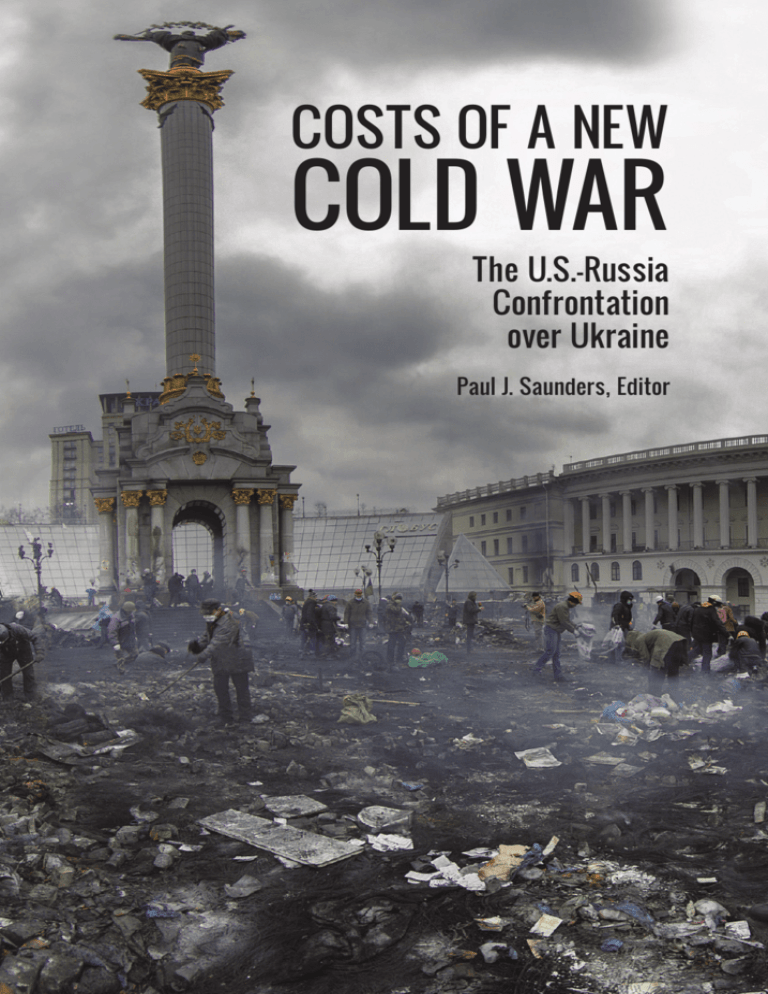

COSTS OF A NEW

COLD WAR

The U.S.-Russia

Confrontation

over Ukraine

Paul J. Saunders, Editor

COSTS OF A NEW COLD WAR:

THE U.S. RUSSIA CONFRONTATION OVER

UKRAINE

Paul J. Saunders, Editor

September 2014

CENTER FOR THE NATIONAL INTEREST

The Center for the National Interest is a non-partisan public policy institution

established by former President Richard Nixon in 1994. Its current programs

focus on American national security, energy security and climate change,

Iran’s nuclear program, maritime security, and U.S. relations with China, Japan,

Europe, and Russia. The Center also publishes the bimonthly foreign affairs

magazine The National Interest. The Center is supported by foundation,

corporate and individual donors as well as by an endowment.

Copyright 2014 Center for the National Interest. All Rights Reserved.

Costs of a New Cold War: The U.S.-Russia Confrontation over Ukraine

Paul J. Saunders, Editor

Center for the National Interest

1025 Connecticut Avenue, NW, Suite 1200

Washington, DC 20036

Phone: (202) 887-1000

E-mail: info@cftni.org

www.cftni.org

TABLE OF CONTENTS

OVERVIEW: TOWARD A NEW COLD WAR?

1

RUSSIA’S ASYMMETRICAL RESPONSE:

GLOBAL AIKIDO

9

THE DANGERS OF A NEW CONTAINMENT

POLICY FOR RUSSIA

25

TARGETED SANCTIONS WITH AN UNCLEAR

TARGET

39

RUSSIA, UKRAINE, AND U.S. ECONOMIC

POLICY

51

By Paul J. Saunders

By Fyodor Lukyanov

By Thomas Graham

By Igor Yurgens

By Blake Marshall

TOWARD A NEW COLD WAR?

BY PAUL J. SAUNDERS

Relations between the United States and Russia have steadily deteriorated

since the collapse of Viktor Yanukovych’s presidency and Russia’s

subsequent annexation of Crimea and support for separatist rebels in eastern

Ukraine. After just a few months, the ties between Washington and Moscow

have unraveled remarkably rapidly, reaching a level of tension unprecedented

since Russia’s independence in 1992. And the crisis continues to get worse—

on an almost daily basis. This leads to two important questions. First, how

bad can the U.S.-Russia relationship get? More significantly, what could be

the consequences of this deterioration for U.S. vital interests?

Relations between Washington and Moscow are arguably already worse than

U.S.-Soviet/Russian relations at any time since 1986, when Ronald Reagan

and Mikhail Gorbachev established the practice of wary but constructive

cooperation that steadily improved during Reagan’s remaining years in office

and throughout the George H.W. Bush administration. Moreover, mutual

expectations between 1986 and 1992 were cautious yet positive, while today

they are cynical and negative. How long will it take for both sides to begin

acting and talking as if it were 1984 rather than 2014? The clock hands seem

to be spinning backwards.

U.S.-Russian and European-Russian differences over Ukraine are clearly

driving this process, though the Ukraine crisis followed years of growing

frustration on all sides. At the time of this writing, the United Nations

estimates that the death toll in the ongoing fighting in eastern Ukraine has

recently doubled within two weeks’ time, to over 2,600, with more than 6,000

wounded.1 Although Ukrainian government forces appeared increasingly

successful on the battlefield during much of August, the separatists reversed

this momentum at the end of the month, possibly with direct Russian

assistance. Though a shaky cease-fire is now in place, new fighting would

raise inevitable and appropriate questions about U.S. and NATO military aid

to Ukraine’s government.

Meanwhile, the United States and the European Union have announced

further economic sanctions on Russia in an apparent effort to strengthen

1John

Revill, “Civilian Death Toll in Ukraine Rising, U.N. Report,” The Wall Street Journal,

August 29, 2014, http://online.wsj.com/articles/civilian-death-toll-in-ukraine-rising-u-nreport-says-1409299965

Saunders

Kiev’s weak hand in talks. For its part, Moscow has threatened a variety of

retaliatory measures. President Vladimir Putin has also announced a major

restructuring of Russia’s military-industrial complex—taking personal

charge—and called for widespread modernization of Russia’s military.2 Even

with talks underway between Ukraine’s government and rebels, the United

States and Russia continue to escalate their actions and rhetoric.

While it is too soon to predict the course or outcome of the negotiations, the

rebels appear to be in a strong position (with Russia’s support) after

Ukraine’s acceptance of a cease-fire in place. If the conflict resumes, the

Kremlin need only avoid allowing Kiev to defeat the separatists; merely

sustaining the insurgency will be sufficient to enable Russia to achieve its

objective of forcing Ukraine’s government to provide greater autonomy to

the Russian-speakers in the country’s eastern and southern regions. Already

committed to expending $20 billion over the next five years to integrate

Crimea3—which it seized largely intact—with Russia proper, Moscow is

unlikely to seek annexation of a region devastated by civil war when it could

instead consolidate its influence there while ensuring that financial

responsibility for the territory and its residents remains with Kiev, Brussels,

and Washington. This would produce further incremental expansion of

Russian aid to the rebels (rather than a large-scale invasion) and could lead to

a long and grinding conflict in Ukraine. At best, it could produce an enduring

stalemate with daily civilian casualties and dangerous possibilities for new

tragedies like the downing of Malaysian Airlines Flight 17.

Unfortunately, it would be a mistake to assume that a Ukrainian defeat of

rebel forces—which Moscow seems unwilling to permit—would obviate the

escalation danger. If the so-called People’s Republics in Donetsk and

Luhansk should collapse, a deeper crisis between the U.S. and Russia could

well follow. Most immediately, how would the Kiev government treat

defeated rebel leaders, soldiers, and sympathizers? Would Ukraine’s military

and police protect Russian-speaking civilians in eastern Ukraine from the

reprisals that are all-to-common after civil conflicts? What political

conditions would Ukraine’s government impose – and how would Moscow

react?

More broadly, how would the United States react to a Ukrainian military

victory? Would the Obama administration attempt to calm U.S.-Russian

“Meeting on drafting the 2016–2025 State Armament Programme,”

http://eng.kremlin.ru/news/22930.

3 "Crimea, Sevastopol to Get 700 Billion Rubles for Development in Next 5 Years," ITARTASS News Agency, August 7, 2014, http://en.itar-tass.com/economy/743917.

2

2

Toward a New Cold War?

tensions and revoke American sanctions while Moscow still controls Crimea?

Or would the administration continue to pressure Russia in an effort to

return the Peninsula to Kiev’s control? After achieving victory, how would

Ukraine’s government handle delicate post-conflict issues like demobilization, reconciliation, and reconstruction? How will citizens in eastern

Ukraine react? And how would Russia react? How would Putin respond

internationally and domestically to the humiliation of defeat?

Conversely, if current negotiations produce an agreement on autonomy that

looks like a defeat for Ukraine, how will the United States and NATO

respond? Would Russia contribute economically to reconstruction in new

autonomous regions in Donetsk and Luhansk? It would be much less

expensive that taking full responsibility for the costs, as would be required if

Russia annexed the territory, and could have strong symbolism. How would

the West view this? Would it look like expanding Russian influence in

Ukraine? This is another path to enduring confrontation.

Since we cannot predict the future with certainty, it is impossible to answer

these questions definitively. What is clear, however, is that without a

comprehensive political settlement, there are many plausible paths to

escalation and further crisis in U.S.-Russia relations.

Some argue that this matters little because Russia lacks the capability to

seriously threaten or harm vital U.S. national interests, and that American

resolve could deter such efforts by imposing much greater costs on Moscow.

Moreover, they argue, the high stakes in Ukraine justify any risks possibly

entailed in directly and immediately confronting Russia. Conversely, some in

Russia argue that America lacks the will to confront Moscow or that U.S. and

Western action will do more damage to America and its allies than to Russia.

The question of what is at stake for the United States in Ukraine—and the

related one of what the Obama administration is willing to do about it—have

been topics of considerable debate, and the answers will ultimately become

clear as America’s political system translates this debate into action (or

inaction) over time. The goal of this publication is to illustrate the costs that

any further unraveling of the U.S.-Russian relationship may have for both

Washington and Moscow in light of some of the policies that each

government may pursue.

The intent is not to make threats but to present reasonable or even likely

policy pathways should Washington and Moscow settle on confrontation

rather than the more challenging process of de-escalation and re-engagement.

3

Saunders

Hopefully this may encourage all sides to reduce tensions in order to limit

damage to their own interests. These papers do not attempt to propose any

particular solution to this extremely complex problem.

This volume presents two American perspectives and two Russian ones on

U.S. and Russian policy options in an environment of deteriorating relations.

The two U.S. authors, Thomas Graham and Blake Marshall, outline

America’s possible political/security and economic responses, respectively.

The two Russian authors, Fyodor Lukyanov and Igor Yurgens, assess

Russia’s potential policy responses, with the same division of labor. All four

authors have extensive, multifaceted experience with the U.S.-Russia

relationship.

The overarching conclusion of the four papers is that both the U.S. and

Russian governments are likely to believe that they possess acceptable policy

options to not only confront one another but to impose significant costs on

the other party if necessary. However, one foundation of this judgment on

both sides is a failure to recognize the potential price that their own nation

may pay in a direct conflict or (more likely) in a long-term adversarial

relationship.

On the U.S. side of this equation, Graham outlines a combination of changes

in NATO basing and force posture, expanded missile defense deployments,

new security cooperation with Russia’s post-Soviet neighbors, and efforts to

restrict Russia’s access to defense and energy technologies, among other

likely measures. Considering how Russia’s leaders have defined the country’s

security over the last two decades—in speeches, interviews, and statements

responding to events, as well as in formal doctrine and guidance to defense

officials and diplomats—the security moves that Graham outlines could

dramatically worsen Russia’s overall security environment. If NATO

members simultaneously increase their defense spending and pursue greater

military integration—strengthening NATO’s capabilities by eliminating

duplication—Moscow would face a more powerful NATO.

Meanwhile, while not without cost to the United States and especially to

European countries, the harsh economic sanctions that Marshall describes

could significantly damage the Russian economy. If America is able to help

the European Union to reduce its energy imports from Russia, it would

further increase the impact of sanctions. Gazprom may well be able to find

other customers, but it would be costly and time-consuming to build new

infrastructure—and the company might find it difficult to get customers

willing to pay European-level prices (particularly if Gazprom’s prospective

4

Toward a New Cold War?

partners gain negotiating leverage due to Russia’s partial isolation). The

global nature of the oil market would make it harder to deny revenue to

Russia’s major oil exporters, but technology restrictions could cut into oil

production over time. Though Marshall does not mention the option, the

U.S. Congress could also impose sanctions on third countries, targeting firms

that trade with Russian companies. Congress has taken this approach to

sanctions against Iran in the past.

Even with $500 billion in reserves, Russia could not indefinitely sustain its

current government budgets under heavy economic pressure. Further, the

potential that investors will begin to sense that Russia may be in trouble

could produce high volatility and sharp drops in markets, whether for

currency, debt, or stocks.

From a Russian perspective, Lukyanov argues that Vladimir Putin will seek to

use America’s size and power against it in a form of geopolitical judo. He

argues that Putin may be reluctant to foment instability in countries like

Afghanistan—where spillover could affect Russia. Instead, Putin will seek to

rally governments troubled by U.S. conduct to form a coalition to press for

an overhaul of global governance and institutions that would weaken

American and Western dominance. Beijing would be a key player, he

suggests, in addition to other large emerging economies and any other

governments dissatisfied with the political, economic, or social/cultural

consequences of globalization. Moscow could catalyze this process by

developing and articulating a new ideology based on equality and justice

among nations.

Further, Lukyanov writes, it may be enough for the Kremlin to cease its

cooperation with Washington in the security sphere, rather than actively

opposing the United States. For example, he suggests, Putin saved America

from another costly and unpredictable war in the Middle East (or from a

humiliating retreat from President Obama’s “red line”) by facilitating an

agreement on Syria’s chemical weapons. International expectations of the

United States have grown to such an extent that they are both hard to fulfill

and hard to ignore. Without Moscow’s help, America may face more and

more embarrassment.

Yurgens thoroughly assesses the challenges to Russia’s economy entailed in

any extended confrontation, but adds that the longer the crisis continues, the

more the influence of Russia’s “neoconservatives”—whom he defines as

foreign policy hawks content with economic isolation from the West—will

increase. Concurrently, the political constituency in Russia favoring economic

5

Saunders

engagement will suffer the most from Western sanctions and will lose

influence, especially if the United States and the West refuse to offer any

carrots to facilitate a settlement in Ukraine. As a result, Yurgens asserts,

Moscow’s policy is likely to become less economically rational over time, as

Russia’s economic integration with the United States and the EU assumes

diminished importance in Russian politics and in Kremlin decision-making.

In addition, Moscow will have to look harder for new markets and new

lenders, he says. Notwithstanding its reluctance to become dependent upon

China, he continues, Moscow will likely see this as “the lesser of two evils” if

relations with the West remain strained.

Yurgens also outlines existing proposals to reduce Russia’s economic ties to

the West. Moscow’s options would include: moving dollar- and Eurodenominated assets out of NATO countries to neutral nations, returning

state-owned property to Russia, halting exports of strategic metals and

minerals, shifting trade to barter trade or settling transactions using nonWestern currencies, taxing capital flight, establishing a domestic electronic

payment system, and a number of other steps. Actions like these would of

course have real impacts inside Russia, but would nonetheless impose costs

on Western financial institutions. Although Yurgens does not address the

risks of nationalization, Western firms would be ill-advised to ignore that

possibility if an escalating military conflict prompts U.S. and European

sanctions intended to cripple the Russian economy.

One key point emerging from all four papers is that it is impossible to fully

assess the consequences of an enduring U.S.-Russia confrontation without

considering responses by other key actors, including the EU, NATO, major

European governments, and China. American and Russian policy rests on

certain assumptions about Europe and China that analysts should

acknowledge. On the U.S. side, for example, likely U.S. security policies—

reinforcing security ties to NATO allies, expanding missile defense, and

increasing defense cooperation and military deployments along Russia’s

frontiers—would require a generally unified Europe prepared to risk

sustained confrontation. U.S. efforts to isolate Russia economically may

actually require an even greater level of coordination with Europe (since its

economic relationship with Russia is an order of magnitude larger than is

America’s and Europe would shoulder most of the costs). Fully isolating

Russia economically would also require cooperation from China.

Conversely, given the huge military and economic disparities between the

United States and Russia—much less those between the West as a whole and

Russia—Moscow’s probable policy course of action depends upon rapidly

6

Toward a New Cold War?

expanding trade and investment ties with China and other emerging

economies. Russia would also require sufficient dissension within NATO to

prevent the most threatening Alliance moves—e.g., deployment of groundbased anti-missile interceptors in Central Europe, which Russian military

leaders have said would undermine their ability to deter a nuclear attack.

Without the former, Russia’s economy could face significant and lasting

damage;; without the latter, Russia’s security environment could deteriorate

sharply. A logical strategy for Moscow would be to continue its past efforts

to court China while dividing Europe.

Graham’s, Lukyanov’s, and Yurgens’ papers each address Russia’s relations

with China and articulate prevailing perspectives in Washington and

Moscow. In the United States, for example, Graham writes that closer energy

cooperation with Beijing “is not without serious risk” for Russia, because

Moscow would be in a relatively weak bargaining position. Nevertheless,

Lukyanov argues, China may welcome and support Russian attempts at a

global realignment that consolidates cooperation among governments

opposed to Western concepts of world order and is combined with

progressive social values. Indeed, although Beijing may be unwilling to lead

such an effort itself, its tacit encouragement—and willingness to settle

transactions in currencies other than the dollar or the Euro, among other

measures—could have significant consequences over time.

In Europe, Russia may find it more difficult to exploit internal differences

there, particularly after the MH17 disaster, which appears to have unified and

hardened public opinion and official policies. That said, even during the

height of the Cold War, the Soviet Union was often able to find and

exacerbate points of tension within NATO. Given its power and its distance

from European Russia, the United States has historically been more willing

to pursue confrontational policies than many of its allies. Moreover, the

longer the current confrontation lasts, the more actual and potential

differences within the West will emerge; it will not be easy to sustain

consensus-based policies indefinitely, particularly when they have disparate

impacts on individual nations. Of course, aggressive Russian policies can

(and have) overcome this, at least for a time.

What both Washington and Moscow would do well to recognize is that their

relationship has entered unchartered territory. The U.S.-Russia relationship

has returned to the 1980s in its temperature, but not in its management—

contacts between officials are more limited, the informal rules and patterns

of the Cold War have been forgotten, and the combination of globalization

with the information revolution and changing norms and priorities (especially

7

Saunders

in the West) has made our bilateral relations harder to understand or predict.

From this perspective, the late 1940s and early 1950s, a time when the two

governments were just beginning to figure out how to deal with one another

through a succession of trial-and-error experiments, may provide a better

analogy. Even after over a decade into that process, the two sides came

dangerously close to a war during the Cuban Missile Crisis.

Today, Russia lacks the Soviet Union’s capabilities, whether in military,

political, or economic terms. Nevertheless, it retains many of the USSR’s

nuclear weapons, both strategic and tactical, and both Russian military

doctrine and elite-level Russian politics assign continuing importance to

nuclear weapons far beyond that offered by their American counterparts.

This is an especially significant considering during times of crisis.

Deescalating the conflict in Ukraine and working toward a political

settlement will be extremely difficult. After all, a settlement is only a

settlement if it is acceptable to all sides, and it is not yet clear that Ukrainian,

Russian, American, and European interests intersect sufficiently to allow for

such a solution. Nevertheless, the alternative—continued escalation with no

apparent upward limit—is also very unattractive for everyone, and first and

foremost for Ukraine.

Absent a political solution, the United States should do whatever it takes to

protect vital U.S. national interests in the current dispute with Russia over

Ukraine and to defend U.S. allies. In doing so, however, American officials

should consider carefully the potential costs of a long-term adversarial

relationship with Moscow. Russia’s leaders will make their own decisions, but

they would do their country a service by also evaluating the costs of a longterm tensions.

8

RUSSIA’S ASYMMETRICAL RESPONSE:

GLOBAL AIKIDO

BY FYODOR LUKYANOV

Forecasting global developments is the first and foremost task of

professional policy analysts, whether they work for the government or for

corporations, and for researchers, who attempt to study events from an

academic perspective. But experience shows that such forecasting is not

always precise, in part because those who conduct it are often influenced by

prevailing stereotypes. Thus, a combination of rational evaluation and literary

fantasy sometimes proves to be much more accurate than traditional, matterof-fact analytical work.

The Specter of the Future

Let us imagine a not-so-distant future—the fall of 2017. A major

international conference entitled “One-hundred Years after the October

Revolution: Lessons for the 21st Century” is taking place in Moscow. The

conference’s attendees include Chinese President Xi Jinping, Brazilian

President Dilma Rousseff, Indian Prime Minister Narendra Modi, South

African President Jacob Zuma, Iranian President Hassan Rouhani, and the

leaders of many other Latin American, Asian, and African countries.

Additional guests include prominent European politicians—not only those

professing leftist and social-democratic views but also Eurosceptics—and

representatives of non-governmental organizations, anti-globalization

movements, etc.

Russian President Vladimir Putin delivers a keynote address. Its focus is not

on communist ideology or attempts to revive the Soviet economic and

political model. Instead, its underlying message is that the Russian Revolution

of October 1917 ushered in a new era in the history of mankind. It was a

pivotal point that began a drive for equality and justice, and that rejected the

power of a small group of countries, monarchs, and financial and industrial

conglomerates over most of the world’s citizens. Although actual practice

exposed the faults and blunders made when building “real socialism,” these

mistakes did not undermine the international, historical importance of the

event. In today’s new chapter, mankind should remember the energy for

renewal and the aspirations to build a fairer and more democratic world that

the 1917 Revolution unleashed. Now, at the beginning of the 21st century,

the world is again undertaking this quest, having become tired of an

Lukyanov

international system dominated ideologically, politically, and economically by

one power center that seeks to impose its development model on others,

often by force. Everyone immediately recognizes the identity of this single

power center.

Today, this sounds like fantasy. Modern Russia was born in 1991, through

the rejection of communism. Vladimir Putin is the direct heir to Mikhail

Gorbachev, the politician who drove to dissolution the Soviet system created

by the October Revolution. Russian life and economic practices are

characterized by many of the typical features of early capitalism, and are

much harsher than living and economic conditions in the United States or in

Western Europe. Doing business in Russia – and living there – are

sometimes extremely unfair, partly due to the country’s feudal form of

government and partly due to this government’s inefficiency. Beyond this,

Kremlin ideology is based on conservative, traditional values, at least as they

are understood by the present Russian leadership. Although Russia’s foreign

policy is based in part on opposition to the West, Russia is not engaged in an

ideological confrontation like the one that secured the Soviet Union support

from and robust diplomatic ties with many developing countries.

However bizarre this vision may seem to Western readers, the logic of

politics may push Russia to seek ways to expand its support in the world

should confrontation with the West, and especially with the United States,

deepen. If America and Europe respond to a possible political settlement in

Ukraine by further increasing the pressure on Russia—to add to Ukraine’s

negotiating leverage, or to try to go beyond stabilizing eastern Ukraine to

return Crimea to Kiev’s control—that could still happen. And Moscow has

many options for responding to American pressure, which is likely to grow in

the years ahead almost regardless of immediate outcomes in Ukraine. But the

situation is not symmetrical, and the United States objectively has more ways

to influence Russia than vice versa.

The “war of sanctions lists” that erupts from time to time between Russia

and the United States is a vivid, albeit comical, example that shows the

uselessness of the “eye for an eye” approach. In 2012, after the U.S.

Congress passed the Magnitsky Act, Moscow responded by adopting a

similar law and creating a list of American officials to whom it intended to

deny entry to Russia. But it was hardly a match for Washington’s move. In

fact, it’s difficult to imagine why American Senators or judges would consider

it necessary to go to Russia; their Russian colleagues are far more likely to

travel to the United States. Furthermore, the mutual freeze of assets looks

like a joke. There is no proof that the officials from the so-called “Magnitsky

10

Russia’s Asymmetrical Response

list” or other such lists have assets in the U.S., but America’s “violators of the

rights of Russian people” surely do not have any holdings in Russia.

Clearly, however, Moscow will not sit idly and simply register new

restrictions imposed by Washington—Russia’s retaliatory agricultural

sanctions make this clear, as do Prime Minister Dmitry Medvedev’s threats to

shut off access to Russian airspace for Western commercial airlines. Moscow

understands that if relations continue to deteriorate further, the United States

and its allies (many reluctantly and under pressure) may move over to

informal but systemic measures intended to deter Russia and cut it off from

Western financing and technology. In fact, widespread elite opinion in Russia

holds that our relations with the United States have already assumed a state

essentially reminiscent of the Cold War. Most believe this situation will most

likely continue for several more years, and that it is not simply connected

narrowly to the Ukrainian crisis.

Washington regards Moscow as a force that inhibits what the United States

considers to be the proper functioning of the international system. Therefore,

this force must be curbed and prevented from questioning the order of

things. Yet for Russia, the incorporation of Crimea became a red line beyond

which there is no going back without risking political collapse. If the United

States and the West also view Crimea as a red line, and continue heavy

pressure on Russia even after a possible settlement in eastern Ukraine, it may

be difficult to avoid a worsening long-term confrontation.

Given these asymmetrical realities, Kremlin leaders understand that Russia

should avoid getting involved in reciprocal responses modeled on the

methods employed by the Soviet Union, which closely watched the balance

of actions and reactions between both sides.

Symbolically, Russia has always acted quite reciprocally. Suffice it to recall its

response to incidents involving Russian citizens in other countries, such as

when three Russian school kids, the children of Russian diplomats, were

beaten up under unclear circumstances in Poland in 2007. Subsequently,

three Poles were attacked in Moscow. Or recall that when Dutch police used

force against a Russian deputy ambassador during a row over Russia’s

detention of a Greenpeace ship in 2013, his counterpart was roughed up in

Moscow. This list can be continued.

However, Russia does no more than merely demonstrate its commitment to

national prestige. Most understand that Russia lacks sufficient power to

deliver an equivalent, reciprocal response to hostile U.S. moves. This means

11

Lukyanov

not only that its responses should be asymmetrical and “creative,” but also

that they should be systemic and strategic. Above all, Russia should use

objective global development trends that can benefit it, especially the rise of

China and other emerging economies and the diffusion of economic power,

while also exploiting U.S. weaknesses unrelated to Russian interests and

activities but tied to America’s position as a global leader.

When experts study Vladimir Putin’s political style, they often recall one of

his sport hobbies: Oriental martial arts, specifically judo. While musing over

Moscow’s responses to U.S. pressure, one is compelled to draw an analogy

from Putin’s pastime;; namely, that one of the key skills in many martial arts

(in judo and even more so in aikido) is the ability to first avoid a heavier

opponent’s overpowering attacks and to then turn the opponent’s weight

advantage against him by using momentum and inertia. These principles are

likely to prevail in a potential Russian-American confrontation.

Will Russia Seek an Eye for an Eye?

But before one begins to study this confrontation from a martial arts

perspective, one should consider several more likely and expectable Russian

measures. They may not necessarily be taken, but the possibility that they will

be cannot be dismissed. They are described quite well in an article written by

Russian international relations expert Alexei Fenenko4 and published by the

online edition of Russia Direct, and we may as well rely in our analysis on his

conclusions.

One way to take revenge upon America, Fenenko argues, would be to create

problems for the Northern Distribution Network, which is critical for

providing logistical support to U.S. troops in Afghanistan. Since the United

States is in the crucial stage of its withdrawal from that country amid a

disastrous situation in Iraq, intentional complication of this process could

create serious problems for Washington.

Denunciation of the agreements signed in 2008 and 2009 with NATO and a

ban on land and air transit through Russia could also be a possibility. This

would make the United States and its allies hurriedly look for alternative

routes in the Caucasus and Kazakhstan, which would be costlier and longer,

while transit through Pakistan would be fraught with serious security risks.

"Don't Tease the Bear: Russia's Retaliatory Sanctions Have Teeth," Alexey Fenenko, Russia

Direct, April 3, 2014, available at http://www.russia-direct.org/content/dont-tease-bearrussias-retaliatory-sanctions-have-teeth

4

12

Russia’s Asymmetrical Response

Experts also mention Russia’s pressure on its Collective Security Treaty

Organization (CSTO) allies to curtail their cooperation with the United States

and NATO on Afghanistan. This is possible in principle, but some of

Moscow’s partners may sabotage this effort to avoid putting all their eggs in

Russia’s basket. Uzbekistan, which has officially quit the CSTO and is not

Russia’s ally, would be least reliable.

Another traditional area where Russia could make a U-turn and thus

influence the United States is arms control and international nuclear security

treaties, especially since practically all of them contain a clause allowing

Russia to withdraw if its national security is endangered. In fact, when New

START was under negotiation, some skeptical voices in Moscow questioned

the need for new agreements with the United States. The treaty’s preamble,

which links defensive and offensive strategic armaments, is interpreted in

Russia as providing an indisputable right to repudiate all agreements if the

United States proceeds with its missile defense plan. Since U.S. missile

defense deployment is underway, it won’t be hard to find such justification in

Russia.

In March of this year, rumors emerged that Russia would renege on the

agreement giving American inspectors access to its nuclear arsenals. This

hasn’t happened yet, but limiting transparency measures is a natural

possibility as bilateral relations are increasingly characterized by militaristic

rhetoric.

Some international treaties, particularly those signed by Presidents Mikhail

Gorbachev and Boris Yeltsin, were never popular in the Russian strategic

community. The wisdom of continuing to honor the 1987 INF Treaty and

the Comprehensive Test Ban Treaty (CTBT), to which Russia acceded in

1996, are most often questioned. In a confrontation with the United States,

Moscow could abandon them, especially since the CTBT has not been

ratified by the United States or China and the INF Treaty is already

producing fierce disagreements between Russia and America.

Following through on Vladimir Putin’s recent indication that Russia could

terminate the INF Treaty would quickly affect the course of events, most

likely reviving Europe’s worries of the 1980s, when the Old World feared

becoming a battlefield between the United States and the Soviet Union. At

the time, Europe’s fears were two-fold: On one hand, Europeans urged

America to strengthen Europe’s nuclear forces to deter the Soviets;; On the

other hand, there were strong anti-war protest movements in Europe

directed against America, which left-wing activists and sympathetic leftist

13

Lukyanov

politicians said was ready to sacrifice Europe to further its own superpower

ambitions. Now, of course, the situation is different: Russia is not the Soviet

Union, nor can it mobilize the broad European public for its benefit. At the

same time, however, America’s popularity in Europe has plunged, especially

after a series of U.S. scandals and failures in the world, ranging from

mistreatment of prisoners in Iraq to electronic surveillance and spying.

Another possibility that would annoy America would be Russia’s return to

Cuba and restoration of the Russian radar station at Lourdes, which was

closed by Vladimir Putin in 2001. This option was discussed in 2007, when

Russia and the United States were at loggerheads over missile defense, but

things did not go any further then. Today, this looks more probable, as

Russia is generally bent on restoring relations with former Soviet allies. The

closure of the radar station angered Cuba’s then-leader, Fidel Castro, and its

present leadership will most likely welcome its reopening, especially since it

will give the country an additional source of much needed revenue. After

Putin’s visit to Cuba in July 2014, the Russian president publicly denounced

rumors of a deal to reactivate the station and said that no agreement has been

reached. Of course, this doesn’t exclude the possibility of reaching one later.

Russia can also make things harder for the United States in the Middle East.

Moscow’s firm and unyielding position on Syria in 2011-2014 has partly

restored the Kremlin’s authority in the region, which was lost after the

disintegration of the Soviet Union and Russia’s disinterest in the region

during the 1990s. Many countries, including those historically relying on the

United States but deeply disappointed by its ill-considered and inconsistent

policies in the region, expect Russia to assume a more active position.

With Iraq falling apart and the Syrian-Iraqi region turning into a battlefield

for religious war, Russia can step up its support for traditional partners such

as Bashar al-Assad, Iran, and pro-Iranian Shiites in Iraq. Lifting sanctions on

Tehran if its nuclear talks end successfully would allow Moscow to resume

full-scale arms sales, energy trade, and peaceful nuclear cooperation with

Iran.

However, frankly speaking, it’s hard to imagine what exciting and

provocative steps Moscow could take now to create more problems for the

United States in the Middle East, as the situation there is already highly

chaotic – even by Middle Eastern standards.

14

Russia’s Asymmetrical Response

Fenenko comes to the conclusion in his article that unlike the Soviet Union,

Russia can, as a last resort, take drastic measures to destabilize the global

situation. He thinks that, in the Soviet Union,

the prevailing view was that global stability in itself is valuable,

even at the cost of serious concessions. Now the situation has

changed. Russia’s changed circumstances since the Soviet era

is impelling Moscow to look at tougher retaliatory measures.

The Soviet leadership felt more secure in its superpower status

and could afford not to respond to provocation. The Russian

leadership has no such safety margin.

However, it’s hard to agree with this conclusion. In fact, the Soviet Union

did feel quite secure and never doubted its ability to control processes, since

dramatic and dangerous confrontation always occurred within certain limits,

written or unwritten. This enabled the Kremlin (and the White House) to do

many things. For example, Moscow could afford to support and even foment

regional conflicts, finance the “right” kind of extremist and terrorist

organizations, test its strength in different parts of the world, and raise the

degree of confrontation while firmly believing that de-escalation was quite

possible, if necessary.

Today, the Russian leadership thinks differently. Vladimir Putin has spoken

often about the dangers of a chaotic, unpredictable, and uncontrollable

world, a world of unforeseen consequences. Uncertainty about the results is

the main deterrent to geopolitical troublemaking. The Russian leadership

believes that the United States pursues an adventurist and irresponsible

policy by getting engaged in different foreign campaigns and endeavors with

unfathomable results. The growing uncontrollability of the international

environment is seriously worrying the Kremlin, which is well aware of

Russia’s vulnerabilities to instability.

Thus the desire to improve Russia’s position by fishing in “murky waters” is

not currently the underlying motive of the Russian leadership. Still, Russia

views what is required for achieving stability differently than does the United

States in some respects—as is obvious in Syria—and steps by Moscow to

promote stability could instead look—in American eyes—like attempts to

promote the opposite. Setting this aside, however, Russia’s actions are as a

rule reactive and defensive in nature, even if they look offensive and

aggressive. The incorporation of Crimea is not an exception to this, as it was

driven primarily by the fear of having on its border either a completely

uncontrolled and explosive state or an officially-avowed anti-Russian one.

15

Lukyanov

(Actually, both of these outcomes are still possible and an anti-Russian

Ukraine seems increasingly likely.) Russia’s involvement, albeit quite

reluctant, in the civil war in eastern Ukraine only bears out Moscow’s

concerns that nothing can be predicted.

Besides, we should remember one of Putin’s personal features: Being

generally quite suspicious of the West in general and having no positive

feelings about the United States in particular, he is very fastidious about the

promises he makes. This explains why Russia has so far not even considered

terminating its cooperation with Washington and NATO on Afghanistan,

even though this would be a logical step now that relations have chilled. It is

notable that even the most consistent opponents of the United States in the

State Duma mentioned this possibility for the first time only on July 17 of

this year, after the Obama administration imposed fairly tough sanctions on

selected Russian banks and energy companies.

Taking all of this into account, it would be hard to imagine Russia

deliberately destabilizing the world order and becoming a global spoiler

preoccupied with damaging the United States. However, Moscow can pursue

a different strategy, one not destructive (destroying the existing world order)

but instead constructive (building a new world order). The world may already

be ripe for this, and Russia has some tools for doing this that it has not used

yet. This brings us back to “martial arts” and Russia’s search for asymmetrical

policy responses.

Russia’s Asymmetrical Option: Global Aikido

Many believe that the new Russian-American and Russian-Western

antagonisms differ from Cold War-era tensions because of the absence of an

ideological basis for the conflict. According to this view, the new

confrontation is a classical geopolitical rivalry: America seeks to sideline

Russia, while Russia naturally resists, biting back wherever possible. Hence

the expectation is that Moscow will start “taking revenge” on the U.S. in the

Middle East, East Asia, and elsewhere.

However, as was mentioned above, Russia would pay a significant price in a

struggle like this. Yet there are two other options that are complementary,

rather than mutually exclusive. One involves avoidance of any further, and

termination of all existing, assistance to the United States without direct

conflict. The other option is ideologizing the confrontation under the banner

of building a new and more just world order in place of the U.S.-centric one

that is now under increasing strain.

16

Russia’s Asymmetrical Response

Let’s first discuss avoidance of assistance. It is widely believed in Russia that

the United States, which has voluntarily assumed the role of world leader, is

overstrained and unable to cope with this task. In practical diplomatic terms,

this means that without assistance from its partners, Washington is unable to

control many difficult processes in the world simultaneously, especially as

their number is growing. In the most important conflict areas—Iran, Syria,

North Korea, Afghanistan, and now Ukraine—the U.S. needs the

participation of other countries. Even Russia is an integral part of solutions

to some of these issues and others, as Americans themselves admit. Or

rather, without Russia, there may be no solutions that do not require

excessive expenditure.

At the same time, against the background of unending public political

discussions, Russian and American diplomats cooperate in a businesslike

manner on a wide range of issues, including Iran’s nuclear program, Syria’s

chemical disarmament, coordination of an international response to North

Korea’s behavior, the settlement of endless contradictions within the WTO

framework, and responses to local conflicts in Africa. In many cases—such

as the Iran, Syria and North Korea ones—Russia’s connections and

capabilities significantly facilitate communication and enable progress or, at

least, prevent regression. Numerous conflicts in Asia, which are bound to

escalate, are an obvious area where Russian-American interaction might be

useful. In some cases, Russia is viewed as a more neutral participant,

considered acceptable to all sides, than is the U.S. or Europe (the post-Soviet

space is an obvious exception to this, but here one can only note the evercontinuing “agreement to disagree”).

According to many Russian diplomats, if Russia simply ceases to participate

in all these processes and ends its cooperation, the U.S. will soon be faced

with growing problems. In this case, America’s military-political and

economic weight will play against it, since expectations are high, but most

complex conflicts require political solutions based on a multilevel and subtle

approach. Russia’s disengagement would make this more difficult.

Last fall’s chemical weapons agreement on Syria is an elegant example of this.

Without the Russian President’s contribution, the U.S. might have been

involved in yet another military campaign in the Middle East, with

unpredictable results. The alternative to either reaching a deal or going to war

was that America would have backed away from its own “red line.” Judging

by what is occurring in Iraq today, it is easy to guess who would have

benefited from U.S. strikes against Bashar al-Assad’s troops: the Islamic

State, which is now occupying much of Iraq, and which was also a significant

17

Lukyanov

component of the Syrian opposition. Obviously, Vladimir Putin pursued his

own and Russia’s interests, and in doing so helped America to avoid taking

unnecessary and dangerous political-military actions.

Generally, the scale of U.S. involvement in world affairs and the expectations

associated with it are so great that U.S. leadership has turned into a heavy

yoke that cannot be cast off, but is also increasingly hard to carry. Several

years ago, when Barack Obama was preparing to become president,5 the idea

of global burden-sharing—that is, delegating to key regional states the

powers of supporting U.S. partners—became extremely popular. This was

seen as a substitute for the unilateral leadership of the preceding Bush

administration. Now we can say that the result is the opposite: the United

States once again has to rely mainly on itself, while potential regional

supporters behave more and more independently. But while unilateral

leadership was previously a conscious choice, now it is the only possible

option.

Passive behavior—meaning not only that Russia will not use its capabilities

against the United States, but also that it will not use them at all—would be

quite in line with the philosophy of many martial arts, including dodging

blows and benefiting from the rival’s mistakes.6 Russia would not apply this

tactic in the post-Soviet space, where it plays sports like Thai boxing or even

ultimate fighting, but in the rest of the world, where Russia has few if any

vital interests.

The second option is to take advantage of America’s setbacks in global

governance and of the shortcomings in the global economic architecture.

The Ukraine crisis has an important aspect that not everyone has been able

to perceive: in a bid to punish Russia, the United States has used its power as

a regulator of the world economic system as a weapon. By threatening to

withhold the “keys” to globalization, it prompted its opponents to reclassify

anti-Americanism into a conceptually much broader phenomenon: antiglobalism or, rather, alter-globalism; that is, moving beyond the current

design of the global economy in favor of some other system.

The White House’s decision to impose sanctions against the Russian officials

it sees as being closest to Vladimir Putin led to sanctions being imposed

against four Russian commercial banks. The payment systems Visa and

See, for example, Charles Kupchan and Adam Mount, “The Autonomy Rule,” Democracy

Journal No. 12 (Spring 2009), available at http://www.democracyjournal.org/12/6680.php.

6 See Ivan Safranchuk, “Traveling in Different Boats,” Russia in Global Affairs No. 4 (October

– December 2008), available at http://eng.globalaffairs.ru/number/n_11888.

5

18

Russia’s Asymmetrical Response

MasterCard complied with the sanctions and blocked credit card services to

these banks, which caused problems for the banks and fueled long-discussed

plans to establish a national payment system in Russia. Also, Russia’s

Ministry of Finance tightened rules for the two credit card companies,

demanding that they make a huge security deposit as protection against force

majeure. The possible outcome of the conflict is unclear; the credit card

companies are threatening to leave the Russian market, but in the context of

this discussion, this is not the most important consideration.

Denying banks access to international transactions is a powerful lever, but

demonstrating who the master in our shared global home is has a downside.

U.S. world leadership is based on the conceptual premise that it not only

ensures prosperity for all but that it is also just—it is not someone’s

subjective will that decides everything; instead, the laws of the free market are

supposedly decisive. Excluding Russian banks from payment systems,

limiting the use of software produced by major IT companies, or shutting

Russia out of the SWIFT system of international banking payments, a

measure that was earlier taken against Iran, demonstrate an indisputable fact:

one power has dominant influence and uses it for political purposes.

As long as such measures were used against countries like Iran, not to

mention odious governments like Gadhafi’s in Libya, they did not have such

a strong effect. But when such pressure is put on one of the most important

and influential countries in the world, it means that no one can feel safe. It

also means that, in a heated conflict with the United States, global rules can

be changed and directed to work against any target Washington desires.

This stimulates new trends—the fragmentation of the global economy and

society, the creation of zones of preferential trade rules and national or

regional payment systems, and hedging against non-economic methods of

global competition. American efforts to establish the Transatlantic Trade and

Investment Partnership (TTIP) and the Trans-Pacific Partnership (TPP)

trade zones actually undermine the WTO’s principle of universal rules for

world trade. The rapidly strengthening partnership between Russia and China

suggests that in response to U.S.-centric economic zones, they may try to

compete with their own major projects—Russia’s Eurasian Economic Union

and China’s Silk Road Economic Belt. Coordinating Russia’s and China’s

interests in order to facilitate cooperation between these two entities will be

difficult, yet hardly more so than is reaching an agreement between the U.S.

and the EU on new trade rules.

19

Lukyanov

Russian Prime Minister Dmitry Medvedev and Minister of Economic

Development Alexei Ulyukayev have both already promised to challenge U.S.

sanctions in the WTO as unfair competition. If filed, this suit could take

several years to be investigated, but it will support the key goal of

demonstrating how the U.S. undermines its own principles for political

purposes.

After the end of the Cold War, the world saw little real institutional redesign.

Some global governance institutions survived from the previous era, and

some others, which formerly provided economic and financial services to the

West, extended their operation to the rest of the world. At the rhetorical

level, they came to reflect universal interests, but in practice there were

continuous charges that these institutions remained instruments of Western

control and dominance. The campaign of sanctions against Russia provides

additional support for this view: for example, the European Bank for

Reconstruction and Development, which in theory is an institution operating

outside of politics, is being used by major shareholders to apply pressure on

Russia.

I repeat, such methods of pressure were used in the past as well. But they

never were used against such a powerful state. The key issues are not military

power nor energy levers, but are instead ideology and the ability to produce a

universal narrative. Vladimir Putin has already begun to focus on this, as was

clear in his recent remarks at the 2014 BRICS Summit in Brazil.

The world as a whole is growing increasingly tired of the lack of alternatives

to the U.S.-centric order. Not everyone likes the Western model of social

order and political behavior, yet no one offers any viable alternative.

Meanwhile, the complete domination by the United States in world affairs

causes growing resentment and rejection of America, even among U.S. allies.

Previous attempts to offer alternatives failed either because the countries that

made them did not have enough international clout, or because of their

scandalous leaders, like the late Hugo Chavez. Unlike these countries, Russia

still has much of the strategic mindset of the USSR, which aspired to be a

systemic alternative to the West. This factor manifested itself last year in the

Middle East, where many expected that Russia would convert its successful

Syria policy into the role that the Soviet Union had played in the region—

namely, as a second patron to whom one could defect from the United

States. There were, and could be, no such plans last year. Now the situation is

changing—and Russia may be at least ready to assume this role.

20

Russia’s Asymmetrical Response

Acting as a serious troublemaker (Moscow did cross a red line in Crimea),

Russia cannot continue to operate within the same global paradigm, wherein

the West has an indisputable advantage. To strengthen its position, Moscow

will have to oppose America ideologically and must formulate a different

vision of the world order. Emphasizing conservatism will not be enough—

this is good only for discussions within Western culture. A united “right-left”

opposition is needed, in which the conservative defense of national identity

would be combined with the Third World’s anti-globalist rhetoric about the

injustice of the current system.

No other country but Russia can bring about such an opposition. China

values the opportunities provided by globalization, although it is not happy

about everything. In addition, it is not good at advancing global-scale ideas—

this has long been America’s forte. By virtue of its cultural identity, China’s

ideological influence can only spread within the Chinese cultural area. On the

other hand, Beijing can tacitly support such an initiative; after all, it hardly

misses any opportunity to remind the West that the time of its hegemony has

passed. Also, China understands that Russia’s conflict with the West has only

postponed a global rivalry between China and the United States, which may

unfold and intensify in a few years, probably by 2020. The dispute between

Russia and the West has hardly erased Sino-U.S. tensions. That is why

Russian-Chinese cooperation may become one of Russia’s most consistent

responses to increasing pressure from the United States.

At the global level, new Russian-Chinese cooperation is likely to spur

systemic efforts by the two countries—albeit very cautious at first—to erode

the global domination of institutions and practices of the Washington

Consensus. A gradual weakening of the U.S. dollar in trade settlements

among members of the SCO and the BRICS and the development and

mutual recognition of national payment systems by them, the establishment

by the BRICS of their own development bank,7 and the creation by Russia

and China of an international rating agency to compete with the Big Three—

Moody’s, Fitch, and Standard & Poor’s8—could be the first signs of a

restructuring of the global economy.

Leonid Grigoriev and Alexandra Morozkina, "Different Economies, Similar Problems,"

Russia in Global Affairs, June 30, 2013, available at

http://eng.globalaffairs.ru/number/Different-Economies-Similar-Problems-16051

8 "Siluanov: Russia and China Will Establish a Joint Rating Agency," Vedomosti, June 3, 2014,

available at http://www.vedomosti.ru/finance/news/27301271/siluanov-rossiya-i-kitajsozdadut-sovmestnoe-rejtingovoe (In Russian).

7

21

Lukyanov

In early June, Russian Minister of Finance Anton Siluanov said at the fifth

Financial Dialogue between Russia and China in Beijing that the two

countries had agreed to establish a joint international rating agency. Earlier,

the Chinese Dagong rating agency had announced plans to create a joint

venture with American and Russian partners to organize an independent

global rating group. The structure is to be called Universal Credit Rating Group.

The partners will be Egan Jones Ratings of the United States and RusRating

of Russia. The Russian parliament adopted a law on the establishment of a

national payment system almost immediately after the banks Rossiya, SMP,

and others were hit with U.S. sanctions. Potential international partners

include China’s UnionPay, Japan’s JCB, as well as VISA and MasterCard.

Brazil and Argentina may also participate in the project.

Russia’s post-Crimea turn towards China may have another unexpected

effect with serious consequences: the “nationalization” of the Internet. In

addition to the two countries’ close positions on the role of the Internet

Corporation for Assigned Names and Numbers (ICANN) and on Internet

governance (the need to delegate the governance functions from a private

U.S. company to international institutions), the Russian government’s

determination to establish a Russian analog of the Great Firewall of China

can be a kind of revenge of the Westphalian order on the World Wide Web.

As noted by Russian researcher Dmitry Yefremenko, “the famous principle

cuius regio eius religio (‘Whose realm, his religion’) in the middle of the 2010s

can be reformulated as ‘Whose server, his Internet’.”

The most likely outcome of this conflict will be the acceleration of a process

that has long been spoken of in Russia: a departure from the U.S. dollar as

the dominant currency in international trade transactions. Russian

presidential advisor Sergei Glazyev has long insisted on such measures and

has even proposed not using the dollar at all. Now this probability is

discussed by Russian businesspeople.9 As a model, they look to IndianIranian transactions, whereby India pays for Iranian oil in rupees. Iran

maintains a rupee account with UCO Bank in Kolkata, from where Indian

exporters are paid against their shipments of various goods. Russia also had

experience with such interaction in Soviet times. The Council for Mutual

Economic Assistance, the economic wing of the Warsaw Pact, practiced

trade in non-convertible currencies on a mutual offset basis. Another model,

clearing, was used between the Soviet Union and Finland, for example. The

"Russian Companies Prepare to Pay for Trade in Renminbi," Jack Farchy and Kathrin

Hille, Financial Times, June 8, 2014, available at http://www.ft.com/intl/cms/s/0/9f686816ed51-11e3-abf3-00144feabdc0.html#axzz3A79iXllB

9

22

Russia’s Asymmetrical Response

May 2014 Russia-China gas deal, which contemplates $400 billion in gas

supplies over the next 30 years, allows for some renminbi–ruble payments.

Russian-Chinese rapprochement may also have a purely political regional

effect—a marked strengthening of the Shanghai Cooperation Organization

(SCO). The SCO is already the most representative and influential

organization in Central Eurasia. Against a backdrop of ongoing geopolitical

changes, it can increase its symbolic capital even further. Until recently,

China had continuously delayed admitting India and Pakistan to the SCO.

But now, according to Russian diplomats, Beijing is ready to take a more

flexible approach because of its growing rivalry with the United States in East

Asia. An enlarged SCO (including India, Pakistan, and also possibly

Mongolia) could become a serious and highly diversified organization with

unique capabilities in a critically important region. If the current negotiations

on the Iranian nuclear program succeed and the UN Security Council lifts its

sanctions against Tehran, Iran could become a full member as well (it now

has observer status). The SCO Charter prohibits countries under

international sanctions from enjoying full membership.

Moscow will not be able to retain a monopoly on rule-setting in such a large

organization involving such powerful countries. Actually, Russia does not

have a monopoly now—China outweighs Russia economically, and if the

SCO’s present composition does not change, there will be little room for

balancing. But if the SCO admits India, Pakistan, and Iran, the diplomatic

process within the organization will become more complicated but will also

allow for more potential “coalitions.” In addition, the overall clout of the

organization in the world will multiply. Back in 2005, the SCO called on the

U.S. to clearly define a timeline for its presence in Central Asia. Now, the

organization’s aversion to the U.S. presence in the region has only increased.

Of course, Moscow will also take into account the growing tension between

Washington and the latter’s European allies. Many of these allies have

resisted strengthening of sanctions against Russia, because those measures

will badly affect EU economies. Sanctions have already generated visible rift

inside the EU, where businesspeople and even some in the political

establishment complain that Washington has totally disregarded European

interests while struggling to punish Russia, rather than attempting to resolve

the crisis in Ukraine. This comes on top of fury in Germany about

comprehensive spying by the U.S. that might have a long-term impact on

transatlantic relations. Russia will not be afraid to use these sentiments to

advance its interests.

23

Lukyanov

*

*

*

Over the 15 years of Vladimir Putin's rule, we have learned his political style

well enough. Firstly, he never responds immediately and usually takes a break

to consider matters; he has strategic patience. Secondly, he does not like to

break promises, even if they were given to his opponents. Thirdly, he has a

comprehensive view of the world, and he understands the world system and

its various interrelationships. Combined with a tactical flair and fast

adaptation to changes, this helps him to do without an action strategy, which

hardly exists in practice.

“As long as Russia is not subject to systemic sanctions, which could bring an

artificial limit to our economy's access to dollars...then I don't think Russia

will take any steps in order to bring about artificial de-dollarization," the

Financial Times quoted Andrei Belousov, economic adviser to Mr. Putin, as

saying.10 Yet one cannot rule out the possibility for exacerbation of the crisis

in relations with the United States. If a real confrontation begins, Russia will

seek to use objective weaknesses of the world leader. If Moscow sides with

advocates of a revision of the current international system, which it has never

supported before, this may significantly change the global balance of power.

Russia may pool its capabilities with those of China—not in the military

sphere, as only fringe Russian politicians propose, but in their approaches to

global governance. As masters of judo teach, it is better to not rely on one’s

own strength but to instead use your opponent’s strength against him.

Formulating an alternative approach to global governance when

disappointment over the present leader’s approaches is increasing is

consistent with this teaching. Russia can become a catalyst of this process,

which has already begun. This does not guarantee an immediate effect, but it

could be quite successful over time.

"Russian Companies Prepare to Pay for Trade in Renminbi," Farchy and Hille, Financial

Times, Op. Cit.

10

24

THE DANGERS OF A NEW CONTAINMENT

POLICY FOR RUSSIA

BY THOMAS GRAHAM

The Ukraine crisis has ushered in a new era in U.S.-Russian relations. To be

sure, relations had been deteriorating for some time—at least since fall 2011,

when Putin announced his decision to return to the Kremlin. Stark

differences between both countries over Syria and broader developments in

the Arab world, Moscow's offer of asylum to NSA-leaker Edward Snowden,

and Putin’s vehement accusations of U.S. interference in Russia's domestic

affairs—thereby justifying a crackdown on internal dissent—have all stressed

U.S.-Russian relations to the breaking point. The glimmer of hope offered by

the agreement to work together to eliminate Syria's chemical weapons was

quickly extinguished last fall by fundamental differences over the situation in

the Ukraine.

But it was Moscow's reaction to the ouster of President Yanukovych in

Ukraine—its annexation of Crimea and the destabilization of southeastern

Ukraine, done with a combination of audacity and skill—that finally jolted

the American political establishment into viewing Russia as a significant

threat. That Russia was prepared to flout the rules of Europe's post-Cold

War order to assert its interests was not particularly surprising. After all, it

had already done that in the Georgian War in 2008. But no one had

anticipated that Russia would act in Crimea with such exquisite skill and leave

the United States appearing flat-footed, lacking an adequate response. That

set Ukraine apart from Georgia.

Obama's reset is now dead. Previous failed resets were followed in short

order by new attempts. Indeed, U.S.-Russian relations since the end of the

Cold War have been marked by a recurring cycle of great expectations

followed by deep disappointments. But this time is different. Today's

estrangement runs deeper than it has during any time since the Gorbachev

years. No influential forces in either Washington or Moscow are calling for

improved relations; rather, political leaders and the media in both countries

are actively vilifying the other side. Most bilateral contacts have been totally

severed. Looking forward, both sides increasingly see each other as long-term

adversaries. Unlike in the past, no new reset is just over the horizon simply

awaiting a new American president.

Graham

In the absent of significant hope for constructive relations, the American

political establishment has reached back to the recent past, to the Cold War

era, for guidance. The talk is of an updated containment policy.11 At the

beginning of the crisis in early March, President Obama warned the Russians

that if they did not move to deescalate the situation in Ukraine, the United

States was "examining a whole series of steps—economic, diplomatic—that

will isolate Russia and will have a negative impact on Russia’s economy and

its status in the world."12 As the crisis worsened, the administration began to

make good on that threat by sharply reducing bilateral contacts with Russia,

levying targeted sanctions against individuals and entities considered either

responsible for Russia's actions in Ukraine or to be financially close to Putin,

and trying to rally European allies behind its policy. At the end of May,

Obama claimed success.

Our ability to shape world opinion helped isolate Russia right away.

Because of American leadership, the world immediately condemned

Russian actions; Europe and the G7 joined us to impose sanctions;

NATO reinforced our commitment to Eastern European allies; the

IMF is helping to stabilize Ukraine’s economy; OSCE monitors

brought the eyes of the world to unstable parts of Ukraine.13

With those and similar remarks, Obama may not have explicitly adopted a

policy of containment, but the logic of his administration's actions points in

that direction. The administration continues to threaten Russia with further

sanctions should Moscow not act to deescalate the crisis, but it provides no

clear indication of what Russia must do for the sanctions to be lifted. It

speaks as if it intends to treat Russia as a long-term adversary (or for at least

as long as Putin remains in power), while limiting cooperation—as in the

Cold War—to those areas it judges critical to American security and which

necessitate working with Russia (e.g., implementation of the new START

11

See "Summary of North American Chapter" in Paula Dobriansky, Andrzej Olechowski,

Yukio Satoh, and Igor Yurgens, Engaging Russia: A Return to Containment?, The Trilateral

Commission 2013/2014 Task Force Report, May 15, 2014, pp. 12-20, which leans heavily

towards containment as the appropriate U.S. Russia policy.

12

See "Remarks by President Obama and Prime Minister Netanyahu before Bilateral

Meeting," March 3, 2014, available at http://m.whitehouse.gov/the-pressoffice/2014/03/03/remarks-president-obama-and-prime-minister-netanyahu-bilateralmeeting.

13

See Remarks of President Barack Obama, Graduation Ceremony, West Point, New York,

May 28, 2014, available at http://www.whitehouse.gov/the-pressoffice/2014/05/28/remarks-president-barack-obama-graduation-ceremony-west-point-newyork.

26

The Dangers of a New Containment Policy for Russia

treaty and retaining access to the International Space Station). Moreover, its

tendency to look at Russia and the Ukraine crisis solely through the prism of

security in Europe—the Cold War's central battlefield—lends its Russia

policy a Cold-War aura, even if Obama insists we are not witnessing a return

to that era.14

There are good reasons for skepticism that the United States can contain

Russia as effectively today as it once did the Soviet Union. Today's world is

radically different from the Cold War's bipolar world of existential struggle

between two diametrically opposed views of man, society, and the state,

between two world systems with few points of contact. Now, in contrast, we

live in an increasingly multipolar, globalized world in which traditional

geopolitical competition is overlaid by a set of global challenges, the

management of which requires collective action. Russia, among the world's

largest economies, is moreover increasingly integrated into the global

economy, having abandoned the Soviet quest for autarky, which is now

considered unworkable. Under those circumstances, the developed world will

not defer to the United States, as it generally did during the Cold War, and

the major emerging powers are unlikely to give the U.S. much heed.

Notwithstanding closer U.S.-European Union alignment and greater

European unity after Ukraine’s rebel forces apparently accidentally shot

down Malaysian Airlines Flight 17, the travails in forging transatlantic unity

on tough sanctions against Russia and the refusal of China, India, and Brazil

to condemn Russia's annexation of Crimea foretell the challenges ahead. If

the current cease-fire in Ukraine holds and the parties begin to seek a

political settlement, these challenges will grow.

*

*

*

The challenges, however, are not likely to dissuade the American political

establishment from considering—nor the Administration from

implementing—ever-harsher measures to tame a resurgent Russia, even if

actual containment is infeasible. The prevailing view is that the United States,

as a matter of principle and national interest, must push back vigorously

against a Russia that challenges the principles of the American-led world

order and that more often than not seeks to constrain American action on a

range of functional and geopolitical matters.

14

Ibid.

27

Graham

The world-order challenge is hardly new. Even under Yeltsin, the Kremlin

never truly accepted American leadership. Initially it aspired to be an equal

with the United States in managing the global agenda, however impossible an

ambition that might have been given the gaping asymmetry in power and

fortune between the two countries then. Later, it actively promoted a

multipolar world, working with China and India, in particular, to create a

counterbalance to the West. All along it vehemently opposed NATO

expansion. Moreover, while it might have declared support for democratic

and free-market principles, it upheld a traditional view of national

sovereignty and rejected humanitarian intervention; witness the stiff

opposition to NATO's military operation against Serbia for its actions in

Kosovo in 1999. The United States evinced little concern, however, for

Yeltsin's Russia was mired in a profound socioeconomic and political crisis

and lacked the capability for effective resistance.

That changed under Putin. The remarkable and largely unanticipated

recovery that took place on his watch gave Russia the resources and

confidence to pursue more assertive policies against what it saw as the

United States’ hegemonic designs. Throughout his first two presidential

terms, Putin sought to constrain the United States in three ways: He

championed the UN Security Council as the sole authority for legitimating

the use of force (other than in self-defense) and sought to bring key issues to

the Council, where Russia could use its veto to thwart or shape American

initiatives; He built coalitions designed to limit America's room for

maneuver, taking the lead in creating the BRICS in order to lessen Western

domination of global economic management and joining China in the