MINDSCAPE Case Studies Case Studies

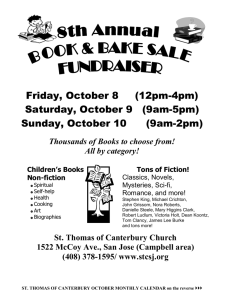

advertisement

Case Studies MINDSCAPE You know you’ve hit the mark with a new product when, soon after launching it, someone knocks on your door offering to buy the entire company. That was the story for Wellington tech firm Mindscape when in early 2013 it released Raygun, a Software As Service (SaaS) product that helps software developers diagnose and fix errors and crashes. “From the beginning, the interest and demand for Raygun was substantially higher than anything we’d put out before,” says CEO John-Daniel Trask, who founded Mindscape in 2007 with Jeremy Boyd to build software tools for software developers. In fact, Raygun was well named, blasting a smoking hole through their business expectations. It’s used by 15,000 developers and climbing, earns ten times the revenue of all other Mindscape products combined, and has fast-tracked the company’s development, with 15 per cent monthon-month growth for the last six months. Why so popular? Trask compares Raygun to an Apple product – it’s simple, but does something quite sophisticated. “We like to think of it as building a digital nervous system for our customers’ software, so they can see what’s working, what’s not, what they can improve, what parts people really love working with, and so on. Let’s be honest, software developers are an expensive resource, and if they can fix something in an hour rather than a week, then that’s good for efficiency.” Trask and Boyd, who are both highly regarded Case Studies NZ MID-MARKET REPORT developers on the Wellington tech scene, bootstrapped Mindscape through the early years. However, that acquisition offer in 2013 lit a fire under them, and last year they raised $1.4 million in a friends-and-family capital round to help the company “go a bit faster”, as Trask puts it. They recently opened a US subsidiary, Raygun Inc, and are looking to hire 11 staff stateside to focus entirely on sales and marketing. “More than 90 per cent of our revenue is from exports, and most of that is into the United States, so it makes sense to establish our sales and marketing over there,” he remarks. The capital raising exercise also financed a boost in R&D spend last year – in line with a trend among Wellington Mid-Market companies noted in the 2015 GE Capital Mid-Market report. Trask says that Mindscape has been supported by Callaghan Innovation in a project to diversify the Raygun product. No standing still, then? “No, but that’s what I love about the tech industry. I like to think we’re trying to make everyone’s software better, not just our own, and that’s a pretty big challenge.” Case Study 1 Case Studies BAY RADIOLOGY You need a strong business plan and nerves of steels to invest in expensive services during an economic downturn . . . thankfully, Bay Radiology’s executive team had both when they made the decision to continue with large scale investment into buildings and equipment at the start of the GFC. “We could use the same pieces of equipment for 20 years, they are certainly robust enough to survive that long, but that’s not what we are in the market to do,” says General Manager Steve Harris. Better and faster diagnosis drives innovation and the continual investment in plant, he says. “This means we are constantly upgrading equipment well before it needs to be replaced.” “At the start of global financial crisis we had committed to significant investment in buildings and plant, and we continued with that despite the slowdown. The good news is that some of that pain is now justified as we are finding it much easier to maintain capacity expectations than we would have if we hadn’t made that investment.” Tauranga’s Bay Radiology has succeeded by concentrating on its region and being clever about use of resources. Since launching in 1988, it has grown to four sites offering a comprehensive range of services and a further four satellite sites. “We are innovative in our approach to business models,” says Harris, citing joint ventures with other radiology practices and the public sector as one way in which Bay Radiology has countered the challenge of delivering healthcare in relatively small, and sometimes isolated communities. “By sharing Case Studies NZ MID-MARKET REPORT resources, equipment and staff we can capture a share of a wider market that we otherwise wouldn’t necessarily be able to operate in. And we do a lot of work for the public sector under contract, which means we’re not competing with them and the assets are employed efficiently.” Like many Mid-Market businesses strong leadership and engaged, talented staff are crucial to the success of meeting targets and delivering on client and contractual expectations, says Harris. Though this is not always easy – GE Mid-Market Report discovered half of all Mid-Market firms are expecting to increase staffing levels, making the search for talented employees tough. “We have needed to grow personnel capacity in order to meet this new demand and to do that we are competing in a global market for highly skilled staff. “We are coming up against northern hemisphere salaries as well as Australian salaries, so we have to do a good job to attract them to Tauranga.” Once signed on with the company, Bay Radiology works hard to retain staff. They have a strong leadership team with many of the same people in key roles for a number of years, says Harris. “This has been a grounding influence on the business throughout those tougher times and now as we look to grow.” Case Study 2 Case Studies AMURI HELICOPTERS You could call Tony Michelle a survivor. When the North Canterbury chopper pilot co-founded Amuri Helicopters in 1989 there were 114 operators licensed to do agriculture work; today, barely more than a dozen of those original companies are still in action. The key to longevity in the notoriously cut-throat helicopter business? Adaptation and diversification. Over the years, the Hanmerbased three-chopper operation has minimised its exposure to the fortunes of its farming clients by taking on more tourism and corporate work. In 2014, for example, with Canterbury in the grip of a drought and farmer returns suffering, Amuri Helicopters had “a pretty good year”, says Michelle. “Our corporate work increased, so that’s proved to be an excellent buffer.” It’s been a hard-earned wisdom. During the rural downturn of the late 1990s, the company had to downsize due, in part, to farmers cutting spending on aerial fertiliser and spraying operations. Farm gate prices eventually improved, but in the meantime Michelle had moved the base from Waikari to Hanmer Springs and found reliable repeat business flying fishermen and deer hunters into the North Canterbury wilderness. Today, a large portion of Amuri Helicopters’ work is performed for three large ‘corporate’ clients, with two contracting it for aerial aquatic weed spraying in the Waikato and throughout the South Island. The aquatic weed spraying business is another buffer, a protection of sorts against predatory Case Studies NZ MID-MARKET REPORT pricing and other anti-competitive practices that persist in the industry, according to Michelle. “It’s something we’ve specialised in that other operators don’t do – again, it minimises our exposure.” It’s a bigger challenge, however, to survive in the face of increasing regulatory pressure. Compliance is the company’s third largest cost, after repairs and maintenance, and salaries. Dealing with regulation is a not uncommon complaint from kiwi companies, according to the 2015 GE Capital Mid-Market Report. “It’s an increasing feast, really, flight compliance, health and safety and environmental compliance,” says Tony. “We have seven fulltime equivalent staff, and I consider that one-and-a-half of those fulltime positions are just about dealing with compliance.” Client expectation is partly responsible. But Michelle, who spent three years as chair of the New Zealand Agriculture Aviation Association, wants to see a shift to risk-based rather than prescriptive environmental regulations. “We want consistent rules, too. We work in the Waikato, Canterbury, West Coast, Nelson, Marlborough, Otago and Southland, and every region has different rules around spraying and fertilising.” He’s hopeful of progress. And farmer returns will rebound. But there’s a looming challenge that might prove harder for his industry to stave off: the entry of drones to agriculture spraying. “These things will become a reality,” he predicts. Case Study 3