Interest Theory Richard C. Penney Purdue University

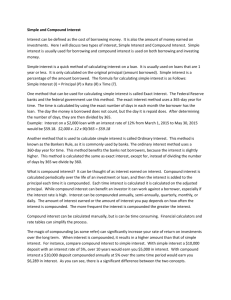

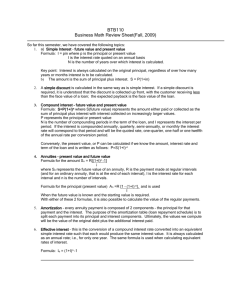

advertisement