Managerial Accounting Chapter 8

advertisement

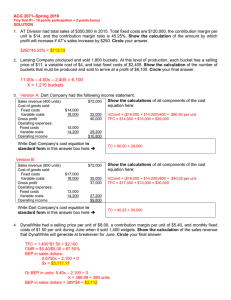

Chapter 8 Managerial Accounting Multiple Product CostVolume-Profit Analysis Prepared by Diane Tanner University of North Florida Sales Mix What is sales mix? The relative proportion in which a company’s products are sold Based on the premise that different products have different selling prices, cost structures, and contribution margins Buckets Pails Units 2,000 8,000 Sales $4,000 $6,000 Expenses $1,600 $3,500 Profit $2,400 $2,500 Two ways to express • Unit sales mix 2000 : 8000 1:4 • Revenue sales mix 4000 : 6000 2:3 2 Pushing Products to Customers Goal is to generate the largest profit If customers prefer to buy one product and are indifferent to their cost Push the product with the higher contribution margin per unit If customers prefer to spend a fixed sum of money and are indifferent to products they buy Push the product with the higher contribution margin ratio (i.e., the highest profit out of each sales dollar) 3 Pushing Products to Customers 4 ABC Company provides the following product sales analysis reflecting sales of 500 of product A and 1,000 of product B for 2018: Sales Variable costs Contribution margin Fixed costs Profit Product A Product B Total $25,000 100% $ 30,000 100% $ 55,000 100.00% 15,000 60% 13,500 45% 28,500 51.82% $ 10,000 40% $ 16,500 55% 26,500 48.18% 17,000 $ 9,500 Assume customers will buy only one item. Which product will you ‘push’ to your customers? A = $10,000/500 = $20.00 B = $16,500/1,000 = $16.50 Push the product with the highest CM per unit—Product A (CM/unit= $20 per item) Pushing Products to Customers 5 ABC Company provides the following product sales analysis reflecting sales of 500 of product A and 1,000 of product B for 2018: Sales Variable costs Contribution margin Fixed costs Profit Product A Product B Total $25,000 100% $ 30,000 100% $ 55,000 100.00% 15,000 60% 13,500 45% 28,500 51.82% $ 10,000 40% $ 16,500 55% 26,500 48.18% 17,000 $ 9,500 Assume customers will spend exactly $2,000. Which product will you ‘push’ to your customers? A = 40% × $2,000 = $800 B = 55% × $2,000 = $1,100 Push the product with the highest CM ratio— Product B (CM = 55%) Two Assumptions of Multi-Product CVP Analysis 1 2 Sales Mix is Constant SUVs Sedan No Inventories are Held Units Produced = Units Sold 6 7 Multiproduct Analysis Two approaches Contribution margin approach For similar products A weighted average approach Calculates ‘units’ needed to breakeven Contribution margin ratio approach For substantially different products A weighted average approach Calculates ‘dollars’ needed to break even 8 Determining BEP with Multiple Products To determine the number of units to be sold for multiple products, use Weighted average CM per unit, and Unit sales mix To determine the sales dollars to be generated for multiple products, use Weighted average CM ratio, and Revenue sales mix 9 Contribution Margin Per Unit Approach How many units of each product must be sold to break Product A Product B Total even? Sales Variable costs Contribution margin Fixed costs Profit 500 1,000 1,500 $25,000 100% $ 30,000 100% $ 55,000 100.00% 15,000 60% 13,500 45% 28,500 51.82% $ 10,000 40% $ 16,500 55% 26,500 48.18% 17,000 $ 9,500 Weighted-average CM per unit = $26,500/1,500 = $17.6657 per unit Unit sales mix = 500 : 1,000 1 : 2 BEP in units = SPx – VCx – TFC = Profit CMx - TFC = Profit 17.6657x – 17,000 = 0 X = 962.31 total units A: 1/3 × 962.31 = 321 units B: 2/3 × 962.31 = 642 units 10 Contribution Margin Ratio Approach How much sales revenue of each product must be sold to break even? Sales Variable costs Contribution margin Fixed costs Profit Product A Product B Total 500 1,000 1,500 $25,000 100% $ 30,000 100% $ 55,000 100.00% 15,000 60% 13,500 45% 28,500 51.82% $ 10,000 40% $ 16,500 55% 26,500 48.18% 17,000 $ 9,500 Revenue sales mix = 25,000 : 30,000 5 : 6 BEP in units = CMRx- TFC = Profit 0.4818x – 17,000 = 0 X = $35,284.35 A: 5/11 × $35,284.35 = $16,038.34 B: 6/11 × $35,284.35 = $19,246.01 The End 11