Seminar exercises week 47

advertisement

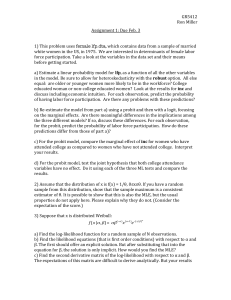

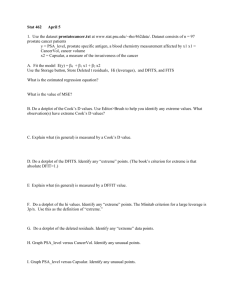

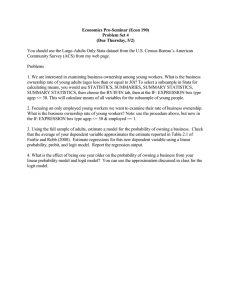

SEMINAR EXERCISES WEEK 47 (ECON 4135) 1. Consider question 9 in your Written paper 2: Estimate now, on the same data set, Probit and Logit models, with y as the dependent variable. (Use dummy variables for employment intervals: empl2, empl3, etc. ) 2. What are the ratios between the estimated regression coefficients in the Logit model and in the Probit model (calculate one ratio for each coefficient)? Also predict the probability of exit for each firm in the data set, and compare with the predicted exit probabilities for the Probit model by graphing the two predicted exit probabilities against each other. Why does the estimated regression coefficients in the two regression models differ so much, whereas the predicted exit probabilities tend to be very similar? 3. Calculate the estimated probability that y 1 for a firm with the following values of the regressors: taxposition=0, share_high=.03, VA_empl=507, firmage_10y=0, empl4=1. What is, ceteris paribus, the change in the probability that y 1 when the variable taxposition changes from 0 to 1 ? 4. Exam 2004, except Question 4. 1