Starwood Hotels & Resorts

StayAt

StayCity Serviced Apartments

StayWell

StayWell

Steigenberger

Sun International

Sun Maris Hotels

Sun Suites Hotels

Sunroute

Sunscape Resorts & Spas

Sunstar Hotel

Super Hotel

SuperClubs

Swallow Hotels

Swiss Inn

Swiss-Belhotel International

Swiss-Garden

T A Fisher Group

Tauzia Hotels

the b

The Doyle Collection

The Heritage Hotels Group

The Indian Hotel Company

The LaLit Group

The Leela Palaces & Resorts

The Marmara

The Park Hotels

The Peninsula Hotel

The Pride Group

The Three Corners

The Triton

TIME Hotels LLC

Hilton Worldwide

Hilton Worldwide

Hipotels

Hmg Hotel Management

Hmi Hotel Group

Homegate

Home-towne Suites

Hospes Hotels)

Hospitality Manage

Hoteis Othon

Hoteis Slaviero

Hotel 81 Management

Hotel Alpha-one

Hotel Des Gouverneurs

Hotel Edda

Hotel Equatorial

Hotel Guldsmeden

Hotel Husa

Hotel Keihan

Hotel Monterey

Hotel Occidental

Hotel Rh

Hotel Tokyu Bizfort

Hotel Trusty

Hotel Wing Internationa

Hoteles Estelar

Hoteles H2

Hoteles Serena

Hoteles Vista

Hotels & Compagnie

Hotels & Compagnie

Hotetur

Iberostar Hotels & Resorts

Sponsored by

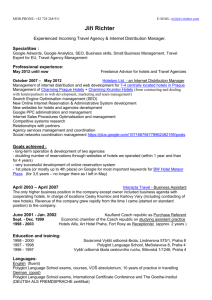

#1

Rooms in supply

Rooms under construction

Rooms in development pipeline

“Our goal is to serve our guests anywhere in the world,

for any lodging need they have.”

Chris Nassetta, President & CEO

Hilton Worldwide is the Global Hospitality Leader1

Twelve distinct brands, 4,300 hotels and timeshare properties, more than 715,000 rooms

in 94 countries and territories and unmatched as:

• Number 1 in rooms in supply

• Number 1 in rooms under construction

• Number 1 in development pipeline

• Number 1 in net unit growth (excluding portfolio acquisitions)

The Hilton Performance Advantage:

• Combinesthepowerofscale,access,reputation,andinnovation—deliveredbytheworld’s

premier hospitality company.

• Provides powerful resources across our portfolio of brands, delivering leading edge solutions

toconsistentlydriveprofitsandefficienciesforourowners.

• Creates a higher share of wallet, guest loyalty, and leading innovation, making it easier

for on-site personnel to focus on delivering a superior guest experience.

1

Smith Travel Research, Global New Development Pipeline, December 2014; STR, Global Census, January 2015

04 big brands have big impacT

EXECUTIVE SUMMARY

05

06

INFOGRAPHIC

Branded vs Non-Branded

breakdown

FEATURE

The race to 1 million

rooms heats up

By Patrick Mayock, Editor-in-Chief

Hotel Companies

08 10by Largest

room count

INFOGRAPHIC

11

12

INFOGRAPHIC

percentage of global rooms

by class & location

FEATURE

The workhorse

brands

By Patrick Mayock, Editor-in-Chief

14

15

18

INFOGRAPHIC

top 5 brands - open

INFOGRAPHIC

top 5 brands - pipeline

FEATURE

Small brands seek profit

without commoditization

By Stephanie Ricca, Editor-At-Large

23 BRAND LAUNCH TIMELINE

27 BRAND FAMILY TREE

ONLINE EXCLUSIVES

ONLINE EXCLUSIVES

THE 2015 BIG BRANDS REPORT

3

Big brands have big impact

T

he hotel brand race is on. As the global hotel industry

enjoys strong performance coupled with favorable

supply-and-demand ratios, brand companies are in fullon growth mode. For the giants, that means going after

market share and net rooms growth in diverse locations. For

smaller companies, that means taking measured steps to

leverage current market conditions.

The bottom line for both is the same: The branded hotel

footprint is growing around the world.

In this special report, Hotel News Now shares data

(and the stories behind the data) that outline what brands

are growing, how they’re doing it and where. Read what

powerhouse company might be the first to reach the

1-million-guestrooms mark. Find out which specific brands

are the real heavy lifters for their companies, shouldering the

majority of growth. And get real-world growth strategy tips

from “small-but-mighty” brands that are making expansion

work on their own terms.

Infographics, supported by data from STR, STR Global

and the brand companies, showcase just how big the large

hotel companies and brands are right now—and how big

they plan to get in the future.

While branded hotels around the world might be

growing thanks to a handful of powerhouse companies,

the overall footprint of hotels carrying a brand name—be it

small or large—is growing as well. North America (with 67%

of its hotels carrying a brand) leads the world in branded

inventory, followed by the Asia/Pacific region, with 51% of

its hotel inventory branded. Europe, South America and the

Middle East/Africa still favor non-branded hotels, but that

gap is narrowing as brand companies become increasingly

open to alternate expansion strategies beyond the traditional

franchise model.

Go online to www.HotelNewsNow.com to find more

coverage of global hotel brand trends, and sign up to

receive our Daily Update newsletter. Find the articles and

infographics in this report by clicking on the “Special

Reports” section from the home page. Download a PDF of

the full report, share articles with colleagues and keep the

conversation going. Tweet using the hashtag #BigBrands2015.

Thank you for reading!

The HNN editorial staff

Photo: Hilton Dallas/Plano Granite Park, Plano, Texas

4

A breakdown of branded hotels and non-branded hotels by region

67%

41%

51%

59%

44%

33%

41%

49%

56%

59%

THE 2015 BIG BRANDS REPORT

Sources: STR and STR Global. Data current as of 31 December 2014.

5

The race to 1 million

rooms heats up

By Patrick Mayock, Editor-in-Chief

G

LOBAL REPORT—InterContinental Hotels Group CEO Richard Solomons

scoffed when first asked about it. Sitting in a suite at the JW Marriott

at LA Live, the hustle and bustle of the Americas Lodging Investment

Summit just a few floors below, he had more pressing matters to

tackle.

But there it was, the question looming large and heavy: Do

you want to be the first hotel company to reach 1 million rooms?

“I don’t care about it,” he said. “I know somebody’s gone out

there and talked about it, and good for them.”

That somebody was Marriott International,

which fired the first shot across the bow

with a 20 January news release that read:

“Marriott expects to reach 1 million rooms

“I don’t care about it,” said IHG’s Richard

open or in development in 2015.”

Solomons of crossing the 1-million-room mark.

Hilton fired back six days later with a

declaration that it was the “world’s largest

Hilton has the most rooms combined either

and fastest-growing hospitality company.”

open or under development.

Even Best Western International joined the fray,

Size does matter in the era of asset light.

when on 27 January the company announced

its own record-breaking year.

In an asset-light age where the

industry’s big players generate

an increasingly larger share

of revenues from fees,

one thing is clear:

Size does matter.

“We like to be on top, for sure.

Arne Sorenson

agreed with

Global development is directly

that premise.

related to unit growth.”

“We like to be

on top, for sure,” said

Marriott’s Arne Sorenson regarding the company’s position as

one of the largest hotel companies in the world.

Marriott’s president

and CEO via email.

HIGHLIGHTS

CONTINUE READING ON PAGE 7

6

Sponsored by Hilton Worldwide

RACE TO 1 MILLION

7

CONTINUED FROM PAGE 6

“Global development is

directly related to unit

growth, which is tied to

our business model of

managing and franchising

hotels. The power of our

portfolio allows us to meet

the development strategies

of individual owners and

franchisees and propel

distribution and growth.”

As does Hilton’s

Chris Nassetta.

“Our large-scale,

broad geographic and

chain-scale distribution is

a huge differentiator, and

the loyalty effect of having

the right brands in the right

markets is undeniable,”

the company’s president

and CEO said via email.

Solomons does too,

with a caveat. For him,

growth for the sake

of growth is not

the point. What

matters most

is delivering

a relevant

offering to

guests. Do

that, and

expansion

naturally

follows.

“We

don’t talk

about being

big-hearted. We don’t talk

about being enormous. We

talk about being brandhearted, which is about

delivering a product that

consumers want,” he

said. “If you get that right,

you’ll grow the business.”

The company turns

away more deals than

it signs in some regions,

Solomons said. And

the existing portfolio is

constantly being combed

to remove the bottom

performers to ensure that

delivery to guests.

Wooing Wall Street and guests

Talk of brand-heartedness

doesn’t woo Wall

Street, though.

Case in point:

the recent ousting of

Starwood Hotels &

Resorts Worldwide’s Frits

van Paasschen, whose

resignation came days

after the company

reported another quarter

of lagging unit growth.

“We have come to

the conclusion that now

CONTINUE READING ON PAGE 9

Part of Marriott International’s

expansion plans call for more

than doubling its current

presence in the Asia/Pacific

region. Shown here is the

Courtyard by Marriott Seoul

Pangyo in South Korea.

(Photo: Marriott International)

7

10 Largest Hotel Companies by room count

PIPELINE

EXISTING

Sources: Companies' Reported 2014 Data

IF 100% OPEN

HOTELS

ROOMS

HOTELS

ROOMS

HOTELS

ROOMS

4,840

710,295

1,221

193,772

6,061

904,067

4,278

708,268

1,351

230,000

5,629

938,268

4,044

692,801

1,450

240,000

5,494

932,801

7,645

660,826

960

117,000

8,605

777,826

6,379

505,278

510

39,000

6,889

544,278

3,717

482,296

800

156,188

4,517

638,484

1,222

354,225

480

108,000

1,702

462,225

3,931

303,522

447

44,441

4,378

347,963

2,609

296,075

401

N/A

3,010

N/A

1,092

172,234

280

50,150

1,372

222,384

Notes: All data are current as of 31 December 2014. 1Numbers exclude residences and serviced

apartments. 2Domestic pipeline only (company does not report international pipeline). 3Home Inns does

not report rooms in the pipeline.

RACE TO 1 MILLION

9

CONTINUED FROM PAGE 7

is the right time to turn to

new leadership to drive

execution of Starwood’s

growth strategy,” said

Bruce Duncan, chairman

of the board, during

a conference call.

Starwood has some

ground to gain. The

company counts seventh

on a list of global chains

by rooms in operation

combined with rooms

in the pipeline as of 31

December 2014. Hilton

quality growth,” said

Wyndham’s president

and CEO, Geoff

Ballotti, via email.

For him, that hotel

tally is meaningful.

It demonstrates the

company’s commitment

to growth, as does

it Wyndham’s strong

reception from owners

and developers.

“They’re looking to

partner with an established,

trusted organization

in rooms in supply, rooms

under construction and

development pipeline,

we’re doing just that.

And we continue to be

confident in the global

strength of our 12 distinct

brands that guests love

and owners prefer.”

Growth drivers

The major chains employ

a variety of tools as they

chart global expansion.

“I don’t care about it. I know somebody’s gone out

there and talked about it, and good for them.”

IHG’s Richard Solomons when asked if being the first to cross the 1-million-room mark matters.

claims the No.1 spot with

938,268 rooms open or in

the pipeline, followed by

Marriott (932,801 rooms)

and IHG (904,067 rooms).

Wyndham Hotel Group

comes in at a distant

fourth with 777,826 rooms,

despite the company

having the largest number

of hotels open with 7,645.

“We’re extremely proud

of our portfolio and the

growth we’ve experienced

both here in the U.S. and

internationally—and our

goal is to continue that

THE 2015 BIG BRANDS REPORT

that will drive guests

through their doors

and offer the resources

and support needed to

succeed,” Ballotti said.

Guests see size similarly,

Nassetta explained. System

size conveys comfort, the

promise that a preferred

brand (or brand family)

will be represented in

any market they visit.

“Our goal is to serve

any guest anywhere in

the world, for any lodging

need they have,” he said.

“As the industry leader

Management

contracts, franchising

and (in the right situation)

even leases contribute

to growth. So, too, do

portfolio acquisitions.

Marriott in particular is

executing on the latter. The

company in recent years

acquired Spain’s AC Hotels

(2010), the United Statesbased Gaylord Hotels

(2012) and South Africa’s

Protea Hotel Group (2013).

Most recently the

CONTINUE READING ON PAGE 10

9

10

RACE TO 1 MILLION

CONTINUED FROM PAGE 9

company brought Torontobased Delta Hotels and

Resorts into the fold,

expanding Marriott’s

footprint in Canada

by 38 hotels and more

than 10,000 rooms.

Wyndham, too, has

pulled the portfolioacquisition trigger, most

recently in February when

the company announced

the $57-million buy of

Dolce Hotels and Resorts.

The executive team at

Hilton prefers organic unit

growth, Nassetta said.

“In 2014, we

continued to lead the

industry in net unit growth

excluding portfolio

acquisitions,” he said.

“Putting all that

together with our asset-light

strategy and a tremendous

amount of hard work

from our team members

has allowed us to grow in

good times and bad.”

Team approach

Each executive spoke of

the importance of their

developments teams,

particularly as it relates

to expansion in new and

emerging markets around

the world.

10

IHG also has

approached

development from a

global perspective—a

strategy largely bred of

the company’s United

Kingdom home base

offering fewer opportunities

for growth than, say, the

U.S., Solomons explained.

“Because our home

market is relatively small,

we have to think about

the other markets. What it

leads to is strong presence

on the ground in each of

those markets,” he said.

In China, for instance,

IHG has a standalone team

that reports directly to the

CEO. That approach has

“enabled us to understand

our local markets better,”

Solomons said.

At Wyndham, more

than half the development

pipeline is outside the

U.S., and nearly 70% of

that is new construction,

Ballotti said.

“We’ve focused on

expanding our presence

in markets where the

demand is ripe for hotel

development—like

China, India, Peru, Brazil

and parts of the Middle

East,” he said. “We have

incredible, motivated

development teams

around theworld dedicated

to connecting us with

likeminded partners and

ensuring that our brands

expand in the markets

where the brand and

our franchisees are best

positioned for success.”

Growth on a global

scale is not possible

without shared leadership,

Nassetta said.

“Success is also

dependent on distributing

leadership by giving

people accountability

and responsibility to make

decisions at the point of

most information,” he said.

Sorenson described

a similar situation with his

development team.

“They know they

have my OK to be

innovative and to try

new things that will help

them and the company

succeed,” he said.

Whether that leads

Marriott or Hilton or IHG

or Wyndham over that

1-million-room mark

first, only time will tell.

UP NEXT: THE WORKHORSE BRANDS

Sponsored by Hilton Worldwide

Percentage of global rooms

by class and location

The class for a

chain-affiliated hotel

is the same as its

chain scale. An

independent hotel is

assigned a class

based on its ADR,

relative to that of

the chain hotels in its

geographic

proximity. (Source:

Hotel News Now’s

“Hotel Industry Terms

to Know”)

Location segments

are hotel

classifications driven

by physical location.

(Source: Hotel News

Now’s “Hotel

Industry Terms to

Know”)

Sources: STR and STR Global. Data current as of 31 December 2014.

11

The workhorse

brands

By Patrick Mayock, Editor-in-Chief

G

LOBAL REPORT—All brands are not

created equal. In the race toward

global expansion, some clearly

shoulder a larger share of the weight.

They are the workhorses, those tried-andtrue offerings that resonate with travelers,

developers and investors alike.

Holiday Inn Express is the heaviest

hitter. Its 228,514 rooms were the most open

among any brand as of 31 December 2014,

according to census data from STR, parent

company of Hotel News Now. The uppermidscale brand also claimed the largest

share of the global active pipeline (4.1%)

with 56,190 rooms.

Rounding out the top five of brands with

the most rooms under contract were:

2. Hilton Hotels & Resorts: 47,929 rooms (3.5% of the global pipeline)

3. Holiday Inn: 44,607 rooms (3.3%)

4. Hampton: 40,107 rooms (2.9%)

5. Hilton Garden Inn: 37,523 rooms (2.8%)

Courtyard by Marriott, with 2.6% of the global

pipeline, is another brand heavyweight.

That Holiday Inn Express and Holiday

Inn occupy such high spots on that list is

no surprise, according to Joel Eisemann,

HIGHLIGHTS

Holiday Inn Express has the most rooms open and

under contract.

The rooms with the largest share of the pipeline

primarily fall in the focused-service segment.

Full-service brands typically lead expansion into

previously untapped regions.

CONTINUE READING ON PAGE 14

12

Sponsored by Hilton Worldwide

Photo: Holiday Inn Express Chicago Magnificent Mile

THE 2015 BIG BRANDS REPORT

13

14

WORKHORSE BRANDS

CONTINUED FROM PAGE 12

chief development officer

of the Americas with parent company InterContinental Hotels Group.

The company’s

development team

exhausts a lot of time and

energy to ensure their

continued growth, he said.

What’s more, there’s a

clear appetite for such midtier offerings from various

customer subsets, he said.

“One of our customers

is the developer. We

need to have brands

that resonate with the

developer and makes

sense from a development

perspective—that they’re

easy to build, that we’re

thinking about the cost

to build a hotel, and the

kind of return an owner

would get,” Eisemann

said. “And then of course

we spend a significant

amount of time thinking

about the traveler.”

A large segment of

those travelers are looking

for affordable, efficient,

no-fuss offerings that have

become the hallmark of the

limited-service segment.

Hampton Inn and Hilton

Garden Inn, like Holiday Inn

Express, are among several

standouts in that space.

With 198,848 rooms open,

Hampton is the fourth

largest brand in the world.

CONTINUE READING ON PAGE 15

14

Sponsored by Hilton Worldwide

WORKHORSE BRANDS

15

CONTINUED FROM PAGE 14

The popularity of

such brands makes their

absence conspicuous

in much of the

emerging world, where

burgeoning middle

classes are clamoring for

accommodations that

fit the brand landscape

and, more importantly,

their budgets, explained

Tony Capuano, executive

VP and global chief

development officer at

Marriott International.

In India, for instance,

the growing middle class

has led to “stratospheric

growth in the volume

of domestic business

travelers,” he said.

Courtyard could fit that

need; Marriott’s Fairfield Inn

and Suites even more so.

“Local partners see

growth of the domestic

business travel market,

and Fairfield is a perfect

fit for that,” he said. “It’s

the consumer trends that

start us down the path

of whether some of our

platforms have applications

in those countries.”

3.5%

Still focused on full service

The recent explosion of the

select-service segment,

particularly in North

America, belies the viability

of full-service expansion

CONTINUE READING ON PAGE 16

THE 2015 BIG BRANDS REPORT

15

16

WORKHORSE BRANDS

CONTINUED FROM PAGE 15

throughout previously

untapped regions such as

the Asia/Pacific, sources

said.

Break down Hilton

Worldwide Holdings’ total

pipeline by room count,

and the majority falls under

the likes of Hampton,

Hilton Garden Inn and

other select-service flags.

But if you analyze those

same projects by revenuegenerating potential, the

ratio flips in favor of full-

Photo: Hilton Istanbul Bosphorus

16

service, explained Ian

Carter, Hilton’s president of

development, architecture

and construction.

That promise of more

profitability has kept the

Hilton Hotels & Resorts iron

hot, he said. Case in point:

The brand has the second

most rooms under contract

of any tracked by STR.

But executing on fullservice growth can prove

challenging in mature

countries such as the U.S.,

where most major cities

are saturated with the

likes of Hilton, Marriott and

InterContinental flags.

“It is harder

for new

development.

That’s across

all the

various

brand

companies. You’re not

seeing as many new fullservice hotels being built

in the United States and

Canada,” Eisemann said.

That diverts expansion

plans elsewhere, primarily

to developing countries

where the first demand for

travel accommodation

typically materializes at the

higher end of the market.

Most of the rooms in the

Hilton Hotels brand portfolio

are slated for outside the

company’s domestic base

in the U.S., for example.

“From the investor

perspective, our

pipeline reflects a more

balanced derivation of

(earnings before interest,

taxes, depreciation

and amortization) by

geography,” Carter said.

“You’re not simply relying

on the U.S. being healthy

for profits in the longer

term. When all of that

pipeline is built out, a

lot more will be derived

from outside the U.S.”

Pursuing full-service

growth has another

advantage: It paves the

way for select-service

brands to follow.

Wyndham Hotel

Group follows that model,

establishing beachheads

with its Ramada Worldwide

and Wyndham Hotels

and Resorts brands.

CONTINUE READING ON PAGE 17

Sponsored by Hilton Worldwide

WORKHORSE BRANDS

17

CONTINUED FROM PAGE 16

“If we lead with

Ramada and Wyndham

and try to get a good

distribution of those

products, then we can

bring (Tryp by Wyndham)

or Wyndham Garden,”

said Bob Loewen, the

company’s COO.

Soft brands the next surge?

While not necessarily the

workhorses of their parent

companies’ respective

brand portfolios, soft

brands and collections will

continue to play a larger

role in expansions, sources

said.

“The opportunity

obviously is to establish

our international brands

(particularly in Europe),

but there’s also a massive

opportunity where we

partner with owners

with underperforming

assets. They have

classic hotels locally,

but they could benefit

from our commercial

engine,” Carter said.

That’s why Hilton in

2014 launched Curio –

A Collection by Hilton.

The umbrella lets owners

maintain the unique

characteristic and feel

of their hotels while

giving Hilton entry into

previously untapped

markets—with one-ofa-kind hotels to boot.

The fledgling Curio

counted five hotels at

press time. Much larger

in scale is Marriott’s

Autograph Collection,

which launched four years

ago and numbers 76

properties as of press time.

“We’re racing toward

100,” Capuano said. “It’s

been a really fascinating

platform for us.”

UP NEXT: SMALL BRANDS SEEK PROFIT WITHOUT COMMODITIZATION

China, along with India, Peru and

other non-U.S. markets are top

on the list of places Wyndham

Hotel Group President and CEO

Geoff Ballotti said the company

is targeting for expansion. Shown

here is Wyndham Super8 Xian

Xidajie-Xian, China

(Photo: Wyndham Hotel Group)

17

Small brands

seek profit

without

commoditization

By Stephanie Ricca, Editor-At-Large

HIGHLIGHTS

“Small-but-mighty” brands define growth

beyond net room count.

Each new brand location must offer an ROI

to owners.

Benefits to remaining small include flexibility

and better control over reputation

management.

Photo: The Ace Hotel London Shoreditch

18

G

LOBAL REPORT—“Bigger” doesn’t always

have to lead to “biggest” when it comes

to a hotel franchise company’s global

footprint. But while total world domination

in guestroom numbers isn’t necessarily

every hotel brand’s goal, successful smaller

companies know what factors comprise their

definition of “growth” and they stick to them.

Of the 991 hotel chains in STR’s latest

census report, 86% have fewer than 10,000

guestrooms in their global portfolio. More than

half (55%) of the hotel chains on the list have

fewer than 2,000 guestrooms in their global

portfolio. Crunch the numbers, and it’s clear

the majority of hotel chain parent companies

are not among the elite few that will reach the

1-million-guestroom mark anytime soon.

For those companies, growth is not

measured strictly by net room count, but

rather through a more holistic approach

CONTINUE READING ON PAGE 19

Sponsored by Hilton Worldwide

SMALL BRANDS

19

CONTINUED FROM PAGE 18

that often gives more

importance to factors such

as return on investment

and control over brand

reputation at all levels.

Those companies that

fit more into the “smallbut-mighty” category

are finding that today’s

hotel development and

operating environment

is one that can support

different growth models.

in a measured way that

offers economies of scale

but that keeps within the

parent company’s reach.

Some companies

“may aspire to the

growth of Starbucks,”

said RLHC Senior VP and

Chief Franchise Officer

Brian Quinn, “but in that

pursuit it’s easy to tip

over to commoditization

that detracts from

your core product.”

Gaining critical mass

played a big role in the

expansion of the Californiabred Joie de Vivre boutique

hotel brand, which earlier

this year made the leap

CONTINUE READING ON PAGE 20

Pipeline matters

Make no mistake, however:

Size does matter. One of

the challenges smaller

companies have is

reaching critical mass

quickly, particularly with

new brand launches.

Red Lion Hotels

Corporation, which

launched lifestyle brand

Hotel RL last year, definitely

has unit growth as part of

its goal. CEO Greg Mount

set a short-term goal of 100

additional hotels across

the company’s entire

brand portfolio (which

currently stands at 55 hotels

open) within 100 weeks.

Is the company on

track to make this 100week goal a reality? “We’ll

lift up and do whatever

we have to do to make

this happen,” Mount said

recently. “We’re already

ahead of pace this year.”

Red Lion executives

know that for them,

growth must happen, but

THE 2015 BIG BRANDS REPORT

Properties open: 55

Guestrooms open: 12,122

As of 1 March 2015

Properties open: 24

Guestrooms open: 3,478

As of 1 March 2015

19

20

SMALL BRANDS

CONTINUED FROM PAGE 19

to the East Coast for the

first time, announcing two

New York City hotels and

one in Miami Beach.

That step, which will

bring the brand to 29

properties, is part of a

controlled growth strategy,

according to JDV parent

company Commune

Hotels + Resorts’ CEO Niki

Leondakis. Commune is

the parent company of

JDV, Thompson Hotels, Alila

and Tommie—all lifestyle-

Leondakis said. “We

learned that our customer

would stay at JDV hotels

and they were looking for

them, but they weren’t

there so they had to make

alternate choices.”

Leondakis said

controlled growth is the

guiding force that helps

the company balance

where its guests want to

be with the company’s

focus on keeping

every development

worry about excessive

encroachment or overlap.

“Because we are

relatively small, we don’t

have to try to have six

Fairmonts in London,”

said Martin Kandrac,

executive VP of real

estate & development

for FRHI Hotels & Resorts

(parent company for the

Fairmont, Raffles and

Swissôtel brands). “That’s

the Starbucks model.

We generally have one

“In every meeting we sit down in, we’re talking about

our ability to keep things simple, our ability to be

nimble and our ability to innovate.”

Red Lion Hotels Corporation’s Greg Mount on the flexibility inherent in being a smaller brand.

centric boutique brands.

When Commune

formed in 2011, its

core brands were split

geographically—JDV

on the U.S. West Coast

and Thompson Hotels in

the East. JDV’s growth

plan came about as the

company learned its

core guests were looking

for properties where

they traveled and not

always finding them.

“JDV guests are about

lifestyle and attitude,”

20

and hotel unique.

“We’re focused on

development where our

guests travel and want us

to be … but we want to

be in markets that make

sense for us,” she said.

“We have opportunities

to go a lot of places that

don’t make sense for us

and we turn them down.”

While growth is on

the agenda for smaller

brands, most see it as

advantageous that their

owners don’t need to

property in each market,

maybe two if there are

distinct submarkets.”

Return on investment

Many such “small-butmighty” hotel brands

credit success to their

commitment to growing

within their means.

“It’s also about making

sure the economics (of

opening a hotel) are right

for the owners,” RLHC’s

CONTINUE READING ON PAGE 21

Sponsored by Hilton Worldwide

SMALL BRANDS

21

CONTINUED FROM PAGE 20

Mount said. That means

focusing on the terms of

franchise deals “so we

recognize it’s a real estate

deal for (our owners) and

they need to monetize it.”

With the hotel industry

cycle (particularly in

the U.S.) at a point that

favors transactions,

owners are tuned in to

the value brands bring to

the table, but they don’t

follow brands blindly if

they don’t believe the

“There’s no value in

having an association

with a large brand if they

can’t execute well.”

Brad Wilson, president

of the seven-property

Ace Hotel brand, said the

company (which is based

in Portland, Oregon, and

New York City) couldn’t

grow without a clear

model in place—even if

that growth is measured.

“Ours is very much

an independent business

Group),” he said. “We don’t

need to be the world’s

largest hotel company. It’s

not in our master plan.”

The financing picture

One benefit to being small

at this point in the hotel

cycle is that financiers

are more knowledgeable

and open to striking

deals outside “the big 10”

franchisor companies than

ever before, sources said.

“We’re not trying to put the most dots on the map. We

want the best places. It’s not a race to meet a quota;

we’re not trying to be the biggest brand out there.”

Commune Hotels + Resorts’ Niki Leondakis on controlled growth.

affiliation is a good one.

“We’re involved

with the brands we’re

with because they can

execute the business,

as simple as that,” said

Gerry Chase, president

and COO of New Castle

Hotels and Resorts, an

ownership, management

and development

company with a mix of 25

branded and independent

hotels comprising 4,388

guestrooms in its portfolio.

unit model, and we have

a very strong structure (in)

reservations and revenue

management,” Wilson said.

“It’s a solid structure

that we’ve developed over

the last couple of years

to manage our hotels.”

He said the company

is equipped to manage

from 15 to 20 hotels,

not 1,500 or 2,000.

“We don’t

have a desire to be

(InterContinental Hotels

“The lending

community has absolutely

become more receptive

to our segment, which has

made a big difference,”

Leondakis said. “The

development community

too has migrated to

(smaller boutique brands)

because they see the

flexibility and they see

how we can manage

through downturns and

do the right thing for each

individual situation.”

CONTINUE READING ON PAGE 22

THE 2015 BIG BRANDS REPORT

21

22

SMALL BRANDS

CONTINUED FROM PAGE 21

Control over reputation, systems

At the end of the day,

factors such as reputation

control and the ability to

be flexible when it comes

to implementing change

rank at the top of the list for

executives of smaller hotel

brands.

“We’re not trying to put

the most dots on the map,”

Leondakis said. “We want

the best places. It’s not

a race to meet a quota;

we’re not trying to be the

biggest brand out there.”

The boutique nature

of JDV is the driving force

behind Leondakis’ words,

but the sentiment rings

true for non-boutique

small brands as well.

“In every meeting

we sit down in, we’re

talking about our ability

to keep things simple, our

ability to be nimble and

our ability to innovate,”

Mount said of RLHC. That

flexibility, he said, has

allowed the company

to control its internal

systems for everything from

revenue management to

point of sale—something

he said could never

happen quickly within a

large, legacy brand.

Properties open: 7

Guestrooms open: 1,058

As of 1 March 2015

Properties open: 113

Guestrooms open: 42,577

As of 1 January 2015

HNN’s Patrick Mayock

contributed to this report.

UP NEXT: BRAND LAUNCH TIMELINE

22

Sponsored by Hilton Worldwide

BRAND LAUNCH TIMELINE

This timeline shows some key global brands and their parent companies

that have been announced since Hotel News Now launched in 2008.

2008

HOTEL NEWS NOW LAUNCHES

(17 September 2008)

2009

HOME2 SUITES BY HILTON

(Hilton Worldwide Holdings) RADISSON BLU

(Carlson)

LEONARDO BOUTIQUE HOTEL

(Fattal Hotels)

LEONARDO ROYAL HOTEL

(Fattal Hotels)

AUTOGRAPH COLLECTION

(Marriott International)

Footnotes: This list is organized by when hotel brands were first announced to the industry; the list is not organized by opening date. This list is not

intended to be an exhaustive list of all global brand launches since 2008. Hotel News Now will maintain this list moving forward. If you would like to add

a brand to the timeline, please contact editor at large Stephanie Ricca at sricca@hotelnewsnow.com. Sources: STR, STR Global, company data.

23

2010

BEST WESTERN PLUS BEST WESTERN PREMIER

(Best Western International) (Best Western International)

VIVANTA BY TAJ B HOTELS

(The Indian Hotel Company) (B Hotels)

EDITION

(Marriott International)

VIRGIN HOTELS

(Virgin Group)

2011

LEMON TREE PREMIER NIGHT HOTELS

(Lemon Tree) (Hampshire Hotels & Resorts)

DREAM HOTELS

(Hampshire Hotels & Resorts)

IBIS BUDGET

IBIS STYLES (Accor)

(Accor)

SOFITEL SO

SOFITEL LEGEND (Accor)

(Accor)

HYATT HOUSE

(Hyatt Hotels Corporation)

24

PUBLIC

(Ian Schrager Hotel Company)

Footnotes: This list is organized by when hotel brands were first announced to the industry; the list is not organized by opening date. This list is not

intended to be an exhaustive list of all global brand launches since 2008. Hotel News Now will maintain this list moving forward. If you would like to add

a brand to the timeline, please contact editor at large Stephanie Ricca at sricca@hotelnewsnow.com. Sources: STR, STR Global, company data.

2012

REGENTA

(Royal Orchid) MEI JUE

(Accor)

EVEN HOTELS

(InterContinental Hotels Group)

HUALUXE HOTELS AND RESORTS

(InterContinental Hotels Group)

WANDA REIGN

(Wanda Hotels & Resorts) WANDA REALM

(Wanda Hotels & Resorts)

WANDA VISTA

(Wanda Hotels & Resorts) SONESTA ES SUITES

(Sonesta ES Suites)

2013

MOXY HOTELS

THE LEO HOTEL COLLECTION (Marriott International)

(Red Lion Hotels Corporation)

TOMMIE

(Commune Hotels and Resorts)

BEST WESTERN PLUS EXECUTIVE RESIDENCY

METROPOLO JINJIANG HOTELS (Best Western International)

(Jin Jiang Hotels)

HYATT ZIVA

(Hyatt Hotels Corporation)

HYATT ZILARA

(Hyatt Hotels Corporation)

DUSIT DEVARANA

(Dusit Thani Public Company Ltd)

Footnotes: This list is organized by when hotel brands were first announced to the industry; the list is not organized by opening date. This list is not

intended to be an exhaustive list of all global brand launches since 2008. Hotel News Now will maintain this list moving forward. If you would like to add

a brand to the timeline, please contact editor at large Stephanie Ricca at sricca@hotelnewsnow.com. Sources: STR, STR Global, company data.

25

2014 QUORVUS COLLECTION RADISSON RED

(Carlson) (Carlson)

CURIO - A COLLECTION BY HILTON NH COLLECTION

(Hilton Worldwide Holdings) (NH Hotels)

HOTEL JEN VENU

(Shangri-La International Hotel Management) (Jumeirah Group)

BW PREMIER COLLECTION

(Best Western International) VIB

(Best Western International)

CANOPY BY HILTON GRADUATE HOTELS

(Hilton Worldwide Holdings) (AJ Capital Partners)

HUB BY PREMIER INN

(Whitbread Hotel Company)

HOTEL RL

(Red Lion Hotels Corporation)

2015

AUGUSTUS HOTELS & RESORTS TIME HOTELS

(Hampshire Hotels & Resorts) (Hampshire Hotels & Resorts)

HYATT CENTRIC UNSCRIPTED HOTELS

(Hyatt Hotels Corporation) (Hampshire Hotels & Resorts)

PROPER HOTELS

(Proper Hospitality) CORDIS HOTELS AND RESORTS

(Langham Hospitality Group)

JAZ IN THE CITY

(Steigenberger Hotels and Resorts) OE COLLECTION

(Loews)

26

Footnotes: This list is organized by when hotel brands were first announced to the industry; the list is not organized by opening date. This list is not

intended to be an exhaustive list of all global brand launches since 2008. Hotel News Now will maintain this list moving forward. If you would like to add

a brand to the timeline, please contact editor at large Stephanie Ricca at sricca@hotelnewsnow.com. Sources: STR, STR Global, company data.

Family Tree: Global hotel companies and their brands

This family tree is organized by parent company and lists hotel brands

that had properties open as of 31 December 2014.

PARENT COMPANY

25Hours Hotels

7 Days Inn

A Victory Hotels

Abad Group

Abba

Abotel

Abou Nawas

Absolute Hotel Services Group

Absolute Hotel Services Group

Absolute Hotel Services Group

Accor

Accor

Accor

Accor

Accor

Accor

Accor

Accor

Accor

Accor

Accor

Accor

Accor

Accor

Accor

Accor

Accor

Accor

Accor

Accor

Accor

Ace Hotel Group

Achat Hotels

Acom Hotel

Acora Hotel And Wohnen

Adrian Hoteles

Affinia

Affordable Suites Of America

Aka

Al Diar

Aldemar

Alfa Hotels

Alila Hotels & Resorts

Allegro Resorts

Allia Hotels

Allia Hotels

Alp`Azur Hotels

Alpitour World Hotels & Resorts

Alt Hotels

Altis Hotel Group

Amaks Hotels & Resorts

Amanresorts International Pte Ltd

Amathus Beach Hotel

Amber Hotel

Amerian Hoteles

Amerian Hoteles

America`s Best Franchising

America`s Best Franchising

AmericInn

Ameron Hotel Collection

Amrath Hotels

Anantara

Anemon Hotels

Apa Hotel

Apex Hotels

Apollo Hotels & Resorts

Aqua Hospitality

Aqua Hospitality

Aqua Hospitality

Aranzazu Hoteles

Arcadia Hotels Af

Archipelago International

Archipelago International

Archipelago International

BRAND

25Hours Hotels

7 Days Inn

A Victory Hotels

Abad Hotels & Resorts

Abba

Abotel

Abou Nawas

Eastin

Eastin Easy

U Hotels & Resorts

Adagio City Aparthotel

All Seasonshotels

Caesar Park Hotels

Coralia

Etap Hotel

Grand Mercure

Hotel F1

Hotel Formule 1

Hotel Ibis

Ibis Budget

Ibis Styles

Libertel

Mercure Hotels

MGallery Hotel Collection

Novotel Hotels

Parthenon

Pullman

Quay

Sofitel Luxury Hotels

Suite Novotel

The Sebel

Ace Hotel Group

Achat Hotels

Acom Hotel

Acora Hotel And Wohnen

Adrian Hoteles

Affinia

Affordable Suites Of America

Aka

Al Diar

Aldemar

Alfa Hotels

Alila Hotels & Resorts

Allegro Resorts

Bristol Hotels

Plaza Inn Hotels

Alp`Azur Hotels

Alpitour World Hotels & Resorts

Alt Hotels

Altis Hotels Group

Amaks Hotels & Resorts

Amanresorts International Pte Ltd

Amathus Beach Hotel

Amber Hotel

Amerian Hoteles

Merit Hotels

America`s Best Suites

Budgetel

AmericInn

Ameron Hotel Collection

Amrath Hotels

Anantara

Anemon Hotels

Apa Hotel

Apex Hotels

Apollo Hotels & Resorts

Aqua Hotels & Resorts

Lite Hotel

Monogram Hotel Collection

Aranzazu Hoteles

Arcadia Hotels Af

Aston International

Fave Hotels

Kamuela Villas

THE 2015 BIG BRANDS REPORT

PARENT COMPANY

Archipelago International

Archipelago International

Arcona Hotels

Arcotel Hotels

Aristos Hotels

Arora

Aryaduta Hotel Group

As Hotels

Ascott Group

Ascott Group

Ascott Group

Ashok

Atahotels

Atlantic Hotels

Atton Hotels S.a.

Austria Trend Hotels & Resorts

Avari Hotels

Axel Hotels

Ayre Hoteles

Ayres Hotels

Azalai Hotels

Azimut

Azur Hotels & Resorts

B&B Hotels

Baglioni Hotels

Banyan Tree Holdings Limited

Banyan Tree Holdings Limited

B-Aparthotels

Barcelo Hotels & Resorts UK

Barcelo Hotels & Resorts UK

Barcelo Hotels & Resorts UK

Bastion Hotels

Bayview Intl Hotels & Resorts

Be Live Hotels

Be Live Hotels

Beijing Capital Tourism Co, Ltd

Beijing Capital Tourism Co, Ltd

Bella Vista Motel

Belmond Luxury Hotels

Berggruen Hotels

Berggruen Hotels

Berjaya Hotels & Resorts

Berkshire Rooms Serviced

Best Hotels

Best Western International

Best Western International

Best Western International

Beta Hotels

Blue Horizon Group

Blue Tree Hotels

Bluebay Resorts

Bluesun Hotels & Resorts

Boarders Inn & Suites

Bonsai Hotels

Boomerang Hotels

Boomerang Hotels

Boscolo Hotels

Boscolo Hotels

Boulders Inn & Suites

Bourbon Hotels & Resorts

Bridal Tea House Hotels

Bridgestreet Accommodations

Britannia Hotels

Brownsword Hotels

Budget Host

Budget Suites Of America

Cabot Lodge

Canad Inns

Candeo Hotels

Capella

Carlson

Carlson

Carlson

Carlson

BRAND

Neo Hotels

Quest Hotels

Arcona Hotels

Arcotel Hotels

Aristos Hotels

Arora

Aryaduta Hotel

As Hotels

Ascott

Citadines

Somerset Hotels

Ashok

Atahotels

Atlantic Hotels

Atton Hotel S.a.

Austria Trend Hotels & Resorts

Avari Hotels

Axel Hotels

Ayre

Ayres

Azalai Hotels

Azimut

Azur Hotels & Resorts

B&B Hotels

Baglioni Hotels

Angsana Hotels & Resorts

Banyan Tree

B-Aparthotels

Barcelo Comfort

Barcelo Hotels

Barcelo Premium

Bastion Hotels

Bayview Intl Hotels & Resorts

Be Live Hotel

Be Smart Hotel

Btg-Jianguo Hotels & Resorts

Shindom Inn

Bella Vista Motel

Belmond

Keys Hotels & Resorts

Keys Klub

Berjaya Hotels & Resorts

Berkshire Rooms Serviced

Best Hotels

Best Western

Best Western Plus

Best Western Premier

Beta Hotels

Blue Horizon Group

Blue Tree Hotels

Bluebay Resorts

Bluesun Hotels & Resorts

Boarders Inn & Suites

Bonsai Hotels

Guesthouse Inns

Settle Inn

B4 Hotels

Boscolo Hotels

Boulders Inn & Suites

Bourbon Hotels & Resorts

Bridal Tea House

Bridgestreet Accommodations

Britannia Hotels

Abode

Budget Host

Budget Suites Of America

Cabot Lodge

Canad Inns

Candeo Hotels

Capella

Art’otel

Country Inn & Suites

Park Inn

Park Plaza

27

PARENT COMPANY

Carlson

Carlson

Carlson

Carlton

Carlton Hotel Collection

Carris Hoteles

Casa Andina

Casa Andina

Casa Andina

Catalonia

Centara Hotels & Resorts

Centara Hotels & Resorts

Centara Hotels & Resorts

Centara Hotels & Resorts

Centerhotel

Centerstone Hotels

Centra Hotels & Resorts

Central Apartment Hotels

Centrum Hotels (Germany)

Chaaya

Chandris Hotels & Resorts

Chase Suites

Cheval Residence Group

Chi Hotels & Resorts

Chic & Basic

Choice Hotels International

Choice Hotels International

Choice Hotels International

Choice Hotels International

Choice Hotels International

Choice Hotels International

Choice Hotels International

Choice Hotels International

Choice Hotels International

Choice Hotels International

Choice Hotels International

Choice Hotels International

Choice Hotels International

Choice Hotels International

Choice Hotels International

Cinnamon

CitizenM Hotels

Citrus Hotels & Resorts

City Comfort Inn Group

City Express

City Express Grp

City Express Grp

City Inns

City Lodge Hotels Group

City Lodge Hotels Group

City Lodge Hotels Group

City Lodge Hotels Group

City Marque

Ciutat Hotels

Clarendon Serviced Apartments

Clarks Group Hotels

Classical

Club Magic Life

Club Med

Club Quarters

Clubhouse

Coast Hotels & Resorts

Coast Hotels & Resorts

Cobblestone Hotels

Columbus Hotels

Commundo Tagungshotels

Commune Hotels + Resorts

Commune Hotels + Resorts

Commune Hotels + Resorts

Compass Hospitality

Comwell

Concept Hospitality

Concept Hospitality

Confortel Hoteles

Constance Hotels

Cosmopolitan Hotels

Cotels Serviced Apartments

Country Garden Phoenix Hotels

Cresta Hotels

Crestwood Suites

Crown Hotels

Crystal Hotels

Crystal Inn

Cumulus

Dafam Hotels

28

BRAND

Quorvus Collection

Radisson

Radisson Blu

Carlton

Carlton Hotel Collection

Carris Hoteles

Casa Andina Classic

Casa Andina Private Collection

Casa Andina Select

Catalonia

Centara Boutique Collection

Centara Grand Hotels & Resorts

Centara Hotels & Resorts

Centara Residences & Suites

Centerhotel

Centerstone Hotels

Centra Hotels & Resorts

Central Apartment Hotels

Centrum Hotels (Germany)

Chaaya

Chandris Hotels & Resorts

Chase Suites

Cheval Residence Group

Corinthia

Chic & Basic

Ascend Collection

Cambria Suites

Clarion

Clarion Collection

Comfort

Comfort Inn

Comfort Suites

Econo Lodge

Mainstay Suites

Quality

Quality Hotel & Resort

Quality Inn

Rodeway Inn

Sleep Inn

Suburban Extended Stay Hotels

Cinnamon

CitizenM Hotels

Citrus Hotels & Resorts

City Comfort Inn

City Express

City Junior

City Suites

City Inn

City Lodge

Courtyard Hotel

Road Lodge

Town Lodge

City Marque

Ciutat Hotels

Clarendon

Clarks Group Hotel

Classical

Club Magic Life Af

Club Med

Club Quarters

Clubhouse

Coast Hotels & Resorts Canada

Coast Hotels & Resorts USA

Cobblestone Hotels

Columbus Hotels

Commundo Tagungshotels

Alila

Joie de Vivre

Thompson

Citrus Hotels

Comwell

Fern Residence

The Fern Hotels & Resorts

Confortel Hoteles

Constance Hotels

Cosmopolitan Hotels

Cotels Serviced Apartments

Country Garden Phoenix Hotel

Cresta Hotels

Crestwood Suites

Crown Hotel

Crystal Hotels

Crystal Inn

Cumulus

Dafam Hotels

PARENT COMPANY

BRAND

Dai-Ichi

Daiwa Royal Hotels

Daiwa Roynet Hotels

Dakota Hotels

Dan Hotels

Danubius Hotels Group Company

Danubius Hotels Group Company

De Vere Plc

De Vere Venues

Dedeman Hotels

Delfin Hotels

Delta Hotels

Derag Hotel And Living

Derby Hotels Collection

Diego De Almagro Hoteles

Disney Hotels

Divan

Divani Hotels

Dolan Hotels

Dolce Hotels

Domina Hotel

Dorchester Collection

Dorint Hotels & Resorts

Dormero Hotel

Dormy Inn

Downtowner Inns

Dreamhouse Serviced Apartments

Dreams Resorts & Spas

Drury Hotels

Drury Hotels

Drury Hotels

Drury Hotels

Drury Hotels

Drury Hotels

Dusit Thani Public Company Ltd

Dusit Thani Public Company Ltd

Dusit Thani Public Company Ltd

Dusit Thani Public Company Ltd

Duxton International

Dynasty Hotel Group

Dynasty Hotel Group

Dynasty Hotel Group

Easyhotel

Ehotel

Elba Hotels

Electra Palace Hotel

Elegant Hotels Group

Elite Hotels

Emaar Hospitality Group

Emaar Hospitality Group

Emaar Hospitality Group

Emaar Hospitality Group

ESA Serviced Apartments

Euroagentur Hotel

Eurohotel

Europa

Eurostars Hotel

Eurotel Hotels

Evenia Hotels

Evergreen

Exclusive Hotels

Extended Stay Hotels

Extended Stay Hotels

Extended Stay Hotels

E-Z 8

Fairbridge Hotels International

Fairbridge Hotels International

FRHI Hotels & Resorts

FRHI Hotels & Resorts

FRHI Hotels & Resorts

Family Inns Of America

Far East Consortium International

Far East Consortium International

Far East Consortium International

Far East Consortium International

Fen Hoteles

Fen Hoteles

Fenix Hospitality Sweden Ab

Fiesta Hotels

Firmdale Hotels

First

Fjb Hotels

Fletcher Hotels

Flexstay Hotel Management

Flexstay Hotel Management

Dai-Ichi

Daiwa Royal Hotels

Daiwa Roynet Hotels

Dakota Hotels

Dan Hotels

Danubius

Hungarhotels

Village Urban Resorts

De Vere Venues

Dedeman Hotels

Delfin Hotels

Delta Hotels

Derag Hotel And Living

Derby Hotels Collection

Diego De Almagro Hoteles

Disney Hotels

Divan

Divani Hotels

Dolan Hotels

Dolce Hotels & Resorts

Domina Hotel

Dorchester Collection

Dorint Hotels & Resorts

Dormero Hotel

Dormy Inn

Downtowner Inns

Dreamhouse Serviced Apartment

Dreams Resorts & Spas

Drury Inn

Drury Inn & Suites

Drury Lodge

Drury Plaza Hotel

Drury Suites

Pear Tree Inn

Dusit Devarana

Dusit Princess

Dusitd2

The Dusit Thani Group

Duxton International

Citylife Hotels

Dynasty Hotels

Heritage

Easyhotel

Ehotel

Elba Hotels

Electra Palace Hotel

Elegant Hotels Group

Elite Hotels

Armani Hotels & Resorts

Nuran Serviced Residences

The Address Hotels & Resorts

Vida Hotels & Resorts

ESA Serviced Apartments

Euroagentur Hotel

Eurohotel

Europa

Eurostars Hotel

Eurotel Hotels

Evenia Hotels

Evergreen

Exclusive Hotels

Crossland Suites

Extended Stay America

Extended Stay Deluxe

E-Z 8

Fairbridge Inn

Loyalty Inn

Fairmont Hotels & Resorts

Raffles

Swissotel

Family Inns Of America

D Collection

Dorsett

Grand Dorsett

Silka Hotels

Dazzler Hotels

Esplendor Hotels

Sweden Hotels

Fiesta Hotels

Firmdale Hotels

First

Fjb Hotels

Fletcher Hotels

Flexstay Inn

Hotel Mystays

Sponsored by Hilton Worldwide

PARENT COMPANY

Floris

Fosshotel

Fountain Court Apartments

Four Pillars Hotels

Four Seasons Hotels & Resorts

Fragrance Hotels

Franklyn Hotels & Resorts

Frantour

Frasers Hospitality

Fresh Hotels

Fujiya Hotels

Fullon Hotels

Furama Hotels

Fx Hotels Group

G S M Hoteles

G6 Hospitality

G6 Hospitality

Garden Inns

Garden Palace Hotels

Gems Of Barbados

Ghl Hoteles

Ghl Hoteles

Gloria

Go Native Apartments

Good Inn Hotels

Good Nite Inn

Grace Inns

Grand America Hotels & Resort

Grand Hotel Management Group

Grand Hotel Management Group

Grand Hotels International

Grand Hotels International

Grand Hotels International

Grand Metropark

Grandstay Hospitality

Grandstay Hospitality

Grange Hotels

Granvia

Great Western

Great Wolf Lodge

Greene King Inns

Greene King Inns

Greentree Inns

Gresham Hotels

Groupe Du Louvre

Groupe Du Louvre

Groupe Du Louvre

Groupe Du Louvre

Groupe Du Louvre

Groupe Du Louvre

Groupe Du Louvre

Groupe Du Louvre

Groupe Envergure

Groupe Menguy Investissements

Grupo Empresarial Angeles

Grupo Empresarial Angeles

Grupo Empresarial Angeles

Grupo Posadas Grp

Grupo Posadas Grp

Grupo Posadas Grp

Grupo Posadas Grp

Grupo Sol Melia

Grupo Sol Melia

Grupo Sol Melia

Grupo Sol Melia

Grupo Sol Melia

Grupo Sol Melia

Grupo Sol Melia

Grupotel

Gunnewig Hotels

Guoman Hotels Ltd

Guoman Hotels Ltd

H10 Hotels

Habtoor

Habtoor

Hallmark Hotels

Hampshire Hospitality

Hampshire Hospitality

Hampshire Hospitality

Hampshire Hotels & Resorts

Hampshire Hotels & Resorts

Hand Picked

Hankyu Hotel

Hanover International

Harbour Plaza Hotels & Resorts

BRAND

Floris

Fosshotel

Fountain Court Apartment

Four Pillars Hotels

Four Seasons

Fragrance Hotels Af

Franklyn Hotels & Resorts

Frantour

Frasers Hospitality

Fresh Hotels

Fujiya Hotels

Fullon Hotels

Furama Hotels

Fx Hotels Group

G S M Hoteles

Motel 6

Studio 6

Garden Inns

Garden Palace Hotel

Gems Of Barbados

Ghl

Ghl Comfort

Gloria

Go Native Apartments

Good Inn Hotel

Good Nite Inn

Grace Inn

Grand America Hotels & Resort

Grand Hotel

Leeden Hotel

Hotel Grand Central

Hotel Grand Chancellor Hotels

Hotel Grand Continental

Grand Metropark

Crossings By Grandstay

Grandstay Residential Suites

Grange Hotels

Granvia

Great Western

Great Wolf Lodge

Greene King Inn

Old English Inn

Greentree Inns

Gresham Hotels

Campanile Hotel

Concorde Hotels

Golden Tulip

Hotel Premiere Classe

Kyriad

Kyriad Prestige

Royal Tulip Hotels

Tulip Inn Hotel

Hotel Clarine

Appart’city

Camino Real

Quinta Real

Real Inn

Fiesta Americana

Fiesta Inn

Live Aqua

One Hotels

Gran Melia

Innside By Melia

Me

Melia

Melia Boutique

Paradisus Resorts

Sol

Grupotel

Gunnewig Hotels

Guoman

Thistle Hotels

H10 Hotels

Habtoor Grand

Metropolitan

Hallmark Hotels

Hampshire Hotels

Hampshire Classic

Hampshire Eden

Dream Hotels

Night Hotels

Hand Picked

Hankyu Hotel

Hanover International

Harbour Plaza Hotels & Resorts

THE 2015 BIG BRANDS REPORT

PARENT COMPANY

Hard Rock

Hastings Hotels

Hatton Hotels

Hayley Conference Centres

Hcc Hotels

Heartland Hotels

Heliopark

Helnan Hotels

Hengda Hotel Management Group

Hi! Hotels International

High Tech Hotels & Resorts

Hilton Worldwide Holdings

Hilton Worldwide Holdings

Hilton Worldwide Holdings

Hilton Worldwide Holdings

Hilton Worldwide Holdings

Hilton Worldwide Holdings

Hilton Worldwide Holdings

Hilton Worldwide Holdings

Hilton Worldwide Holdings

Hilton Worldwide Holdings

Hilton Worldwide Holdings

Hilton Worldwide Holdings

Hilton Worldwide Holdings

Hipotels

Hmg Hotel Management

Hmi Hotel Group

Hna Int’t Hotels

Hna Int’t Hotels

Hna Int’t Hotels

Hna Int’t Hotels

Holiday Star Hotels

Home Inns

Home Inns

Home Inns

Home Inns

Homegate

Home-Towne Suites

Hospes Hotels

Hospitality Management Holdings

Hospitality Management Holdings

Hospitality Management Holdings

Hoteis Othon

Hoteis Slaviero

Hotel 81 Management

Hotel Alpha-One

Hotel Az

Hotel Des Gouverneurs

Hotel Edda

Hotel Equatorial

Hotel Guldsmeden

Hotel Husa

Hotel Keihan

Hotel Monterey

Hotel Occidental

Hotel Rh

Hotel Tokyu Bizfort

Hotel Trusty

Hotel Wing International

Hoteles Estelar

Hoteles H2

Hoteles Serena

Hoteles Vista

Hotels & Compagnie

Hotels & Compagnie

Hotetur

Huazhu Hotels Group

Huazhu Hotels Group

Huazhu Hotels Group

Hunguest

Hyatt

Hyatt

Hyatt

Hyatt

Hyatt

Hyatt

Iberostar Hotels & Resorts

Iberostar Hotels & Resorts

Iberostar Hotels & Resorts

Ic Hotels

Idea Hotels

Imperial

Imperial Hotels Group

Impiana Hotels Resorts & Spas

Innkeeper`s Lodge

BRAND

Hard Rock

Hastings Hotels

Hatton Hotels

Hayley Conference Centres

Hcc Hotels

Heartland Hotels

Heliopark

Helnan Hotels

Hengda Hotels & Resorts

Hi! Hotels

Petit Palace Hotels

Conrad

Curio - A Collection by Hilton

Doubletree

Doubletree Club

Embassy Suites

Hampton Inn

Hampton Inn & Suites

Hilton

Hilton Garden Inn

Hilton Grand Vacations

Home2 Suites By Hilton

Homewood Suites

Waldorf Astoria

Hipotels

Fleming`S Hotels & Restaurant

Hotel Pearl City

Hna Business Hotel

Hna Express Inn

Hna Grand Hotel

Tangla Hotels

Holiday Star Hotel

Home Inn

Motel 168

Motel 268

Yotel Qq

Homegate

Home-Towne Suites

Hospes Hotels

Coral Hotels & Resorts

Corp Executive Hotels

Ewa Hotel Apartments

Hoteis Othon

Hoteis Slaviero

Hotel 81

Hotel Alpha-One

Hotel Az

Hotel Des Gouverneurs

Hotel Edda

Hotel Equatorial

Hotel Guldsmeden

Hotel Husa

Hotel Keihan

Hotel Monterey

Hotel Occidental

Hotel Rh

Hotel Tokyu Bizfort

Hotel Trusty

Hotel Wing International

Hoteles Estelar

Hoteles H2

Hoteles Serena

Hoteles Vista

Balladins

Hotel Climat

Hotetur

Hanting

Ji Hotels

Starway

Hunguest

Andaz

Grand Hyatt

Hyatt

Hyatt House

Hyatt Place

Park Hyatt

Iberostar Grand

Iberostar Hotels & Resorts

Ole Hotels

Ic Hotels

Idea Hotels

Imperial

Imperial Hotels Group

Impiana Hotels Resorts & Spas

Innkeeper`s Lodge

29

PARENT COMPANY

Innsuites Hotels

Intercity Hotel Group

InterContinental Hotels Group

InterContinental Hotels Group

InterContinental Hotels Group

InterContinental Hotels Group

InterContinental Hotels Group

InterContinental Hotels Group

InterContinental Hotels Group

InterContinental Hotels Group

InterContinental Hotels Group

InterContinental Hotels Group

InterContinental Hotels Group

InterContinental Hotels Group

InterContinental Hotels Group

Intown Suites

Isle Of Capri

Isrotel Ltd

Itc-Welcomgroup

Itc-Welcomgroup

Itc-Welcomgroup

Itc-Welcomgroup

Itc-Welcomgroup

Itc-Welcomgroup

Itc-Welcomgroup

Jal Hotels Company

Jal Hotels Company

Jardin

Jaz

Jebel Ali

Jinjiang Holding

Jinjiang Holding

Jinjiang Holding

Jinjiang Holding

Jinjiang Holding

Jinjiang Holding

Jinling Group

Jinling Group

Jolly Hotels

Jr Kyushu Hotel Group

Jr Kyushu Hotel Group

Jumeirah

Jurys Inns

K+K Hotel

Kagum Hotels

Kamat Hotels India

Kamat Hotels India

Keio Presso Inn

Kempinski Hotels

Kenzi Hotels Group

Kerzner International

Key West Inns Company

Kibbutz Hotels

Kimpton Hotels

Kipriotis Hotels

Kris Hoteles

KSL Capital Partners

KSL Capital Partners

Lakeview Distinctive Hotels

Landidyll Hotel

Langham Hospitality Group

Langham Hospitality Group

Langham Hospitality Group

Lapland Hotels

Larkspur

Legacy Hotels

Legacy Hotels Uk

Legacy Vacation Club

Lemon Hotels

Lemon Tree

Lemon Tree

Lemon Tree

Leonardo Hotels

Leonardo Hotels

Leonardo Hotels

Lifeclass Hotels & Resorts

Lindner Hotels, Inc

Loews Hotels Company

Lords Inn Hotels & Developers Ltd.

Lotte Hotels & Resorts

Lotus

Louis Hotels

Lq Management Llc

Lungarno Hotels

Lux*

30

BRAND

Innsuites Hotels

Intercity Hotel Group

Ana

Candlewood Suites

Crowne Plaza

Even Hotels

Holiday Inn

Holiday Inn Express Hotel

Holiday Inn Garden Court

Holiday Inn Select

Hotel Indigo

InterContinental Hotels & Resorts

Kimpton Hotels & Restaurants

Staybridge Suites

Sunspree Resorts

Intown Suites

Isle Of Capri

Isrotel

Fortune Inn

Fortune Park

Fortune Resorts

Fortune Select

Itc

My Fortune

Welcomheritage

Hotel Jal City

Hotel Nikko

Jardin

Jaz

Ja

Bestay Hotel Express

Goldmet Inn

Jin Jiang Hotel

Jinjiang Inns

Magnolia Hotels

Metropolo Jinjiang Hotels

Jin`s Inn

Jinling

Jolly Hotels

Hotel Mets

Jr Kyushu Hotel Group

Jumeirah

Jurys Inns

K+K Hotel

Kagum Hotel

Lotus Resorts

Vits

Keio Presso Inn

Kempinski Hotels

Kenzi Hotel

One & Only Resorts

Key West Inn

Kibbutz Hotels

Kimpton

Kipriotis Hotels

Kris Hoteles

Hotel Du Vin

Malmaison

Lakeview Distinctive Hotels

Landidyll Hotel

Eaton Hotels

Langham Place Hotels and Resorts

The Langham Hotels and Resorts

Lapland Hotels

Larkspur Landing

Legacy Hotels

Legacy Hotels Uk

Legacy Vacation Club

Lemon Hotel

Lemon Tree Hotel

Lemon Tree Premier

Red Fox Hotels

Leonardo Boutique Hotels

Leonardo Hotels

Leonardo Royal Hotels

Lifeclass Hotels & Resorts

Lindner Hotels, Inc

Loews

Lords Inn Hotels & Developers Ltd.

Lotte Hotels & Resorts

Lotus

Louis Hotels

La Quinta Inns & Suites

Lungarno Hotels

Lux*

PARENT COMPANY

BRAND

Luxemon Hotels & Resorts

Luxemon Hotels & Resorts

Lynch Hotels

Macdonald Hotels & Resorts

Maeva

Maistra

Maldron Hotels

Mamaison

Mandarin Oriental Hotel Group

Manorview Hotels

Manotel

Mantra Hotels Group

Mantra Hotels Group

Mantra Hotels Group

Mapple Hotels

Marco Polo Group

Maritim

Marlin Apartments

Marriott International

Marriott International

Marriott International

Marriott International

Marriott International

Marriott International

Marriott International

Marriott International

Marriott International

Marriott International

Marriott International

Marriott International

Marriott International

Marriott International

Marriott International

Marriott International

Marriott International

Marriott International

Marriott International

Marti

Martin`s Hotels

Master Hosts Inns

Masters Inn

Max Hotels & Resorts

Mbi International

Mbi International

Mbi International

Meininger Hotels

Menzies Hotel

Meriton Serviced Apartments

Meritus Hotels & Resorts

Merlin

Metro

Metropark

Millennium & Copthorne Global

Millennium & Copthorne Global

Millennium & Copthorne Global

Mint Hotels & Apartments

Mister Bed Hotels

Mitsis

Mitsui Garden Hotels

Miyako Hotels

Movenpick Hotels & Resorts

Montage Hotels

Monte Carlo Inns

Moran Hotels

Moran Hotels

Motel One

Mutiara Hotels & Resorts

My One Hotel

Myhotel Hotels

N H Hotels

N H Hotels

N H Hotels

Nanyuan Inns

National 9

Nestor Hotel

Nevsky Hotels Group

New Century Hotels

New Century Hotels

New Century Hotels

New Hotel

New Otani Hotels

New World Hotel Group

New World Hotel Group

Nishitetsu Inn

Norlandia

Excemon

Luxemon

Lynch Hotels

Macdonald Hotels

Maeva

Maistra

Maldron Hotels

Mamaison

Mandarin Oriental Hotel Group

Manorview Hotels

Manotel

Breakfree Resort

Mantra

Peppers Hotels

Mapple Hotels

Marco Polo

Maritim

Marlin Apartments

AC Hotels By Marriott

African Pride

Autograph Collection

Bulgari Hotels

Courtyard

Edition

Fairfield Inn & Suites

Gaylord Entertainment

JW Marriott

Marriott Hotels

Marriott Conference Center

Marriott Executive Apartments

Moxy Hotels

Protea Hotels

Renaissance Hotels

Residence Inn

Ritz-Carlton

Springhill Suites

Towneplace Suites

Marti

Martin`s Hotels

Master Hosts Inns

Masters Inn

Max Hotels & Resorts

Amarante Hotels & Resorts

Hotel Stars

Median Hotels

Meininger Hotels

Menzies Hotel

Meriton Serviced Apartments

Meritus Hotels & Resorts

Merlin

Metro

Metropark

Copthorne Hotels

Kingsgate Hotels

Millennium Hotels

Mint Hotels & Apartments

Mister Bed Hotels

Mitsis

Mitsui Garden Hotel

Miyako Hotels

Movenpick Hotels & Resorts

Montage Hotels

Monte Carlo Inns

Bewley’s Hotels

Moran Hotel

Motel One

Mutiara Hotels & Resorts

My One Hotel

Myhotel Hotels

Hesperia Hoteles

N H Express

N H Hotels

Nanyuan Inn

National 9

Nestor Hotel

Nevsky Hotels

New Century Grand Hotel

New Century Hotel

New Century Resort

New Hotel

New Otani Hotels

New World

Rosewood

Nishitetsu Inn

Norlandia

Sponsored by Hilton Worldwide

PARENT COMPANY

Northland

Nova Hotels

Novum Group

Now Resorts & Spas

Nylo Hotels

O`Callaghan Hotels

Oak Tree Inn

Oakford Hotels

Oaks Hotels & Resorts

Oakwood Worldwide

Oakwood Worldwide

Oakwood Worldwide

Oberoi

Oberoi

Oceania

Okura Hotels & Resorts

Olav Thon Grp

Omena Hotels

Omni Hotels & Resorts

Omni Hotels & Resorts

Onomo Hotel

Onyx Hospitality

Onyx Hospitality

Onyx Hospitality

Onyx Hospitality

Orea Hotel

Oro Verde Hotels

Outrigger Hotels Company

Outrigger Hotels Company

Ovolo Group Limited

Oxford Hotels & Inns

P`Tit Dej Hotel

Palace Inns

Palace Resorts

Palladium Hotels

Pan Pacific Hotel Group

Pan Pacific Hotel Group

Paradise Hotels

Paradores

Parc Hotels & Resorts

Parkland Hotels & Resorts

Passport Inns

Pearl Continental Hotels

Penta

Pestana

Phoenix Inn

Piao Home Inn

Prayag Hotels & Resorts

Premier Apartments Uk

Premier International Ltd

Premier International Ltd

Prince Hotels & Resorts

Prince Hotels & Resorts

Prince Hotels & Resorts

Princess

Principal Hayley

Prodomo

Punthill

Qualys Hotel

Quantum Hotel Group

Qubus Hotels

Quest Serviced Apartments

Rantasipi

Real De Minas

Red Carnation

Red Carpet Inns

Red Lion Hotels Company

Red Roof Inns

Red Roof Inns

Regal & Corus Hotels

Regal Hotels International

Regalia Hotel

Regardz

Regent Hotels

Reikartz Hotels & Resorts

Relexa Hotels

Resol Hotel & Resort

Resortquest Hawaii Grp

Resta

Rica Hotels

Richmond Hotels

Rimonim Hotels & Resorts

Ringhotels

Riu Hotels & Resorts

Riu Hotels & Resorts

BRAND

Sandman Hotels & Inns

Nova Hotels

Novum Group

Now Resorts & Spas

Nylo Hotel

O`Callaghan Hotels

Oak Tree Inn

Oakford Hotels

Oaks Hotels & Resorts

Oakwood Apartments

Oakwood Premier

Oakwood Residence

Oberoi Hotels

Trident Hotel

Oceania

Okura Hotels

Thon Hotels

Omena Hotels

Mokara

Omni

Onomo Hotel

Amari

Ozo

Shama

The Mosaic Collection

Orea Hotel

Oro Verde Hotels

Ohana Hotels

Outrigger

Ovolo Group Limited

Oxford Hotels & Inns

P`Tit Dej Hotel

Palace Inn

Palace Resorts

Palladium Hotels

Pan Pacific Hotel Group

Parkroyal

Paradise Hotels

Paradores

Parc Hotels

Parkland Hotels & Resorts

Passport Inns

Pearl Continental Hotels

Penta

Pestana

Phoenix Inn

Piao Home Inn

Prayag Hotels & Resorts

Premier Apartments Uk

Accord Hotels

Premier Hotels

Grand Prince Hotel

Prince Hotels

The Prince

Princess

PH Hotels

Prodomo

Punthill

Qualys Hotel

Quantum Hotel Group

Qubus Hotels

Quest Serviced Apartments

Rantasipi

Real De Minas

Red Carnation

Red Carpet Inns

Red Lion

Red Roof Inn

Red Roof Plus

Corus Hotels

Regal Hotels International

Regalia Hotel

Regardz

Regent Hotels

Reikartz Hotels & Resorts

Relexa Hotels

Resol Hotel & Resort

Aston Hotels

Resta

Rica Hotels

Richmond Hotels

Rimonim Hotels & Resorts

Ringhotels

Luca Hotels & Resorts

Riu Hotel

THE 2015 BIG BRANDS REPORT

PARENT COMPANY

Rixos

Road Star Inn

Roc Hotels

Rochester Hotels