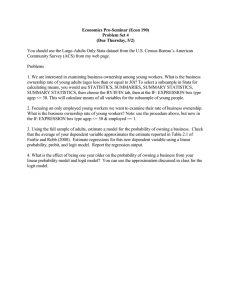

Econometrics Exercise Answers: Logit Model Analysis

advertisement

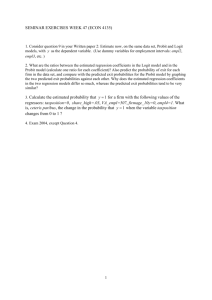

CHAPTER 16 Exercise Answers EXERCISE 16.2 (a) The maximum likelihood estimates of the logit model are 1 2 DTIME 0.2376 0.5311DTIME (se) (0.7505) (0.2064) These estimates are quite different from the probit estimates on page 593. The logit estimate 1 is much smaller than the probit estimate, whereas 2 and the standard errors are larger compared to the probit model. The differences are primarily a consequence of the variance of the logistic distribution 2 3 being different to that of the standard normal (1). (b) dp d (l ) dl (1 2 x)2 , where l 1 2 x dx dl dx Given that DTIME = 2, the marginal effect of an increase in DTIME using the logit estimates is dp 0.1125 dDTIME (c) Using the logit estimates, the probability of a person choosing automobile transportation given that DTIME = 3 is 0.7951 1 Chapter 16, Exercise Answers, Principles of Econometrics, 4e 2 Exercise 16.2 (continued) (d) The predicted probabilities (PHAT) are 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. +-------------------------+ | dtime auto phat | |-------------------------| | -4.85 0 .0566042 | | 2.44 0 .7423664 | | 8.28 1 .9846311 | | -2.46 0 .1759433 | | -3.16 0 .1283255 | | 9.1 1 .9900029 | | 5.21 1 .9261805 | | -8.77 0 .0074261 | | -1.7 0 .2422391 | | -5.15 0 .0486731 | | -9.07 0 .0063392 | | 6.55 1 .9623526 | | -4.4 1 .0708038 | | -.7 0 .3522088 | | 5.16 1 .9243443 | | 3.24 1 .8150529 | | -6.18 0 .0287551 | | 3.4 1 .827521 | | 2.79 1 .7762923 | | -7.29 0 .0161543 | | 4.99 1 .9177834 | +-------------------------+ Using the logit model, 90.48% of the predictions are correct. EXERCISE 16.3 (a) The least squares estimated model is pˆ 0.0708 0.160 FIXRATE 0.132 MARGIN 0.793YIELD (se) (1.288) (0.0822) (0.0498) (0.323) 0.0341MATURITY 0.0887 POINTS 0.0289 NETWORTH (0.0118) (0.191) (0.0711) All the signs of the estimates are consistent with expectations. The predicted values are between zero and one except those for observations 29 and 48 which are negative. Chapter 16, Exercise Answers, Principles of Econometrics, 4e 3 Exercise 16.3 (continued) (b) The estimated probit model is pˆ (1.877 0.499 FIXRATE 0.431MARGIN 2.384YIELD (se) (4.121) (0.262) (0.174) (1.083) 0.0591MATURITY 0.300 POINTS 0.0838 NETWORTH ) (0.0379) (0.623) (0.241) All the estimates have the expected signs. Ignoring the intercept and using a 5% level of significance and one-tail tests, we find that all coefficients are statistically significant with the exception of those for MATURITY and POINTS. (c) The percentage of correct predictions using the probit model to estimate the probabilities of choosing an adjustable rate mortgage is 75.64%. (d) The marginal effect of an increase in MARGIN at the sample means is dp 0.164 dMARGIN This estimate suggests that, at the sample means, a one percent increase in the difference between the variable rate and the fixed rate decreases the probability of choosing the variable-rate mortgage by 16.4 percent.