FinMan Chapter 14 SM - Departamento de Contabilidad

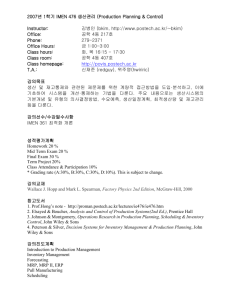

advertisement