measures and risk-neutral pricing

33 (h) (ii)(part),(v)

Black-Scholes and the Greeks

Trading strategies and hedging

26

36

(h)

(i)

(g)

(h)

(i)

(f)

23

(i)

(ii)(part),(iii),(iv),(vii)(part)

(i)(part)

(i)-(ii)

(vi)

(i)(part),(ii)-(iii) n/a

(iv)

2

5

11 Interest markets

12 Interest rate derivatives

13 Interest models

(e)

18

(j)

27

(e)

(j)

(part)

(i)(part),(iv)

(part)

(i)(part),(ii)-(iii),(v)

3

6

© IFE: 2015 Examinations The Actuarial Education Company

ST6: Study Guide Page 3

2 ActEd study support

Successful students tend to undertake three main study activities:

1.

Learning – initial study and understanding of subject material

2.

Revision – learning subject material and preparing to tackle exam-style questions

3.

Rehearsal – answering exam-style questions, culminating in answering questions at exam speed without notes.

Different approaches suit different people. For example, you may like to learn material gradually over the months running up to the exams or you may do your revision in a shorter period just before the exams. Also, these three activities will almost certainly overlap.

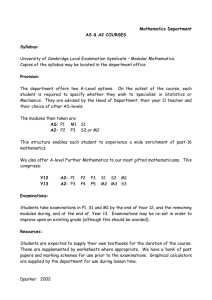

ActEd offers a flexible range of products to suit you and let you control your own learning and exam preparation. The following table shows the products that ActEd produces. Note that not all products are available for all subjects.

LEARNING

Course Notes

LEARNING &

REVISION

Q&A Bank

X Assignments

Combined

Materials Pack

(CMP)

REVISION

Flashcards

Sound

Revision

MyTest

REVISION &

REHEARSAL

Revision Notes

ASET

Revision

Tutorials

REHEARSAL

X Assignment

Marking

Tutorials

Online

Classroom

The products and services available for Subject ST6 are described below.

Mock Exam A

Additional

Mock Pack

(AMP)

Mock / AMP

Marking

The Actuarial Education Company © IFE: 2015 Examinations

Page 4 ST6: Study Guide

“Learning” products

Course Notes

The Course Notes, together with the textbooks (see below), will help you develop the basic knowledge and understanding of principles needed to pass the exam.

Each chapter starts with the relevant syllabus objectives and a table showing the

Reading / Topics covered and ends with a list of relevant practice questions, FAQs and a checklist of what you should know.

In contrast to the Core Reading for most other subjects, the Core Reading for this subject consists largely of details of which sections of the Textbooks to study, but is augmented in places by additional material. The Subject ST6 Course Notes include the Core

Reading in full, after the ActEd chapters.

The Course Notes cover the complete Subject ST6 Syllabus and so cover the same topics as the separate Core Reading and relevant sections of the Textbooks. The Notes cover what we believe you need to know for the exam. In places, the Textbooks will go into more detail than our Course Notes, but in other places we give more explanation.

Textbooks

The Core Reading makes extensive reference to the following two Textbooks:

“ Options, Futures, and Other Derivatives by Hull

” (seventh edition or eighth edition)

This ActEd Course is designed to work with either edition and references to both are included throughout the Course Notes.

“ Financial Calculus – An introduction to derivative pricing ” by Baxter & Rennie

ISBN: 0-521-55289-3

These are both well-established derivatives textbooks, which you will want to have available during your studies, although neither of them has been written specifically with actuarial students in mind.

© IFE: 2015 Examinations The Actuarial Education Company

ST6: Study Guide Page 5

“Learning & revision” products

Question and Answer Bank

The Question and Answer Bank provides a comprehensive bank of questions (including some past exam questions) with full solutions and comments. The Question and Answer

Bank is divided into seven parts. The first six parts include a range of short and long questions to test your understanding of the corresponding part of the Course Notes. Part seven consists of 100 marks of exam-style questions.

X Assignments

The six Series X Assignments (X1 to X6) cover the material in Parts 1 to 6 respectively.

Assignments X1, X2 and X3 are 80-mark tests and should take you two and a half hours to complete. Assignments X4, X5 and X6 are 100-mark tests and should take you three hours to complete. The actual Subject ST6 examination will have a total of 100 marks.

Combined Materials Pack (CMP)

The Combined Materials Pack (CMP) comprises the Course Notes, the Question and

Answer Bank and the Series X Assignments.

The CMP is available in eBook format for viewing on a range of electronic devices. eBooks can be ordered separately or as an addition to paper products. Visit www.ActEd.co.uk

for full details about the eBooks that are available, compatibility

with different devices, software requirements and printing restrictions.

CMP Upgrade

The purpose of the CMP Upgrade is to enable you to amend last year’s study material to make it suitable for study for this year. In most cases, it lists all significant changes to the Core Reading and ActEd material so that you can manually amend your notes. The upgrade includes replacement pages and additional pages where appropriate.

However, if a large proportion of the material has changed significantly, making it inappropriate to include all changes, the upgrade will only outline what has changed. In this case, we recommend that you purchase a replacement CMP (printed copy or eBook) or Course Notes at a significantly reduced price.

The Actuarial Education Company © IFE: 2015 Examinations

Page 6 ST6: Study Guide

The CMP Upgrade can be downloaded free of charge from our website at www.ActEd.co.uk

. Alternatively, if the upgrade contains a large number of pages, you may prefer to purchase a hard copy from us at a minimal price to cover production and handling costs.

A separate upgrade for eBooks is not produced but a significant discount is available for retakers wishing to re-purchase the latest eBook.

X Assignment Marking

We are happy to mark your attempts at the X assignments. Marking is not included with the Assignments or the CMP and you need to order it separately. You can submit your scripts by email, fax or post. Your script may be marked electronically, in which case you will be able to download your marked script via a secure link on the internet. Otherwise your marked script will be returned to you in the post.

Don’t underestimate the benefits of doing and submitting assignments:

Question practice during this phase of your study gives an early focus on the end goal of answering exam-style questions.

You’re incentivised to keep up with your study plan and get a regular, realistic assessment of progress.

Objective, personalised feedback from a high quality marker will highlight areas on which to work and help with exam technique.

In a recent study, it was found that students who attempt more than half the assignments have significantly higher pass rates.

Series Marking

Series Marking applies to a specified subject, session and student. If you purchase

Series Marking, you will not be able to defer the marking to a future exam sitting or transfer it to a different subject or student.

We typically send out full solutions with the Series X Assignments. However, if you order Series Marking at the same time as you order the Series X Assignments, you can choose whether or not to receive a copy of the solutions in advance. If you choose not to receive them with the study material, you will be able to download the solutions via a secure link on the internet when your marked script is returned (or following the final deadline date if you do not submit a script).

© IFE: 2015 Examinations The Actuarial Education Company

ST6: Study Guide Page 7

If you are having your attempts at the assignments marked by ActEd, you should submit your scripts regularly throughout the session, in accordance with the schedule of recommended dates set out in information provided with the assignments. This will help you to pace your study throughout the session and leave an adequate amount of time for revision and question practice.

The recommended submission dates are realistic targets for the majority of students.

Your scripts will be returned more quickly if you submit them well before the final deadline dates.

Any script submitted after the relevant final deadline date will not be marked. It is your responsibility to ensure that scripts are received by ActEd in good time.

Marking Vouchers

Marking Vouchers give the holder the right to submit a script for marking at any time, irrespective of the individual assignment deadlines, study session, subject or person.

Marking Vouchers can be used for any assignment. They are valid for four years from the date of purchase and can be refunded at any time up to the expiry date.

Although you may submit your script with a Marking Voucher at any time, you will need to adhere to the explicit Marking Voucher deadline dates to ensure that your script is returned before the date of the exam. The deadline dates are provided with the assignments.

If you live outside the UK you must ensure that your last script reaches the ActEd office earlier than this to allow the extra time needed to return your marked script.

Tutorials

ActEd tutorials are specifically designed to develop the knowledge that you will acquire from the course material into the higher-level understanding that is needed to pass the exam.

ActEd runs a range of different tutorials including face-to-face tutorials at various locations, and Live Online tutorials. Full details are set out in ActEd’s Tuition Bulletin, which is available from the ActEd website at www.ActEd.co.uk

.

The Actuarial Education Company © IFE: 2015 Examinations

Page 8 ST6: Study Guide

Regular and Block Tutorials

In preparation for these tutorials, we expect you to have read the relevant part(s) of the

Course Notes before attending the tutorial so that the group can spend time on exam questions and discussion to develop understanding rather than basic bookwork.

You can choose one of the following types of tutorial:

Regular Tutorials (three full days) spread over the session.

A Block Tutorial (three full consecutive days) held two to eight weeks before the exam.

“Revision & rehearsal” products

ActEd Solutions with Exam Technique (ASET)

The ActEd Solutions with Exam Technique (ASET) contains ActEd’s solutions to the previous four years’ exam papers, ie eight papers, plus comment and explanation. In particular it will highlight how questions might have been analysed and interpreted so as to produce a good solution with a wide range of relevant points. This will be valuable in approaching questions in subsequent examinations.

A “Mini-ASET” will also be available in the summer session covering the April Exam only.

“Rehearsal” products

Mock Exam A

Mock Exam A is a 100-mark mock exam paper and is a realistic test of your exam preparation. It is based on Mock Exam A from last year but it has been updated to reflect any changes to the Syllabus and Core Reading.

Additional Mock Pack (AMP)

The Additional Mock Pack (AMP) consists of two further 100-mark mock exam papers

– Mock Exam B and Mock Exam C. This is ideal if you are retaking and have already sat Mock Exam A, or if you just want some extra question practice.

© IFE: 2015 Examinations The Actuarial Education Company

ST6: Study Guide Page 9

Mock / AMP Marking

We are happy to mark your attempts at Mock Exam A or the mock exams included within the AMP. The same general principles apply as for the X Assignment Marking. In particular:

Mock Exam Marking is available for Mock Exam A and it applies to a specified subject, session and student

Marking Vouchers can be used for Mock Exam A or the mock exams contained within the AMP; please note that attempts at the AMP can only be marked using

Marking Vouchers.

Recall that:

marking is not included with the products themselves and you need to order it separately

you can submit your scripts by email, fax or post

your script may be marked and returned to you electronically, or marked and returned by post.

Queries and feedback

From time to time you may come across something in the study material that is unclear to you. The easiest way to solve such problems is often through discussion with friends, colleagues and peers – they will probably have had similar experiences whilst studying.

If there’s no-one at work to talk to then use ActEd’s discussion forum at www.ActEd.co.uk/forums (or use the link from our home page at www.ActEd.co.uk

).

Our online forum is dedicated to actuarial students so that you can get help from fellow students on any aspect of your studies from technical issues to study advice. You could also use it to get ideas for revision or for further reading around the subject that you are studying. ActEd tutors will visit the site from time to time to ensure that you are not being led astray and we also post other frequently asked questions from students on the forum as they arise.

If you are still stuck, then you can send queries by email to ST6@bpp.com

(but we recommend that you try the forum first). We will endeavour to contact you as soon as possible after receiving your query but you should be aware that it may take some time to reply to queries, particularly when tutors are away from the office running tutorials.

At the busiest teaching times of year, it may take us more than a week to get back to you.

The Actuarial Education Company © IFE: 2015 Examinations

Page 10 ST6: Study Guide

If you have many queries on the course material, you should raise them at a tutorial or book a personal tuition session with an ActEd tutor. Information about personal tuition is set out in our current brochure. Please email ActEd@bpp.com

for more details.

If you find an error in the course, please check the corrections page of our website

( www.ActEd.co.uk/Html/paper_corrections.htm

) to see if the correction has already been dealt with. Otherwise please send details via email to ST6@bpp.com

or send a fax to 01235 550085 .

Each year ActEd tutors work hard to improve the quality of the study material and to ensure that the courses are as clear as possible and free from errors. We are always happy to receive feedback from students, particularly details concerning any errors, contradictions or unclear statements in the courses. If you have any comments on this course please email them to ST6@bpp.com

or fax them to 01235 550085 .

The ActEd tutors also work with the profession to suggest developments and improvements to the Syllabus and Core Reading. If you have any comments or concerns about the Syllabus or Core Reading, these can be passed on via ActEd.

Alternatively, you can send them directly to the Institute and Faculty of Actuaries by email to education.services@actuaries.org.uk

.

© IFE: 2015 Examinations The Actuarial Education Company

ST6: Study Guide Page 11

3 How to study to pass the exams

The ST Subject exams

It is important to recognise that the ST subject exams are very different from the

CT Subject exams in both the nature of the material covered and the skills being examined.

Both the Core Reading (including the Textbooks) and the exam papers themselves are generally much less numerical and more “wordy” than the typical CT subject. The exam will primarily require you to explain a particular point in words and sentences, rather than to manipulate formulae. Numerical questions typically account for only a small part of each exam paper. If you haven’t sat this type of exam for some time, you need to start practising again now. Many students find that it takes time to adjust to the different style of the ST subject exam questions. As ever, practice is the key to success.

The aim of the exams is to test your ability to apply your knowledge and understanding of the key principles described in the Core Reading to specific situations presented to you in the form of exam questions. Therefore your aim should be to identify and understand the key principles, and then to practise applying them. You will also need a good knowledge of the Core Reading and Textbooks to score well and quickly on any bookwork questions.

We recommend that you prepare for the exam by practising a large number of exam-style questions under exam conditions. This will:

help you to develop the necessary knowledge and understanding of the key principles described in the Core Reading

highlight exactly which are the key principles that crop up time and time again in many different contexts and questions

help you to practise the specific skills that you will need to pass the exam.

There are many sources of exam-style questions. You can use past exam papers, the

Question and Answer Bank (which includes many past exam questions), assignments, mock exams and ASET.

The Actuarial Education Company © IFE: 2015 Examinations

Page 12 ST6: Study Guide

Overall study plan

We suggest that you develop a realistic study plan, building in time for relaxation and allowing some time for contingencies. Be aware of busy times at work, when you may not be able to take as much study leave as you would like. Once you have set your plan, be determined to stick to it. You don’t have to be too prescriptive at this stage about what precisely you do on each study day. The main thing is to be clear that you will cover all the important activities in an appropriate manner and leave plenty of time for revision and question practice.

Aim to manage your study so as to allow plenty of time for the concepts you meet in this course to “bed down” in your mind. Most successful students will probably aim to complete the course at least a month before the exam, thereby leaving a sufficient amount of time for revision. By finishing the course as quickly as possible, you will have a much clearer view of the big picture. It will also allow you to structure your revision so that you can concentrate on the important and difficult areas of the course.

A sample ST subject study plan is available on our website at: www.ActEd.co.uk/Html/help_and_advice_study_plans.htm

It includes details of useful dates, including assignment deadlines and tutorial finalisation dates.

Study sessions

Only do activities that will increase your chance of passing. Try to avoid including activities for the sake of it and don’t spend time reviewing material that you already understand. You will only improve your chances of passing the exam by getting on top of the material that you currently find difficult.

Ideally, each study session should have a specific purpose and be based on a specific task, eg “ Finish reading Chapter 3 and attempt Questions 1.4, 1.7 and 1.12 from the

Question and Answer Bank ”, as opposed to a specific amount of time, eg “Three hours studying the material in Chapter 3 ”.

Try to study somewhere quiet and free from distractions ( eg a library or a desk at home dedicated to study). Find out when you operate at your peak, and endeavour to study at those times of the day. This might be between 8 am and 10 am or could be in the evening. Take short breaks during your study to remain focused – it’s definitely time for a short break if you find that your brain is tired and that your concentration has started to drift from the information in front of you.

© IFE: 2015 Examinations The Actuarial Education Company

ST6: Study Guide Page 13

Order of study

We suggest that you work through each of the chapters in turn. To get the maximum benefit from each chapter you should proceed in the following order:

1. Read the Syllabus Objectives. These are set out in the box on page 1 of each chapter.

2a. Study the material listed in the “Reading / Topics covered” table on page 2 of the chapter. The reading from the Textbooks that is referred to in the Core Reading is listed, together with any other relevant sections of the Textbooks (shown in brackets).

2b. Study the Course Notes, which cover the Syllabus objectives in a fairly concise style and include extra explanation of some of the key topics.

The Course Notes have been designed so that you can perform steps 2a and 2b in whichever order you wish. Our Course Notes do not rely on you having read the other material first.

3. As you study, pay particular attention to the listing of the Syllabus Objectives.

You may wish to annotate the tuition material and possibly make your own notes.

4. Work your way through the Chapter Checklist carefully. If there are any items that you can’t remember covering in the Course Notes, read the relevant section of the notes again to refresh your memory.

It’s a fact that people are more likely to remember something if they review it several times. So, do look over the chapters you have studied so far from time to time. It is useful to re-read the Chapter Checklists again a few days after reading the chapter itself.

You may like to attempt some questions from the Question and Answer Bank when you have completed a part of the course. It’s a good idea to annotate the questions with details of when you attempted each one. This makes it easier to ensure that you try all of the questions as part of your revision without repeating any that you got right first time.

Once you’ve read the relevant part of the notes and tried a selection of questions from the Question and Answer Bank (and attended a tutorial, if appropriate), you should attempt the corresponding assignment. If you submit your assignment for marking, spend some time looking through it carefully when it is returned. It can seem a bit depressing to analyse the errors you made, but you will increase your chances of passing the exam by learning from your mistakes. The markers will try their best to provide practical comments to help you to improve.

The Actuarial Education Company © IFE: 2015 Examinations

Page 14 ST6: Study Guide

To be really prepared for the exam, you should not only know and understand the Core

Reading but also be aware of what the examiners will expect. Your revision programme should include plenty of question practice so that you are aware of the typical style, content and marking structure of exam questions. You should attempt as many questions as you can from the Question and Answer Bank and past exam papers.

Active study

Here are some techniques that may help you to study actively.

1. Don’t believe everything you read! Good students tend to question everything that they read. They will ask “why, how, what for, when?” when confronted with a new concept, and they will apply their own judgement. This contrasts with those who unquestioningly believe what they are told, learn it thoroughly, and reproduce it (unquestioningly?) in response to exam questions.

2. Another useful technique as you read the Course Notes and Textbooks is to think of possible questions that the examiners could ask. This will help you to understand the examiners’ point of view and should mean that there are fewer nasty surprises in the exam room! Use the Syllabus to help you make up questions.

3. Annotate your notes with your own ideas and questions. This will make you study more actively and will help when you come to review and revise the material. Do not simply copy out the notes without thinking about the issues.

4. Attempt the assignments as you work through the course. Write down your answer before looking at the solution provided. Attempting the assignments under exam conditions has some particular benefits:

It forces you to think and act in a way that is similar to how you will behave in the exam.

When you have your assignments marked it is much more useful if the marker’s comments can show you how to improve your performance under exam conditions than your performance when you have access to the notes and are under no time pressure.

The knowledge that you are going to do an assignment under exam conditions and then submit it (however good or bad) for marking can act as a powerful incentive to make you study each part as well as possible.

It is also quicker than trying to write perfect answers.

© IFE: 2015 Examinations The Actuarial Education Company

ST6: Study Guide Page 15

5. Sit a mock exam four to six weeks before the real exam to identify your weaknesses and work to improve them. You could use a mock exam written by

ActEd or a past exam paper.

The Actuarial Education Company © IFE: 2015 Examinations

Page 16 ST6: Study Guide

4 Frequently asked questions

Q: What knowledge of earlier subjects should I have?

A: The Course Notes have been written on the assumption that you have studied

Subject CT8. However, we have included reminders of any concepts and facts that are essential for Subject ST6. We have also assumed that you have an adequate knowledge of mathematical statistics (from Subject CT3) and financial mathematics (from Subject CT1).

Q: Will the questions in ST6 be mathematical or “wordy”?

A: Some of the Syllabus Objectives for this subject start with “derive” or

“calculate”, indicating that the exam papers are likely to include a significant proportion of “maths” – more so than for most of the other ST subjects. On the

ST6 exam papers to date, the split has been approximately 55% mathematical and 45% “wordy”, although some have varied significantly from this.

Q: I intend to use the old Certificate in Derivatives (CiD) exam papers for additional practice. What are the differences between this and

Subject ST6?

A: Subject ST6 was originally based on the old Certificate in Derivatives, but there are now some extra topics covered by Subject ST6:

Property derivatives and exotic options

Numerical methods for pricing American options

Multi-factor interest rate models

The LIBOR and swap market models

Structured derivatives and synthetic securities

Measuring credit risk

Credit derivatives.

Q: Is it worth looking at exam papers from the old Advanced Certificate in Derivatives (ACiD) subject?

A: Some of the topics listed in the previous answer were examinable under ACiD and so some of these exam questions are worth attempting. We have included references to some of these questions in the lists at the end of the chapters.

© IFE: 2015 Examinations The Actuarial Education Company

ST6: Study Guide Page 17

Q: I’m a retaker. How is the 2015 Syllabus and Core Reading different from what I’ve already studied for the 2014 exams?

A: The 2015 Syllabus is the same as the 2014 Syllabus.

Updates or changes have been made to the Core Reading on the following topics:

Unit 1 – Central Counterparties (CCPs)

Unit 4 – The state of the property derivatives market

Unit 15 – Inflation hedging (RPI and LPI swaps)

This material is covered in Chapters 1, 3 and 14, respectively, of the 2015 ActEd

Notes.

Further details of these Core Reading changes may be found on the Institute and

Faculty of Actuaries’ website (search for “ST6 changes”.)

Q: What calculators am I allowed to use in the exam?

A: Please refer to www.actuaries.org.uk

for the latest advice.

The Actuarial Education Company © IFE: 2015 Examinations

Page 18 ST6: Study Guide

5 Core Reading and the Syllabus

Core Reading

The Syllabus for Subject ST6, and Core Reading that supplements the Textbooks, has been written by the Institute and Faculty of Actuaries to state the requirements of the examiners. The relevant individual Syllabus Objectives are included at the start of each course chapter and a complete copy of the Syllabus is included in Section 6 of this

Study Guide. We recommend that you use the Syllabus as an important part of your study. The purpose of Core Reading is to give the examiners, tutors and students a clear, shared understanding of the depth and breadth of treatment required by the

Syllabus. In examinations students are expected to demonstrate their understanding of the concepts in Core Reading. Examiners have the Core Reading available when setting papers.

Core Reading deals with each syllabus objective. Core Reading covers what is needed to pass the exam but the tuition material that has been written by ActEd enhances it by giving examples and further explanation of key points. The Subject ST6 Course Notes include the Core Reading in full, integrated throughout the course. Here is an excerpt from some ActEd Course Notes to show you how to identify Core Reading and the

ActEd material.

Core Reading is shown in this bold font.

Note that in the example given above, the index will fall if the actual share price goes below the theoretical ex-rights share price. Again, this is consistent with what would happen to an underlying portfolio.

becomes:

This is

After allowing for chain-linking, the formula for the investment index then text

i

N P

This is Core

Reading where N is the number of shares issued for the ith constituent at time t;

Core Reading accreditation

The Institute and Faculty of Actuaries would like to thank the numerous people who have helped in the development of the material contained in this Core Reading.

© IFE: 2015 Examinations The Actuarial Education Company

ST6: Study Guide Page 19

Changes to the Syllabus and Core Reading

The Syllabus and Core Reading are updated as at 31 May each year. The exams in

April and September 2015 will be based on the Syllabus and Core Reading as at

31 May 2014.

We recommend that you always use the up-to-date Core Reading to prepare for the exams.

The Institute and Faculty of Actuaries’ Copyright

All study material produced by ActEd is copyright and is sold for the exclusive use of the purchaser. The copyright is owned by Institute and Faculty Education Limited, a subsidiary of the Institute and Faculty of Actuaries. Unless prior authority is granted by ActEd, you may not hire out, lend, give out, sell, store or transmit electronically or photocopy any part of the study material. You must take care of your study material to ensure that it is not used or copied by anybody else.

Legal action will be taken if these terms are infringed. In addition, we may seek to take disciplinary action through the Institute and Faculty of Actuaries or through your employer.

These conditions remain in force after you have finished using the course.

Past exam papers

You can download some past exam papers and Examiners’ reports from the profession’s website at www.actuaries.org.uk

.

Recommended reading

The exam will be based on the relevant Syllabus and Core Reading and the ActEd course material plus Textbooks will be the main source of tuition for students.

The Actuarial Education Company © IFE: 2015 Examinations

Page 20 ST6: Study Guide

6 Syllabus

The full Syllabus for Subject ST6 is given here. To the right of each objective are the chapter numbers in which the objective is covered in the ActEd course.

Aim

The aim of the second finance and investment technical subject is to instil in successful candidates the ability (at a higher level of detail and ability and detail than in CT8) to value financial derivatives, to assess and manage the risks associated with a portfolio of derivatives, including credit derivatives and to value credit derivatives using simple models for credit risk.

Links to other subjects

This subject develops concepts introduced in Subject CT8 – Financial Economics, particularly objectives (vii), (viii) and (ix) of this syllabus.

Subject CA1 – Actuarial Risk Management: covers the general underlying principles affecting all specialisms.

Objectives

On completion of this subject the candidate will be able to:

(a) Show an awareness of the basic characteristics of the derivatives markets.

(Chapters 1 and 2)

(i) Define and describe exchange traded contracts and over-the-counter contracts.

(ii) Describe the payoffs of forwards and futures, calls and puts (American and European).

(iii) Describe the uses of forwards, futures and options by hedgers, speculators and arbitrageurs.

(iv) Demonstrate an understanding of how futures markets work.

© IFE: 2015 Examinations The Actuarial Education Company

ST6: Study Guide Page 21

(b) Demonstrate a knowledge of forward and future prices.

(i) Derive forward and future prices by no-arbitrage, on:

a non-dividend paying stock

a dividend-paying stock

a stock index a foreign currency an investment commodity a consumption commodity.

(Chapter 2)

(ii) Define the following:

investment commodity consumption commodity

cost of carry convenience yield storage costs.

(c) Show an awareness of the role of futures in hedging. (Chapter 2)

(i) Describe how to use futures contracts defined in (b) for hedging.

(ii) Define what is meant by basis risk and its impact on hedging strategies.

(d) Define and describe the following traded derivative contracts: (Chapter

stock options currency options

index options options on futures warrants convertibles over-the-counter options property derivatives.

The Actuarial Education Company © IFE: 2015 Examinations

Page 22 ST6: Study Guide

(e) Define and describe the following interest rates, and interest-rate derivatives:

(Chapters 11 and 12)

Treasury rates, LIBOR rates, repo rates

zero rates forward rates forward rate agreements interest rate futures

Treasury bond futures interest rate swaps

European swap options (swaptions) caps and caplets floors and floorlets

Bermudan swaptions.

(f) Describe the following exotic equity and foreign exchange derivatives:

quanto options

chooser options barrier options binary options lookback options

Asian options exchange options basket options.

(g) (i) Describe how the following factors affect option prices: (Chapter

stock price strike price

term to expiry volatility

risk-free rate dividends.

(ii) Draw simple charts to illustrate these effects.

© IFE: 2015 Examinations The Actuarial Education Company

ST6: Study Guide Page 23

(h) Demonstrate a knowledge and understanding of the mathematics underpinning the pricing and hedging of derivative instruments. (Chapters 4 to 8 and 10)

(i) Demonstrate a knowledge and understanding of the theory underpinning the calculation of derivative prices and their hedging strategies using the binomial model including:

sample paths filtrations

the binomial representation theorem conditional expectations previsible process self-financing portfolio strategies replicating strategies pricing under the martingale measure.

(ii) Demonstrate a knowledge and understanding of the theory underpinning the calculation of derivative prices and their hedging strategies using the

Black-Scholes model including:

Brownian motion

Ito calculus

Ito’s formula statement of the Cameron-Martin-Girsanov theorem the concept of the Radon-Nikodym derivative change of measure statements of the martingale representation theorem continuous-time portfolio strategies self-financing portfolios in continuous time the Black-Scholes model construction of replicating strategies using the martingale approach

the Black-Scholes formula for non-dividend paying stocks.

(iii) Show how to adapt the martingale approach to the pricing of foreignexchange options and options on stock indexes paying dividends continuously.

(iv) Derive the Black-Scholes-Merton partial differential equation.

The Actuarial Education Company © IFE: 2015 Examinations

Page 24 ST6: Study Guide

(v) Demonstrate an understanding of the role of the market price of risk in the transfer between the real-world and the risk-neutral probability measures.

(vi) Demonstrate an understanding of the role of the volatility parameter in the valuation of options, including:

calculation of implied volatility from option prices estimation of volatility from historical time series or other market indices ( eg the VIX index)

the “smile” effect and volatility surfaces.

(vii) Describe approaches to valuing options on discrete dividend paying securities.

(viii) Describe the following numerical methods for calculating equity and foreign exchange derivative prices and hedging strategies:

finite differences

Monte-Carlo techniques lattices.

(ix) Demonstrate an awareness of the problems in pricing American options and describe the following methods of calculation:

binomial and trinomial trees

Monte-Carlo simulation using the least-squares (Longstaff-

Schwartz) approach.

(i) Demonstrate a knowledge and understanding of how to hedge individual derivatives and portfolios of derivatives. (Chapters 7 to 9)

(i) Calculate the partial derivatives (the Greeks) and discuss their use in hedging individual derivatives and portfolios of derivatives.

(ii) Demonstrate the way in which option prices and Greeks change in relation to underlying variables.

(iii) Describe how to manage portfolios of derivatives using scenario analysis.

(iv) Understand the risk management characteristics of certain exotic products ( eg foreign exchange or equity barrier options).

© IFE: 2015 Examinations The Actuarial Education Company

ST6: Study Guide Page 25

(j) Demonstrate a knowledge and understanding of interest rate derivatives and the

Black model. (Chapters 11 and 12)

(i) Calculate, and explain how to calculate:

the yield curve, zero rates, forward rates and bond prices

the relationship between forward rates and futures rates the value of interest rate swaps.

(iii) Demonstrate a knowledge and understanding of the use of the Black model for pricing and valuing the following contracts:

options on futures contracts

caps and floors

European swap options (swaptions).

(iv) Comment on the assumptions underlying Black’s model.

(v) Describe the hedging of interest rate derivatives with respect to the underlying parameters (the Greeks).

(k) Demonstrate a knowledge and understanding of models of the term structure of interest rates. (Chapter 13)

(i) Describe the Hull & White model for the term-structure of interest rates and contrast this with the Vasicek and Cox-Ingersoll-Ross models.

(ii) Show an understanding of the numerical techniques used to value an interest-rate derivative using the risk-neutral approach to pricing.

(iii) Be aware of valuation methods of an interest-rate derivative using an appropriate forward measure and zero-coupon bond.

(iv) Demonstrate an understanding of the role of the market price of risk and changes of numeraire in the dynamics of term structure models.

(v) Describe how interest-rate models can be developed in a multifactor setting.

(vi) Demonstrate an understanding of the characteristics of the LIBOR market model and swap market model and show how they can be used to price caps and swaptions.

The Actuarial Education Company © IFE: 2015 Examinations

Page 26 ST6: Study Guide

(vii) Demonstrate how Black’s model can be used to calibrate the LIBOR and swap market models, and discuss the problems with this approach.

(l) Demonstrate an awareness of the characteristics of different types of structured derivatives and synthetic securities that can be encountered in actuarial work.

(i) Define the following securities and OTC contracts and describe how each can be used to hedge certain types of liability:

gilt STRIPS

interest-rate swaps interest-rate swaptions index-linked gilts inflation swaps limited price indexation (LPI) swaps

LPI bonds.

(ii) Describe how non-economic risks such as longevity risk can be hedged using suitable index-linked securities and OTC contracts.

(iii) Describe how the following issues affect the suitability of traded securities and OTC contracts for liability hedging:

basis risk

capital structure credit risk.

(iv) Describe how special purpose vehicles can be used as part of a mechanism for risk transfer, including the role of a credit enhancement agency.

(m) Identify the market, credit and liquidity risks that arise in the use of derivatives.

(Chapters 15 and 16)

(i) Define market risk, credit risk and liquidity risk.

(ii) Outline the way in which these risks affect the use of derivatives and how these risks may be handled.

(iii) Demonstrate an understanding of the use and limitations of credit ratings.

(iv) Demonstrate an understanding of simple techniques for measuring credit risk on derivatives.

© IFE: 2015 Examinations The Actuarial Education Company

ST6: Study Guide Page 27

(v) Outline possible methods for establishing value at risk (on a portfolio).

(vi) Demonstrate a knowledge and understanding of the following types of credit derivatives:

credit default swaps (CDS’s)

N th-to-default baskets collateralised debt obligations (CDO’s).

(vii) Demonstrate an awareness of the relationship between CDS’s and corporate bonds, in particular as shown by their relative credit spreads.

(viii) Describe how credit derivatives can be used to manage the credit risk present in a portfolio of securities.

(ix) Show an awareness of the role of correlation in pricing credit derivatives.

The Actuarial Education Company © IFE: 2015 Examinations

All study material produced by ActEd is copyright and is sold for the exclusive use of the purchaser. The copyright is owned by Institute and Faculty Education Limited, a subsidiary of the Institute and Faculty of Actuaries.

Unless prior authority is granted by ActEd, you may not hire out, lend, give out, sell, store or transmit electronically or photocopy any part of the study material.

You must take care of your study material to ensure that it is not used or copied by anybody else.

Legal action will be taken if these terms are infringed. In addition, we may seek to take disciplinary action through the profession or through your employer.

These conditions remain in force after you have finished using the course.

© IFE: 2015 Examinations The Actuarial Education Company