Accounting Cycle Test Review: Chapter 8 Practice & Key Terms

advertisement

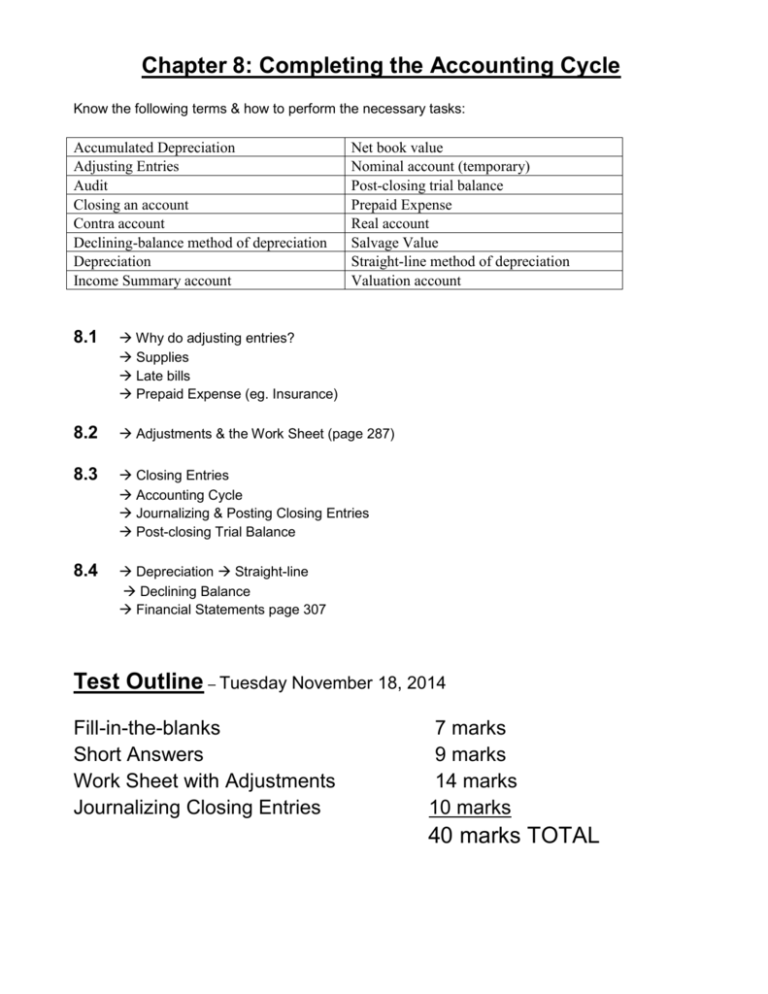

Chapter 8: Completing the Accounting Cycle Know the following terms & how to perform the necessary tasks: Accumulated Depreciation Adjusting Entries Audit Closing an account Contra account Declining-balance method of depreciation Depreciation Income Summary account Net book value Nominal account (temporary) Post-closing trial balance Prepaid Expense Real account Salvage Value Straight-line method of depreciation Valuation account 8.1 Why do adjusting entries? Supplies Late bills Prepaid Expense (eg. Insurance) 8.2 Adjustments & the Work Sheet (page 287) 8.3 Closing Entries Accounting Cycle Journalizing & Posting Closing Entries Post-closing Trial Balance 8.4 Depreciation Straight-line Declining Balance Financial Statements page 307 Test Outline – Tuesday November 18, 2014 Fill-in-the-blanks Short Answers Work Sheet with Adjustments Journalizing Closing Entries 7 marks 9 marks 14 marks 10 marks 40 marks TOTAL BAF 3MI: Chapter 8 – Test Review Completing the accounting cycle 1. The nine steps of the accounting cycle are listed below in random order. Number the steps in the order in which they occur in the accounting cycle. 2. _________ Accounting entries are recorded in the journal. _________ An income statement and a balance sheet are prepared. _________ Adjusting entries are journalized and posted. ________ Transactions occur. _________ The ledger is balanced by means of a trial balance. _________ A post-closing trial balance is prepared. ________ A worksheet is prepared. ________ Closing entries are journalized and posted. ________ Journal entries are posted to the ledger accounts. The trial balance figures for Dennison Delivery Service appear on the following worksheet. Using the additional information below, complete the eight-column worksheet for the fiscal year ended June 30, 20–4. HST accounts are not to be considered. Additional Information 1. Purchase invoices received in July, 20–4, pertaining to goods and services received in June 20–4, are for the following: Supplies $280.00 Miscellaneous Expense 140.00 Utilities Expense 210.20 2. The supplies inventory taken on June 30, 20–4, amounted to $625.00. 3. The Prepaid Licences account showed that the value of unexpired licences on June 30, 20–4, amounted to $412.00. 4. The prepaid insurance schedule as of June 30, 20–4, showed a total of $215 in unexpired insurance. Dennison Delivery Service ACCOUNTS Bank Accounts Receivable Worksheet ADJUSTMENTS Dr Dr Cr 1 074.00 1 400.00 17 000.00 Building 50 000.00 Furniture and Equipment 12 970.00 Trucks 48 472.00 Accounts Payable Cr BALANCE SHEET Dr 3 417.40 J. Budd, Capital 114 273.68 8 900.00 Fees Earned 70 721.19 Bank Charges 115.25 Miscellaneous Expense 219.51 Truck Expense Dr 1 146.00 Land Telephone Expense Cr 12 419.00 Prepaid Insurance J. Budd, Drawings INCOME STATEMENT 2 570.00 Supplies Prepaid Licences Year Ended June 30, 20–4 TRIAL BALANCE 316.25 11 901.32 Utilities Expense 2 506.00 Wages Expense 17 402.94 188 412.27 188 412.27 B. Prepare the four closing entries for Dennison Delivery Service as of June 30, 20–4. GENERAL JOURNAL DATE PARTICULARS P.R. PAGE _____ DEBIT CREDIT C. Assuming all entries have been posted, calculate the ending Capital balance for Dennison Delivery Service as of June 30, 20–4. Use the account provided below. Cr J. Budd, Capital ACCOUNT DATE Jul. 20–3 D. NO. 301 PARTICULARS P.R. DEBIT 1 CREDIT 114 2 7 3 Dr/Cr 68 Cr BALANCE 114 2 7 3 Prepare a post-closing trial balance for Dennison Delivery Service. ___________________________________ ___________________________________ ____________________________________ ACCOUNTS 3. DEBIT CREDIT A company purchases equipment costing $24 000, which it expects to last 6 years and to have a salvage value of $3000. A. Prepare a schedule of depreciation for the first five years using the straight-line method. Straight-line Depreciation Year Depreciation Balance $24 000 1 2 3 4 5 B. For the same equipment, prepare a schedule of depreciation for the first five years using the true declining-balance method. Canada Revenue Agency’s prescribed rate for depreciation is 30%. Declining Balance Year Depreciation Balance $24 000.00 1 2 3 4 5 4. Indicate which of the accounts below are nominal accounts by placing a checkmark (✓) in the 68 space provided. A. Accounts Receivable F. Salaries B. Bank Charges G. Chris Vella, Capital C. Miscellaneous Expense H. Fees Earned D. Automobiles I. E. Accounts Payable J. Bank Loan Chris Vella, Drawings 5. Calculate the value of the unexpired insurance on the following policies as of June 30, 20–4. Company Policy Date Term Premium Unexpired Insurance a. Bristol July 31, 20–3 1 year $ 420 _______________________ b. Maine October 31, 20–3 1 year $1 080 ________________________ c. Ipswich January 31, 20–4 1 year $ 576 _______________________ 6. For each account, which worksheet column would be extended? Place a checkmark (✓) in the appropriate column. Trial Balance Dr Example: Commission Earned A. Accounts Payable B. Miscellaneous Expense C. Advertising Expense D. Equipment E. G. Rojek, Capital F. HST Recoverable G. HST Payable H. G. Rojek, Drawings I. Bank Charges J. Supplies Cr ✓ Income Statement Dr Cr ✓ Balance Sheet Dr Cr