Caterpillar - GlobalCapital

advertisement

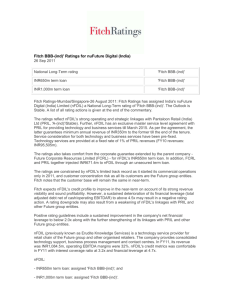

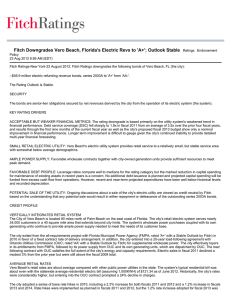

Caterpillar Rating A2, A, A Issuing entity: Caterpillar Financial Services Corp Financial Overview key officials Douglas Oberhelman: CEO Ed Rapp: CFO Jim Duensing: CFO, Caterpiller Financial services Mike de Walt Head of IR Address: 100 Northeast Adams Street, 61629 Peoria, Illinois www.cat.com Qtr End 09/2010 $ (m) Qtr End 06/2010 $ (m) Total Assets 37,517 34,509 Total Liabilities 27,185 Revenue Rating 21-Apr2011 Affirmed 24,805 Short Term Issuer F1 Default Rating: 21-Apr2011 Affirmed 10,452 9,723 Source: Fitch Ratings PBT 993 837 EBIT 1,146 939 1,451 Source: Fitch Ratings Rank Lead manager Amount No. of $(m) issues 5,137 2 Citi 4,183 11 17.3 3 Barclays Capital 3,620 9 14.9 4 Société Générale 2,595 8 10.7 5 Goldman Sachs 2,323 5 9.6 17,858 143 73.6 24,249 169 100.0 Subtotal Total 125 Key recent rating agency commentary: Fitch % share Bank of America Merrill Lynch 1 21.2 Source: Dealogic (Jan 1, 2008 to May 31, 2011) Mandated Lead Arranger – Loans A / Stable Key Ratios Qtr End 09/2010 Qtr End 06/2010 Net Fixed Charge Cover (x) 8.5 7.3 Op. EBITDA/Gross Interest Expense (x) 9.9 7.6 Gross Profit/ Revenues (%) 29.5 28.1 Net Income/ Revenues (%) 7.6 7.3 Adjusted Debt Net of Cash/Op. EBITDAR(x) 1.7 1.9 The ratings incorporate CAT’s strong competitive position, solid operating performance, diversified customer base, global manufacturing footprint, an established and well capitalized dealer network, strong free cash flow, and strategic benefits from the pending acquisition of Bucyrus (BUCY). These strategic benefits should offset several risks related to the BUCY acquisition, a large part of which will be funded with debt. After the transaction is completed, some of CAT’s credit metrics will be weak for the current ratings, and they will be exposed to economic downturns and performance missteps. However, Fitch projects that CAT’s credit metrics will improve within 12-18 months of the acquisition’s closing as a result of secular growth in the company’s markets and incremental earnings from completion of the pending BUCY and MWM Holding GmbH (MWM) acquisitions. Source: Fitch Ratings Pos. Mandated lead arranger Deal value $ (m) No. % share 1 JP Morgan 9,825 6 44.2 2 Citi 5,959 4 26.8 3 Société Générale 1,393 2 6.3 4 Mitsubishi UFJ 1,358 8 6.1 5 BofA Merrill Lynch Subtotal Total 1,039 2 4.7 19,573 14 88.1 22,214 14 100.0 Source: Dealogic (Jan 1, 2008 to May 31, 2011) Date Long Term Issuer A Default Rating: Funds From Operations 1,378 Top Bookrunners – Bonds rating update: FItch CDS — McDonald’s — Caterpillar — Unilever 100 80 60 40 offshore RMB Bonds Source: EuroWeek Amount (RMB) 1bn TenorCoupon (years) (%) 2 2.00 Ja n Date Nov 2010 20 Fe 10 b 20 1 M ar 0 20 Ap 10 r2 01 M ay 0 20 Ju 10 n 20 Ju 10 l2 0 Au 10 g 20 Se 10 p 20 O 10 ct 20 No 10 v 20 De 10 c 20 Ja 10 n 20 Fe 11 b 20 1 M ar 1 20 Ap 11 r2 01 M ay 1 20 Ju 11 n 20 11 20 Source: Markit Offshore RMB Bonds EuroWeek 85