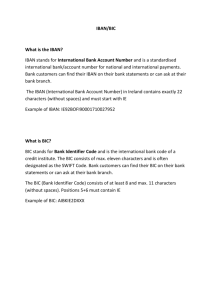

Memorandum of Incorporation

advertisement