09 allow for sampling risk0001

advertisement

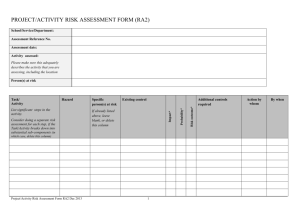

Attachment 4: Workpaper 2 alternate Charles Cabinets Revenue Collection cycle Accounts Receivable performed by: date: John 2/29112 Nature of test: Test of details Objective: The objective ofthis procedure is to determine if the accounts receivable account are overstated. Assertion(s): Existence; Valuation and Allocation Tolerable error: For accounts receivable tolerable error has been set at 10% of the account balance $237,198.36 ( 10% x $2,371.983.60) Procedure: Sample size calculation and evaluation of sample results Account balance Tolerable error Standard deviation $2,371,983.601 N 237,198.36 806.81 Ho: u > 2,550.52 - 255.05 a = 0.30 Za/2 = 1.04 P = 0.15 Z~ = 1.04 = 930 average = $2,550.52 255.05 tolerable error is 10% of the recorded balance risk of incorrect rejection risk of incorrect acceptance TE = Z~* SJ...Jn + Za/2* Sx/...Jn 255.05 = 1.04*806.811...jn + 1.04*806.811...Jn ...In = 2.08*806.81 1255.05 255.05 = 2.08*806.8\t...Jn n = 43.29 => n = 44 4'" . .s ~II •• Y,~ \ ,'" 0" ~\ pl' e Projection of Sample Results to the population sample results 106,724.85 =Zp 1.04 sample n= mean N= 44 ,>.425.56/' 2,371,983.60 Book value 2,255,775.24 projected balance 116,208.36 projected overstatement * SJ'l/n 1,390.09 "44 = 217.95 x 930 202,690.25 318,898.62 allowance for sampling risk projected error plus allowanc We are unable to conclude that Accounts Receivable is not materially overstated because the projected overstatement plus the allowance for sampling risk exceeds the $237,198.36 tolerable error. 14 Attachment 2: Workpaper 2 performed date: Charles Cabinets Revenue Collection cycle Accounts Receivable John by: 2/29112 Nature of test: Test of details Objective: The objective of this procedure is to determine if the accounts receivable account are overstated. Assertion(s): Existence; Valuation and Allocation Tolerable error: For accounts receivable tolerable error has been set at 10% of the account balance $237,198.36 ( 10% x $2,371.983.60) Procedure: Sample size calculation and evaluation of sample results Account balance Tolerable error Standard deviation $2 371.983.601 N = 930 237,198.36 806.81 Ho: u > 2,550.52 - 255.05 a = 0.30 ZaJ2 = 1.04 ~=0.15 ZB =1.04 average = $2,~50.52 255.05 tolerable error is 10% of the recorded balance risk of incorrect rejection risk of incorrect acceptance y. TE = Zp* Sxl,jn + ZaJ2* Sxl,jn 255.05 = 1.04*806.811,jn + 1.04*806.811,jn ,jn = 2.08*806.81 1255.05 255.05 = 2.08*806.811,jn/hJ1 n =43.29 =>h~44 \\0 'r 1-\·1.o.J Evaluation of Sample Results Critical Value = /.l + Zp* Sxl,jn /sl ~" , "I>' , Iff ~ 2,295.47 + i04 * 1,39-0-.0-9 -I,j-4•)••• 2513.42 We are unable to conclude that Accounts Receivable is not materially overstated because the sample mean of $2,425.56 is less than the $2,513.42 critical value. 12 ~D .J1 z 1. 451'7 ell Z '511,liS :2.. L3t.\ "leG ""t'(" I r e J .c.,. ~~"'P\e %.\1. qj zez., r.qo r3 255o.5z- ,\\1 rz. 1