Account Information booklet - Community Financial Credit Union

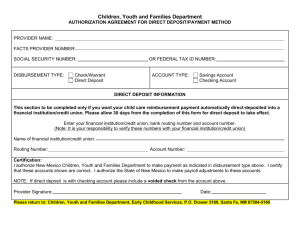

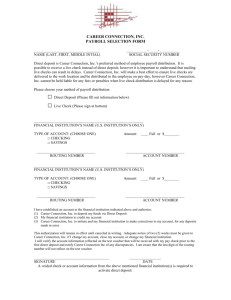

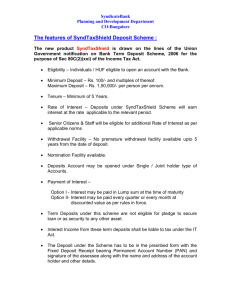

advertisement