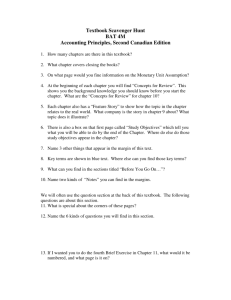

Accounting Information for Managers

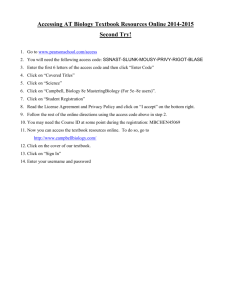

advertisement