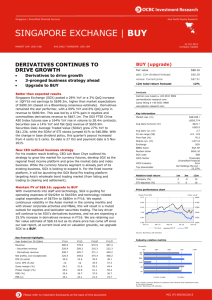

Full Report

advertisement

Singapore | Telecoms Sector Asia Pacific Equity Research TELECOM SECTOR | OVERWEIGHT 28 Aug 2015 Sector Update Defensive business as usual OVERWEIGHT (upgrade) Interest rate concerns overdone? Analysts Yields are pretty decent now UPGRADING TO OVERWEIGHT Carey Wong (Lead) ● +65 6531 9808 carey@ocbc-research.com Andy Wong Teck Ching, CFA ● +65 6531 9817 2Q15 earnings mostly in line For the Jun quarter, the three telcos reported results that were mostly in line with our expectations. Although StarHub’s 2Q15 earnings were also in line, it had a weaker-than-expected 1Q15; but with margins likely to hold up, we think it should do better in 2H15. And as expected, the three telcos have kept their guidance unchanged for the year. AndyWong@ocbc-research.com Relative total return 1m 3m Sector (%) -8 -5 12m 1 STI-adjusted (%) 2 7 10 Price performance chart Defensive business in uncertainty economic time Overall mobile market continues to remain stable, with post-paid subscribers inching up another 0.8% QoQ; monthly post-paid ARPUs were also steady. And with 4G subscribers now making up 68% of all mobile subscribers here, it comes as no surprise that the three telcos are optimistic about rising data usage and further improvements in ARPUs. Hence even in an increasingly uncertainty economic environment, we believe that the main mobile business should do relatively well; although we could see a drop in roaming income. Interest rate concerns likely overdone Recently, we have seen the prices of the telcos correcting quite sharply, spooked by concerns of rising interest rates. However, with the recent global market turmoil, coupled with the devaluation of the CNY against the USD, the odds for a rate hike in Sep seem to have dropped; some market watchers also believe that the quantum of hike has also been reduced. As such, we believe that the current yields have reached pretty attractive levels. STH SPHP Stock coverage ratings BBRG Ticker Price M1 SP Equity 2.96 Fair Value 3.66 ST SP Equity 3.85 4.38 BUY STH SP Equity 3.59 3.96 BUY Rating BUY Upgrade to OVERWEIGHT As we had also recently upgraded StarHub from Hold to BUY, we now have BUY calls on all three telcos; hence, we upgrade our sector recommendation to OVERWEIGHT. Key risks include an unexpected spike in interest rates and further depreciation in the regional currencies against the SGD, but this affects mainly Singtel. While there could still be a new entrant coming into the Singapore market, we think that any impact is likely muted and would probably be felt from 2018 onwards. Please refer to important disclosures at the back of this document. MCI (P) 008/06/2015 OCBC Investment Research Singapore Equities Exhibit 1: 2QCY15 Results Jun 15 Quarter (S$ m) M1 SingTel* StarHub 276.8 (+16%) 4209 (+2%) 589.5 (+2%) EBITDA 83.6 (+1%) 1241 (-1%) 194.5 (+4%) Net Profit 44.3 (+1%) 895 (+2%) 99.1 (+5%) 29.5% 35.1% Operating Revenue Service EBITDA Margin 40.8% Note: SingTel revenue includes Australia Source: Telcos, OIR Increases are YoY Exhibit 2: Latest Guidance after 2QCY15 Results Company Latest Guidance M1 Expects moderate earnings growth (in single digit) Capex around S$120m (vs. S$140m in FY14) Dividend payout of at least 80% of net profit SingTel Core revenue and EBITDA to grow by mid and low single digit level Group capex of S$2.3b (vs. S$2.0b in FY14); FCF of S$1.5b Dividend payout ratio kept at 60-75% of underlying earnings StarHub Low single-digit revenue growth; 32% service EBITDA margin Capex around 13% (vs. 13.5% as FY14) of total revenue Dividend target of S$0.20/share, or S$0.05 per quarter Source: Telcos 2Q15 earnings mostly in line For the Jun quarter, the three telcos reported results that were mostly in line with our expectations. Although StarHub’s 2Q15 earnings were also in line, it had a weaker-than-expected 1Q15; but with margins likely to hold up, we think it should do better in 2H15. And as expected, the three telcos have kept their guidance unchanged for the year. Exhibit 3: Singapore’s Post-Paid Market Source: Telcos, OIR 2 OCBC Investment Research Singapore Equities Exhibit 4: Post-Paid ARPU Trends Source: Telcos, OIR Exhibit 5: Broadband Trends Source: Telcos, OIR 3 OCBC Investment Research Singapore Equities Exhibit 6: Pay TV Trend Source: Telcos, OIR Defensive business in uncertainty economic time Overall mobile market continues to remain stable, with post-paid subscribers inching up another 0.8% QoQ; monthly post-paid ARPUs were also steady. And with 4G subscribers now making up 68% of all mobile subscribers here, it comes as no surprise that the three telcos are optimistic about rising data usage and further improvements in ARPUs. Hence even in an increasingly uncertainty economic environment, we believe that the main mobile business should do relatively well; although we could see a drop in roaming income. Exhibit 7: Singapore Yield Curve Source: Bloomberg, OIR Interest rate concerns likely overdone Recently, we have seen the prices of the telcos correcting quite sharply, spooked by concerns of rising interest rates. However, with the recent global market turmoil, coupled with the devaluation of the CNY against the USD, the odds for a rate hike in Sep seem to have dropped; some market watchers also believe that the quantum of hike has also been reduced. As such, we believe that the current yields have reached pretty attractive levels. 4 OCBC Investment Research Singapore Equities Exhibit 8: Relative Performance YTD Source: Bloomberg, OIR Upgrade to OVERWEIGHT As we had also recently upgraded StarHub from Hold to BUY, we now have BUY calls on all three telcos; hence, we upgrade our sector recommendation to OVERWEIGHT. Key risks include a sharper-thanexpected spike in interest rates and further depreciation in the regional currencies against the SGD (but this affects mainly Singtel). While there could still be a new entrant coming into the Singapore mobile market, we think that any impact is likely muted and would probably be felt from 2018 onwards. Exhibit 9: OIR Recommendations Stock Price Rating Fair Value Dividend Yield MobileOne S$2.96 BUY S$3.66 6.3% SingTel S$3.85 BUY S$4.38 4.6% StarHub S$3.59 BUY S$3.96 5.6% Source: OIR 5 OCBC Investment Research Singapore Equities SHAREHOLDING DECLARATION: For shareholding disclosure on individual companies, please refer to the latest reports of these companies. DISCLAIMER FOR RESEARCH REPORT This report is solely for information and general circulation only and may not be published, circulated, reproduced or distributed in whole or in part to any other person without the written consent of OCBC Investment Research Pte Ltd (“OIR” or “we”). This report should not be construed as an offer or solicitation for the subscription, purchase or sale of the securities mentioned herein or to participate in any particular trading or investment strategy. Whilst we have taken all reasonable care to ensure that the information contained in this publication is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness, and you should not act on it without first independently verifying its contents. Any opinion or estimate contained in this report is subject to change without notice. We have not given any consideration to and we have not made any investigation of the investment objectives, financial situation or particular needs of the recipient or any class of persons, and accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of the recipient or any class of persons acting on such information or opinion or estimate. You may wish to seek advice from a financial adviser regarding the suitability of the securities mentioned herein, taking into consideration your investment objectives, financial situation or particular needs, before making a commitment to invest in the securities. In the event that you choose not to seek advice from a financial adviser, you should consider whether investment in securities and the securities mentioned herein is suitable for you. Oversea-Chinese Banking Corporation Limited (“OCBC Bank”), Bank of Singapore Limited (“BOS”), OIR, OCBC Securities Pte Ltd (“OSPL”) and their respective connected and associated corporations together with their respective directors and officers may have or take positions in the securities mentioned in this report and may also perform or seek to perform broking and other investment or securities related services for the corporations whose securities are mentioned in this report as well as other parties generally. The information provided herein may contain projections or other forward looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures are not necessarily indicative of future or likely performance. Privileged / confidential information may be contained in this document. If you are not the addressee indicated in this document (or responsible for delivery of this message to such person), you may not copy or deliver this message to anyone. Opinions, conclusions and other information in this document that do not relate to the official business of OCBC Bank, BOS, OIR, OSPL and their respective connected and associated corporations shall not be understood as neither given nor endorsed. RATINGS AND RECOMMENDATIONS: - OCBC Investment Research’s (OIR) technical comments and recommendations are short-term and trading oriented. - OIR’s fundamental views and ratings (Buy, Hold, Sell) are medium-term calls within a 12-month investment horizon. - As a guide, OIR’s BUY rating indicates a total return in excess of 10% based on the current price; a HOLD rating indicates total returns within +10% and -5%; a SELL rating indicates total returns less than -5%. Co.Reg.no.: 198301152E Carmen Lee Head of Research For OCBC Investment Research Pte Ltd Published by OCBC Investment Research Pte Ltd Important disclosures