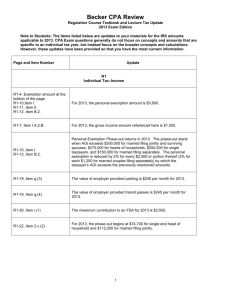

Provided Tax Tables

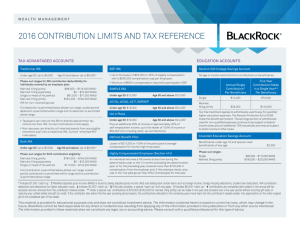

advertisement

Provided Tax Tables The tax tables and limits below are provided to individuals taking the March 2016 CFP® Certification Examination. Exam Window Tax Rates, Tables, & Law Tested March 2016 July 2016 November 2016 2015 2016 2016 INCOME TAX RATES 2015 SINGLE Taxable Income But Not Over % on Over $ 0 -- $ 9,225 9,225 -- 37,450 Pay + Excess of the amount over $ 0 10% $ 0 37,450 922.50 15 9,225 -- 90,750 5,156.25 25 37,450 90,750 -- 189,300 18,481.25 28 90,750 189,300 -- 411,500 46,075.25 33 189,300 411,500 -- 413,200 119,401.25 35 411,500 413,200 -- ------- 119,996.25 39.6 413,200 2015 MARRIED FILING JOINTLY Taxable Income But Not Over $ % on Over $ 18,450 Pay $ + 0 of the amount over Excess 0 -- 10% $ 0 18,450 -- 74,900 1,845.00 15 18,450 74,900 -- 151,200 10,312.50 25 74,900 151,200 -- 230,450 29,387.50 28 151,200 230,450 -- 411,500 51,577.50 33 230,450 411,500 -- 464,850 111,324.00 35 411,500 464,850 -- ------- 129,996.50 39.6 464,850 2015 MARRIED FILING SEPARATELY Taxable Income But Not Over % on Over Pay + Excess 10% of the amount over $ 0 -- $ 9,225 $ 0 $ 0 9,225 -- 37,450 922.50 15 9,225 37,450 -- 75,600 5,156.25 25 37,450 75,600 -- 115,225 14,693.75 28 75,600 115,225 -- 205,750 25,788.75 33 115,225 205,750 -- 232,425 55,662.00 35 205,750 232,425 -- ------- 64,989.25 39.6 232,425 Page 2 of 11 2015 HEAD OF HOUSEHOLD Taxable Income But Not Over $ % on Over $ 13,150 Pay $ + 0 of the amount over Excess 0 -- 10% $ 0 13,150 -- 50,200 1,315.00 15 13,150 50,200 -- 129,600 6,872.50 25 50,200 129,600 -- 209,850 26,722.50 28 129,600 209,850 -- 411,500 49,192.50 33 209,850 411,500 -- 439,000 115,737.00 35 411,500 439,000 -- ------- 125,362.00 39.6 439,000 2015 NET INVESTMENT INCOME TAX The net investment income tax is applied at a rate of 3.8%. Individuals Applied to the lesser of: • • the net investment income, or the excess of modified adjusted gross income over the following threshold amounts: o $250,000 for married filing jointly or qualifying widow(er) with dependent child o $125,000 for married filing separately o $200,000 in all other cases Estates & Trusts Applied to the lesser of: • • the undistributed net investment income, or the excess of: o the adjusted gross income over $12,300 Page 3 of 11 2015 ADDITIONAL MEDICARE TAX The additional Medicare tax is applied at a rate of 0.9%. Filing Status Threshold Amount Married filing jointly $250,000 Married filing separately $125,000 Single, Head of household, or Qualifying widow(er) $200,000 2015 LONG-TERM CAPITAL GAINS RATES Maximum Long-Term Capital Gain Tax Rate Taxpayers in the 10% or 15% ordinary income tax bracket 0% Taxpayers in the 25%, 28%, 33%, or 35% ordinary income tax bracket 15% Taxpayers in the 39.6% ordinary income tax bracket 20% IRC Section 1250 depreciation recapture 25% Collectibles 28% Page 4 of 11 2015 CORPORATE INCOME TAX RATES Taxable Income But Not Over $ % on Over $ 50,000 Pay $ + 0 Excess of the amount over 15% $ 0 -- 0 50,000 -- 75,000 7,500 25 50,000 75,000 -- 100,000 13,750 34 75,000 100,000 -- 335,000 22,250 39 100,000 335,000 -- 10,000,000 113,900 34 335,000 10,000,000 -- 15,000,000 3,400,000 35 10,000,000 15,000,000 -- 18,333,333 5,150,000 38 15,000,000 18,333,333 -- ---------- 35 0 2015 ESTATES AND NON-GRANTOR TRUSTS INCOME TAX RATES Taxable Income But Not Over $ % on Over $ 2,500 Pay $ 0 + of the amount over Excess 0 -- 15% $ 0 2,500 -- 5,900 375.00 25 2,500 5,900 -- 9,050 1,225.00 28 5,900 9,050 -- 12,300 2,107.00 33 9,050 12,300 -- ------ 3,179.50 39.6 12,300 Page 5 of 11 2015 STANDARD DEDUCTIONS AND PERSONAL EXEMPTION Standard Deduction*: Single Married filing jointly/ Qualifying widow $ 6,300 12,600 Married filing separately 6,300 Head of household 9,250 Dependent 1,050** *increased by $1,250 for a married taxpayer age 65 or older or blind ($2,500 if both 65 and blind); by $1,550 for a single taxpayer age 65 or older or blind ($3,100 if both 65 and blind) **or $350 plus earned income, if greater Personal Exemption: $4,000 Page 6 of 11 2015 RETIREMENT PLAN CONTRIBUTION LIMITS AND PHASE-OUTS Elective deferrals 401(k), 403(b), 457, and SARSEPS Catch - up contribution Defined contribution limit Defined benefit limit $18,000 $6,000 $53,000 $210,000 SIMPLE plan elective deferral limit $12,500 SIMPLE catch-up contribution $3,000 Maximum includible compensation $265,000 Highly compensated employee Look-back to 2014 $115,000 Look-back to 2015 $120,000 Key employee (top-heavy plan) SEP participation limit IRA or Roth IRA contribution limit IRA or Roth IRA catch-up >$170,000 $600 $5,500 $1,000 IRA deduction phaseout for active participants Single Married filing jointly Married filing separately Spousal IRA $61,000-$71,000 $98,000-$118,000 $0-$10,000 $183,000-$193,000 Roth IRA phaseout Single $116,000-$131,000 Married filing jointly $183,000-$193,000 Page 7 of 11 2015 ESTATE AND GIFT TAX RATES AND EXEMPTIONS Applicable credit for gift/estate taxes $2,117,800 Applicable exclusion amount $5,430,000 Max Estate/Gift Tax Rate 40% Max Generation-Skipping Transfer Tax (GSTT) Rate 40% $14,000 Annual gift tax exclusion 2015 SOCIAL SECURITY WAGE BASE AND EARNINGS LIMITS Wage base $118,500 Earnings limitations: Below Full Retirement Age $15,720 Persons reaching Full Retirement Age $41,880 2015 SOCIAL SECURITY FULL RETIREMENT AGES Year of Birth Social Security Full Retirement Age Year of Birth Social Security Full Retirement Age 1943-54 66 1958 66 and 8 months 1955 66 and 2 months 1959 66 and 10 months 1956 66 and 4 months 1960 and later 67 1957 66 and 6 months Page 8 of 11 2015 HEALTH SAVINGS ACCOUNT LIMITS High Deductible Health Plan Minimum Deductible Amounts Single $1,300 Family $2,600 Maximum Out-of-Pocket Limits Single $6,450 Family $12,900 Contribution Maximums Single $3,350 Family $6,650 Catch-Up Contributions (age 55 or older) $1,000 Page 9 of 11 2015 EDUCATION PHASE-OUTS EE bonds for education - exclusion phaseout Single Married filing jointly $77,200 - $92,200 $115,750 - $145,750 Coverdell Education Savings Account- contribution phase-out Single Married filing jointly $95,000 - $110,000 $190,000 - $220,000 Lifetime Learning Credit - AGI phase-out Single Married filing jointly $55,000 - $65,000 $110,000 - $130,000 American Opportunity Tax credit - AGI phase-out Single Married filing jointly $80,000 - $90,000 $160,000 - $180,000 Education loan interest deduction - AGI phase-out Single Married filing jointly $65,000 - $80,000 $130,000 - $160,000 Page 10 of 11 2015 ALTERNATIVE MINIMUM TAX (AMT) EXEMPTIONS AND PHASE-OUTS Filing Status Exemption AMTI Phase-Out Single $53,600 $119,200 Married filing jointly $83,400 $158,900 Married filing separately $41,700 $79,450 Trusts and estates $23,800 $79,450 2015 AMT RATES AMTI up to $185,400 26% AMTI over 28% $185,400 2015 CHILD TAX CREDIT Modified AGI Beginning Phase-Out Range for Child Tax Credit Married Filing Jointly $110,000 Single/Head of Household $ 75,000 Married Filing Separately $ 55,000 Phase-out complete when MAGI exceeds applicable threshold by $20,000/child Page 11 of 11