PRIMA - Session 2and3

advertisement

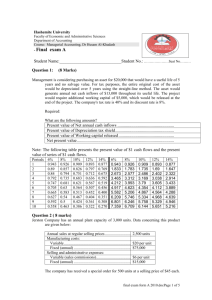

International Product Management g Dr. S D Sandra d C Cohen h scohen@aueb.gr 1 Workshop on Financial Aspects of International Marketing 2 Session 2 3 Section Outline: Break even point • • • • Break even for one product Contribution margin Basic cost cost-volume-profit volume profit model Break even point with multiple products 4 Break even analysis • Break-even point is the level of sales at which the sales revenue equals total costs • At the break-even point the company has zero operating income (neither a profit or a loss) 5 Contribution Margin per unit Price – Variable Cost (production and selling cost) = Contribution Margin 6 Cost behavior • In order to calculate the break –even point the costs have to be analyzed in y theyy behave when relation to the way changes in volume of activity take place – Variable costs – Fixed costs 7 Basic CVP in Graphical Format The Revenue and Cost lines can be overlaid to get a picture of the CVP relationship. Cosst & Reveenues CVP Graph: Fairfield Blues $1,250,000 $1 000 000 $1,000,000 $750,000 $500,000 $250,000 $0 0 50 000 50,000 90 000 90,000 130 000 170,000 130,000 170 000 Quantity of Tickets Sold Fairfield Blues sells tickets for $7. Fixed C Costs are $450,000 and Variable Costs per unit are $2 per ticket. p 8 Basic CVP in Graphical Format Revenue = $7 × Units Sold Fixed Costs = $450,000 , Cost & Revenu ues CVP Graph: Fairfield Blues $1 250 000 $1,250,000 $1,000,000 $750,000 $500,000 $250,000 $0 0 50,000 90,000 130,000 170,000 Quantity of Tickets Sold Total Cost = ($2 × Units Sold) + $450,000 9 Basic CVP in Graphical Format Loss Area is the amount by which total cost exceeds revenue. Cost & Revenu ues CVP Graph: Fairfield Blues Break-Even is Breakwhere the two lines intersect. $1 250 000 $1,250,000 $1,000,000 $750,000 $500,000 $250,000 $0 0 50,000 90,000 130,000 170,000 Quantity of Tickets Sold Profit Area is the amount byy which revenue exceeds total cost. 10 B k Even Break E Point P i t calculation l l ti BEP (units) = Fixed Cost Contribution margin per unit Contribution Margin per unit = Price – Variable Cost BEP (€) = Fixed cost Percentage Contribution Margin Percentage Contribution Margin = Contribution Margin / Price 11 B k Even Break E point i t Price = €5,25/unit Variable Cost = €3,5/unit Fixed cost = €8.300 Contribution Margin per unit = Price – Variable Cost BEP (units) = Fixed Cost Contribution margin per unit 12 B k Even Break E point i t Price = €5,25/unit Variable Cost = €3,5/unit Fixed cost = €8.300 Percentage Contribution Margin = Contribution Margin / Price BEP (€) = Fixed cost Percentage Contribution Margin OR 13 Price = €5,25/unit Variable cost = €3,50/unit , Fixed cost = €8.300 BEP (units) = 4.743 units BEP (€) = €24.900 €24 900 Difference in Diff i units it compared to BEP What would be the operating ti income i if 5.000 units were sold? Contribution Margin 14 Price = €5,25/unit Variable cost = €3,50/unit , Fixed cost = €8.300 BEP (units) = 4.743 units BEP (€) = €24.900 €24 900 Difference iin sales Diff l compared to BEP What would be the operating ti income i if sales we € 20.000? % Contribution g Margin 15 Cost - Volume - Profit analysis • Sales volume required (units) = (Fixed costs +required profit) Contribution margin per unit • Sales volume required (€) = (Fixed costs +required profit) % Contribution p per unit 16 Cost - Volume - Profit analysis Price = €10/unit Variable cost = €6/unit Fixed Cost = €4.000 Required profit = € 2.000 (ignore taxes) • Sales volume required (units) = (Fixed costs +required profit) Contribution margin per unit 17 Cost - Volume - Profit analysis Price = €10/unit Variable cost = €6/unit Fixed Cost = €4.000 Required profit = € 2.000 (ignore taxes) • Sales volume required (€) = (Fixed costs +required profit) % Contribution margin 18 CVP and dT Targett IIncome Break Breake -Even ve analysis ys s uses $0 for o p profit. o . Target ge Profit o analysis, puts a $ target in the profit variable, but uses the same model as BreakBreak-Even analysis. Planet, Inc. sells Model XT telescopes for $2,000 each. Fixed costs are $200,000, variable costs are $800 per unit. How many units does Planet need to sell in order to have target profit of $120,000? 19 Solution 20 Example • The following data relates to a new product due to be launched on the 1st March 20X2. – Selling Price €25.00/unit – Forecast Volume 30,000 30 000 units – Variable Costs €15.00/unit – Fixed Costs €200,000 21 Required: • Assuming that each of the following are independent of one another another, calculate the: – Break even point in units and €. – Break even point in units if variable costs per unit increase to €16.00. – Break even p point in € if the fixed costs increase to € 235,000. – Expected profitability based on forecasted volume – Minimum selling price to meet a profit target of € 70,000. 22 23 24 B k even point Break i t with ith multiple lti l products BEP (units) = Fi d costt Fixed Weighted average Contribution Margin Weighted average Contribution Margin = % Sales Α (in units) x CMΑ + % Sales Β (in units) x CMΒ BEP Α (Units) = BEP x % Sales Α (in units) BEP B (Units) = BEP x % Sales B (in units) 25 Multiple Products Example Planet sells three types of telescopes. Relative sales (units) and cost estimates are the following. Total sales are 30 30.000 000 units : Per Unit Telescope Model XT Earth II Junior Sales price 2.000 1.200 500 Variable Cost 800 500 150 Relative % of Sales CM units 1.200 25% 700 40% 350 35% Required: Calculate the weighted average contribution margin 26 Multiple Products Example WACM XT EARTH II JUNIOR TOTAL PRICE 2000 1200 500 CM % SALES 1200 25% 700 40% 350 35% 100% WACM 27 Multiple Products Example Assume that yearly fixed costs are € 140,500 Per Unit Telescope Model XT Earth II Junior Sales price 2.000 1.200 500 Variable Cost 800 500 150 Relative % of Sales CM units 1.200 25% 700 40% 350 35% Required: C l l t BEP iin units Calculate it ((per product) d t) 28 Multiple Products Example BEP in i units it ((per product) d t) 29 Break even point with multiple products BEP (€) = Fi d costt Fixed % Weighted Average Contribution Margin % Weighted Average Contribution Margin = % Sales Α (in €) x % CMΑ + % Sales Β (in €) x % CMΒ OR BEP in (€) = ΒΕP (in units) A x Price A + ΒΕP (in units) B x Price B 30 Multiple Products Example • Required: – Calculate the BEP in (€) • Use both alternatives – Calculate the Operating income of the company 31 Multiple Products Example % Weighted Average Contribution Margin g XT EARTHIIII EARTH JUNIOR TOTAL PRICE CM %CM 2000 1200 1200 700 500 350 %SALES SALES UNITS SALES € 25% 40% 35% 100% 30.000 %SALES € %WACM 100% 32 Multiple p Products Example p BEP (€) 33 Multiple p Products Example p Operating Income 34 Example: Department Store • The marketing manager of a department store prepares 3 alternative scenarios in order to make projections about the level of sales necessary to Break Even • Scenarios relate to the forecast of sections’ contribution to the total sales (in €) • Budgeted fixed costs are € 50.000 • Please complete the scenarios and comment on the results 35 Scenario 1 Women section Men section Kinds section S l Sales 50% 30% 20% % CM 35% 28% 60% % Weighted Average CM Fixed cost 50.000 BEP € 36 Scenario 2 Women section Men section Kinds section Sales 40% 30% 30% % CM 35% 28% 60% g Average g CM % Weighted Fixed cost 50.000 BEP € 37 Scenario 3 Women section Men section Kinds section Sales 50% 40% 10% % CM 35% 28% 60% % Weighted Average CM Fixed cost 50.000 BEP € 38 International Product Management g Dr. S D Sandra d C Cohen h scohen@aueb.gr 39 Workshop on Financial Aspects of International Marketing 40 Session 3 41 Section Outline: Budget development for a new product • New product budget development – Sales budget – Cost budget g • Production cost – Raw materials, Direct labor and Manufacturing (Production) Overhead • Selling and administrative costs – Budgeted Profit and Loss statement 42 Basic considerations • Budget timeframe – What period of time should the budget cover? • Product characteristics • Frequency of controlling forecasts’ accuracy • Budget B d t development d l t responsibility ibilit – Input from different departments – Responsibility for data aggregation and budget presentation 43 Insider’s view Budget procedure overview Sales Budget Production B d Budget Budgeted Schedule of Direct- Materials Consumption Direct- Labor Budget Manufacturing Overhead Budget Budgeted Schedule of Cost of Goods Manufactured and Sold Selling and Marketing Budget Administrative Budget Budgeted Income Statement Cash Budget 44 Budget is developed in steps • Budget development is a stepwise procedure – Data gathering precedes data processing – Some budgets are developed in sequence (budget amounts t are correlated) l t d) and d some others th iin parallel (budget amounts are independent) • Use U off a software ft program – Commercial or customized – Excel intergraded spreadsheets 45 Budget is developed in steps • Analytical presentation and justification of all hypotheses included in the budget – Accuracy safeguarding – Revisions facilitation – Objective benchmark for comparing actual figures with budgeted estimations 46 Sales budget • Sales budget is the cornerstone of the total budget construction • Sales volume forecasts are based on: – Subjective/Qualitative methods – Objective/Quantitative Obj ti /Q tit ti methods th d • Both internal and external factors are taken into consideration 47 Internal factors • Expected sales per – – – – • • • • • product size, packaging, etc. salesman geographic area distribution channel Marketing strategies and promotion campaigns Product seasonality Market research indications Production capacity ….. 48 External factors • Projections related to the national economy and international economies trends • Projections regarding the sales and profit margins of the industry • Competition conditions – – – – Other products – substitutes Competitors Buyers bargaining power S ll Sellers bargaining b i i power • ….. 49 Sales budget • Be careful when making sales projections – What is the correct price p • Prices may be B2C and B2B • The e retail ea p price ce is s the ep price ce the e cus customer o e is s pay paying g for the product – it includes VAT • The whole sale p price is the p price that the retailer pays to the wholesaler – VAT is added on top 50 How could VAT be taken out from the retail price ? Price used for revenues calculation = Retail price (1+ % VAT) You buy a sandwich for € 2,80, VAT 23%. Sales revenue for the bakery = € 2,80 2 80 /(1+0 /(1+0,23) 23) = € 2,28 2 28 51 Example • Company A sells product X to company B for € 10 / unit • Company B sells product X to customers for € 25 /unit – VAT 23% • Required: – Calculate the sales revenues of company A for 10 units – Calculate the sales revenues of company B for 10 units – Calculate the % gross margin of company B 52 Solution Price Company A Quantity Sales revenue 10 Price Company B 10 100 Quantity Sales revenue 25 10 250 Price Company B 20,3252 Quantity Sales revenue 10 203,252 Gross margin Sales 203,3 Cost of good sold Cost of good sold 100 0 100,0 Gross margin 103,3 50,80% 53 Sales budget • Pricing policy is extremely important – Elasticity of demand • Sales price price, discounts discounts, bundles bundles, special offers, etc. Sales l Budget d (in (i €)) = Sales Budget g (in ( units)) × Sales price per unit 54 Sales budget international considerations • Companies that operate in an international context t t should h ld d develop l a sales l b budget d t ffor any given national market and then integrate th them iinto t a single i l sales l b budget d t • The heterogeneous characteristics of the national markets influence among others the estimated quantities of products to be sold, the seasonality of the demand, the pricing policy, etc. 55 Production budget • Production budget is based on the sales budget after making the necessary j adjustments – the beginning inventory of finished goods – the expected sales – the ending desired inventory of finished goods d 56 Production budget • Inventory policy is affected by: – Product vulnerability – Speed of technological obsolescence – Warehousing costs – Etc. Et 57 Production budget Production budget (units) = Sales budget (units) + Desired ending inventory (units) - Beginning inventory (units) 58 Production budget international considerations • Operation in different markets does not i fl influence th the aforementioned f ti d methodology th d l • Production budget should incorporate: – the different market dynamics and the different market maturity stages that eventually effect the l levels l off d desired i d iinventories t i • In case production takes place in more than one factories, the production budget is accordingly adjusted 59 Production cost budgets • Based on the production budget the following budgets are developed – the budget of direct materials, – the budget of direct labor and – the manufacturing overhead budget 60 Budgeted Schedule of Direct Material Consumption • Direct materials are all the raw materials th t are incorporated that i t d iinto t th the product d t • They y constitute an important p p part of the total cost of the materials that will be p consumed for its production • Direct materials are part of the direct cost because they are directly associated with the product 61 Budgeted Schedule of Direct Material Consumption • Includes the quantity and the cost of the necessary direct materials • It is based on product’s technical specifications – quantities of direct materials required for the completion of the product, based on the measurement unit of each direct material (e.g. kilograms, meters, etc) – Technical specifications should also mention the incurrence of waste during the production process 62 Budgeted g Schedule of Direct Material Consumption Budget of Direct-Material Consumption = Required direct materials (units) × Direct materials cost per unit 63 Budgeted B d t d Direct Di t Material M t i lC Consumption ti international considerations • In case production takes place in more th one ffactories, than t i the th budgeted b d t d schedule of direct material consumption should h ld ttake k iinto t consideration id ti – Differences in direct material prices in different areas – Transportation costs – Production efficiency that effects waste – etc. 64 Direct labor budget • Direct labor is the labor offered by those who h are directly di tl involved i l d iin th the processing of direct materials • Direct labor constitutes an important part of the total labor cost p • Direct labor is part of the direct cost because it is directly associated with the product 65 Direct labor budget • Direct labor is usually required along the range of all processing activities – From the original shaping to the completion of the product – It can be either manual or technical (through the operation of machines) • When the production process takes place in more than one departments direct labor budgets g are developed on a departmental basis • The hourly labor cost per department usually varies according to the company remuneration policy 66 Direct labor budget international considerations • In case production takes place in more than one factories, f t i the th direct di t labor l b b budget d t should h ld take into consideration – – – – Salary differences Workers’ working hours Overtime policy and remuneration Production facilities conditions (level of automatization) i i ) – etc. 67 Manufacturing Overhead budget • Manufacturing (production) overhead is the i di t costt th indirect thatt is i iincurred d iin th the context t t off a production process of a company and must b allocated be ll t d tto allll products d t produced d d – indirect or other materials – indirect labor – various operating expenses (rents, energy, i insurance, d depreciation, i ti utilities) tiliti ) – etc. 68 Manufacturing Overhead budget • Manufacturing Overhead Budget= • Manufacturing Overhead associated with the new (usually negligible) directly product • + [Allocation [All ti rate t × allocation ll ti base b ( (e.g. product unit, direct labor hours)] 69 Allocation rate • In the beginning of each year in each factory an allocation rate is calculated Budgeted production overheads Budgeted level of allocation base ( (e.g. product d units, direct d labor l b hours) h ) 70 Manufacturing Overhead budget international considerations • In case production takes place in more than one factories, the manufacturing g should take into overhead budget consideration – Differences in production overheads – Differences in allocation rates – etc. 71 Total production cost international considerations • In case production takes place in more than one factories, the total production g cost should take into budgeted consideration – Differences in per unit production cost in different factories – An A average production d ti costt should h ld also l b be calculated 72 Cost of goods manufactured • The cost of goods manufactured during a period refers to the cost of the products that were p p produced during g this period • It is calculated as the sum of direct materials consumed, direct labor and manufacturing overhead (allocated) 73 Cost of goods produced Direct materials + Di t llabor Direct b + Cost of goods produced Production Overhead 74 Cost of goods sold • The cost of goods sold during a period of time refers to the cost of the products g this p period that were sold during • It is the sum of the value of beginning inventory of finished goods plus the cost of goods manufactured minus the value of the ending inventory of finished goods g 75 Cost of goods sold Cost of goods produced Cost of beginning + inventory (produced in a previous i period) i d) Cost of ending inventory = Cost of goods d sold 76 Administrative expenses budget • The general administrative expenses are the expenses that related to the company’s company s administration • Expenses of supporting departments – – – – the accounting department the human resource management department the legal services the information technology (IT) department • Other expenses p – General manager’s salaries, the rent, the electricity and the conditioning of the central offices etc. 77 Administrative expenses budget • Usually there are no direct administrative expenses related l t d tto a new product d t – However if the new product initiates a new product li th line there may b be di directt admin. d i expenses • The budgeted administration expenses that are associated with the new product are calculated by multiplying the budgeted sales value l off the h new product d with iha predetermined (usually percentage) rate 78 Selling expenses budget • • • The Selling Expenses are the expenses created in order to promote sales and deliver the products to the end consumer They also include marketing expenses Examples: – – – – – – – advertising costs, salaries of the sales manager, salaries and commissions of the sales-persons, sales persons, expenses for commercial exhibitions participation, finished products transportation and logistics expenses, promotion ti expenses , etc. 79 Selling expenses budget • Direct expenses • Refers to the special promotion activities for the new product – – – – free samples advertisements listing fees, etc etc. • Indirect expenses • These expenses are associated not only with the new product but with other products as well – Examples: the proportion of sales-persons salaries and those of their managers, their traveling g expenses, p , the costs of participating in exhibitions, etc. These expenses are allocated to the new product on the basis of a predetermined rate 80 Selling expenses budget international considerations • In case the new product is launched in several markets the different promotion q in these markets should requirements be taken into consideration 81 Budgeted income statement Budgeted Sales - Budgeted cost of goods sold =Budgeted gross margin - Administrative and selling expenses =Budget operating income …………… …………… …………… …………… …………… 82 Cash budget • All the inflows and the outflows that are related to the new product are presented in the Cash budget – Presentation and assessment of the liquidity constrains imposed by the new product – It provides valuable information to management for finance decisions • The sales are translated in cash collections on the b i off th basis the credit dit policy li ffollowed ll db by th the company • The expenses that are related to the product are transformed into payments 83 Finalizing the budget • Application of sensitivity analysis and scenario i planning l i – Sensitivity analysis: • One or more parameters that participate in the budget development are changed and in this way the crucial points are determined • The parameters that are proved to have a considerable impact p on the p profitability y and the viability of the new product are identified and carefully studied 84 Finalizing the budget • Application of sensitivity analysis and scenario i planning l i – Scenario planning: • Different combinations of the possible outcomes of several parameters are modeled • Usually, the pessimistic, the normal and the optimistic scenario are developed – These scenarios are given probabilities of incurrence • Th Their i outcomes t are assessed d in i terms t off their th i financial fi i l and no financial implications to the company 85 What if you have to apply an external view? • Detailed information is not available – Companies do not reveal their costs ! – Base assumptions on data retrieved by financial statements and market benchmarks • Analyse % gross margins (gross margin/sales) • % of Selling and Administrative expenses over sales – Try to make informed projections based on marketing policies 86 Example Sales Cost of goods sold Gross Margin Selling and administrative expenses Financial expenses Net income 20X3 % 50.000 100,00% 32.000 64,00% 18.000 36,00% 7.500 15,00% 2.500 5,00% 8.000 16,00% Amounts in '000 euros 87 What if we just buy and resell the product? • In this case there is no production cost budget – Make assumptions about the quantity of products to be bought and sold • Similarities with the raw materials acquisition budget • Define selling gp prices 88