Economics 110/110 – Practice Problems – Chapter 6

advertisement

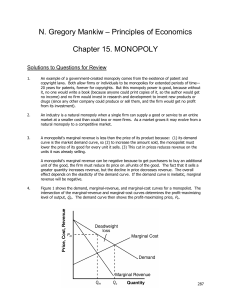

Chapter 12 – Practice Problems True, False, or Uncertain Explain why each of the following statements is True, False, or Uncertain according to economic principles. Use diagrams where appropriate. Unsupported answers would receive no marks. It is the explanation that is important. 12-1. A supply and demand equilibrium outcome is an efficient outcome. Problems 12-2. Suppose the demand and cost conditions facing a monopoly are given by: Demand: p = 100 - q Marginal Revenue: MR = 100 - 2q Total Cost: C = 700 + 20q Marginal Cost: MC = 20 (a) Calculate the monopoly output level, the monopoly price, and the profits of the firm. (b) Draw a diagram to illustrate your answers to part (a). (c) Explain, illustrate and calculate the deadweight loss from this monopoly. (d) Explain why this market might be considered to be a "natural" monopoly. (e) Illustrate and explain the problems that exist if a regulator were to impose (i) average cost pricing, (ii) marginal cost pricing. Chapter 12 – Solutions True, False, or Uncertain 12-1. True. Equilibrium in the market occurs at price p* where the quantity supplied equals the quantity demanded. Therefore, as shown in the diagram below, equilibrium output is Q*. At this output level the sum of producer surplus (the area below the price line and above the supply curve, area p*BC) and consumer surplus (the area below the demand curve and above the price line, area Abp*) is maximized. Another way to see this is to realize that, at Q*, the marginal willingness-to-pay (measured by the height of the demand curve) is equal to the marginal cost (measured by the height of the supply curve). Therefore the total surplus generated in the market (equal to total willingness-to-pay less total cost, area ABC) is maximized. Problems 12-2. (a) Profit maximization requires that the monopolist produce where MR = MC. Solving for the profit maximizing quantity: MR = MC 100 - 2q = 20 80 = 2q q = 40. Price is determined by the demand curve, so, at q = 40: p = 100 - 40 = 60 Profits equal total revenues minus total costs so: Profits = pq - C = 60(40) - 700 - 20(40) = 900. (b) See the figure below, q = 40, p = 60 and profits (shown as the shaded region) equal 900. p 100 a b 60 g c d 20 AC MC e f MR 0 10 20 30 40 50 D 60 70 80 90 100 q (c) The deadweight loss measures the inefficiency of the monopoly production level. At q = 40 the marginal benefit to consumers is 60 (the height of the demand curve). However, the marginal cost of production is only 20. Therefore the production of another unit would generate benefits to society of the difference, or 40. This is also true (although the numbers are different) for all units between 40 and the point where the height of the demand curve equals marginal cost (which occurs at q = 80). Therefore, the total deadweight loss to society is the area “bdf” in the figure. The area of a triangle is one half times the base times the height so the area “bdf” is equal to ½(40)(40) = (20)(40) = 800. (d) This market can be considered to be a natural monopoly because average costs are declining over the whole range of the market. That is, it is cheaper for one firm to serve this market than it would be for more than one firm to do so. (e) (i) If the regulator imposes average cost pricing on this firm, the price quantity combination would be at point “c” in the diagram. You can find this point by equating the demand curve with the average cost curve. The problem with this solution is that it is still not efficient. Some deadweight loss remains. It is shown in the diagram as area “cde”. To solve for this point requires use of the binomial theorem (you aren’t expected to know this - a diagrammatic explanation is sufficient) to find q = 70 and p = 30. For those who are interested, the solution is shown below: p = AC 100 - q = 700/q + 20 2 q - 80q + 700 = 0 q = 40 " 30 q = 70 p = 100 - 70 = 30 Thus, the area of the deadweight loss can be calculated as ½(10)(10) = (5)(10) = 50. (ii) If the regulator pursues efficiency and imposes marginal cost pricing, price is set equal to 20 and the resulting quantity is 80. This is shown in diagram as point “d”. This solution is efficient in this, but, as a quick look at the diagram establishes, price is less than average cost. This means the firm is making a loss and would require a subsidy to stay in business. The loss is given by: Profit (marginal cost pricing) = 20(80) - 700 - 20(80) = -700. Thus, the firm would require a subsidy of 700. The problem is that the government must raise this revenue through taxation, which itself causes some deadweight loss elsewhere in the economy.