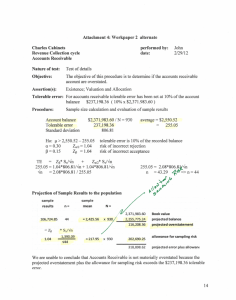

Attachment 2: Workpaper 2 - Accounts Receivable simulation

advertisement

Accounts Receivable: An Audit Simulation “The auditor must obtain sufficient appropriate audit evidence by performing audit procedures to afford a reasonable basis for an opinion regarding the financial statements under audit.” (AICPA 2010a) THE AUDIT SIMULATION This is your first week on the job as a new hire at the CPA firm, DC&H, LLP. During today’s training we will learn how to confirm accounts receivables. This training is based on a client of the firm. Although there may be situations when accounts receivable is understated, our primary concern for accounts receivable is typically overstatement and this exercise will focus on overstatement. The related financial statement assertions are existence, and valuation and allocation. In 1938, the Securities Exchange Commission (SEC 1940) investigated the McKesson & Robbins, Inc. fraud and found that the auditors had failed to detect $19 million in fictitious receivables and inventory. At that time, auditing standards did not require the confirmation of receivables. In their findings the SEC stated “The facts of this case, however, demonstrate the utility of circularization and the wisdom of the profession in subsequently adopting confirmation of accounts and notes receivable as a required procedure whenever practicable and reasonable, and where the aggregate amounts of notes and accounts receivable represents a significant proportion of the current assets or of the total assets of a concern.” (Securities and Exchange Commission) This exercise covers auditing standards relating to the confirmation process, audit sampling, evaluation of results, and audit documentation. It includes a hands-on Excel simulation. After completing this project you should understand the confirmation process used to audit accounts receivable; one type of alternative audit procedure that can be performed for customers who do not respond to confirmations; how statistical sampling can be used to control detection risk; how to evaluate the audit evidence generated by the audit procedures; and how to prepare audit workpapers for accounts receivable. The Confirmation Process (AICPA 2010 AU 330) Accounts receivable are addressed by AU 330, The Confirmation Process (AICPA 2010b). “Confirmation of accounts receivable is a generally accepted auditing procedure. As discussed in paragraph .06, it is generally presumed that evidence obtained from third parties will provide the auditor with higher-quality evidence than is typically available from within the entity. Thus, there is a presumption that the auditor will request the confirmation of accounts receivable during the audit unless one of the following is true: Accounts receivable are immaterial to the financial statements. The use of confirmations would be ineffective. The auditor’s combined assessed level of inherent risk and control risk is low, and the assessed level, in conjunction with the evidence expected to be provided by analytical procedures or other substantive tests of details, is sufficient to reduce audit risk to an acceptably low level for the applicable financial statement assertions. In many situations, both confirmation of accounts receivable and other substantive tests of details are necessary to reduce audit risk to an acceptably low level for the applicable financial statement assertions.” Audit Sampling (AICPA 2010 AU 350) The first step in the confirmation process is to determine how many customer accounts must be confirmed in order to provide sufficient evidence and then determine which customers to confirm. Although auditing standards permit the use of non-statistical sampling, statistical sampling provides auditors with an objective method to determine the sufficiency of the evidence. This can be beneficial during peer reviews, PCAOB inspections or litigation. On most audits, DC&H uses dollar-unit-sampling (DUS) to calculate the sample size, select the sample and analyze the results. DUS is a form of probability-proportional-to-size 2 sampling which may have been discussed in your college statistics course. However, today’s exercise uses mean-per-unit (MPU) sampling, a classical variables approach, because college curricula typically use classical variables sampling to introduce confidence intervals and hypothesis tests. So, you should be somewhat familiar with classical variables sampling. Classical variables sampling allows us to illustrate how sample size can be used to manage risk during audit planning. In statistics, alpha (or type I) risk is associated with confidence intervals and beta (or type II) risk is associated with hypothesis testing. In auditing literature, these correspond with the risk of incorrect rejection (alpha risk) and the risk of incorrect acceptance (beta risk). “The risk of incorrect rejection is the risk that the sample supports the conclusion that the recorded account balance is materially misstated when it is not materially misstated. The risk of incorrect acceptance is the risk that the sample supports the conclusion that the recorded account balance is not materially misstated when it is materially misstated.” (AICPA 2010c) If our primary concern is that accounts receivable may be overstated, there are four possible outcomes as shown in Table 1. If accounts receivable are in fact fairly presented, we may correctly conclude they are fairly presented or incorrectly conclude they are materially overstated. If accounts receivable are materially overstated, we may correctly conclude accounts receivable are materially overstated or incorrectly conclude they are fairly presented. Table 1 If accounts receivable are actually fairly presented materially overstated and the auditor concludes accounts receivble are fairly presented materially overstated correct conclusion incorrect rejection β risk or Type II risk incorrect rejection α risk or Type I risk correct conclusion 3 If the accounts receivable are materially overstated and the sample size is to small, then the risk of incorrectly concluding the balance is fairly presented (i.e., the risk of incorrect acceptance) will be unacceptably high. This increases the probability that DC&H might issue an unqualified opinion on financial statements that are materially misstated which exposes DC&H to legal liability to investors. If the accounts receivable are fairly presented and the sample size is to small, then the risk of incorrectly concluding the balance is materially overstated (i.e., the risk of incorrect rejection) will be unacceptably high. This increases the probability that DC&H will expand the scope of the audit or attempt to modify their opinion. Such a conclusion will lead to inefficiency or even damage the firm’s relationship with the client. When sample sizes are larger than necessary we perform excessive procedures which reduces the engagement’s profitability and inconveniences the client. At the extreme, firms that consistently perform excessive procedures price themselves out of the market. Charles Cabinet’s accounts receivable has a $2,908,144.44 balance which includes 1,000 customers. The standard deviation of these 1,000 accounts is $1,204.33. The standard deviation is a critical element in determining the appropriate sample size. It is important to realize that the standard deviation will change if there are any discrepancies between the audited balances and the recorded balances. If the incorrect standard deviation is used to calculate the required sample size, then sampling risk will differ from the planned risk of incorrect acceptance. Although professional standards do not require auditors to use statistical sampling, they do state that “an auditor who applies nonstatistical sampling uses professional judgment to relate 4 these factors1 in determining the appropriate sample size. Ordinarily, this would result in a sample size comparable to the sample size resulting from an efficient and effectively designed statistical sample, considering the same sampling parameters.” (AICPA 2010d) In this exercise, the audit team previously performed tests of controls and concluded that controls over credit sales transactions were very effective. Based on their test results, control risk was assessed as low for credit sales transactions. Because they are such a significant class of transactions, DC&H’s policies require that we always assess inherent risk as high for credit sales transactions. Table 2 is from DC&H’s audit manual and it specifies the appropriate risk of incorrect acceptance to calculate the required sample size. The risk of material misstatement (RMM) is the combination of internal risk and control risk. Any deviation from this firm guidance requires the engagement partner’s approval. Table 2 Appropriate level for Risk of Incorrect Acceptance Inherent Risk High Moderate Low Effectiveness of Controls less effective effective very effective CR = high CR = moderate CR = low RMM = high RMM = high RMM = high RoIA = .05 RoIA = .10 RoIA = .20 RMM = high RMM = mod RMM = mod RoIA = .10 RoIA = .25 RMM = mod RMM = mod DR = .20 DR = .30 RoIA = .30 RMM = low analytical procedures The Confirmation Process Continued (AICPA 2010 AU 330) 1 To determine the number of items to be selected in a sample for a particular test of details, the auditor should consider tolerable misstatement and expected misstatement, the audit risk, the characteristics of the population, and the assessed risk for other substantive procedures related to the same assertions. 5 After you determine the required sample size, you select a random sample of customers from Charles Cabinets' accounts receivable subsidiary ledger. You will provide their controller a list of customers to be confirmed and provide her or him with DC&H's template for positive confirmations on which they can prepare the confirmation requests. The Excel simulation will select the sample of customers in this exercise. Although the client prepares the confirmations, we must review the confirmation requests and oversee them being placed in envelopes. It is essential that we mail the confirmations from a public post office or from DC&H’s office but they cannot be mailed from the client’s mail room. The confirmation will include a return envelope that is pre-addressed to DC&H’s office. In the Excel simulation, go to the Summary Tab and enter the required sample size in the designated cell and click the “Generate” button to select a random sample of customers. Next, click the “Create” button and the simulation will prepare confirmations for those customers in the sample. By pressing the red “Confirms” link you can review these confirmations in your web browser. Next, the simulation will electronically mail the confirmations to the selected customers. After five days, you would go to DC&H’s office and pick up the responses from those customers who have returned their confirmations. In the simulation, you retrieve the first round of confirmations by clicking the “First” button. This is equivalent to picking up the mail from DC&H’s office. You can observe these responses in your web browser by clicking the green “Firsts” link. You will need to agree the customer name, address and balance on the confirmation response with information from the accounts receivable subsidiary ledger which will be available under the “Results” tab. The “Results” page is designed to accumulate your sample results and facilitate the preparation of 6 your workpapers. The “Results” page has a column to record the amount reported by the customer. If there is a discrepancy between the amount reported by the customer and the accounts receivable subsidiary ledger, assume the amount reported by the customer is correct. On actual engagements, you would perform additional procedures to investigate such discrepancies. For example, payments from customers which are in transit on December 31st can create discrepancies, as can shipments to customers which are in route as of December 31st. Again, for today’s exercise you should assume the amount reported by the customer is correct. Unfortunately, not all customers respond to confirmation requests. Last year’s workpapers indicate that only 22 out of 44 customers responded. If confirmations are scheduled early in the audit process we may be able to mail a second round of confirmations. One week after mailing the first confirmation requests, you will mail a second confirmation request to those customers who have not yet responded. This can be simulated by clicking the “Second” button, which electronically mails confirmations to those customers who have not yet responded. Responses to the second confirmation request can be viewed using the green “Seconds” link. The process is the same as for the first round of confirmations. The “Results” page of the workbook has a “2nd Balance” column to record the amounts confirmed by these customers. Alternative Procedures In order to limit the risk of incorrect acceptance to the desired level we must audit every account in the sample. Alternative procedures must be performed for customers who do not respond to the confirmations. One alternative procedure might be to investigate subsequent cash receipts. When customers pay their account in early January this provides evidence that those 7 accounts existed. However, subsequent cash receipts may not establish that the balance existed as of December 31st. In this exercise, the audit program shown in Table 3 instructs you to vouch from the accounts receivable subsidiary ledger to the invoice, bill of lading and customer’s purchase order. The purchase order will provide external evidence that there was an agreement between the customer and Charles Cabinets. The bill of lading will provide evidence that the goods were shipped and the revenue earned as of December 31st. The invoice will provide evidence that Charles Cabinets has billed the customer. Table 3 audit program for accounts receivable performed by da te workpa per reference Confirm accounts receivable determine appropriate sample size send first confirmation requests send second confirmation requests Perform alternate procedures for customers who do not respond to confirmations vouch account balance to invoice(s) vouch invoice to bill of lading vouch bill of lading to purchase order Evaluate results of confirmation and alternative procedures Conclude on accounts receivable Clicking the “Alternative” button in the simulation retrieves file copies of the invoices, bills of lading and purchase orders for those customers who have not responded to the confirmation requests. You can view these invoices in your web browser by clicking the green “Ins” link. You need to agree the customer’s name, address, amount and date on the invoice with the information on the accounts receivable subsidiary ledger. The amount on the invoice should be entered in the appropriate column of the “Results” page of the workbook. The green “BOLs” link enables viewing of bills of lading and the green “POs” link enables viewing of purchase 8 orders. You will agree the information on these source documents with the accounts receivable subsidiary ledger and document your observations in the appropriate columns of the “Results” page of the workbook. Evaluation of Results Auditing standards require us to project our sample results to the population. In order to conclude that accounts receivable are not materially overstated the projected error must be significantly less than tolerable misstatement. Otherwise, the sample results do not provide sufficient evidence for us to conclude that accounts receivable are fairly presented. If the projected error is only slight less than tolerable misstatement there may be an unacceptable level of risk (AU 350 AICPA 2010e). In such circumstances additional audit procedures will be necessary to reduce the level of audit risk to the acceptable level. Statistical sampling does not replace auditor judgment, but it does provide a valuable tool to evaluate the results of the firm’s confirmation procedures. Unexplained discrepancies should cause us to reconsider our assessment of control risk. In this exercise, control risk was previously assessed as low. However, a significant number of discrepancies or significantly large discrepancies are revealed by our substantive tests, the effectiveness of internal controls needs to be reviewed, regardless of the results from previous tests of controls. However, an extensive discussion of internal controls is beyond the scope of this exercise. 9 Audit Documentation (AICPA 2010 AU 339) AU 339 Audit Documentation (AICPA 2010f) states the following: “.10 The auditor should prepare audit documentation that enables an experienced auditor, having no previous connection to the audit, to understand: a. The nature, timing, and extent of auditing procedures performed to comply with SASs and applicable legal and regulatory requirements; b. The results of the audit procedures performed and the audit evidence obtained; c. The conclusions reached on significant matters; and d. That the accounting records agree or reconcile with the audited financial statements or other audited information.” Auditing standards require the auditor who performed the work to document her or his name and the date the work was completed. Audit documentation must be in sufficient detail to allow auditors who are new to the engagement to understand the procedures performed in the prior audit and must also provide guidance on how to perform the procedure in the current engagement. DC&H policy requires that workpapers utilize the template shown in Table 4. Table 4 Workpaper (reference number) Client name Transaction cycle Class of transactions or Account Nature of test: performed by: date: analytical procedure, test of controls, test of details, substantive analytical procedure Objective: Assertion(s): Tolerable error: Either a dollar amount or a percentage of the account balance Procedure: Description of the procedure performed be in sufficient detail to allow auditors who are new to the engagement to understand the procedures performed in the prior audit and must also provide guidance on how to perform the procedure in the current engagement Conclusion: Evaluation of the results of the procedure or a conclusion regarding the account or class of transactions 10 Hands-On Training Assignment General Instructions You are required to complete the same workpapers as provided from last year’s audit. The simulation uses four *.html templates to create certain files. You will need to download these templates and place them in the same folder as the spreadsheet. When Excel opens the simulation, you will probably need to enable macros. If your computer’s security settings are too restrictive, it may not allow you to enable the macros, in which case you will need to relax the security settings on the computer. Instructions for the simulation are on the “ReadMe” tab at the bottom of the spreadsheet. The “Results” page of the spreadsheet is designed to accumulate information for your workpapers. It may be easiest to imbed an Excel spreadsheet in your workpapers. The “Results” page can then be copied from the simulation and pasted into your workpapers. Project Deliverables Use your sample results to test the hypothesis that accounts receivable is materially overstated. Tolerable error should be $290,814.44, which is 10 percent of the book value. The risk of incorrect acceptance is 20 percent, and the risk of incorrect rejection is also 20 percent. The hypothesis test needs to evaluate whether the actual balance is less than $2,617,330.00 ($2,908,144.44 - $290,814.44). Calculate the critical value for your test. Compare your sample results to the critical value and determine whether you will (1) accept, or (2) fail to accept, that the recorded book value is not materially overstated. Present your answers in the form of working papers, as required by auditing standards: “The auditor must prepare audit documentation in connection with each engagement in sufficient detail to provide a clear understanding of the work performed (including the 11 nature, timing, and extent, and results of audit procedures performed), the audit evidence obtained and its source, and the conclusions reached.” (AICPA 2010f) There is no need to reinvent the wheel. Last year’s workpapers (Attachments 1 to 4) should help you understand the work to be performed and serve as a guide for preparing this year’s workpapers2. However, don’t let yourself become mechanical as circumstances will change from year to year. It is essential that you (1) understand why you are performing the procedures, (2) objectively evaluate the results of your procedures, and (3) update the workpapers accordingly. 2 Two examples of workpaper 2 are included. In the first example, a hypothesis test is used to evaluate the sample results. In the alternate presentation of workpaper 2, the sample results are projected to the account balance and the projected overstatement is compared with the tolerable misstatement for accounts receivable. 12 Attachment 1: Workpaper 1 Charles Cabinets Revenue Collection cycle Accounts Receivable performed by: date: John 2/29/11 Nature of test: Test of details Objective: The objective of this procedure is to determine if the accounts receivable account are overstated. Assertion(s): Existence and Valuation Tolerable error: For accounts receivable tolerable error has been set at 10% of the account balance Procedure: DC&H, LLP selected a random sample of 44 entries from the accounts receivable sub-ledger. On Feb. 10, 2011, a confirmation letter was sent to each customer in the sample. On Feb. 17, 2011 a second confirmation letter was sent to each customer in the sample who had not responded to the first letter. For each customer who did not respond to either confirmation, we vouched from the account balance on the schedule in Workpaper 3, which was selected from the accounts receivable sub-ledger, to the invoice, bill of lading and sales order. We agreed the date, customer name, address, PO number, and amount from the schedule with the invoice. We then agreed the date, customer name, address, and PO number on the invoice with the bill of lading. Finally, we agreed the date, customer name, address, PO number, and amount from the invoice with customer purchase order. Workpaper 2 shows how the appropriate sample size was calculated and the evaluation of the sample results. Workpaper 3 shows the sample results. Conclusion: Based on the sample results we are unable to conclude that accounts receivable are not materially overstated. More extensive substantive tests of details need to be performed to reduce the risk of incorrect acceptance to the desired level. 13 Attachment 2: Workpaper 2 Charles Cabinets Revenue Collection cycle Accounts Receivable performed by: date: John 2/29/11 Nature of test: Test of details Objective: The objective of this procedure is to determine if the accounts receivable account are overstated. Assertion(s): Existence and Valuation Tolerable error: For accounts receivable tolerable error has been set at 10% of the account balance $237,198.36 ( 10% x $2,371.983.60 ) Procedure: Sample size calculation and evaluation of sample results Account balance Tolerable error Standard deviation $2,371,983.60 / N = 930 237,198.36 806.81 Ho: μ > 2,550.52 – 255.05 α = 0.30 Zα/2 = 1.04 β = 0.15 Zβ = 1.04 average = $2,550.52 = 255.05 tolerable error is 10% of the recorded balance risk of incorrect rejection risk of incorrect acceptance TE = Zβ* Sx/√n + Zα/2* Sx/√n 255.05 = 1.04*806.81/√n + 1.04*806.81/√n √n = 2.08*806.81 / 255.05 255.05 = 2.08*806.81/√n n = 43.29 => n = 44 Evaluation of Sample Results Critical Value = μ + Zβ* Sx/√n 2,550.52 + 1.04 * 1,390.09 / √ 44 2,768.47 We are unable to conclude that Accounts Receivable is not materially overstated because the sample mean of $2,425.56 is less than the $2,768.47 critical value. 14 Attachment 3: Workpaper 3 Charles Cabinets Revenue Collection cycle Accounts Receivable performed by: date: John 2/29/11 Nature of test: Test of details Objective: The objective of this procedure is to determine if the accounts receivable account are overstated. Assertion(s): Existence and Valuation Tolerable error: For accounts receivable tolerable error has been set at 10% of the account balance Procedure: Results of confirmations and alternative procedures #1 part of the order was backordered and not shipped until Jan. 2011 #2 items were returned prior to 12/31/10 15 Attachment 4: Workpaper 2 alternate Charles Cabinets Revenue Collection cycle Accounts Receivable performed by: date: John 2/29/11 Nature of test: Test of details Objective: The objective of this procedure is to determine if the accounts receivable account are overstated. Assertion(s): Existence and Valuation Tolerable error: For accounts receivable tolerable error has been set at 10% of the account balance $237,198.36 ( 10% x $2,371.983.60 ) Procedure: Sample size calculation and evaluation of sample results Account balance Tolerable error Standard deviation $2,371,983.60 / N = 930 237,198.36 806.81 Ho: μ > 2,550.52 – 255.05 α = 0.30 Zα/2 = 1.04 β = 0.15 Zβ = 1.04 average = $2,550.52 = 255.05 tolerable error is 10% of the recorded balance risk of incorrect rejection risk of incorrect acceptance TE = Zβ* Sx/√n + Zα/2* Sx/√n 255.05 = 1.04*806.81/√n + 1.04*806.81/√n √n = 2.08*806.81 / 255.05 255.05 = 2.08*806.81/√n n = 43.29 => n = 44 Projection of Sample Results to the population sample results sample n= mean 106,724.85 44 = 2,425.56 x 930 2,371,983.60 2,255,775.24 116,208.36 = Zβ * Sx /√n = 217.95 x 930 202,690.25 1.04 1,390.09 √44 N= 318,898.62 Book value projected balance projected overstatement allowance for sampling risk projected error plus allowance for sampling risk We are unable to conclude that Accounts Receivable is not materially overstated because the projected overstatement plus the allowance for sampling risk exceeds the $237,198.36 tolerable error. 16 References AICPA Audit Sampling Guide Task Force. 2008 AICPA. Audit Guide: Audit Sampling, 2.30. New York: American Institute of Certified Public Accountants. Auditing Standards Board. 2010a. Codification of Statements on Auditing Standards, AU 150.02 Generally Accepted Auditing Standards. New York: American Institute of Certified Public Accountants. Auditing Standards Board. 2010b. Codification of Statements on Auditing Standards, AU 330.34 The Confirmation Process. New York: American Institute of Certified Public Accountants. Auditing Standards Board. 2010c. Codification of Statements on Auditing Standards, AU 350.12 Audit Sampling. New York: American Institute of Certified Public Accountants. Auditing Standards Board. 2010d. Codification of Statements on Auditing Standards, AU Section 350.23 Audit Sampling. New York: American Institute of Certified Public Accountants. Auditing Standards Board. 2010e. Codification of Statements on Auditing Standards, AU Section 350.26 Audit Sampling. New York: American Institute of Certified Public Accountants. Auditing Standards Board. 2010f. Codification of Statements on Auditing Standards, AU Section 339.10. Audit Documentation. New York: American Institute of Certified Public Accountants. Auditing Standards Board. 2010g. Codification of Statements on Auditing Standards, AU Section 339.03. Audit Documentation. New York: American Institute of Certified Public Accountants. Miller, C., and Savage, A. 2009. Vouch or Trace: A Revenue Recognition Audit Simulation. Issues in Accounting Education 24(1): 93-103. Monhemius, J., and Durkin, K. 2009. Detecting Circular Cash Flow. Journal of Accountancy Vol. 208(6): 23-30. Securities and Exchange Commission, Accounting Standards Release No. 19. Dec, 5, 1940. In the Matter of McKesson & Robbins. 17