Multiple choice Tests -Financial accounting and reporting

advertisement

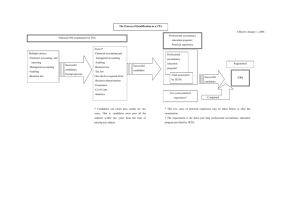

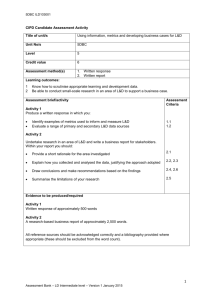

Process for Becoming a CPA Effective on January 1, 2006 Professional accountancy CPA Examinations conducted by CPAAOB (FSA) education program / Practical experience Essays* Multiple choice Tests -Financial accounting and reporting -Managerial accounting -Auditing -Business Law -Financial accounting and Professional Managerial accounting accountancy -Auditing Successful candidates -Business law Successful -Tax law candidates education Registration 1 program One elective required from: Final assessments -Business administration; by JICPA Successful CPA Candidates -Economics; -Civil Code; or Minimum Two years of -Statistics Practical experience2 Completed * Candidates can retain pass credit for two 1 years. That is, candidates must pass all the program provided by Japan Foundation for Accounting Education and Learning subjects within two years from the time he/she (JFAEL) first passes any one or more of the subjects. 2 The requirement is the three-year long professional accountancy education Minimum two years of practical experience is required, which can be taken either before or after the examinations.