SINGAPORE EXCHANGE | BUY

advertisement

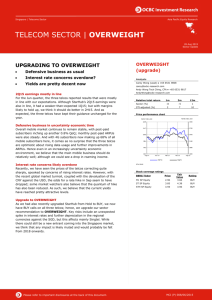

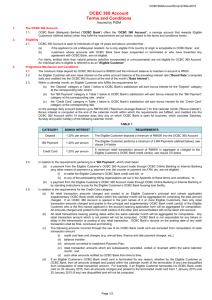

Singapore | Diversified Financial Services Asia Pacific Equity Research SINGAPORE EXCHANGE | BUY MARKET CAP: USD 5.8B 22 Oct 2015 Company Update AVG DAILY TURNOVER: USD 15M DERIVATIVES CONTINUES TO DRIVE GROWTH BUY (upgrade) Fair value S$8.16 add: 12m dividend forecast S$0.28 versus: Current price S$7.51 Derivatives to drive growth 3-pronged business strategy ahead Upgrade to BUY 12m total return forecast Better than expected results Singapore Exchange (SGX) posted a 28% YoY or a 3% QoQ increase in 1QFY16 net earnings to S$99.3m, higher than market expectations of S$90.3m (based on a Bloomberg consensus estimate). Derivatives remained the star performer, with a 69% YoY and 6% QoQ jump in revenue to S$90.9m. This was led by a 67% gain in equities and commodities derivatives revenue to S$67.1m. The SGX FTSE China A50 Index futures saw a 164% YoY rise in volume to 28.4m contracts. Securities saw a 14% YoY and flat QoQ revenue of S$55.9m. Securities Daily Average Traded Value (SDAV) grew 27% YoY to S$1.23b, while the SDAV of STI stocks jumped 61% to S$0.88b. With the change in base dividend policy, this quarter’s payout increased from 4 cents to 5 cents. Ex-date is 27 Oct and payment date is 5 Nov 2015. New CEO outlined business strategy For his maiden result briefing, CEO Loh Boon Chye outlined his strategy to grow the market for currency futures, develop SGX as the regional fixed income platform and grow the market data and index business. While the currency futures segment is already part of its existing business, SGX is looking to expand it. For the fixed income platform, it will be launching the SGX Bond Pro trading platform targeting Asia’s wholesale bond trading market (from listing and trading to clearing and settlement). Maintain FV of S$8.16; upgrade to BUY With investments into staff and technology, SGX is guiding for operating expenses of S$425m to S$435m and technology-related capital expenditure of S$75m to S$80m in FY16. We expect continuous volatility in the Asian market in the coming months and with slower corporate activities and M&As, this will result in a muted outlook for equities and lackluster securities trading. The key driver will continue to be SGX’s derivatives business, and we are expecting a 25.5% increase in derivatives revenue in FY16. We are retaining our fair value estimate of S$8.16 but as its share price has come off since our last report, at current level and on valuation grounds, we upgrade SGX to a BUY. 12% Analysts Carmen Lee (Lead) ● +65 6531 9802 carmen@ocbc-research.com Carey Wong ● +65 6531 9808 carey@ocbc-research.com Key information Market cap. (m) S$8,048 / USD5,774 Avg daily turnover (m) S$21 / USD15 Avg daily vol. (m) 2.7 52-wk range (S$) 6.9 - 8.8 Free float (%) 76.3 Shares o/s. (m) 1,071.6 Exchange SGX BBRG ticker SGX SP Reuters ticker SGXL.SI SGX code GICS Sector GICS Industry Top shareholder Relative total return S68 Financials Diversified Financial Svcs Sel Holdings Pte Ltd – 23.33% 1m 3m 12m Company (%) 2 -9 14 STI-adjusted (%) -3 0 16 Price performance chart Sources: Bloomberg, OIR estimates Key financial highlights Year Ended Jun 30 (S$m) FY14 FY15 FY16F FY17F Revenue 686.9 778.9 872.9 967.4 - Securities revenue 226.9 209.3 216.3 222.3 - Derivatives revenue 208.7 295.7 371.1 440.2 Net profits, excl exceptionals 320.4 348.6 375.4 408.2 30.0 32.6 35.0 38.1 Cons. EPS (S cts) na na 34.4 37.3 Gross margin (%) 54.1 51.6 50.3 49.4 Pretax margin (%) 55.2 52.8 51.1 50.2 ROE (%) 35.4 36.7 37.0 36.7 PER (x) 25.1 23.1 21.4 19.7 EPS (S cents) Industry-relative metrics Note: Industry universe defined as companies under identical GICS classification listed on the same exchange. Sources: Bloomberg, OIR estimates Please refer to important disclosures at the back of this document. MCI (P) 005/06/2015 OCBC Investment Research Singapore Equities Exhibit 1: Key Highlights of 1QFY16 Results Y/E: Jun 30 (S$m) 1QFY16 1QFY15 YoY 4QFY15 QoQ Revenue 219.6 168.9 30.1% 215.6 1.9% - Securities revenue 55.9 49.1 13.8% 55.7 0.5% - Derivatives revenue 90.9 53.7 69.1% 85.8 5.9% - Market data 9.6 8.6 11.8% 9.3 3.5% - Member services & connectivity 11.9 10.6 12.1% 11.5 3.4% - Depository services 29.7 23.9 24.4% 28.7 3.4% - Issuer services 21.4 22.7 -5.8% 24.2 -11.8% Operating Expenses 102.3 81.9 24.9% 104.9 -2.5% - Staff costs 42.0 33.5 25.5% 43.4 -3.2% - Technology 30.5 27.9 9.5% 29.9 2.1% - Processing and royalties 15.5 7.7 101.1% 14.5 6.9% - Premises 6.0 5.1 17.9% 5.9 1.0% Operating Profit 117.3 87.0 34.9% 110.7 6.0% Pretax Profit 119.7 89.6 33.5% 112.7 6.2% Net Profit 99.3 77.6 28.0% 96.2 3.2% 2 OCBC Investment Research Singapore Equities Company financial highlights Income statement Year Ended Jun 30 (S$m) FY14 FY15 FY16F FY17F 686.9 226.9 208.7 251.3 371.7 315.2 126.5 379.0 320.4 320.4 778.9 209.3 295.7 274.0 402.2 376.7 150.0 411.5 348.6 348.6 872.9 216.3 371.1 285.5 438.8 434.1 172.6 446.4 375.4 375.4 967.4 222.3 440.2 304.8 477.5 489.8 195.2 485.4 408.2 408.2 FY14 FY15 FY16F FY17F 756.9 572.2 61.5 1,641.1 0.0 719.0 719.0 428.3 922.1 1,641.1 789.9 653.5 61.2 1,801.6 0.0 825.2 825.2 428.6 976.4 1,801.6 786.9 939.9 61.2 2,090.2 0.0 1,034.5 1,034.5 428.6 1,055.6 2,090.2 868.5 991.2 61.2 2,227.9 0.0 1,061.4 1,061.4 428.6 1,166.5 2,227.9 FY14 FY15 FY16F FY17F 376.6 -18.0 358.6 -71.8 6.5 -65.2 -299.5 -6.1 613.0 606.8 409.6 19.4 429.0 -82.4 -12.9 -95.4 -307.9 25.8 606.8 632.6 446.4 77.9 524.4 -65.0 5.0 -60.0 -310.0 154.3 632.6 786.9 485.4 8.3 493.8 -75.0 5.0 -70.0 -342.2 81.6 786.9 868.5 Key rates & ratios FY14 FY15 FY16F FY17F EPS (S cents) NAV per share (S cents) Gross margin (%) Pretax margin (%) Net profit margin (%) PER (x) Price/NAV (x) Dividend yield (%) ROE (%) Net gearing (%) 30.0 86.2 54.1 55.2 46.7 25.1 8.7 3.7 35.4 0.0 32.6 87.9 51.6 52.8 44.8 23.1 8.5 3.7 36.7 0.0 35.0 95.2 50.3 51.1 43.0 21.4 7.9 3.7 37.0 0.0 38.1 105.5 49.4 50.2 42.2 19.7 7.1 4.1 36.7 0.0 Revenue - Securities revenue - Derivatives revenue - Other revenue Gross profit Operating expenses - Staff costs Pretax profits Net profits Net profits, excl exceptionals Balance sheet As at Jun 30 (S$m) Cash and cash equivalents Inventories Property, plant, equipment Total assets Debt Current liabilities excluding debt Total liabilities Shareholders equity Total equity Total equity and liabilities Cash flow statement Year Ended Jun 30 (S$m) Operating profits Working capital, taxes and int Net cash from operations Purchase of PP&E Other investing flows Investing CF Financing CF Net cash flow Cash at beginning of year Cash at end of the year Sources: Company, OIR forecasts Company financial highlights OCBC Investment Research Singapore Equities SHAREHOLDING DECLARATION: The analyst/analysts who wrote this report holds/hold NIL shares in the above security. DISCLAIMER FOR RESEARCH REPORT This report is solely for information and general circulation only and may not be published, circulated, reproduced or distributed in whole or in part to any other person without the written consent of OCBC Investment Research Pte Ltd (“OIR” or “we”). This report should not be construed as an offer or solicitation for the subscription, purchase or sale of the securities mentioned herein or to participate in any particular trading or investment strategy. Whilst we have taken all reasonable care to ensure that the information contained in this publication is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness, and you should not act on it without first independently verifying its contents. Any opinion or estimate contained in this report is subject to change without notice. We have not given any consideration to and we have not made any investigation of the investment objectives, financial situation or particular needs of the recipient or any class of persons, and accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of the recipient or any class of persons acting on such information or opinion or estimate. You may wish to seek advice from a financial adviser regarding the suitability of the securities mentioned herein, taking into consideration your investment objectives, financial situation or particular needs, before making a commitment to invest in the securities. In the event that you choose not to seek advice from a financial adviser, you should consider whether investment in securities and the securities mentioned herein is suitable for you. Oversea-Chinese Banking Corporation Limited (“OCBC Bank”), Bank of Singapore Limited (“BOS”), OIR, OCBC Securities Pte Ltd (“OSPL”) and their respective connected and associated corporations together with their respective directors and officers may have or take positions in the securities mentioned in this report and may also perform or seek to perform broking and other investment or securities related services for the corporations whose securities are mentioned in this report as well as other parties generally. The information provided herein may contain projections or other forward looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures are not necessarily indicative of future or likely performance. Privileged / confidential information may be contained in this document. If you are not the addressee indicated in this document (or responsible for delivery of this message to such person), you may not copy or deliver this message to anyone. Opinions, conclusions and other information in this document that do not relate to the official business of OCBC Bank, BOS, OIR, OSPL and their respective connected and associated corporations shall not be understood as neither given nor endorsed. RATINGS AND RECOMMENDATIONS: - OCBC Investment Research’s (OIR) technical comments and recommendations are short-term and trading oriented. - OIR’s fundamental views and ratings (Buy, Hold, Sell) are medium-term calls within a 12-month investment horizon. - As a guide, OIR’s BUY rating indicates a total return in excess of 10% based on the current price; a HOLD rating indicates total returns within +10% and -5%; a SELL rating indicates total returns less than -5%. Co.Reg.no.: 198301152E Carmen Lee Head of Research For OCBC Investment Research Pte Ltd Published by OCBC Investment Research Pte Ltd Important disclosures Published by OCBC Investment Research Pte Ltd